Welcome to The Think Tank, your Saturday dive into thought-provoking research from think tanks, academics, and leading policy thinkers in Canada and around the world, curated by The Hub. Here’s what’s got us thinking this week.

President Trump’s trade war has made headlines around the world, as the U.S. seeks to remake a global trading order. While the tariffs are still fresh, their impacts are already being felt on the ground. Stories are coming out about just how much American businesses will need to raise prices and the impact this will have on consumers, particularly at the lower end of the income distribution.

Beyond the U.S., we’re also starting to get a sense of what the global macroeconomic impact of Trump’s tariffs will be. The International Monetary Fund (IMF) has just released its semi-annual World Economic Outlook (WEO), which provides a projection of where the global economy is headed. The results are sobering. The trade war is acting as a major drag on economic growth.

Let’s dig into what the macroeconomic picture looks like in the year ahead.

2025: Trump’s tariffs will shave a full point off Canadian economy

The IMF’s World Economic Outlook (April 2025) signals a sobering shift in global economic forecasts, amid a resurgence in protectionist trade policies and surging geopolitical uncertainty. The headline: global growth is set to fall to 2.8 percent in 2025—down from 3.3 percent forecasted just three months earlier—with little improvement expected in 2026.

These revisions follow President Trump’s dramatic move to impose near-universal tariffs in early April, triggering retaliatory measures and plunging the global economy into a new era of uncertainty reminiscent of pre-Second World War trade regimes.

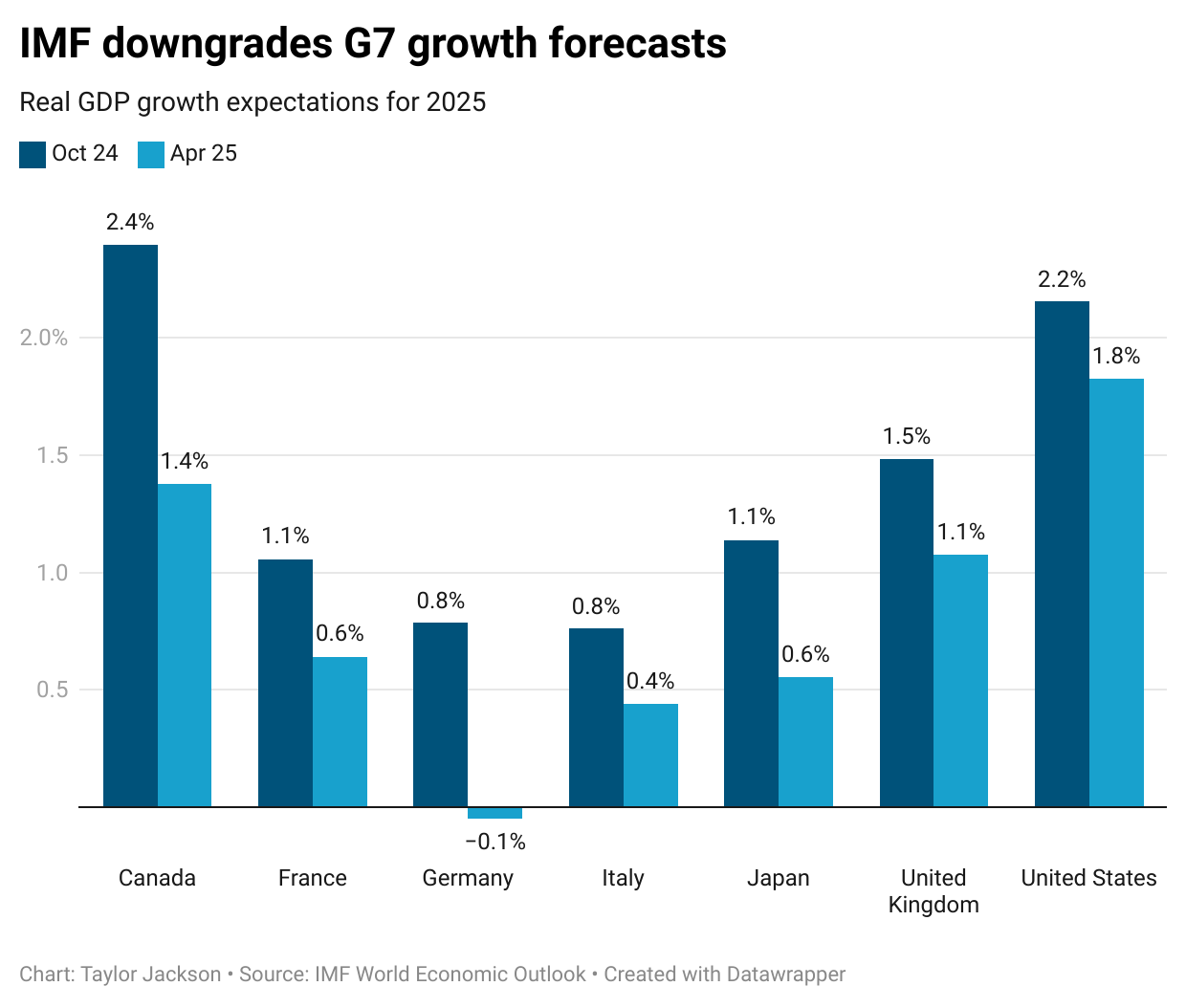

The economic drag will be felt broadly. Advanced economies are forecast to grow by a meager 1.4 percent next year, with U.S. growth revised sharply downward to 1.8 percent. Europe, too, faces stagnation at 0.8 percent. Emerging markets and developing economies fare slightly better at 3.7 percent in 2025, but that figure masks deeper hits in export-heavy countries like China, where retaliatory tariffs are biting hard.

For Canada, the story is mixed. Real GDP growth is projected to be 1.4 percent in 2025. This is a full percentage point lower than what the IMF projected for Canada in October last year. It is also the largest deterioration in projected growth of any G7 country, likely owing to Canada’s trade dependence on the U.S.

On the upside, Canada’s real GDP growth is expected to be the second highest in the G7, only behind the U.S.’s projected 1.8 percent year-over-year growth rate.

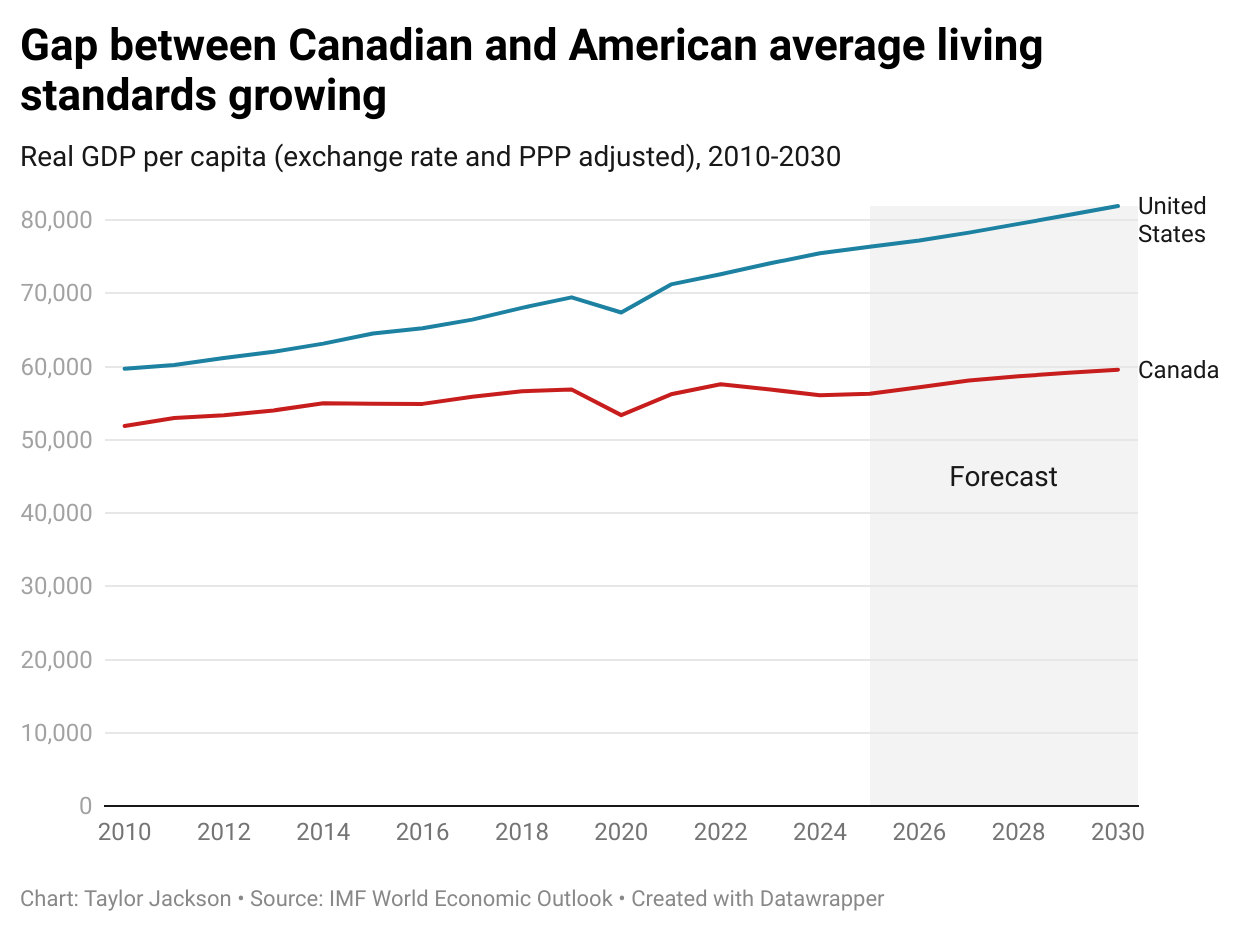

However, a major challenge Canada’s next government will face is closing the longstanding gap between Canadian and American average living standards, measured by real GDP per capita.

Back in 2010, Canada’s real per capita GDP stood at 87 percent of the U.S.’s. Yet by 2030, the IMF is projecting that Canada’s average living standards will fall to less than 73 percent of those in the U.S.

Yet, tariffs are not the only rough waves global economies must endure. The IMF warns of cascading risks, including inflationary pressures in advanced economies, capital flight from debt-distressed nations, and the potential for broader financial instability. Inflation is now expected to linger longer than previously projected, and debt servicing costs are climbing in many low- and middle-income countries, threatening social and fiscal stability.

Despite the gloom, the report underscores a possible off-ramp: global coordination and de-escalation. A rollback of tariffs, a stabilization of trade rules, and focused domestic reforms—particularly in labour and fiscal policy—could restore growth and financial resilience. But the window for corrective action is narrow. Central banks, it cautions, must walk a tightrope: managing inflation without choking already fragile growth.

Ultimately, the 2025 outlook captures an inflection point. Without international cooperation and structural reforms, the world risks sliding further into economic fragmentation and volatility.

Canada is also at an inflection point. With Trump’s policies slowing American economic growth prospects, Canadian governments have an opportunity to unleash economic growth and push average living standards back towards those in the U.S.

Trump’s tariffs are deeply damaging the American economy

In a sweeping critique of Trump’s revived tariff agenda, an American Enterprise Institute report by Kyle Pomerleau and Erica York dissected the economic and fiscal fallout of the latest wave of trade protectionism. The study focused its assessment on President Trump’s imposition of broad-based tariffs, policies pitched as a way to boost U.S. manufacturing and slash the trade deficit.

The tariffs are about “the national security of manufacturing and making the things that we need, from steel to pharmaceuticals,” Vice President JD Vance has said.

However, the authors argue tariffs won’t achieve these goals. They contend that trade deficits are determined not by tariffs, but by underlying savings and investment patterns. Instead of rebalancing trade, tariffs distort market signals, misallocate resources, and reduce long-term economic output. By raising costs for both consumers and producers, tariffs lower after-tax wages and hinder capital investment. While the tariffs have caused the appreciation of the U.S. dollar to temper import prices, they have simultaneously harmed exports and transferred wealth to foreign holders of U.S. assets.

Tariffs also underperform as a revenue source. While a proposed 10 percent universal tariff could raise up to $2.6 trillion over a decade, the net gain is sharply reduced—first by tax avoidance and behavioural shifts, and second by lower income and payroll tax revenue due to diminished economic output.

The report concludes that tariffs act as a regressive tax, hitting low-income households hardest. Far from restoring industrial strength or balancing trade, tariffs burden American workers and undercut growth, making tariffs an inefficient tool for national economic policy.

Perhaps the most shocking thing about Trump’s trade war is how much of the economic pain will be borne by American citizens themselves. There have been few, if any, moments in history when a democratic leader has inflicted such economic pain on his own voter base.

We will see what comes of Trump’s economic policies in the mid-term elections a year and a half away.

Although given Trump’s proclivity for undoing his signature policies, let’s see how long these tariffs last.

ChatGPT assisted in the creation of this article.