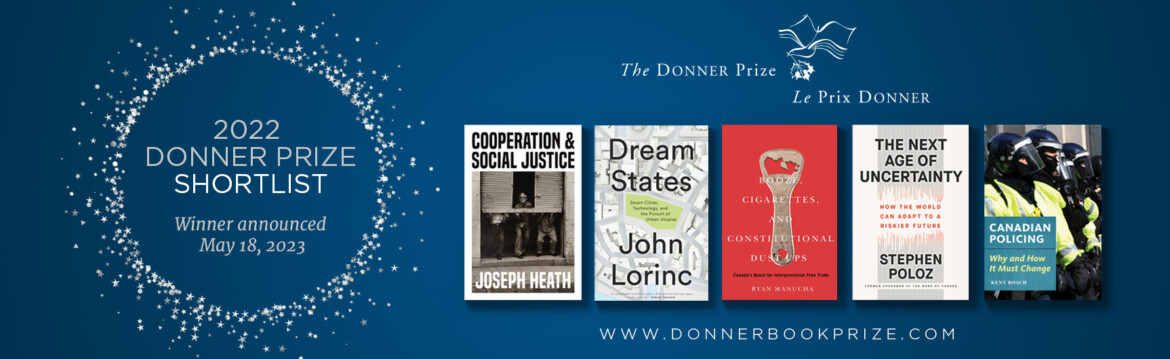

The Hub is proud to be partnering with the Donner Prize, which will be announced on May 18. We’ll be running excerpts from the shortlisted books all week and you can also listen to Hub Dialogues episodes with all the nominees. Click here to view the shortlist and get caught up on Canada’s best public policy books.

From the introduction of Cooperation & Social Justice by Joseph Heath

Joseph Heath is a professor in the Department of Philosophy and the Munk School of Global Affairs and Public Policy at the University of Toronto. A fellow of the Royal Society of Canada and the Trudeau Foundation, Heath is the author of several books including Enlightenment 2.0, which won the Shaughnessy Cohen Prize for Political Writing in 2015, and The Machinery of Government, which won the Donner Prize for best book in public policy in 2020.

One of the clearest points of demarcation between specialist discourses and everyday commentary and debate is that the former are often structured by what might be thought of as “explanatory inversions.” These arise as a consequence of discoveries or theoretical insights that have the effect of changing, not our specific explanations of events, but rather our fundamental sense of what needs to be explained. A simple example of this would be the role that the principle of inertia plays in our understanding of physical motion. Common sense tells us that objects in motion have a tendency to come to rest, and so in order to keep them moving there must be a constant application of force. Isaac Newton’s first law of motion inverts this, by claiming that the tendency of objects in motion is to continue moving until something stops them. Common sense is wrong on this point because we are fooled by a set of invisible forces—gravity, friction, air resistance—that act upon the objects we are most familiar with. If instead we accept Newton’s law, it is not just our understanding of the fundamental properties of matter that changes; our sense of what needs to be explained in physical systems changes. Most importantly, motion no longer needs to be explained, it is only changes in direction or velocity of motion that need to be explained. As a result, the entire approach to physical science is transformed, as scientists wind up focusing on questions that are quite different from those that common sense tells us are in need of response.

The frictions that may result from the gap between the public and the specialist perspective are a well-known source of hostility toward the physical sciences, but they have the potential to become even more explosive when they involve the social sciences. The latter are, of course, the subject of a great deal more scepticism across the board, particularly when it comes to their claim to have produced a useful or reproducible body of knowledge. Whatever one thinks about this broader question, however, there can be little doubt that the social sciences have also produced a number of important explanatory inversions. Perhaps the clearest example involves the concept of social deviance in criminology. Common sense tells us that most people, most of the time obey the law. Crime is an anomaly, and as such, stands in need of explanation. Common sense provides us with a wealth of explanations, which seek to identify the motives that impel people toward criminal acts. But if one stops to examine these motives, as social scientists began to do, the most striking thing about them is how ordinary and ubiquitous they are. For every angry person who commits an assault, or greedy person who steals from others, there are hundreds of equally angry, equally greedy people who refrain from doing so. This is what prompted the realization, articulately in the late 19th century by Emile Durkheim, that it is not crime that cries out for explanation, but rather law-abidingness. Common sense is wrong on this point because we are all reasonably well-socialized adults, living in a well-ordered society, and so we take for granted the institutional arrangements that secure our compliance with the rules. But the underlying mechanisms are ones that we do not really understand, as a result of which it is difficult to explain why more people do not break the law more often (since it is so often in their interest to do so). Again, there is an explanatory inversion at work, because of the change in our understanding what needs to be explained.

A similar explanatory inversion has taken place in our understanding of human cooperation. Common sense tells us that if a group of individuals have a shared interest in achieving some goal, it is natural that they will band together to perform the actions needed to realize that outcome. Thus it is natural to assume that, absent some external impediment, interest groups will be disposed to pursue their interests, corporations will pursue their corporate interests, classes will advance their class interests, nations will act in their national interest, and so on. One of the most significant achievements of 20th century social science was the realization that this sort of cooperative action is actually more mysterious than it might initially appear. Groups often find themselves caught in what are now known as “collective action problems,” where despite having a common interest in achieving some outcome, no individual in the group has an adequate incentive to perform the actions needed to achieve that outcome, as a result of which the group as a whole will fail to act in its collective interest. And so, as Thomas Schelling put it, the default structure of social interaction is one that lacks any mechanism that “attunes individual responses to some collective accomplishment.” It is not failures of cooperation that need to be explained, but rather successful collective action. Common sense is wrong on this point, because we all have the experience of being able to enter into cooperative relations with one another with relative ease. The analysis of collective action problems does not contradict this, it merely gives rise to an explanatory inversion. It suggests that the failure to advance collective goals is the default outcome, cooperation is what cries out for explanation.

Like most explanatory inversions, this insight about cooperation has had the effect of driving a wedge between certain specialist and non-specialist discourses. Nowhere is this more apparent than in our thinking about social justice. The common sense way of thinking about distributive justice is to treat it like a “cutting the cake” division problem. You have some good, like a cake, and a bunch of people who all want as much as possible, and so the question becomes simply how to divide it up between them. The problem with applying this view to society is that the goods that are subject to distribution by a conception of justice do not suddenly appear out of nowhere, the way that a cake does at a birthday party. They are the product of an ongoing system of cooperation. This cooperation is, in turn, difficult to achieve, often requiring a great deal of bargaining and compromise. As a result, it is difficult to apply principles of distributive justice to the outcome without knowing some of the back story, about how that outcome came to be. It is equally difficult to say anything in a prescriptive vein about whether the outcome should be adjusted, without knowing a great deal more about how this will affect the underlying system of cooperation that produced those results. Tradeoffs can easily arise, if a particular scheme of redistribution can be expected to impair the effectiveness or stability of the system of cooperation. As a result, even though it offends a certain political sensibility to say it, there is a gap between expert and public discourse on questions of social justice, because of the complex relationship between cooperation and principles of distributive justice.

Recommended for You

‘A celebration of the spirit of Alberta’: Ryan Hastman on the political, economic, and cultural importance of the Calgary Stampede

Michael Geist: Children accessing porn is a problem, but government-approved age verification technologies are not the answer

Daniel Zekveld: Age verification for pornography is not government overreach

Chris Spoke and Peter Copeland: Ontario is missing millions of homes. Here’s where the government is failling—and how it can actually make a meaningful difference