In a now widely circulated clip, White House Press Secretary Karoline Leavitt claimed, “Tariffs are a tax cut for the American people.” Reality proves the opposite: tariffs raise prices, and are in fact a tax increase on American consumers.

But how do Canadians expect these tariffs—including self-imposed retaliatory tariffs on Canadians—to affect prices at home? It depends on who you ask.

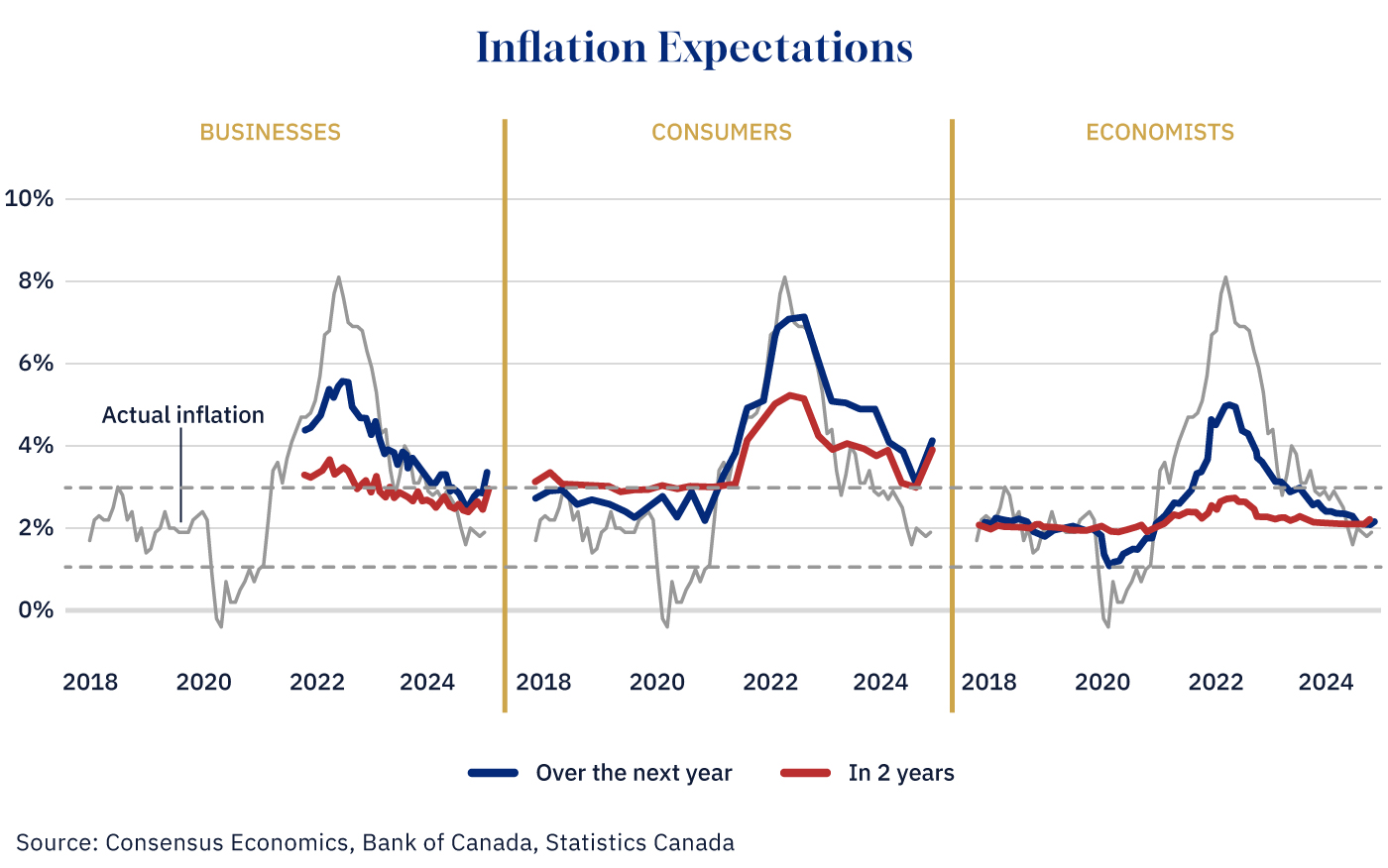

Businesses think prices will rise by about 3 percent over the next couple of years. And, in fact, they already are going up: as of February, companies reported higher costs because of more expensive inputs from the U.S. (the result of a weak Canadian dollar and some retaliatory tariffs) and elsewhere, as well as uncertainty pushing businesses to lock in higher prices for contracts.

Graphic credit: Janice Nelson.

Canadian consumers are even more worried about inflation. Based on the latest Canadian Survey of Consumer Expectations, they anticipate that prices will rise around 4 percent over the next couple of year—twice the Bank of Canada’s target.

But economists—the experts in supply and demand—aren’t so sure. Their inflation forecasts have barely budged from January to February as the talk of tariffs heated up; their inflation expectations for the next year inched up only slightly from 2.02 percent to 2.10 percent. And for the year after that? It’s as if there was never any trade war at all.

Do economists not know that tariffs increase prices? Why might they think otherwise?

One possibility is that economists don’t—or, at least, back in February didn’t—think this trade spat would actually last. There were still strong negotiating-tactic vibes at the time; and things feel a lot different now.

Another possibility, as the governor of the Bank of Canada recently pointed out, is that tariffs affect inflation in Canada in two ways. On the one hand, they raise costs for businesses, for all the reasons already mentioned. On the other, they weaken the economy by reducing demand for Canadian exports. Less revenue for businesses and income for households decrease consumer spending, putting downward pressure on prices. Who’s going to make major purchases or drive up home prices if they’re worried about losing their job?

Economists’ views may differ from businesses and consumers, but there’s one thing we can all agree on: no one has any idea what’s going to come out of the President’s office next.

A version of this post was originally published by the Business Council of Alberta at businesscouncilab.com.