The world needs Canadian energy more than ever, but by prioritizing our emission reduction over energy production we are leaving most of our resources in the ground—and leaving the world dependent on the likes of Russia.

Some think this is worthwhile because it should slightly lower global emissions, and we should now focus on a “just transition” away from oil and gas. It cannot, however, be just to shift hundreds of billions in energy sales to autocratic regimes who disregard the environment and human rights. In fact, by emboldening actions like the invasion of Ukraine, this premature transition away from supplying the world’s energy needs isn’t just naïve, it is actually unjust.

Russia’s invasion should make it clear to most fair-minded Canadians that energy insecurity is a massive global threat. Without its energy hegemony over Europe, it is hard to imagine a Russia with the political or economic power to slog through an invasion of Ukraine.

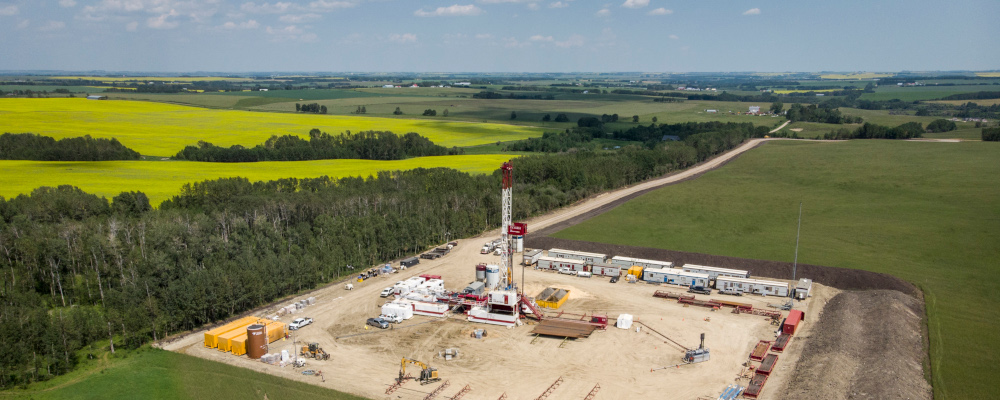

Canada does not have a large military or a large population from which to influence the world. It does, however, have the third-largest petroleum reserves. Standing next to candidates like Saudi Arabia, Venezuela, Iran, and Russia should make Canada the belle of the energy investment ball. But our failure to build pipelines and our obsession with emission taxes and regulations led Canada’s share of global investment to fall 30 percent from 2010 to 2018.

Canada’s loss is the world’s gain, right? Wrong. Oil production kept growing, and a look at the top ten oil-producing countriesWhat countries are the top producers and consumers of oil? https://www.eia.gov/tools/faqs/faq.php?id=709&t=6 reveals a gallery of rogues all too happy to profit from Canada’s hand-wringing.

Russia’s share of global oil and gas investment rose 30 percent over the same time Canada’s dropped 30 percent. The United States has also been a major beneficiary. Not only have companies shifted capital (see rig counts), but entire headquarters have relocated south. Also, while Canada stalled or even strangled various Liquid Natural Gas (LNG) proposals, America went from nowhere to number one over the last five years in meeting a booming global LNG demand.

The rationale for this great “transition” is to reduce emissions and thereby protect the world, but it accomplishes neither. Canadian LNG is a much lower emission fuel than alternatives, especially Asian coal. While LNG is on the rise in Asia, there isn’t enough: in 2020 China announced plans for 43 new coal plants and 18 blast furnaces that would emit an additional 150MT of CO2.China’s power & steel firms continue to invest in coal even as emissions surge cools down https://energyandcleanair.org/wp/wp-content/uploads/2021/08/China-Q2-briefing-coal-steel-CO2.pdf For perspective, that increase is double the CO2 emitted by the entire oilsands.

If abundant LNG were on offer from the relatively close port of Prince Rupert, China and the rest of Asia could choose a cleaner option with less than half the emissions. That’s saving the equivalent of the entire oilsands in the case of China’s 2020 announcement of 150MT of new coal emissions.“Oil sands operations currently emit roughly 70 Megatonnes (Mt) per year.” https://www.alberta.ca/climate-oilsands-emissions.aspx#:~:text=Alberta%20today,-The%20oil%20sands&text=Oil%20sands%20operations%20currently%20emit,by%20facility%20or%20industry%2Dwide. Whatever this lofty green “transition” is, if it means less export of LNG it is failing to reduce emissions by displacing coal.

If you actually were committed to helping the world, though, think about what substantial LNG and oil export off the east coast could be doing for a Europe under siege. Have projects like the LNG terminal in Saguenay been cancelled to protect the world? Stand at the Ukraine-Poland border and see if those 80 million people on either side agree with you. Whether it is environmental, social, and governance (ESG) metrics“ESG stands for Environmental, Social, and Governance. Investors are increasingly applying these non-financial factors as part of their analysis process to identify material risks and growth opportunities. ESG metrics are not commonly part of mandatory financial reporting, though companies are increasingly making disclosures in their annual report or in a standalone sustainability report.” https://www.cfainstitute.org/en/research/esg-investing#:~:text=ESG%20stands%20for%20Environmental%2C%20Social,material%20risks%20and%20growth%20opportunities. or our own moral barometer, it is wrong to focus on emissions alone and ignore energy security and the enrichment of unjust regimes.

If Canada’s policies do not shift to promote development and export of the energy the world needs, when Russia opens back up we will watch helplessly as capital pours into our boreal neighbour to the west. It will not help the environment; it will simply make Canada poorer and Russia stronger.

Compromising the prosperity of future generations of Canadians to enrich and empower autocratic leaders is not just. If an ESG barometer tells you it is, it is clearly broken. Those pushing to move past oil and gas prematurely are really only burying Canadian wealth—and in favour of what? In favour of oil and gas produced with little respect for the environment or anyone’s rights, while benefitting many awful leaders—some of whom would wage war against us and our allies.

The world will move past oil and gas one day, but until then Canada should be maximizing its production and developing excellent export routes in all directions because it is the safest, most reliable, and yes, most just producer to meet the world’s needs.

Fight the unjust transition—support Canadian energy.

Recommended for You

‘Another round of trying to pull capital from Canada’: The Roundtable on Trump’s latest tariff salvo

‘We knew something was coming’: Joseph Steinberg on how Trump is ramping up his latest tariff threats against Canada

Rudyard Griffiths and Sean Speer: Canada’s high-stakes standoff with Trump

‘It’s not yeehaw, it’s yahoo’: Tim Hudak and Anila Umar on why the Calgary Stampede is the ultimate political and cultural equalizer