In each EconMinute, Business Council of Alberta economist Alicia Planincic seeks to better understand the economic issues that matter to Canadians: from business competitiveness to housing affordability to living standards and our country’s lack of productivity growth. She strives to answer burning questions, tackle misconceptions, and uncover what’s really going on in the Canadian economy.

It’s hard not to compare Canada to the U.S. With the U.S. seeing an unexpectedly positive jobs report last Friday, you might wonder what we can expect when our own comes out this Friday.

Last month, a whopping 254,000 jobs were added to the U.S. economy—well over and above the 150,000 expected and the 159,000 in August—while unemployment dipped back down to 4.1 percent. This comes after several months over which many thought the American economy was, at long last, weakening. It also offers some hope that the U.S. economy, with high inflation now behind it, is coming in for that soft, no-recession, landing.

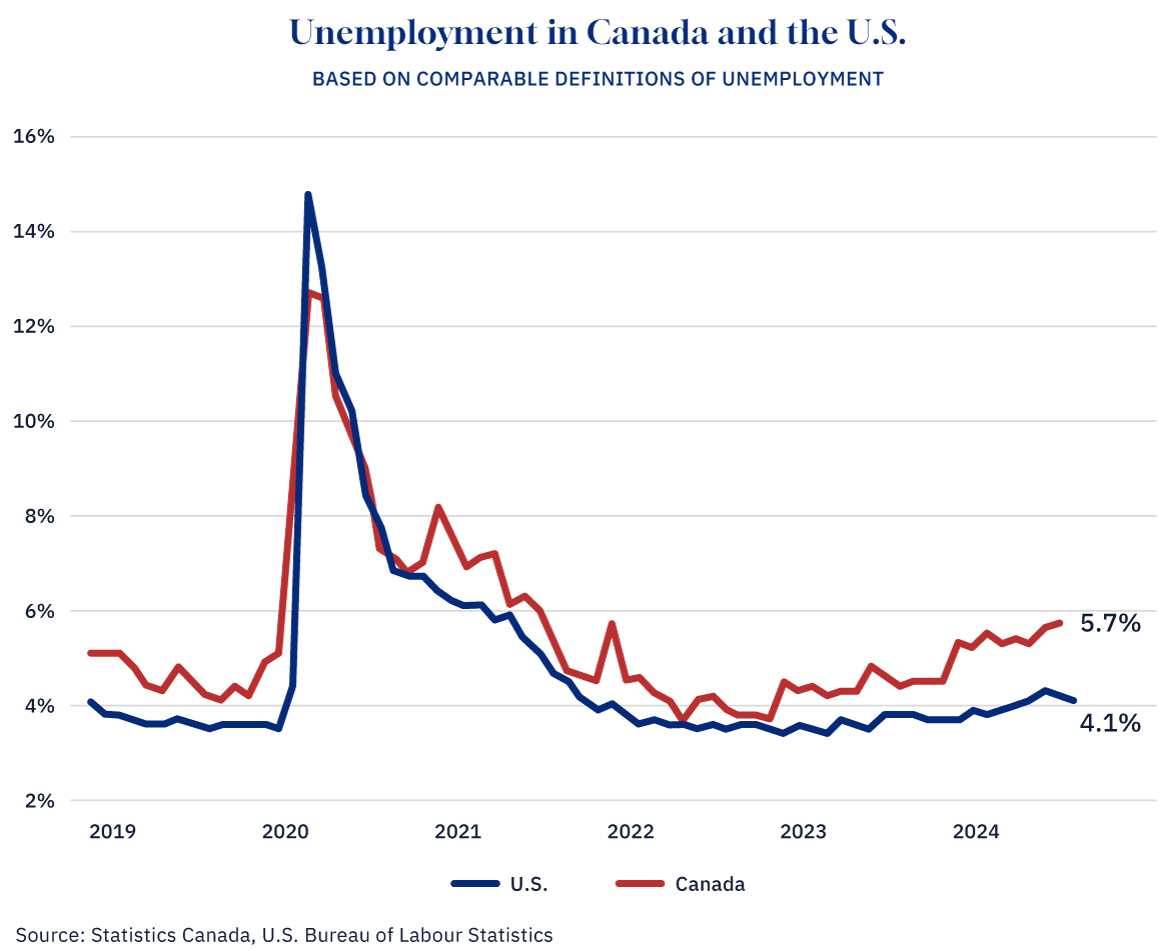

Meanwhile, the Canadian labour market and economy don’t seem to be holding up as well. Though Canada has yet to publish its official labour market data for September, its respective unemployment rate (using a similar definition to that of the U.S. known as the “R3”) shows unemployment was at 5.7 percent as of August.

Graphic credit: Janice Nelson.

While the difference between 4.1 percent and 5.7 percent might seem small, if Canada were to see a similar rate of unemployment as that of the U.S., around 350,000 fewer Canadians would be out of work. The labour market has deteriorated more quickly in Canada, too. The unemployment rate has continued to climb over the last couple of years, up a full 2 percentage points from 3.7 percent at the end of 2022, when Canada was nearly at parity with the U.S. (at 3.5 percent).

It’s worth noting that the strength of the U.S. is a positive, not a negative, for Canada. The U.S. is Canada’s biggest consumer, purchasing over three-quarters of the country’s product exports. Employed and happy U.S. customers mean more dollars flowing into Canada (albeit, not as many as consumer spending shifts from manufactured goods to local services). So, the fact that the U.S. economy is still humming along is good for Canada.

It’s also worth noting that, over the long term, Canada has typically had a higher rate of unemployment than the U.S. Researchers don’t have a clear explanation for why this is. That said, the growing gap more recently does raise some questions. Why do the two economies seem to be diverging? And will it continue?

One reason the gap is likely to continue is that Canadians are feeling more pain from high interest rates. Not only are Canadians more indebted than their neighbours, but they’re also much more likely to have seen their mortgages rise (thanks to shorter-term limits). Consumer spending is, unsurprisingly, taking a bigger hit.

But another reason for the gap may be higher government spending in the U.S. than in Canada. As of 2023, the deficit in the U.S. came in at 6.3 percent of the value of the economy compared to a deficit of just 1.1 percent in Canada. This extra government spending could still be padding consumers’ budgets and supporting more jobs in the U.S. than would otherwise be the case.

A version of this post was originally published by the Business Council of Alberta at businesscouncilab.com.