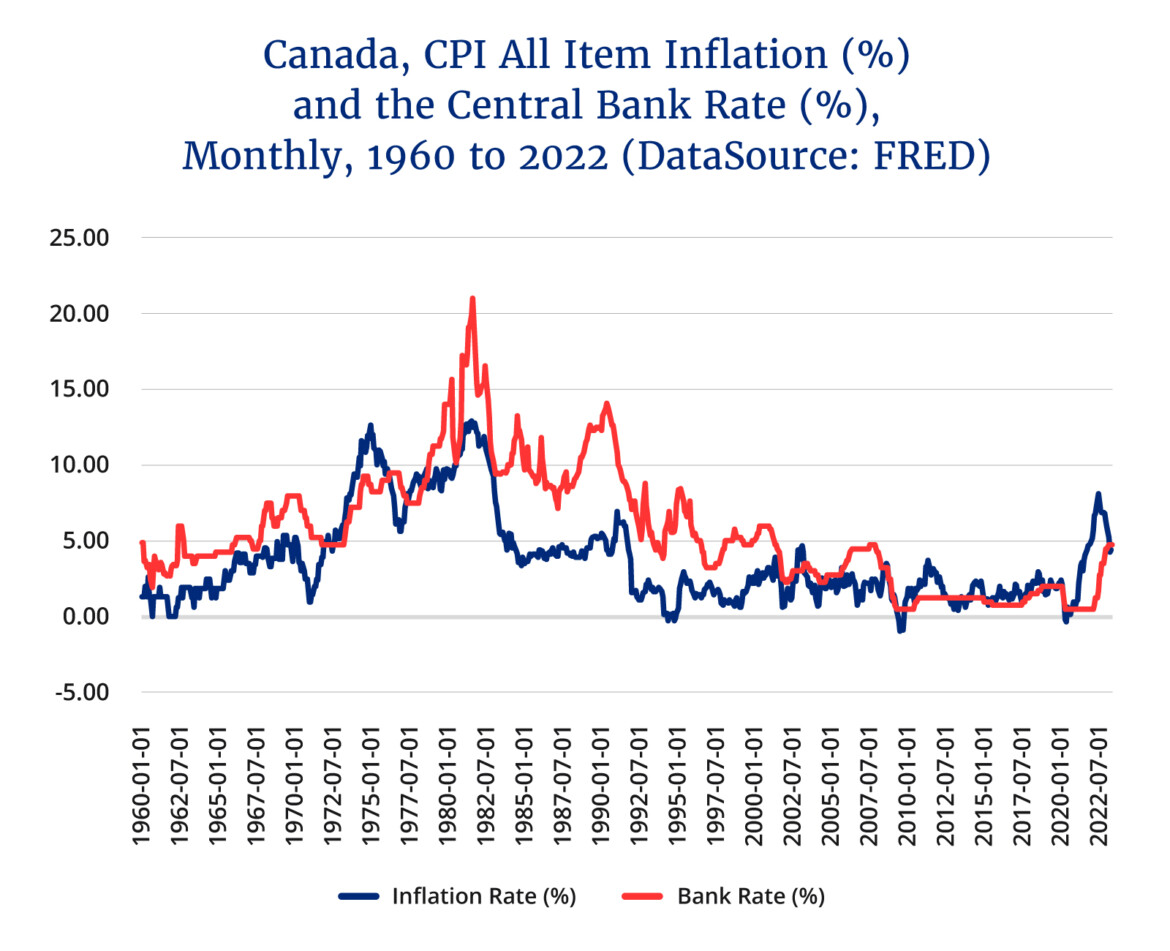

The current public debate on inflation, the bank rate, and monetary policy has been disappointing on a number of levels, not least of which is the detachment from recent economic history and the operation of past monetary and fiscal policy. As the accompanying figure shows, despite the wringing of hands and gnashing of teeth, interest rates as measured by the 24-hour Central Bank Rate are actually still relatively low by historical standards given they are now approaching the levels last seen in mid-2007—which, incidentally, were also rather low by the standards of the 1980s and 1990s. As for inflation, at its peak in mid-2022, it was the highest it had been since the 1980s and has more recently come down to mid-1990s levels.

The current public debate on inflation is dominated by a number of themes focusing mainly on personal impacts including the burden of higher interest rates on borrowers—particularly mortgage holders as renewals loom, the higher cost of living for consumers, the threat of imminent recession and job loss as interest rates rise despite the ongoing resilience of the Canadian economy, and finally the ”there is a better way to fight inflation other than raising interest rates” argument. This has staked out the proposition that the current rate cycle increase is not working and it is corporate greed that needs to be reined in.

This latter thread of discussion is the most intriguing because its calls for a “broader toolkit” reflects the largest disconnect between the current experience and history. If one goes back to the 1970s, the initial approach also included “other tools”, namely the wage and price controls of the Anti-Inflation Board (AIB) which operated from 1975 to 1978 that tried to limit pay increases and included an examination of company profits that returned several hundred million dollars to the market place.

While the AIB appears to have had some success initially in restraining wage and price growth, it proved extremely unpopular with labour as well as corporations and was ultimately abandoned. As the above chart shows, there is a dip in inflation after 1975 but it then begins to rise again—even before the end of the program in 1978—and it is not until monetary policy in the form of higher interest rates kicks in that inflation comes down in the 1980s. Ultimately, it was monetary policy that had to do the heavy lifting.

Left out of the current debate are other themes: the long-term costs to the economy if inflation is not reined in; the benefits of higher interest rates in the long term to savers and the spillover over to capital formation and even business decision-making; the reality that the whole point of increasing interest rates is to slow the economy down and still the most effective way to bring down inflation based on historical experience; and the continuing disconnect between expansionary fiscal policy and contractionary monetary policy.

The theory behind an interest rate increase is that by increasing the cost of borrowed money, aggregate demand for goods and services will go down bringing about an economic slowdown that will moderate the rate of price increases. That after 10 rate increases the economy remains rather resilient is indeed a testament to the continuing effect of labour shortages and supply chain disruptions in the aftermath of COVID, disruptions from Russia’s invasion of Ukraine increased demand due to population growth, and an ample supply of pandemic savings that have yet to be spent. Despite the steepness of this current cycle of rate increases, it is taking longer than expected to slow the economy down as even unemployment rates remain at historic lows.

Moreover, there is continued federal fiscal stimulus designed to “alleviate” the effect of higher rates which essentially works at cross purposes with monetary policy given the money is going directly to consumers to spend, rather than, say, as investment incentives for things like boosting housing stock. After all, if one wants to use a house fire analogy, the Bank of Canada is bringing in the pumper trucks to douse the flames while the federal government is still throwing on accelerants and fanning the flames. It is odd that in the clamour for different tools to fight inflation, restraining federal spending growth rarely makes it to the top of the list.

Going forward, one should not expect interest rates to return to their pre-pandemic levels as those low rates were a historic anomaly. In the wake of the 2008-09 Great Recession, they were kept too low for too long and then reinforced by the quantitative easing of the pandemic. There are important reasons for keeping interest rates at more reasonable levels going forward—meaning a Bank of Canada policy rate closer to 4 percent—given the long-term effects on savings, productivity, and investment.

Higher interest rates have short-and-long term effects. In the short term, they will eventually slow the economy down—perhaps even move it into a brief recessionary period. Indeed, that is the point of monetary policy that raises interest rates to reduce inflation. However, in the long-term, there are beneficial effects to this policy. First, bringing inflation down ends the distortionary effect of higher and less predictable prices on the economy making for better decisions by firms and consumers. Second, higher interest rates will finally end the last decade’s “war on savers” that reduced the return to saving. Anomalous pandemic savings notwithstanding, low interest rates skew preferences from saving to consumption thereby increasing the pool of domestic capital available for investment purposes.

Finally, and perhaps most importantly, the end of cheap money is actually good for business investment from a productivity standpoint in that it forces businesses to invest in projects with higher rates of return. This of course may seem counter-intuitive in that conventional economy theory argues lower interest rates generate more business investment. However, there are two dimensions to business investment: quantity and quality. Low interest rates in the end may allow for less discerning investment decisions as every project that comes along can be funded. Higher rates mean that business investments with a higher rate of return need to be selected given the higher borrowing costs. In the long run, a more reasonable range of interest rates will make for better and more productive business investment decisions that should positively affect long-term per capita GDP growth rates.

While Canadians were adversely affected by the high interest rate episodes of the 1980s and 1990s, they were in the long term rewarded by those monetary policy periods with a nearly thirty-year period of both low inflation and low interest rates. A key issue is that Canadians accustomed to a long period of stable inflation and low interest rates have taken this for granted and built it into their economic expectations. The recent spike in inflation and especially interest rates has been an inconvenient lifestyle surprise. However, interest rates particularly after the Great Recession of 2007-08 remained too low for too long which, when combined with weak supply growth, helped fuel housing prices and exacerbated the housing crisis now underway. An economy based on fiscal stimulus and cheap money is fun while it lasts but does nothing to boost long-term living standards. This is a lesson that appears to be periodically relearned.

Recommended for You

Dare to build, again: 10 big ideas for a better Canada in 2026

Canada’s post-secondary schools need a major wake-up call

The global policeman is becoming the global rent-seeker

An Alberta budget crisis? It may be closer than you think