In each EconMinute, Business Council of Alberta economist Alicia Planincic seeks to better understand the economic issues that matter to Canadians: from business competitiveness to housing affordability to living standards and our country’s lack of productivity growth. She strives to answer burning questions, tackle misconceptions, and uncover what’s really going on in the Canadian economy.

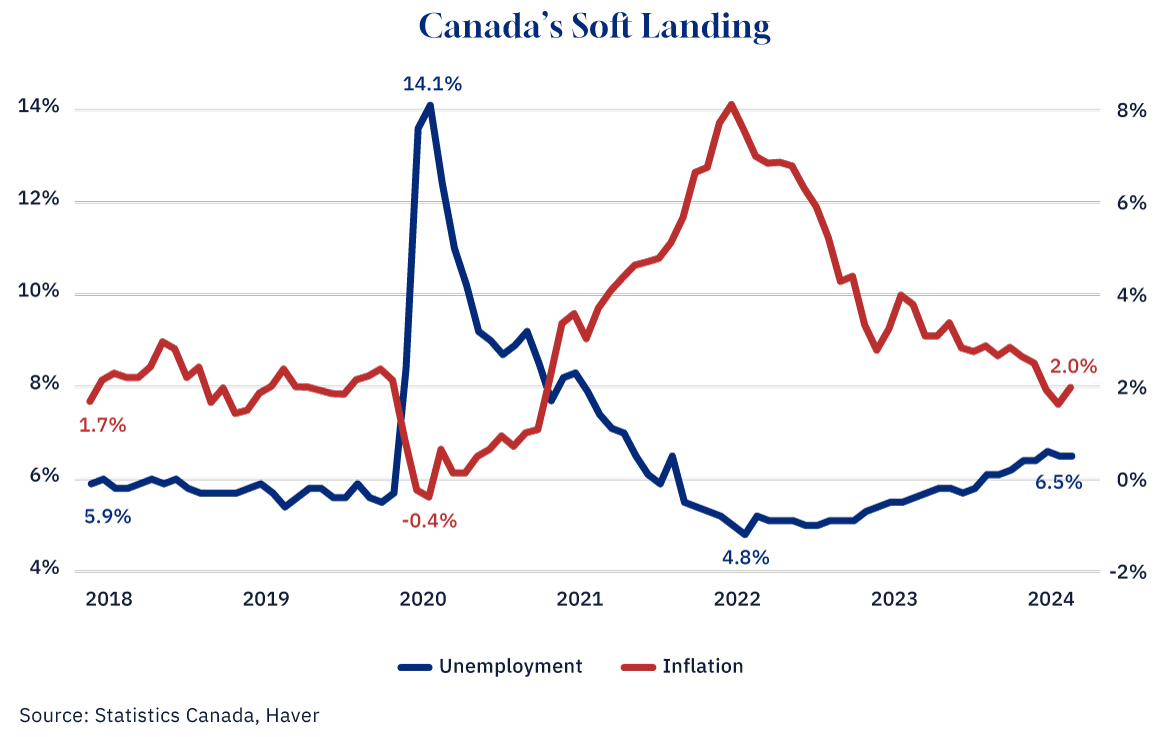

Back in June, the Bank of Canada said the Canadian economy was on track for a soft landing. Fast forward to today and the latest data shows that—at the risk of overplaying the metaphor—we’ve landed the plane, and with minimal turbulence.

Prices are growing at the rate the Bank wants to see (around 2 percent) while unemployment has held fairly steady since summer. To be sure, no one is calling the labour market strong or saying it’s easy to find work with unemployment at 6.5 percent. It’s not. But it’s also not falling apart.

Graphic credit: Janice Nelson.

This is a big deal. Many thought it would not be possible to bring inflation down from its highest level in over 40 years without causing major economic pain. Though it certainly wasn’t all the Bank’s doing—global supply chains were going to iron themselves out eventually—it did some heavy lifting nonetheless. It raised interest rates and consumers responded: by buying less but not so much so that businesses have had to lay off workers. That happy medium, Goldilocks outcome that was hoped for.

Will it hold?

One concern is the continued impact of high interest rates. They may be on their way down, but it’s still more expensive to borrow money or renew a mortgage than it was a couple of years ago. Consumers are likely to be weighed down by debt, and less eager to spend for at least a year. Major banks expect unemployment to rise (slightly) into next year.

But some bank forecasts had also anticipated unemployment would be higher now than it is. And a national survey of businesses suggests that, though the total number of vacant jobs has declined, businesses still plan to hire.

In fact, as of the third quarter of this year, hiring plans were only slightly below historical levels, and few companies were planning to lay off workers. Even if hiring were to prove weaker than expected, the Bank has some wiggle room to bring rates down further and faster to help consumers.

All of this gives confidence that, barring a major event, the plane has, in fact, landed.

Is a change in administration south of the border that major event? It’s possible. A policy shift will certainly affect the longer-term outlook for both countries (which currently does not look good for Canada), but it could have an immediate impact as well.

The most widely expected immediate impact of a Trump presidency is an appetite for high government spending and the stronger dollar (and weaker loonie) that comes with it. While that will make a trip south pricier, it’s not emphatically “bad” for the Canadian economy. It would also increase Americans’ interest in cheap goods from Canada, beefing up the revenues of exporters.

But there are other changes that would be more negative for Canada—think tariffs on Canadian exports—that could still knock out an engine.

A version of this post was originally published by the Business Council of Alberta at businesscouncilab.com.