Chrystia Freeland presented the federal government’s budget to the House of Commons yesterday, a document weighted down with an abundance of commitments and an expanded role for government in Canada’s economy. From health and dental to housing, from military and defence to Indigenous spending, we gathered our experts to weigh in on what’s included (and what’s not) in the budget and to give their quick reactions on what it means for Canadians.

We can’t have big government without paying for it

Howard Anglin

Don Drummond—former senior Department of Finance official, former TD Bank Chief Economist, and current Queen’s professor—had an interesting quote about this week’s budget in the Globe and Mail.

He said: “If I were in the business world I’d be extremely depressed, because we are at some point going to have to turn to how we fund all this spending, and it would seem the go-to funding source is corporate income tax.”Ahead of 2022 federal budget, corporate Canada wants Ottawa to act on economic policy – not just talk about it It’s the first seven words that caught my eye: “If I were in the business world.” The problem is, we are all “in the business world,” whether we like it or not—as workers, consumers, and taxpayers. Tax business, and you tax almost everything we consume and most of the services we depend on.

For a while it seemed we could have big government without paying for it. That “modern monetary theory” may still hold true for the United States, which prints the world’s favoured reserve currency, and it may have seemed true for Canada in an era of cheap money. But as interests have risen, economic reality has come roaring back. If we want stuff from the government—and Canadians most certainly do—we will have to pay for it, now or later. And that means taxes on something or someone.

Economists tend to favour consumption taxes like the GST or European style VATs, but politicians don’t like how visible they are to the voters who pay them. Our political class has also ruled out raising income taxes for similar reasons. Even the NDP, which used to support a generous welfare state funded by higher taxes on the middle- and upper-classes, has abandoned its support for broad-based income tax increases since it became a party of those same classes.

By process of elimination, that leaves corporate taxes, so corporate taxes will have to go up. And those of us—all of us—who live in the world of business will have to bear the costs, directly or indirectly. The only alternative would be to spend less … but who are we kidding?

A bigger but not necessarily better government footprint

Livio Di Matteo

In the wake of the soaring expenditures of the pandemic, Budget 2022 is being advanced as a lower spending fiscal plan that will, according to Finance Minister Freeland, also “review and reduce government spending.” From fiscal year 2020-21 to 2022-23, total revenues are expected to rise from $316.4 to $408.4 billion—an increase of 29 percent while total expenses will fall from $644.2 to $461.2 billion—a decline of 28 percent. While this will not close the gap, the deficit is nevertheless projected to fall from $327.7 billion in 2020-21 to $8.4 billion in 2026-27. As a result, the net federal debt will continue to rise to a projected $1.308 trillion by 2026-27 though the debt-to-GDP ratio will fall somewhat.

More to the point, compared to the pre-pandemic fiscal year 2019-20, total spending by 2022-23 alone will be about 27 percent higher—an average annual increase of 9 percent per year.

This represents a permanent long-term ramping up of federal expenditure that will result in a bigger federal government expenditure footprint but not necessarily a better one. The federal government is entrenching billions and billions of dollars in new permanent spending and creating a larger federal government footprint, but the value for money and effectiveness of new spending in housing, defence, and health remains to be seen.

The government’s history-related spending

J.D.M. Stewart

The federal budget has earmarked just over $55 million dollars for specific, history-related initiatives. The largest chunk, $20 million, will go to the Department of Canadian Heritage to support the construction of a new Holocaust Museum in Montreal. Additionally, there will be $5.6 million over the next five years to support the Special Envoy on Preserving Holocaust Remembrance and Combatting Antisemitism. Former Liberal cabinet minister Irwin Cotler is the current occupant of that position.Prime Minister announces reappointment of Special Envoy on Preserving Holocaust Remembrance and Combatting Antisemitism

Given the rise of antisemitic actions in Canada and around the world in recent years, it’s important to keep supporting the position of special envoy. The federal money for the museum matches the $20 million already confirmed from the government of Quebec for the $80 million project to be located on St. Laurent Blvd, just north of Sherbrooke St. There is also $2.5 million for the Sarah and Chaim Neuberger Holocaust Education Centre in Toronto.

There remains $250 million for museums across Canada, part of a two-year, $500 million commitment made in 2021 to help these facilities recover from the pandemic.

The budget also announced funds to assist the growth of the Muslims in Canada Archive, an initiative of the University of Toronto’s Institute for Islamic Studies. As the budget notes: “For too long, Muslim communities in Canada have had their representations, stories, and identities publicly shaped by predominantly non-Muslim media sources. These depictions are often burdened by narratives of terrorism, war, violence, Islamophobia, and extremism.” This highly interesting project, which will receive $4 million from the 2022 budget, was profiled in the Toronto Star last year.

Missing from the budget was a significant funding announcement to help revitalize Library and Archives Canada which is in abject need of new money and ideas.

Finally, the budget allocated $25 million over three years to digitize documents related to the residential school system. This is an important move for the history of the country, though Library and Archives Canada has much to answer for in how it is curating its web presence and telling the story of Canada.

The Liberals throw some crumbs to the NDP

Ken Boessenkool

This budget confirms that the Liberal-NDP deal delivers mere crumbs to the NDP in the form of an exceedingly modest dental program. The rest of the budget has the Liberals continuing to engorge themselves as they had intended all along.

The dental program will almost certainly be a “fill the gaps” program for modest-income Canadians, initially youth, who don’t currently have private coverage. It will likely be a very modest program so Canadians with coverage will be loath to dump their private plans for a more modest government plan.

On balance, a modest “fill the gaps dental plan” is something, as Howard Anglin recently wrote, that Conservatives should get behind. Doing so would allow the Conservatives to focus all their opposition on the Liberals and ignore an NDP that has largely dealt themselves into irrelevance.

Not much for homebuyers… and that’s a good thing

Patrick Luciani

No question young home buyers will be disappointed with the budget’s skimpy incentives, but governments shouldn’t be in the business of encouraging ownership over renters.

Policy should be neutral between owning and renting. Over the past 20 years, homeownership has gone up by five percentage points to 70 percent—even higher in Toronto and Vancouver—and part of that increase may be driven by generous ownership incentives. Housing may seem a good investment now, but that can change quickly.

Canada has one of the highest homeownership rates in the world, even higher than the U.S.; in Germany, only 55 percent of households own their housing. In a crazy market owning a home is a risky business that encourages too much investment in one primary asset. Renters are helped with rent controls, another bad policy that benefits richer renters at the expense of poorer ones while decreasing the stock of rental units. Owning also drags down the economy making it more expensive for skilled workers to shift locations as markets change. In short, we have the worst of both worlds if our intention is to stabilize the housing market and improve productivity.

And for those worried about wealth disparity between the rich and poor—à la Thomas Piketty—blame the housing market. Studies now show wealth in housing is a main cause of the rising income gap between rich and poor. In areas in Toronto that vote Liberal or NDP, the incentive is to discourage more housing density to protect built-up home equity. Even socialists want market prices when they sell.

The government’s ideas on housing are good but expensive

Chris Spoke

Housing in Canada is expensive because there’s not enough of it. In fact, there’s less of it on a per capita basis than in any other G7 country.

This is especially true in our big cities, where good jobs are most abundant and where housing costs are highest. In Toronto, the average home would run you about $1.33-million. In Vancouver, $1.36-million.

The federal government appears to agree, as they state very clearly in yesterday’s 2022 budget:

“To make housing more affordable, more housing needs to be built.”

They also appear to agree that regulatory supply constraints are to blame for our affordability crisis:

“Building more housing will require investments, but it will also require changes to the systems that are preventing more housing from being built.”

To address these constraints, they’re launching the New Housing Accelerator Fund, which would provide cities and towns with $4-billion over five years, starting in 2022-23, to “[step] up to get more housing built”.

The new fund will target the creation of 100,000 “net new” housing units over the next five years. I’m not sure what that means, but think it’s safe to assume it means 100,000 completions over five years in addition to our average completion rate of about 200,000 per year.

So something like a 10 percent increase.

This is a good idea if a bit expensive: block grants to municipalities for land use liberalization and approvals process improvements.

The key of course will be in the execution. We’ve seen funding announcements made in the past that did not deliver on their promises. (Remember superclusters?)

Let’s hope this one does.

Budget delivers spending for Indigenous priorities, but still falls well short in key areas

Karen Restoule

The federal budget delivered an additional $11 billion over six years for Indigenous priorities. Details on the Indigenous-specific spending are found in Moving Forward on Reconciliation and reveal that nearly $10 billion is committed to social spending including a $4 billion spend on child welfare, close to $3 billion for First Nations housing, with close to $3 billion distributed in health, mental health, education, and addressing the legacy of residential schools.

What got less media attention but is still part of the envelope are dedicated amounts to support Indigenous participation in natural resource projects and economic development more broadly, with $131 million noted for natural resource projects and $200 million for Indigenous business and community economic development.

The budget states the government’s objective is to “continue to support Indigenous children and families, and to help Indigenous communities continue to grow and shape their futures.” For a party leader who kept relatively quiet on commitments to advancing Indigenous reconciliation during the lead-up to the federal election last fall and went so far as to bow out of community activities on the country’s first National Truth and Reconciliation Day, the significant bump in spending comes as a bit of a surprise.

Maybe there’s been a turn of heart, or maybe it’s the result of the recent confidence and supply relationship. We likely will never know what precipitated the increase in these spending commitments. However, what we do know is that the budget falls short on priorities identified by the AFN, as identified by AFN National Chief RoseAnne Archibald in her press release yesterday.National Chief Archibald Says First Nations Require Economic Reconciliation to Advance Healing Path Forward The AFN took part in the pre-budget submission process and outlined several asks in a number of key areas, many of which were left out.

The size of government is growing

Stuart Thomson

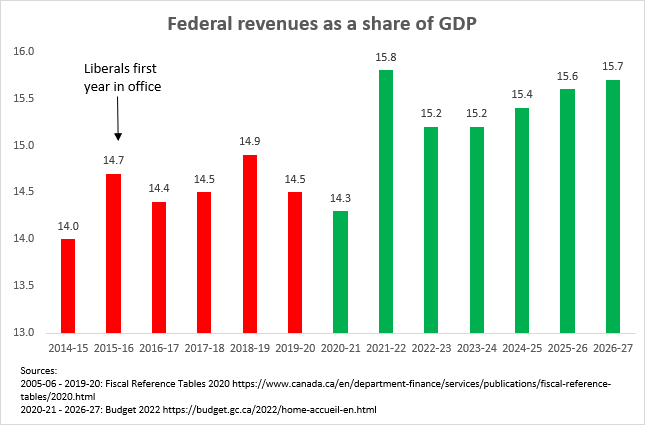

According to this year’s budget projections, the Liberals will have presided over a 1.2 percentage point increase in federal revenues as a share of GDP since forming government in 2015.

That amounts to about $33 billion more flowing into government coffers and represents a small, but telling, insight into the ideological mindset of the current government. And it stands in stark contrast to the goals of the previous Conservative government.

“Reducing the federal tax burden was a priority of (Stephen) Harper’s dating back to his time as senior policy advisor to the Reform Party,” wrote Ken Boessenkool and Sean Speer.“(Harper) subscribes to the wide body of empirical analysis that shows the economic impact of high levels of taxation. He is also driven by the view that individuals, families, and communities are better placed to make decisions about their priorities and needs than the government, and therefore the tax burden imposed by the state ought to be minimal.” https://policyoptions.irpp.org/2015/12/01/harper/ “To these ends, Harper slowly chipped away at federal tax revenues.”

Since Justin Trudeau took over from Harper in 2015, with a wholly different idea of what government should do and how big it should be, the federal government has been growing and it will continue to grow. By 2026-27, government revenues will be about $48 billion higher than when Trudeau took office.

Recommended for You

Crystal Smith and Eva Clayton: Indigenous natural resources development is an efficient, fair, and responsible way to advance economic reconciliation

Peter Menzies: Justin Trudeau’s legislative legacy is still haunting the Liberals

‘There are consequences to this legislation’: Michael Geist on why the Canada-U.S. digital services tax dustup was a long time coming

Rudyard Griffiths and Sean Speer: The future of news in Canada: A call for rethinking public subsidies