Welcome to The Think Tank, your Saturday dive into thought-provoking research from think tanks, academics, and leading policy thinkers in Canada and around the world, curated by The Hub. Here’s what’s got us thinking this week.

We only made it half a week into the election before President Trump’s trade war made headlines. This time, it was 25 percent tariffs on imports of autos and auto parts for “national security” reasons, which will take effect on Wednesday.

Next week, we’ll also see whether potential “reciprocal” tariffs will also be applied to Canada and others, and if broad tariffs will expire. We’re also expecting a U.S. government study on “unfair trade” that Trump ordered in a day-one executive order.

Suffice it to say that Trump and Canada-U.S. relations will likely dominate the campaign next week. Given the current anti-American sentiment among the Canadian populace, expect the parties to zero in on which leader will take a tougher stance with the president.

But that’s next week’s story. Let’s take a look at some of what was driving campaigns this past week.

While Boomers are worried about Trump, young Canadians are concerned about the cost of living

In the last few years, intergenerational angst has risen in Canada amid an affordability crisis, soaring home prices, and a welfare system tilted strongly in favour of seniors.

Before this election, intergenerational conflict was remaking federal politics. The Liberals, who rode a wave of youth support in 2015, were finding that more and more of their base was over the age of 65, while the Conservatives saw young Canadians flock to the party.

Fast forward to today, and we’re seeing stark age differences in the policies that Canadians care about.

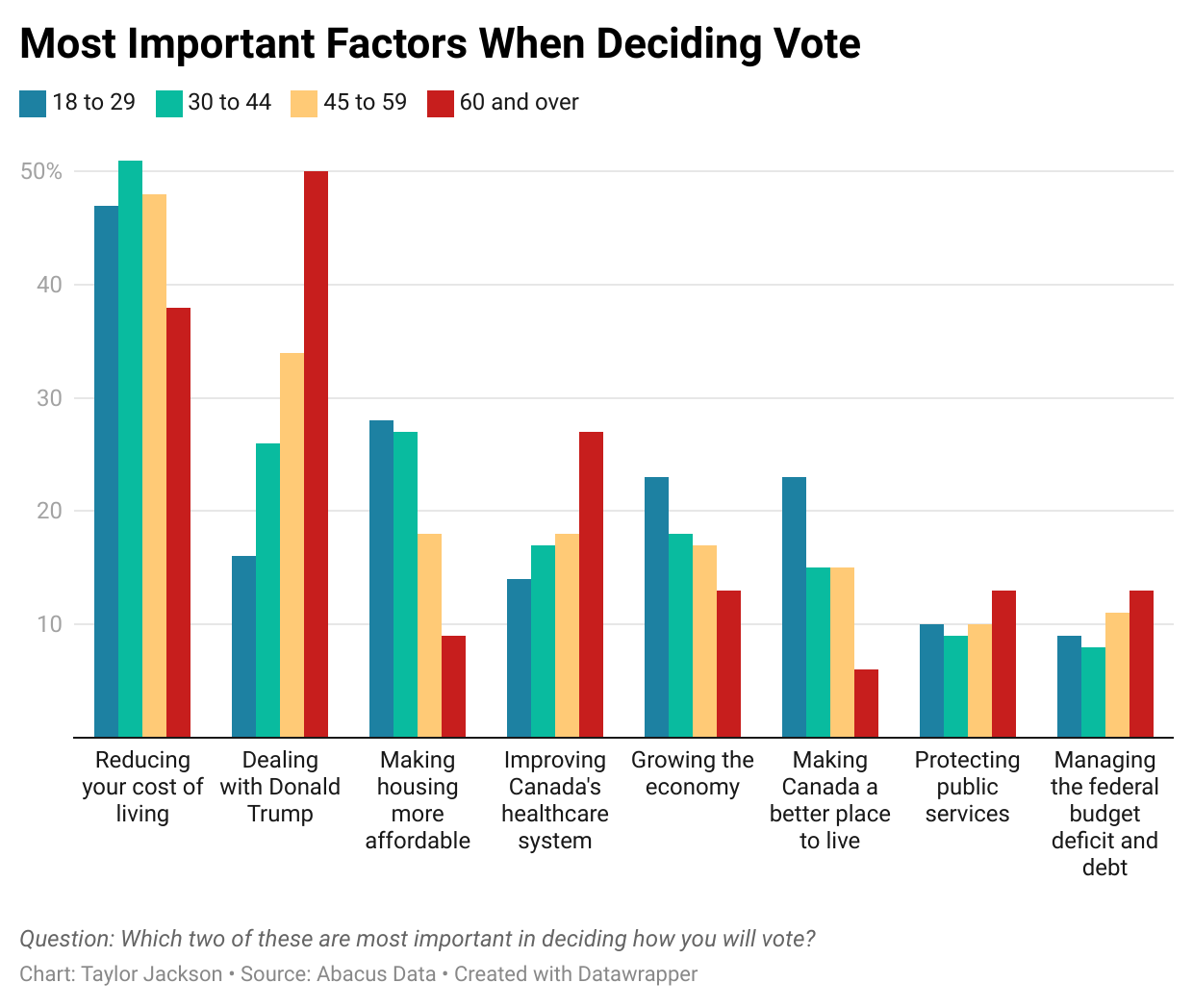

Recent polling from Abacus reveals the most important factors in determining how Canadians will vote, and the age gaps are stark.

While news coverage is intensely focused on the threat from Trump, this is not the case for much of the population. Only 16 percent of Canadians between 18 and 29 think dealing with Trump is one of the two most important factors in deciding their vote. This contrasts starkly with seniors, with 50 percent saying that dealing with the Trump threat is one of their top issues.

If reducing the cost of living is top of mind, you’re much more likely to be a millennial in the 30 to 44 age range. Half of Canadians in this age group say this is one of their top issues. Meanwhile, less than two out of five seniors say reducing the cost of living is one of their top issues.

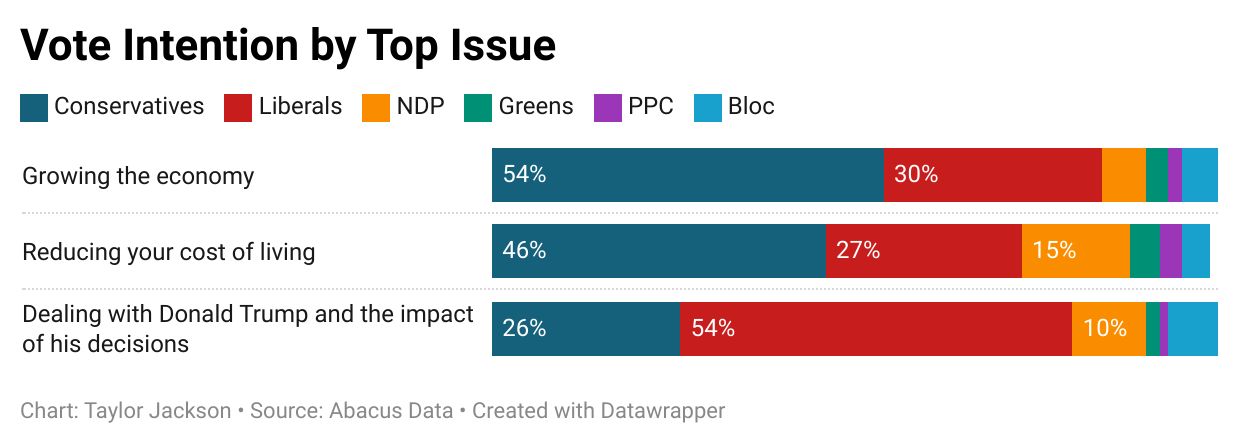

When combined with vote intention by top issues, we start to see how intergenerational politics is playing out. Using data from the same Abacus poll, if growing the economy and reducing the cost of living are someone’s top issues, as they are for younger Canadians, they are much more likely to plan to vote Conservative. However, for those who say managing Trump is their primary focus, as it is for older Canadians, a majority intend to vote Liberal.

The intersection of age, issues, and vote intention can tell us a few things about where this campaign is going. Conservatives win on the economy, and the Liberals win on Trump; expect each party to try to shift the overarching narrative in either direction over the coming weeks.

However, Trump will likely dominate the headlines next week with a flurry of tariff announcements. If he does, many point to Conservative leader Pierre Poilievre needing to take a strong anti-Trump stance to try to gain support with Trump-concerned voters. For Carney, the goal will be to continue looking like a competent manager of Canada’s foreign relations crisis.

Also, expect the parties to start trying to make inroads with the demographic bases where they’re losing ground. For the Conservatives, this will be with seniors. For the Liberals, it will be with younger Canadians who are concerned about affordability and the state of the economy.

We’ve still got a long campaign ahead of us, but it looks like the intergenerational battle lines are already drawn.

Conservatives give seniors a big tax break

Speaking of the Conservatives trying to shore up support with seniors, this week, they made an announcement aimed at winning their votes. The policy proposal had three components:

- Allow working seniors to earn up to $34,000 tax-free—$10,000 more than now.

- Allow seniors the option of keeping their savings growing in RRSPs until they turn 73, up from 71.

- Protect Old Age Security (OAS), the Guaranteed Income Supplement (GIS) and the Canada Pension Plan (CPP) by keeping the retirement age at 65.

“After a Lost Liberal Decade, Canadian seniors can’t afford a fourth Liberal term making Canadians poorer and Canada weaker. They need a new Conservative government that will lower taxes and put Canada First—for a change,” said Conservative leader Poilievre.

While these policy announcements might be good politics if you’re trying to attract older voters, two of the three represent flawed public policy choices that do not address the overarching problems of poverty, affordability, or economic growth borne out by the actual numbers.

Let’s start with the good. There is a strong policy rationale for allowing seniors to keep growing their RRSPs until they are 73. This will allow seniors to maximize their retirement income as they work and live longer.

However, with the increase in the amount of income that seniors can earn tax-free, aside from politics, it’s unclear what problem this policy is trying to solve.

According to Statistics Canada data, the percentage of seniors living in poverty was 6 percent in 2022, the last year for which data is available. This compares to a poverty rate of 11 percent for Canadians aged 18 to 64 and roughly 10 percent for those under 18. That is to say, seniors have the lowest levels of poverty relative to other age groups.

If the Liberals’ lost decade makes Canadians poorer and the Conservatives are serious about rewarding work, one cannot help but ask: don’t all Canadians need this tax relief?

What this policy effectively means is that a 65-year-old at the peak of their career, earning north of $200,000 a year, is being given more tax relief than an 18-year-old working full-time and earning minimum wage.

Even if the Conservatives thought there was an issue with seniors’ poverty, the Guaranteed Income Supplement is meant to address that. They could have proposed changes to this program instead.

Likewise, keeping Canada’s retirement age at 65 bucks the trend of our international peers and puts continued pressure on government coffers.

Instead of pursuing broad-based tax reform that benefits all working Canadians and fosters economic growth, this chosen path of preferential treatment for seniors could stoke already growing intergenerational strife.