Welcome to The Hub’s Federal Election 2021 Policy Pulse, where we’ll be tracking all the policy announcements from the major parties, with instant analysis from our crew of experts.

With the election scheduled for Sept. 20, we’ll be monitoring 36 days worth of policy ideas, so watch out each morning for the day’s live blog where we’ll be tracking every announcement as it happens.

5:00 p.m. — Daily Recap: Trudeau pledges big money to long-term care

The Liberals promised lots of cash for long-term care and the Conservatives tackled Canada’s housing shortage on Thursday. Here’s the rundown, with more news and analysis below.

- Liberal leader Justin Trudeau promised $9 billion to address short-falls in long-term care, including pledges to train 50,000 long-term care workers and to raise the minimum wage for personal support workers to $25/hour.

- Conservative leader Erin O’Toole promised to build one million homes over the next three years and promised to ban foreign buyers who are not living in or moving to Canada from buying homes.

4:30 p.m. — Liberal long-term care funding promise is substantial, but many questions remain

The Hub contributor Livio Di Matteo examines today’s Liberal long-term care announcement:

Canada had 81 percent of all COVID-19 deaths occur in long-term care homes — the highest proportion in the OECD.

Not surprisingly, Liberal leader Justin Trudeau announced a promise to provide $9 billion to address short falls in Canada’s long-term care sector. In addition, there was also a pledge to train 50,000 long-term care workers to address staffing shortfalls as well as raise the minimum wage for personal support workers to $25/hour. This is a well-intentioned investment given that Canada’s population is aging, there are long waiting lists for LTC and compared with the OECD average, Canada had fewer health-care workers (nurses and personal support workers) per 100 senior residents of LTC homes in 2018.

However, long-term care is under provincial jurisdiction rather than federal. According to the CIHI while no clear differences in pandemic outcomes were observed across funding models (public, private or mixed) across the OECD, countries with more centralized LTC provision (e.g., Australia, Austria, Hungary, Slovenia) generally had lower numbers of COVID-19 cases and deaths. Thus, additional funds alone may not be sufficient in addressing care and staffing, issues as well as the older vintage of many long-term care homes.

Needless to say, Ottawa will at minimum need to negotiate individual deals with provinces similar to what is underway in child care. While the plan is to also develop a Safe Long Term Care Act to ensure that seniors are guaranteed a higher standard of long-term care, this will more directly intrude on provincial jurisdiction and even if implemented there is the question of how and whether it would be enforced. The Canada Health Act for example tied federal funding to the provinces for health with compliance to its conditions but since 1981 there has been no major instance of any federal government ever withholding funds for non-compliance.

Along with being under provincial jurisdiction, LTC is a diverse sector in terms of operation. Currently Canada’s long-term care sector has over 2,000 homes of which 46 percent are publicly owned and 54 percent privately owned but with the ownership varying widely across provinces. For example, Newfoundland and Labrador have 2 percent privately owned (for profit or non-profit) whereas while Ontario has 16 percent publicly owned, 57 percent by private for profit corporations and the remainder by private not-for-profit. Both within and across provinces, there will be no one size fits all solutions to fixing the problems in home care.

Finally, given that the Canada Health Transfer for 2021-22 is estimated at $43 billion, $9 billion is a substantial increase in money going to health care and goes some distance in increasing the federal government’s share of provincial health spending which is at about 22 percent.

However, it falls short of the $28 billion dollar increase the provinces were asking for in Spring of 2021. Moreover, the question remains as to how quickly the funding will be rolled out and over how many years.

4:00 p.m. — Here’s how the Conservatives plan to expand Canada’s Magnitsky law

Marcus Kolga, a Canadian human rights activist and senior fellow at the Macdonald Laurier Institute, examines the Conservative platform:

The Conservative platform includes significant proposals to strengthen Canada’s existing Magnitsky human rights and anti-corruption legislation.

Canada’s Sergei Magnitsky law allows the government to target foreign officials and individuals involved in human rights abuse and corruption with asset freezes and visa bans. There is open source evidence that individuals and entities connected to regimes in Russia and China, that engage in political repression and human rights abuse, hold assets in Canada. The law was introduced by Conservative Senator Raynell Andreychuk and MP James Bezan and passed unanimously in 2017 with the active support of Foreign Affairs Minister Chrystia Freeland.

The Canadian government has been reluctant to use the Sergei Magnitsky Law and lags behind allies in designating new entities. In the United States, the State Department regularly engages with civil society groups about sanctions policy and encourages their involvement in nominating new designations.

The Conservative platform proposes a much welcomed update to Canada’s Magnitsky legislation by offering a formal role for civil society and Parliament in the sanctioning process and greater transparency in what is currently an opaque process with no accountability. Greater openness and engagement in Canada’s sanctions process will indeed enhance the overall effectiveness of it.

The Conservatives have also suggested the creation of an innovative, judicially monitored mechanism for transferring assets frozen under the Sergei Magnitsky Law to be transferred to the victims of human rights abuse — including refugees.

2:00 p.m. — How does the Conservative promise on housing compare to Canada’s recent performance?

The Hub’s content editor L. Graeme Smith and editor-at-large Sean Speer take a look at housing:

Today Conservative leader Erin O’Toole announced his plan to build one million new homes over the next three years in order to address the supply-side drivers behind Canada’s ongoing housing affordability challenges.

The question is: how does the Conservative Party’s target of one million new homes compare to Canada’s recent performance?

Historically speaking, it would represent a pretty significant increase. Total housing starts from 1972 to 2020 averaged fewer than 200,000 new housing units per year.

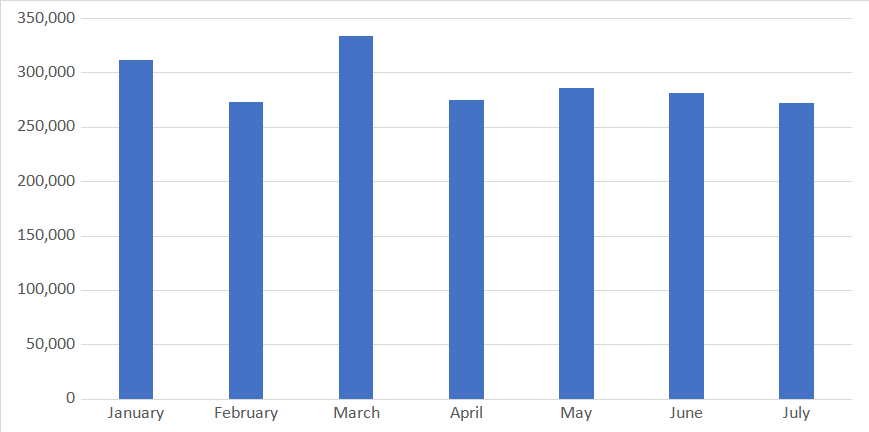

In 2021, though, we’ve seen a notable increase in new housing starts. Over the year’s first seven months, the annualized rate of housing starts per month has averaged 290,098 (see graph below).

This means that the Conservative target would represent a 14-percent increase over the country’s performance thus far in 2021. It’s a stretch goal for sure as The Hub contributor Chris Spoke rightly points out, but it would be building on growing awareness of the supply-side factors behind Canada’s housing affordability challenges.

The biggest challenge to achieving the target is that the federal government’s policy levers influencing housing construction are somewhat limited. Land-use and zoning regulations as well as development charges reside primarily at the provincial and local levels.

Research shows that these restrictive regulations and high building fees are major contributors to Canada’s poor performance on housing supply. A Scotiabank report from earlier this year showed, for instance, that Canada has the lowest number of housing units per 1,000 residents of any G-7 country.

Reaching the Conservative goal will therefore depend on policy reforms to liberalize land-use policies at the provincial and local level. In order to catalyse such policy changes, the Conservatives would place new conditions on federal transit funding that require greater housing density along transit lines.

It’s difficult to know at this stage if that will be enough to boost new housing builds at the rate envisioned by the Conservative government. But even if the three-year target ultimately proves too ambitious, it’s a good sign that the policy debate on housing affordability is shifting from demand-side to the supply-side of the housing market.

1:30 p.m. — Trudeau pledges $9 billion to address long-term care issues

Liberal leader Justin Trudeau was in Victoria today promise $9 billion to address short-falls in Canada’s long-term care sector.

Trudeau also pledged to train 50,000 long-term care workers to address staffing shortfalls and raise the minimum wage for personal support workers to $25/hour. He also promised to double the home accessibility tax credit to $20,000.

Although long-term care falls under provincial jurisdiction, Trudeau compared it to childcare, where he said it’s important for the federal government to step up and offer funding.

12:00 p.m. — Erin O’Toole’s promise to build a million new homes in the next three years could get tricky

The Hub contributor Chris Spoke examines the Conservative housing proposal:

Conservative Party leader Erin O’Toole has promised that, if elected, he will implement policy changes that will lead to one million new homes over the next three years. Foremost among these is a requirement that municipalities that receive federal funding for public transit allow increased housing density near the funded transit.

It’s unclear whether this requirement would only apply to new transit or existing transit as well, or whether it would apply to the areas surrounding transit stations or along transit routes.

Either way, it’s a great proposal that acknowledges that 1) housing in our big cities is expensive because there’s not enough of it, and 2) there’s not enough of it because restrictive municipal land-use rules constrain new supply.

That said, we should ask ourselves whether it will be enough, paired with the rest of the CPC platform, to deliver on the promise of one million new homes.

For context, we saw 586,200 housing completions over the last three years, so we’re talking about an additional ~400,000 homes, or a 70 percent increase, over the next three years.

And here’s where it gets tricky. Real estate development projects in our big cities can take five to eight years to complete, from land acquisition to entitlements and approvals and construction. At a minimum, our next two years of completions are already mostly baked in.

Those ~400,000 additional homes will mostly have to be completed in the third year of the promise, if they’re to be completed at all, which is closer to a 200 percent increase from the best of our last three years (200,262 completions in 2018).

Can that be done? It’s possible, but it would require aggressive negotiations with provinces and municipalities to fast track the required upzoning around transit stations or routes as well as expedited project approvals.

10:30 a.m. — Did we really experience a ‘she-cession?’ The answer is complicated

The Hub’s editor-at-large Sean Speer crunches the numbers behind the pandemic-induced recession:

Yesterday on the campaign trail, Prime Minister Justin Trudeau generated a bit of a buzz by describing the pandemic-induced recession as a “she-cession” and arguing for policies that prioritize a “she-covery.”

It’s actually not the first time that the prime minister and other Liberal Party spokespeople have used this language to characterize the gender-based effects of the recession. The government’s April budget, for instance, referred to a “she-cession” a handful of times.

Although it has enthusiastically adopted its use, the government itself didn’t coin the phrase. It originated with progressive economist Armine Yalnizyan who first used “she-cession” in March 2020 to describe the pandemic’s early employment effects on women.

The question, of course, is: have we experienced a “she-cession” in which women have been disproportionately affected by the pandemic-induced recession?

The answer is somewhat complicated. If the point is that the recession has affected female employment in relative terms more than previous ones, then there is indeed evidence to support this view.

Because public health restrictions generally targeted face-to-face transactions, the recession battered service-based industries — such as restaurants, retail, hospitality, and health care — in which female workers are disproportionately represented. This stands in contrast with past recessions which have tended to hurt male-dominated industries like manufacturing and construction more than other sectors.

Similarly if it refers to the effects that school and daycare closures have had on working mothers, there’s also evidence that they’ve imposed a disproportionate burden on women.

Data from Statistics Canada, for instance, shows that the majority of women (64 percent) reported that they mostly performed homeschooling or helping children with homework during the pandemic, while only 19% of men reported being mostly responsible for this task.

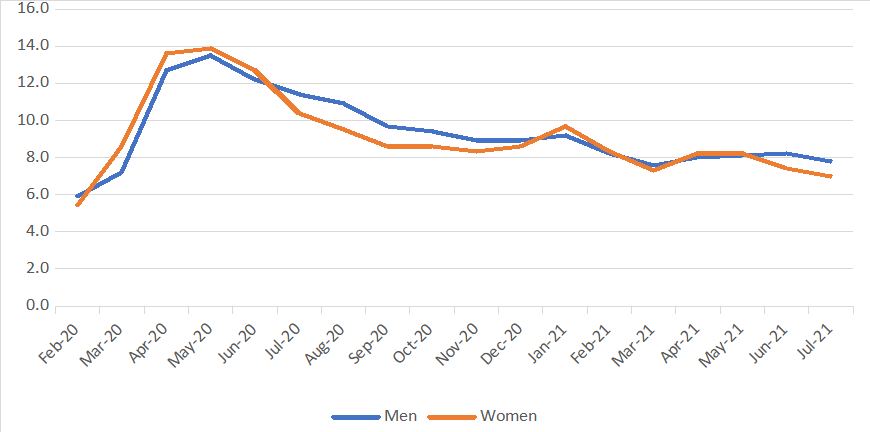

But if the idea of a “she-cession” is that women have experienced disproportionate employment effects, the evidence is weaker. While the female unemployment rate peaked higher (13.9 percent) than men’s (13.5 percent) in May 2020, the rates have since fallen to 7.8 percent for men and 7.0% for women in July 2021 (see graph below).

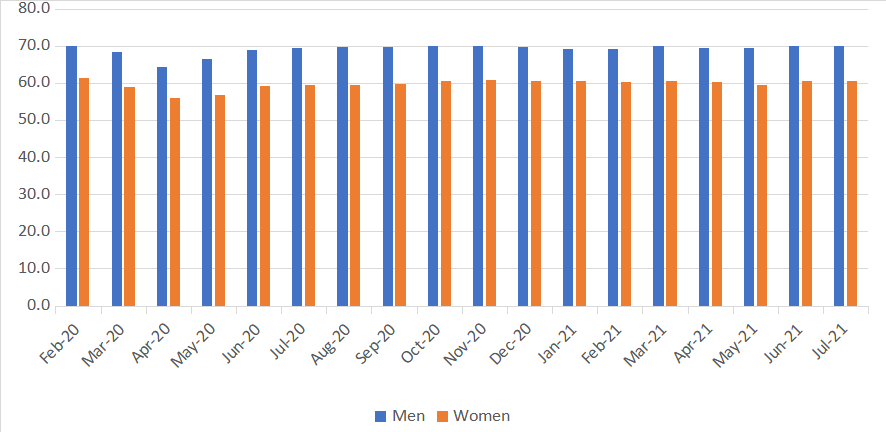

The same goes for participation rates: at its pandemic-induced trough, women’s labour participation fell by 5.5 percentage points in April 2020, compared to 5.7 percentage points for men. Both have since nearly fully returned to pre-pandemic levels (see graph below).

As mentioned above, the point here isn’t that the pandemic hasn’t imposed real burdens on women but rather that the employment effects haven’t necessarily been disproportionately felt by female workers.

To the extent that “she-cession” is therefore narrowly referring to these employment effects, the best that can be said is it may have described labour market outcomes in the early days of the pandemic.

9:00 a.m. — O’Toole touts plan to build a million new homes over three years

Conservative leader Erin O’Toole was in an Ottawa suburb today highlighting his party’s plan for housing.

The Conservative platform touts a promise to build one million homes over the next three years and a pledge to ban foreign buyers who are not living in or moving to Canada from buying homes.

O’Toole also promised to create a new market for mortgages that would have seven- or 10-year terms which he said would increase stability and reduce the need for mortgage stress tests.

The Conservatives have also promised to tweak the mortgage stress test, to avoid “discriminating against small business owners, contractors and other non-permanent employees including casual workers.”

7:00 a.m. — Where the leaders will be on Day 5

Liberal leader Justin Trudeau will in Victoria to make an announcement at 10 a.m. local time (1 p.m. ET).

Conservative leader Erin O’Toole will make an announcement at 9 a.m. in Ottawa.

NDP leader Jagmeet Singh will be in Edmonton to make an announcement about health care at 9:30 a.m. local time (11:30 a.m. ET).

Recommended for You

The Notebook by Theo Argitis: Carney’s One Big Beautiful Tax Cut, and fresh budget lessons from the U.K.

Ginny Roth: How vacant liberal nationalism left Canada worse off than George Grant even imagined

Peter Menzies: Justin Trudeau’s legislative legacy is still haunting the Liberals

‘Our role is to ask uncomfortable questions’: The Full Press on why transgender issues are the third rail of Canadian journalism