In each EconMinute, Business Council of Alberta economist Alicia Planincic seeks to better understand the economic issues that matter to Canadians: from business competitiveness to housing affordability to living standards and our country’s lack of productivity growth. She strives to answer burning questions, tackle misconceptions, and uncover what’s really going on in the Canadian economy.

Inflation has returned to the Bank of Canada’s 2 percent target. And, thanks to the recently introduced GST holiday, is set to decline to 1.5 percent this winter. Even so, household budgets are likely to remain tight this holiday season.

That’s because the impact of the tax holiday will only make a small dent in the affordability that has been lost, and even then, only for a short time. It will remove the cost of the GST (or HST, if you live in Ontario or Atlantic Canada) from certain items (packaged food, puzzles, diapers, and Christmas trees, to name a few) for a couple of months.

To be sure, the removal of the GST/HST will improve affordability for these items. But consumers are likely to still feel sticker shock at the checkout given how much prices have risen in recent years.

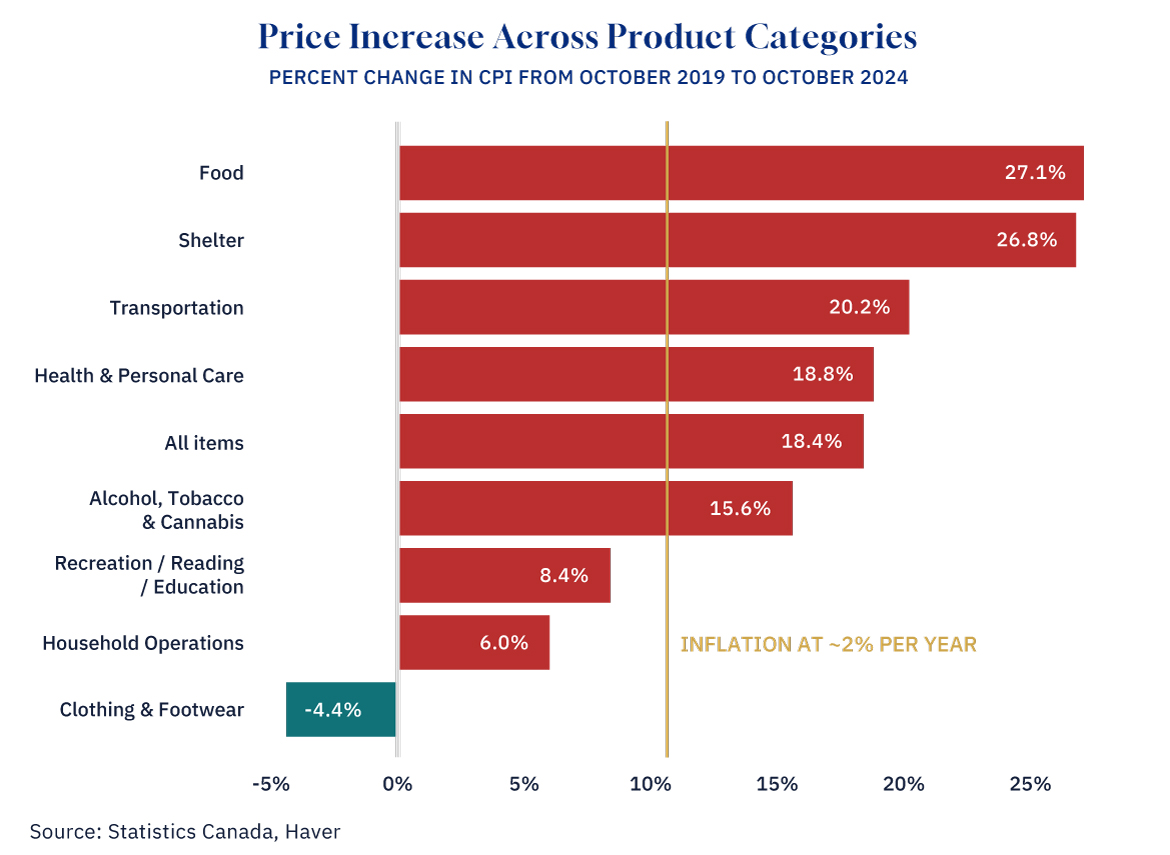

Overall, Canadians will spend approximately 17.5 percent more to buy the same things they bought five years ago (without the tax savings, this figure would be closer to 18 percent). Although prices generally rise over time, that increase is about 8 percentage points higher than what would have occurred under normal inflation.

Consumers will not only face higher costs for holiday-related items like toys, gifts, and decorations but also for essentials. Food and shelter, in particular, have seen the steepest price increases, rising nearly 30 percent since 2019. That’s more than double the expected increase in normal times.

However, it’s not all bad news. There are a few areas where consumers are saving money. Costs related to “household operations” have been mitigated by the federal government’s $10-a-day childcare initiative, which has reduced childcare costs by 30 percent (compared with if costs had grown normally), and by lower prices for cell service. Additionally, clothing is about 13 percent cheaper than what we’d expect given normal inflation.

Nonetheless, prices have largely risen, and Canadians are feeling strained. While incomes have grown slightly faster than prices, on average, not everyone is keeping up. Young people and lower-income households, for whom the cost of food and rent is particularly critical, are likely to continue to feel the pinch of inflation well beyond any short-term, holiday relief.

A version of this post was originally published by the Business Council of Alberta at businesscouncilab.com.