In the time it takes the average Canadian to repay a parking ticket or renew their driver’s license, non-fungible tokens (NFTs) can be created.

NFTs are unique identifiers that are attached to digital assets. They are like the deed of a house or a birth certificate, but instead of corresponding to a home or to a person, they convey the ownership of a digital asset, like a piece of art, sports highlight video, or meme.

There are numerous marketplaces where NFTs are purchased and sold. At transaction, NFTs are uploaded to digital ledgers that detail the date the asset was created, sold, and for what price. This also details ownership: who bought it, who sold it.

The digital asset is one of a kind and its transaction is transparent and traceable. Therefore, unlike copy-cats of famous paintings, no artist can digitally recreate or copy another artist’s digital dog portrait because it has an NFT that marks its validity.

To access these marketplaces, users sign up, just like you would most e-commerce websites, and link their cryptocurrency wallets to their accounts. While the leger details the transfer, the NFT is held in your wallet.

If this all sounds quite fantastical and pointless, at the time of writing over 500,000 pieces of digital art have transacted on online marketplaces in over $1.8 billion (USD) worth of sales, according to nonfungible.com. This significant sum doesn’t even fully cover other forms of NFTs, including collectibles and games, which have exceeded over $9.8 billion (USD) in sales.

I was recently part of the first-ever digital art commission by a real estate firm. Our subsequent viewing of the eight commissioned pieces of art was one of the first NFT galleries in Canada.

There was zero government regulation.

Slate Asset Management (my employer) commissioned eight NFTs and their corresponding digital art pieces. We paired each commissioned piece of art with a penthouse suite at our latest residential condominium project, One Delisle. When a purchaser buys a penthouse, a digital piece of art will be transferred to their wallet. The NFT comes with the .mp4 file, a video of the digital art that can be displayed on a frame or television screen.

Having previously worked in government and now in the private sector, my bureaucracy spidey-senses are consistently tingling. To be at the forefront of this emerging movement was remarkable. Also remarkable? The absence of government.

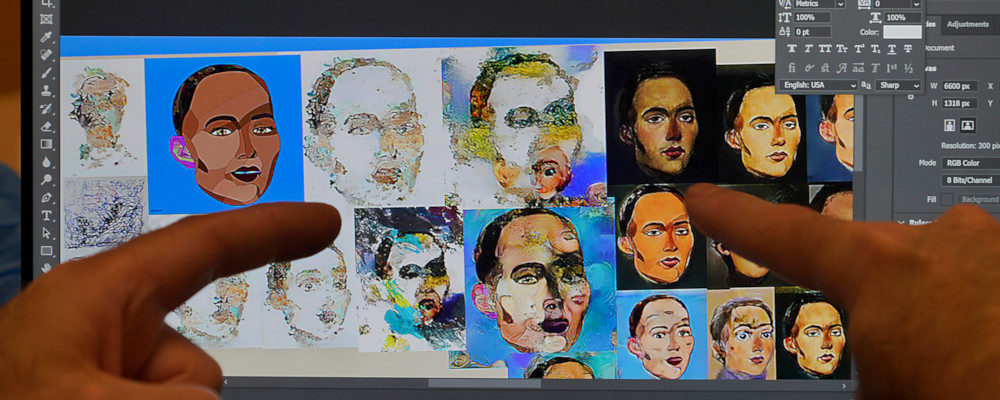

The commissioned artwork is by Los Angeles-based artist Petra Cortright. After the payment for commission, her artwork was transferred from the wallet of her agency (Creative Art Partners) to that of Slate Asset Management. Albeit online, hosted on marketplace OpenSea, the cross-border transaction constituted no duties, no taxes, no shipping or handling fees. There was no slip sent later from UPS detailing our import charges. There was however a “gas fee,” which is a payment to compensate for the computer energy required to process and validate the transaction.

There was zero government regulation.

After consulting with numerous law firms, at the time of writing, there is currently no governing tax law and, at payment, there was no line to collect GST/HST. McMillan law firm has released a thought piece that questions whether or not NFTs will at some point be defined as “securities” and what further implications there could be for large transactions that warrant government protection.

The absence of federal or provincial government intervention is not entirely surprising given how new NFTs are. Facebook was created 17 years ago and the government is only now catching up with the social network.

The rise of digital assets, specifically digital art, has democratized creative industries and challenged conventional norms of critique and curation. While many are cynical about the longevity or legitimacy of NFTs, it is difficult to dismiss the genuine need for a peer-to-peer selling place.

My bet is that NFTs are here to stay, and if the government is looking to collect or protect consumers they should start now. With digital art trading in six and seven figures, it is only a matter of time before a high-net-worth loss ends up before our courts or an infringement of copyright requires correcting.

While I am a champion of reducing red tape and government getting out of the way of business owners and creative people, this might be a time and place for government to be forward looking and consult with industry and create regulations for an unregulated space.