Welcome to The Think Tank, your Saturday dive into thought-provoking research from think tanks, academics, and leading policy thinkers in Canada and around the world, curated by The Hub. Here’s what’s got us thinking this week.

Good news, Canada. If you’ve been letting your neck recover from President Trump’s tariff announcement whiplash, you might have missed that the auto tariffs may be paused now.

“I’m looking at something to help some of the car companies with,” said Trump last Monday. “And they need a little bit of time because they’re going to make them here, but they need a little bit of time. So I’m talking about things like that.”

If Trump follows through, this would be the latest round of trade policy reversals. Whether the pause is about specific issues raised by the auto industry or growing concerns about a trade war-induced recession, what is clear is that policy uncertainty is rising.

Global economic policy uncertainty is now at levels higher than during the pandemic, largely as a result of the U.S. president’s agenda. The outcome is that global economic growth prospects are slowing, and so too is the U.S. economic outlook.

As the negative outcomes of Trump’s trade war become clearer, one has to wonder if U.S. public opinion of trade will begin to shift more towards favouring openness. With that in mind, let’s take a look at some recent polling on Americans’ positions on trade.

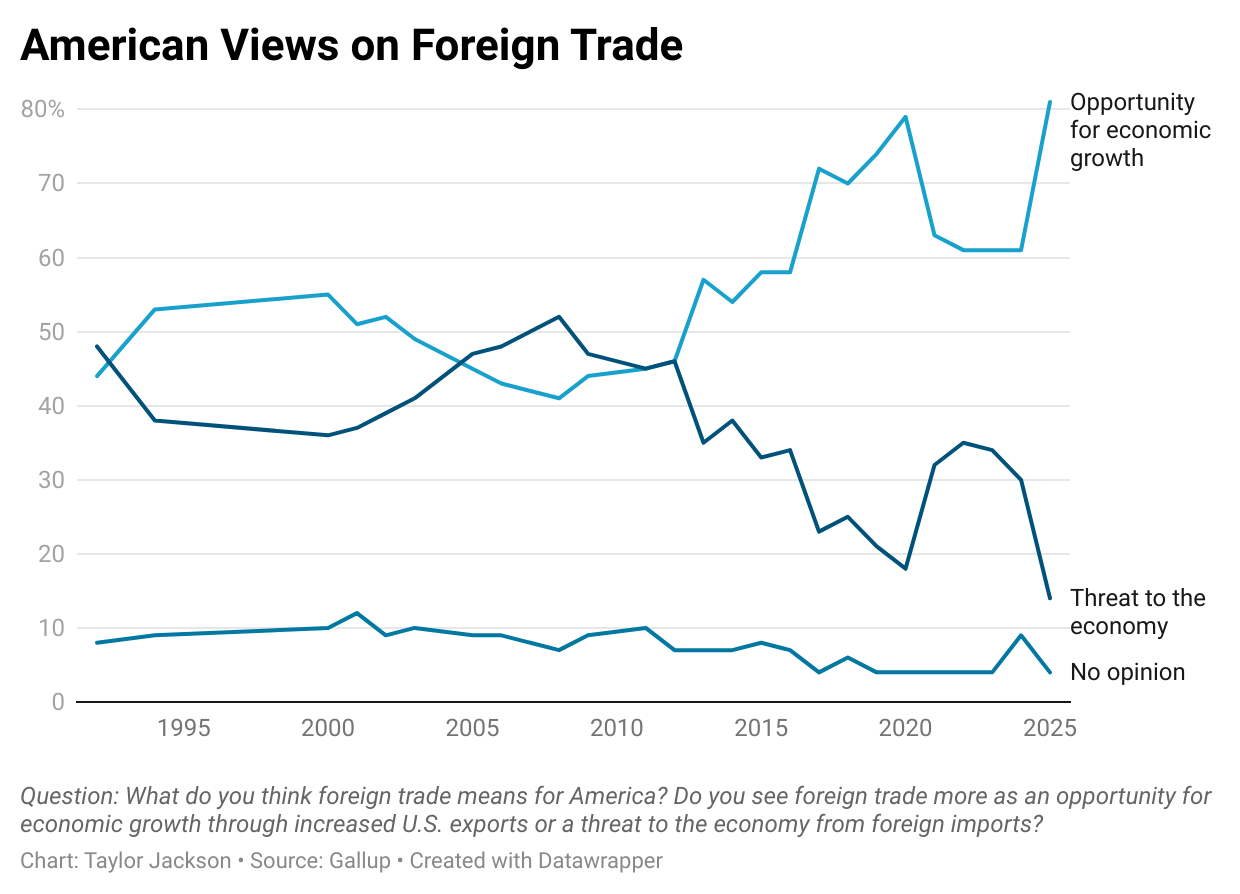

A majority of Americans think trade is good for economic growth

What do Americans think about trade? According to polling from Gallup conducted in February, which has tracked American opinions on trade back to 1992, over 80 percent of Americans think trade is an opportunity for economic growth through increased U.S. exports. This is up 20 percentage points from last year and at its highest point since the end of the first Trump administration.

How does this make sense amid a trade war that is threatening to upend U.S. trade relationships and slow economic growth? Gallup concludes that the rise in positive foreign trade opinions “likely reflect[s] Republicans’ much higher confidence in Trump than Biden to negotiate trade deals that would be favorable to the U.S. For their part, Democrats may be more positive about the benefits of trade defensively, in reaction to Trump’s proposing tariffs on imports.”

There could also be an effect stemming from how the question is worded, since it focuses on the benefits of U.S. exports. This may increase Republican support for the proposition, given that it could be interpreted to align with the Trump administration’s view of trade deficits.

This is not to say that imports don’t also benefit the U.S. The U.S. Trade Representative (USTR) website states that “imports increase consumer choice, and help keep prices low, raising the purchasing power for consumers.” It adds that, “Imports also provide high quality inputs for American businesses helping companies and their U.S. employees become or remain highly competitive in both domestic and foreign markets.”

Don’t tell the Trump administration that a government website admits that imports are good for U.S. consumers and businesses. Nevertheless, it is clear that the vast majority of Americans think there are economic opportunities from trade.

However, the country is much more divided on whether tariffs are the best tool for gaining more economic benefits from trade.

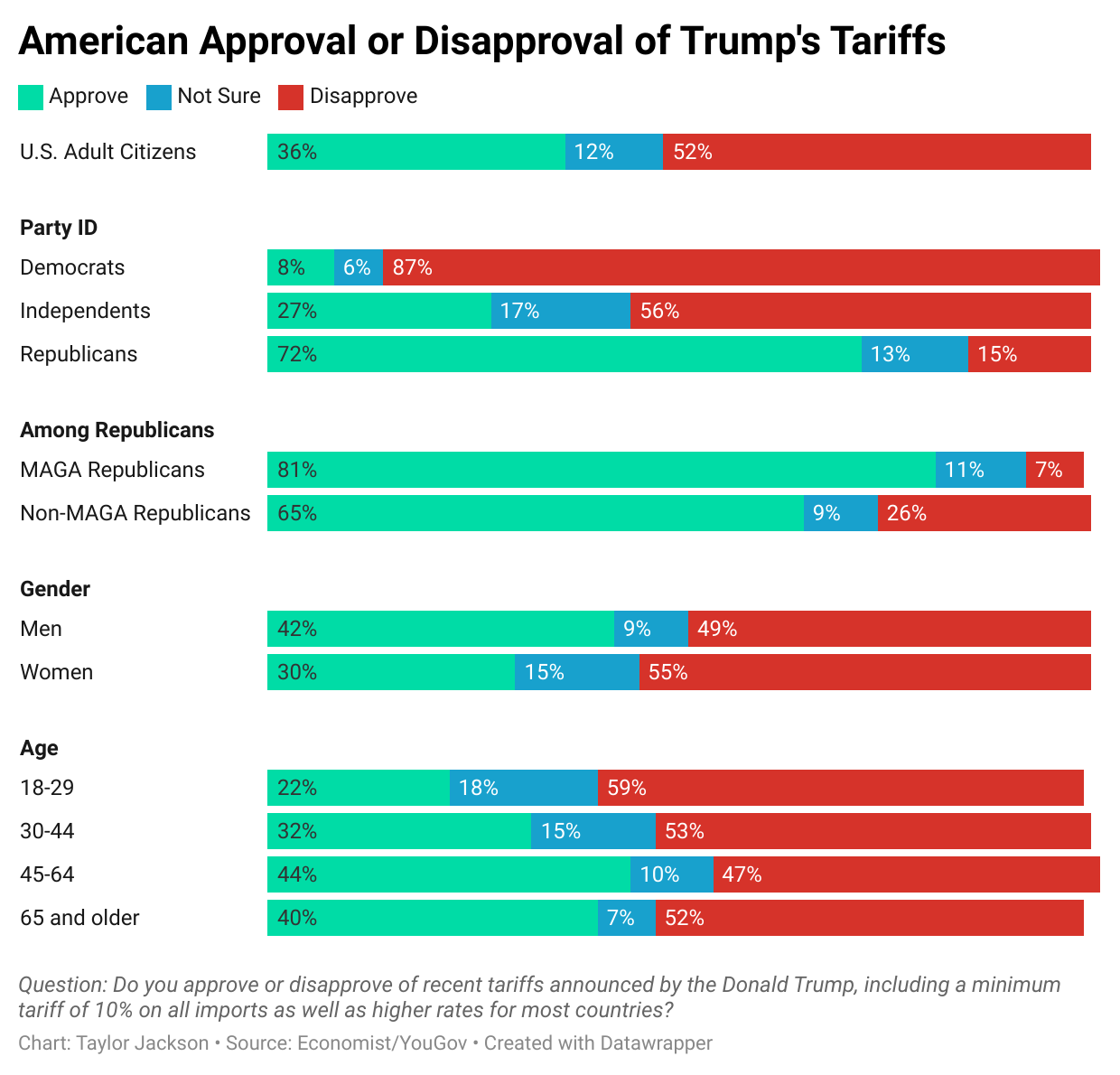

A majority of Americans disapprove of Trump’s tariffs

Economist/YouGov polling from early April asked Americans whether they approved or disapproved of Trump’s tariffs. The results are revealing.

Most Americans are aware of Trump’s “reciprocal” tariffs, which impose a minimum 10 percent rate on all countries, with even higher rates for many. Despite a temporary 90-day pause announced after the survey concluded, the policy remains controversial. Awareness is higher among Democrats (73 percent) than Republicans (53 percent).

Overall, public opinion is negative on Trump’s tariff policies, with 52 percent disapproving and only 36 percent approving.

Net approval is sharply divided along partisan lines: -79 among Democrats, -29 among Independents, and +57 among Republicans. Among Republicans, support is strongest among those identifying with the MAGA movement (+74), compared to non-MAGA Republicans (+39).

Men and older Americans are somewhat more likely to support the tariffs than women and younger adults, though net approval remains negative across all gender and age groups.

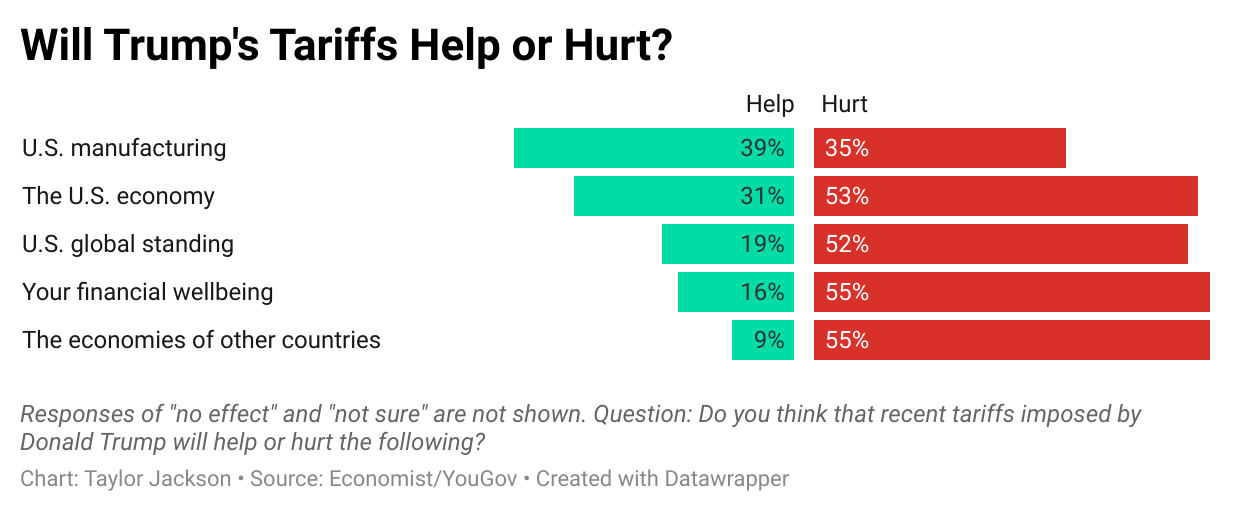

The Economist/YouGov poll also asked whether Americans think the “reciprocal” tariffs will help or hurt the U.S. The poll found that, in general, a plurality of Americans believe that recent tariffs imposed by Trump are harmful to the economy and consumers without offering real long-term benefits (48 percent), compared to 37 percent who view them as painful in the short term but beneficial in the long run.

Public sentiment is largely pessimistic about the broader impact of tariffs: 55 percent expect them to harm their personal financial well-being, 53 percent think they will damage the U.S. economy, 55 percent believe they will hurt other countries’ economies, and 52 percent say they will diminish the United States’ global standing.

One industry they think tariffs could help is U.S. manufacturing, where slightly more Americans expect the tariffs to help (39 percent) than to hurt (35 percent). However, previous experiences with tariffs suggest that the net effect on U.S. manufacturing will be negative, given that the tariffs will raise import prices.

Trump’s economic agenda is hurting U.S. economic growth

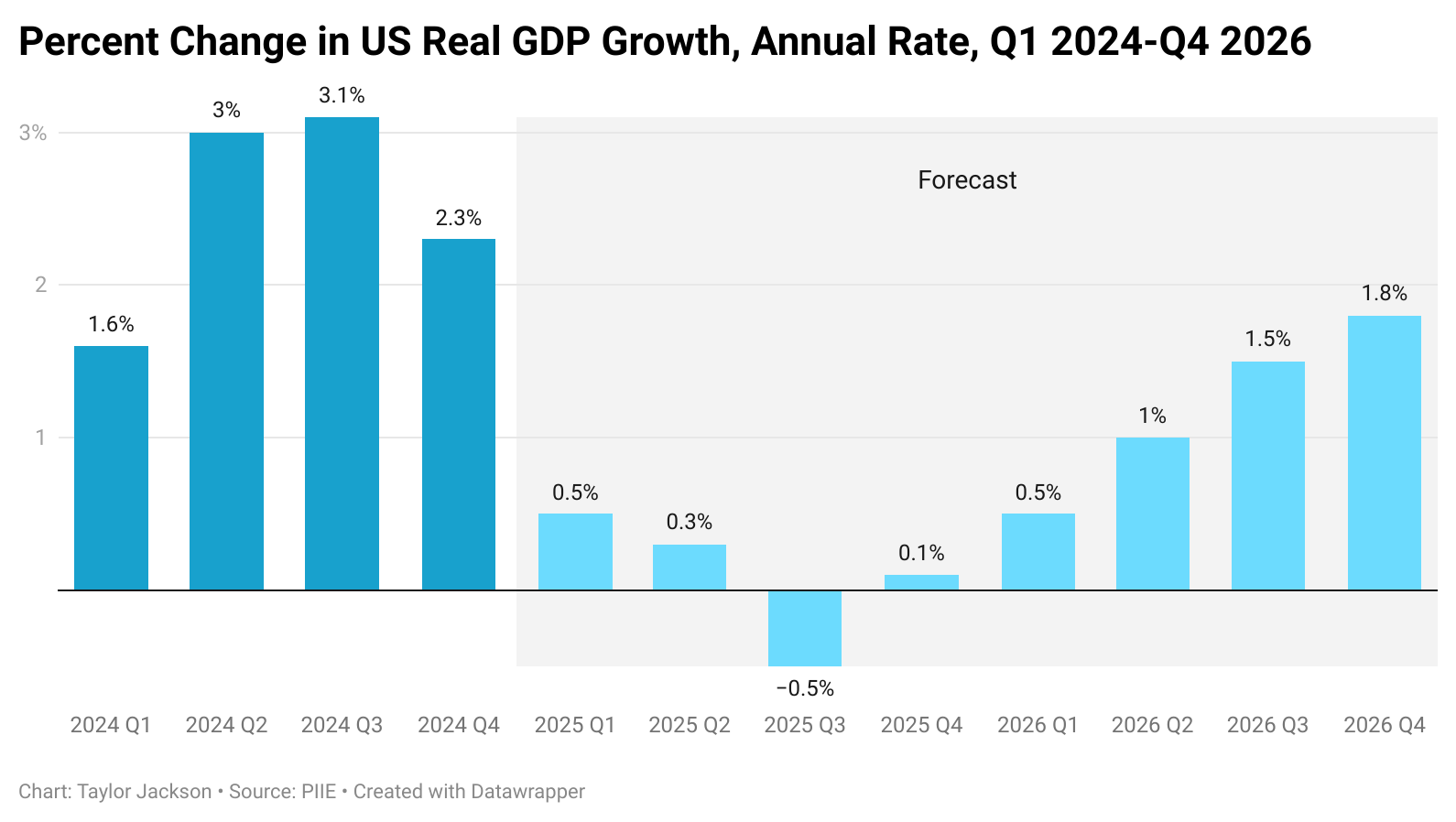

Economic growth forecasts are starting to predict that the majority of Americans who think that the tariffs will hurt the U.S. economy are likely right.

The global economic outlook has dimmed due to recent U.S. policy shifts, notably the imposition of the latest round of tariffs. According to the Peterson Institute for International Economics, global GDP growth is now projected at 2.7 percent for 2025, down from 3.2 percent in 2024, with Trump’s trade war increasing prices, disrupting supply chains, and eroding real incomes. Meanwhile, the president’s frequent policy changes are creating uncertainty for businesses.

In the U.S., additional factors such as federal layoffs and anticipated fiscal realities like large budget deficits are contributing to economic stagnation, with growth expected to slow from 2.5 percent in 2024 to just 0.1 percent in 2025.

Inflation is projected to peak at around 4.5 percent by late 2025, and unemployment may rise above 5 percent before improving in 2026. The Federal Reserve is likely to maintain current interest rates through the year, awaiting clearer signs of inflation easing.

Overall, the combination of trade policies and domestic fiscal actions is exerting a significant drag on both U.S. and global economic performance.

Cato Institute trade scholar Scott Lincicome often says that “tariffs not only impose immense economic costs but also fail to achieve their primary policy aims and foster political dysfunction along the way.”

It looks like economists and, increasingly, a majority of the American people agree with Lincicome. Only time will tell whether slow economic growth and public sentiment will act as a constraint on Trump.

ChatGPT assisted in the creation of this article.