Welcome to Need to Know, The Hub’s roundup of experts and insiders providing insights into the federal election stories, policy announcements, and campaign developments Canadians need to be keeping an eye on.

A Mark Carney win would be good for Donald Trump

By Leonard Waverman, professor emeritus and former dean of finance and business economics at McMaster University

When I read about the very pleasant exchanges between President Trump and Liberal leader Mark Carney, I was a bit surprised. Why would President Trump seem to enjoy a conversation with someone like Carney, a proverbial global elitist, educated at Oxford and a former bank governor in Canada and then the U.K.?

Furthermore, Carney is a committed environmentalist—including, for instance, that he was the co-Chair for the Glasgow Financial Alliance for Net Zero (GFANZ) and the UN special envoy for climate action—something that Trump normally abhors.

It almost causes one’s Machiavellian hat to pop on his or her head. Ostensibly everyone in the U.S. administration knows about Canada’s poor economic performance since 2014. Flat-lined GNP per capita growth, the lowest labour productivity growth of any economy in the West, large budgetary deficits, and anemic real growth. Most of this happened during the Liberal government’s nearly ten years in office.

Pinning all of that on the Liberals alone might not be fair, but the party under Trudeau does deserve much of the blame. Canada’s dismal innovation and productivity performance did not galvanise them into action while in government. Instead, the Liberals seemed to be more concerned with Canadian content on television and social media.

But still, why would Trump prefer that Canada have Carney and another four years of Liberals instead of Pierre Poilievre, who himself is more of a populist and has a real growth agenda?

The answer may be simple: the U.S. under Trump does not want a stronger, more productive Canada, one infused with real growth and that can compete with U.S. energy exports. You can’t ride a strong, prosperous, and economically secure Canada into oblivion or make it the 51st state.

And the Liberals seem to be playing into Trump’s hand. Carney last week stated that reducing the cap on emissions of oil and gas would be good since Canada could develop more energy resources. He was quickly rebuked by his own natural resources minister, who stated that the cap would remain. Carney in turn quickly reversed himself. To see the supposed saviour of Liberal Party fortunes unable to change his own party’s policy is telling.

It shows that the Liberal Party, if given another four-year mandate, will be the same party of the last decade, with a new titular leader but with many of the same ruinous policies in place. Bad for Canada but good for Trump in making America great again.

The Conservative campaign strategy is becoming clearer

By Sean Speer, The Hub’s editor-at-large

Some of us were a bit lukewarm on the Conservatives’ first policy announcement of the campaign to lower the bottom marginal tax rate for individuals by two-and-a-quarter percentage points. Precisely because it’s broad-based, the policy is costly and will only have marginal behavioural effects on investment, work, and other economically valuable activities.

But as the campaign has gone on, the political logic of launching with a broad-based tax cut has become clearer.

Since then, the Conservatives have put forward a series of policy proposals that represent an implicit yet correct diagnosis of what ails Canada’s stagnant economy. The party’s plan to increase the annual TFSA limit, reverse the Trudeau government’s controversial capital gains tax hike, and provide for a capital gains rollover for investment in Canadian assets aims to pull more private capital into the economy in order to boost housing supply, entrepreneurship, and household savings.

It’s almost as if the broad-based tax cut provided the political licence for these more macroeconomic (and wonky) measures which recognize that over the past decade, the Canadian economy has experienced a flat-lining of private investment across the economy and see a role for public policy to reawaken the animal spirits.

They fell into a slumber during the Trudeau era, which was marked by a state-centric understanding of the economy. The government’s mix of unsustainable immigration, a deficit-financed spike in social spending, and an unprecedented programme of large-scale industrial subsidies contributed to a drop in investment, productivity, and Canadian living standards.

In the face of these challenges, the Conservatives’ proposals shouldn’t merely be understood as a set of individual proposals but instead as a different understanding of how the economy works and the role of government to support investment, output, and productivity.

Conservative Leader Pierre Poilievre speaks at a news conference to launch his campaign for the federal election, in Gatineau, Que., on Sunday, March 23, 2025. Justin Tang/The Canadian Press.

Critics might argue that the conditions on these proposals—particularly the requirement for Canadian investments—will diminish their effectiveness. Fair enough.

But in a context in which the Trump administration’s threats to Canada are the most salient issue, it seems inevitable that the Conservatives would want to nod to it. If the cost of these pro-investment measures is that they’re biased towards domestic assets, that seems like a worthwhile tradeoff.

Which brings me to the Conservatives themselves. In a short campaign, there’s an understandable tendency to want to get your policies announced as quickly as possible. That can sometimes preference speed over other considerations. The risk is that while the party itself understands how its various policy announcements hold together, it may be less self-evident to voters. There’s now an onus on the Conservatives to come back to these proposals and explain how they cohere around a broader diagnostic of Canada’s lost decade and a vision for the economy that’s different than what others are offering.

A lot more red ink ahead

By Trevor Tombe, professor of economics at the University of Calgary and a research fellow at The School of Public Policy

Although we’re barely more than a week into the 2025 federal election campaign, it’s already clear that more red ink lies ahead for federal finances. After years of rising borrowing and steadily increasing spending—often beyond what the federal government itself had planned—the fiscal outlook was already far from rosy.

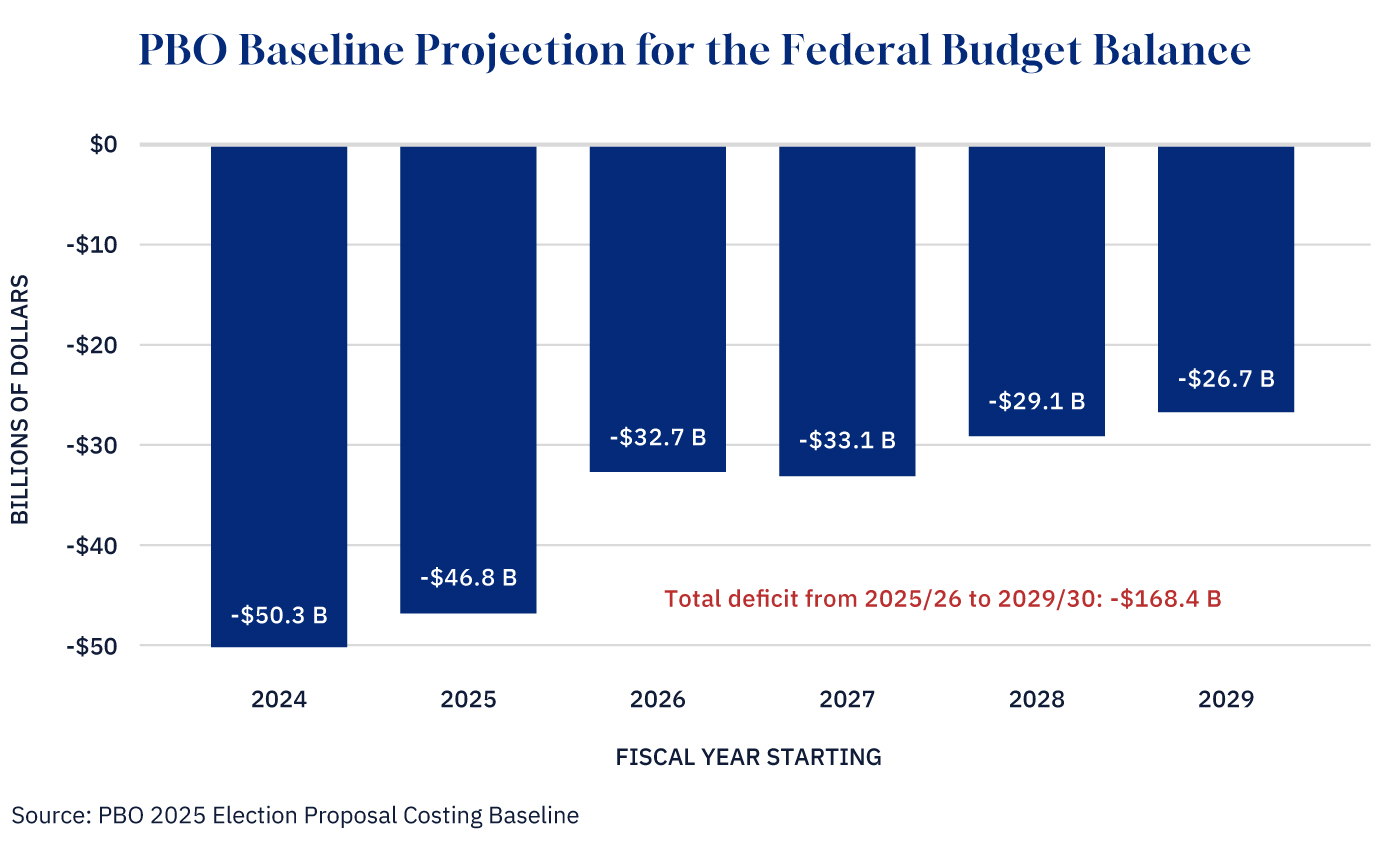

This week, the Parliamentary Budget Officer released its baseline projection for the federal budget balance from 2024 through to the end of the 2029–30 fiscal year. This will serve as the starting point when costing the various proposals put forward by parties in the campaign.

The PBO anticipates that the deficit for the upcoming fiscal year may come in at nearly $47 billion—that’s higher than the roughly $42 billion the government anticipated in its Fall Economic Statement back in December. It’s also higher than the PBO’s own forecast from just a few weeks ago.

Looking ahead, the PBO expects the deficit to gradually shrink, falling to just under $30 billion by 2028 and $27 billion by 2029. But over the next five years, that still adds up to a cumulative deficit of nearly $170 billion—about $14 billion more in borrowing than what the government had projected just a few months ago.

Graphic credit: Janice Nelson.

And all of this is before taking into account the major new commitments being made by all the major parties on the campaign trail—commitments that could drive those deficit numbers even higher.

From personal income tax cuts proposed by the Liberals, Conservatives, and even the NDP, to billions in new infrastructure spending—like the Conservatives’ pledge to unlock the Ring of Fire mining region, or the Liberals’ push for a national economic corridor—the promises are stacking up fast. Add to that increases in military spending, other tax changes, expanded public services, and more.

There’s also the uncosted promise to issue carbon tax rebates this April—even though the tax itself will no longer be in effect and therefore won’t be generating any revenue. That alone adds a few more billion dollars to the tab.

Full, costed platforms from the major parties are potentially coming soon. But for now, the trend points clearly in one direction: a worsening fiscal outlook. And that’s before considering any economic shocks—like potential trade disruptions with the United States—that could slow growth or even tip the economy into recession. Of course, there will be tariff revenues from any retaliation that Canada adopts, but all parties appear committed to using all of those funds to support individuals, businesses, and (maybe) provinces, rather than addressing any federal fiscal shortfalls.

Long-term fiscal planning should aim to ensure we’re in a strong enough position to absorb these kinds of shocks. But based on what we’re seeing so far in this campaign, we’re moving further away from that goal—not closer.

Carney’s housing announcement highlights his centralizing instincts

By Theo Argitis, The Hub’s editor-at-large for business and economics

One of the more interesting reactions to my profile of Mark Carney last week was pushback on the claim that he would be a centralizing prime minister.

Just because he would be a hands-on type of prime minister, that doesn’t equate with him being a command style centralizer. Which of course is fair criticism.

Prime Minister Mark Carney speaks to media at Rideau Hall in Ottawa, Sunday, March 23, 2025. Adrian Wyld/The Canadian Press.

But I still think the label fits. Carney would be a centralizing leader, not only because it aligns with his governing instincts, but there’s reason to believe he thinks the moment demands it.

At a time when Canada is being economically and politically pressured by an increasingly assertive United States, a more centralized federal government could be a useful means of projecting strength and coherence. Certainly, a case can be built for it.

Trump himself is a centralizer—a point made in a great Bloomberg opinion piece over the weekend warning of the perils of his “personalized leadership,” where deal-making and executive orders replace a rules-based economic system.

Carney’s version of centralization would be very different. Where Trump centralizes power in himself, Carney would centralize through institutions. He is, after all, a creature of the regulatory state—a veteran of central banks, international organizations, and the rules-based order.

What does that look like in the Canadian context?

A push for strong federal control over areas like economic policy and national standards—including on housing, as Monday’s policy announcement demonstrates, and climate—which would inevitably spark tensions with the provinces. As well as a strong prime minister’s office, a managed cabinet, a branded message, and efforts to bend Parliament to his will—which to be fair has been the norm in Canadian federal politics in recent decades.

He’ll be surrounded by sharp, loyal advisors in the PMO who, in many cases, would outrank cabinet ministers in influence. And he’ll set the agenda directly—possibly chairing key cabinet committees himself, leaning perhaps on super-ministers to execute, and relying on omnibus legislation to push through major reforms if he wins a majority.

Pierre Poilievre’s shovel-ready Zones are a game-changer for Canada

By Brad Tennant, a vice president with Wellington Advocacy who previously served as the executive director of the United Conservative Party

The ability to expand the ability to move our resources from coast to coast is something Canadian industry has lacked for a generation. One simple policy proposed this cycle could change that.

Election promises often lack impact, but Pierre Poilievre’s “Canada Shovel-Ready Zones” could transform the nation’s economy. This policy designates pre-approved areas for resource and energy projects, mines, LNG plants, pipelines, slashing red tape. Companies could start building fast, unlocking billions in private investment and creating thousands of jobs.

This is what global markets are looking for—more Canada. Unlike Mark Carney’s obsession with carbon pricing, which chases global applause while ignoring Canada’s resource potential, Poilievre’s plan targets what the resource sector needs. A single LNG plant could employ thousands, reviving regions like the Prairies. It’s practical: permits ready, standards clear, shovels in the ground.

The export potential is massive. Years after Russia’s invasion of Ukraine, Europe still buys Russian gas because Canada’s resources aren’t available. Shovel-ready zones could deliver energy to Europe in a few years, bypassing nations like Russia and Iran. Trudeau pushed carbon taxes for trade, but markets want our resources now; a simple export zone could make it happen.

This echoes the national railway’s ambition, connecting Canada to global markets. Critics cite environmental or Indigenous concerns, but Poilievre promises upfront studies and collaboration. The current system loses jobs and investment; this fixes it.

In a time of economic drift, Poilievre’s policy is a bold shift. It could mean jobs, higher resource value, and sovereignty, proving that one small change can reshape Canada’s future.