Welcome to Need to Know, The Hub’s roundup of experts and insiders providing insights into the economic stories and developments Canadians need to be keeping an eye on this week.

Let’s hope the tariffs are short-lived

By Joseph Steinberg, associate professor of economics at the University of Toronto.

The United States is set to impose tariffs on Canada and Mexico today following a month-long delay. President Trump’s Commerce Secretary, Howard Lutnick, stated on Sunday that “[m]aybe the 25-per-cent tariff doesn’t go into effect on Tuesday. Maybe he’s able to negotiate it down.”

Yet on Monday, Trump threw cold water on that notion, saying there was “no room left to deal” for Canada and Mexico.

The details of what those tariffs will fully entail are still to be seen as of now, but one possibility is across-the-board tariffs that are lower than Trump initially threatened. The other possibility is 25 percent tariffs that apply to a narrower range of products. In any case, the president may threaten additional tariffs in the future—higher in the first scenario and broader in the second—to maximize his negotiating leverage.

New tariff threats down the road would only increase trade-policy uncertainty, which is already off the charts. Research shows that this kind of uncertainty can inflict significant economic costs, even if tariffs are never actually implemented. One study estimates that the increase in trade policy uncertainty during the first Trump administration reduced U.S. investment by as much as 2 percent per year.

The economy is already showing signs of this strain. In the United States, commodity prices are rising rapidly and manufacturers’ order books are shrinking. In Canada, worries abound that trade uncertainty could exacerbate decades of under-investment and poor productivity growth.

Amidst all the unknowns, one thing does remain certain: tariffs on all imports from Canada would only cause even greater economic harm—on both sides of the border. Let’s hope that they are short-lived, whatever form they take.

Has the 2025 Canadian recession already started?

By Trevor Tombe, professor of economics at the University of Calgary and a research fellow at The School of Public Policy

Statistics Canada reported strong economic growth in Canada in the final quarter of last year. While this was welcome news, the economic reality has fundamentally changed since then. Thanks to potentially major disruptions to our trade relationship with the U.S.—due largely to the ever-present threat of tariffs hanging over the country’s head—uncertainty has spiked.

This surge could have major implications for Canada’s economy, regardless of whether tariffs are implemented or not. In fact, the uncertainty itself may be enough to push Canada into a recession—one that may already be underway.

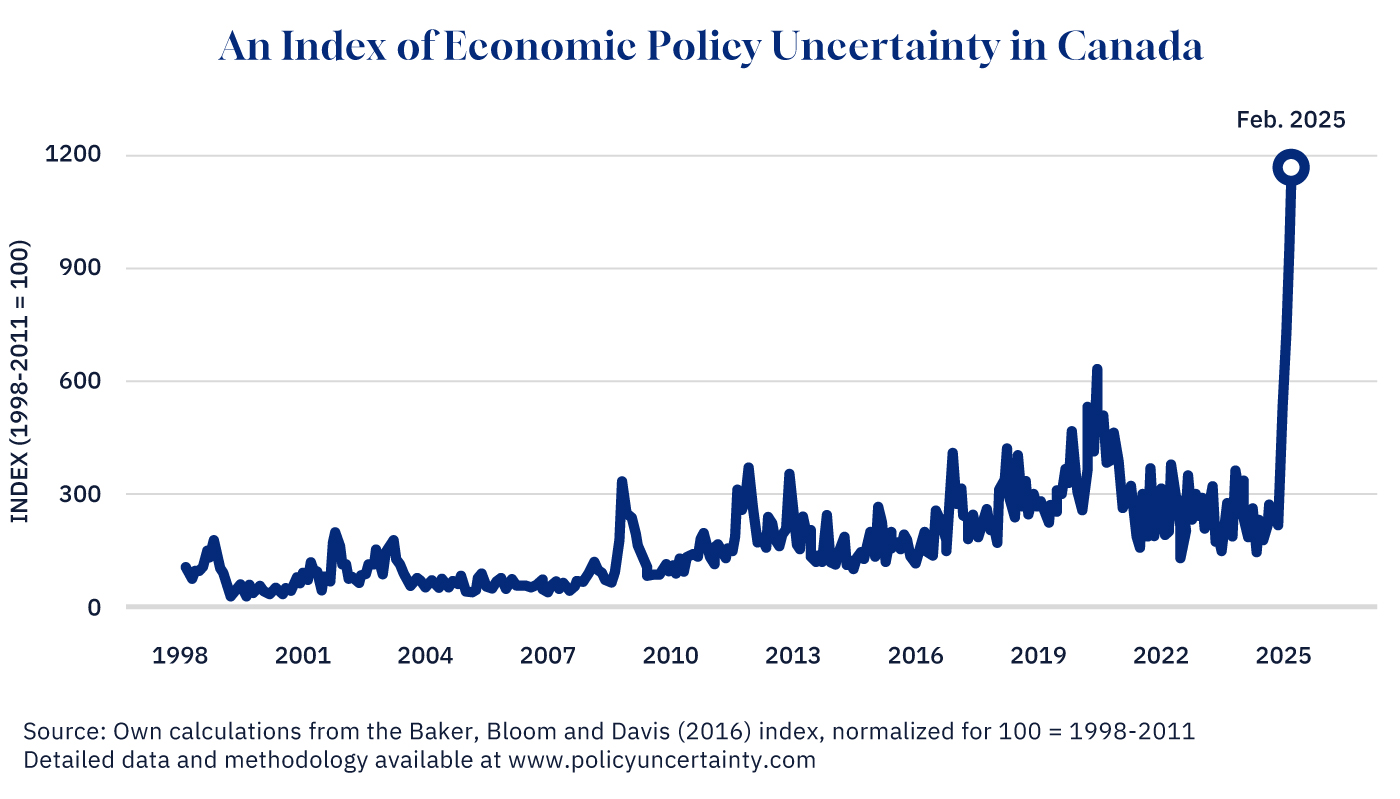

While this is difficult to measure, the leading index of economic policy uncertainty paints an incredibly stark picture. We set a record for economic uncertainty in January—and unfortunately blew well past that record in February.

Today, economic uncertainty is approximately 500 percent higher than it was this time last year.

Graphic credit: Janice Nelson.

And while uncertainty is rising around the world,All but two countries tracked by this index of uncertainty now face higher uncertainty than this time last year. Canada has (not surprisingly) seen a sharper rise than anyone else.

Though precise predictions are difficult, high-quality research suggests a clear link between rising uncertainty and negative economic outcomes. This shouldn’t be surprising, as uncertainty would naturally lead prudent firms to pause major investment decisions at the very least. Indeed, studies using experimental evidence show that when firms face uncertainty, they lower prices, reduce hiring, cut back on investment, and experience declining sales. Worryingly for Canada, which already struggles with lagging productivity growth, uncertain conditions also make firms less likely to invest in new technologies.

This can also be measured for the economy as a whole, with studies linking heightened uncertainty to lower production, lower employment, reduced investment, and higher unemployment rates. A quantitative analysis of 12 countries, which included Canada, found that a 150 percent increase in uncertainty (as measured by the above index) corresponds to a 1 percent decline in production and a 0.25 percentage point rise in the unemployment rate. For the U.S., a similar spike in uncertainty was estimated to decrease aggregate investment by 6 percent.

Given that Canada is currently experiencing an uncertainty increase roughly four times higher than the one examined in that study—comparable to the uncertainty levels leading up to the U.S. financial crisis—we could anticipate even more severe effects. Applying these estimates naively to Canada’s situation today suggests that total economic output could decline by 4 percent, unemployment could rise by a full percentage point, and investment could drop by nearly one-quarter.

This sharp spike in uncertainty may very well be triggering a recession. Historically, research has shown that uncertainty shocks can potentially lead to short, sharp recessions. We won’t have the data for several months—and it took roughly one year for the peak effects in the above study to fully manifest—but anecdotal evidence of firms re-evaluating their investment decisions is mounting. The Bank of Canada’s latest Business Outlook Survey also finds that many more business leaders than not anticipate lower investment and employment at their firm following the U.S. election.

There is little Canadian policymakers can do to reduce global uncertainty. However, now more than ever, it is crucial that they seriously commit to making Canada’s economic and investment environment as stable and attractive as possible. By doing so, they may help, at the very least, minimize the potentially inevitable economic damage that this unprecedented level of uncertainty may create.