A recent report from the OECD confirms what many already know: one big reason Canada’s economy is struggling is that we’re not investing enough, especially in the machinery and equipment that help businesses get more done.

In fact, Canada invests less in these productivity-enhancing assets than nearly every other country in the OECD for every dollar of economic output it produces.

Canada’s weakness has been especially clear since investment in the oil and gas sector cratered in 2014. Once responsible for about a third of all capital spending, investment in the sector is now just half of what it was. While this trend has been driven in part by market forces—oil and gas companies globally are setting aside less money for reinvestment into the industry—it’s been made worse by government policies that have constrained growth.

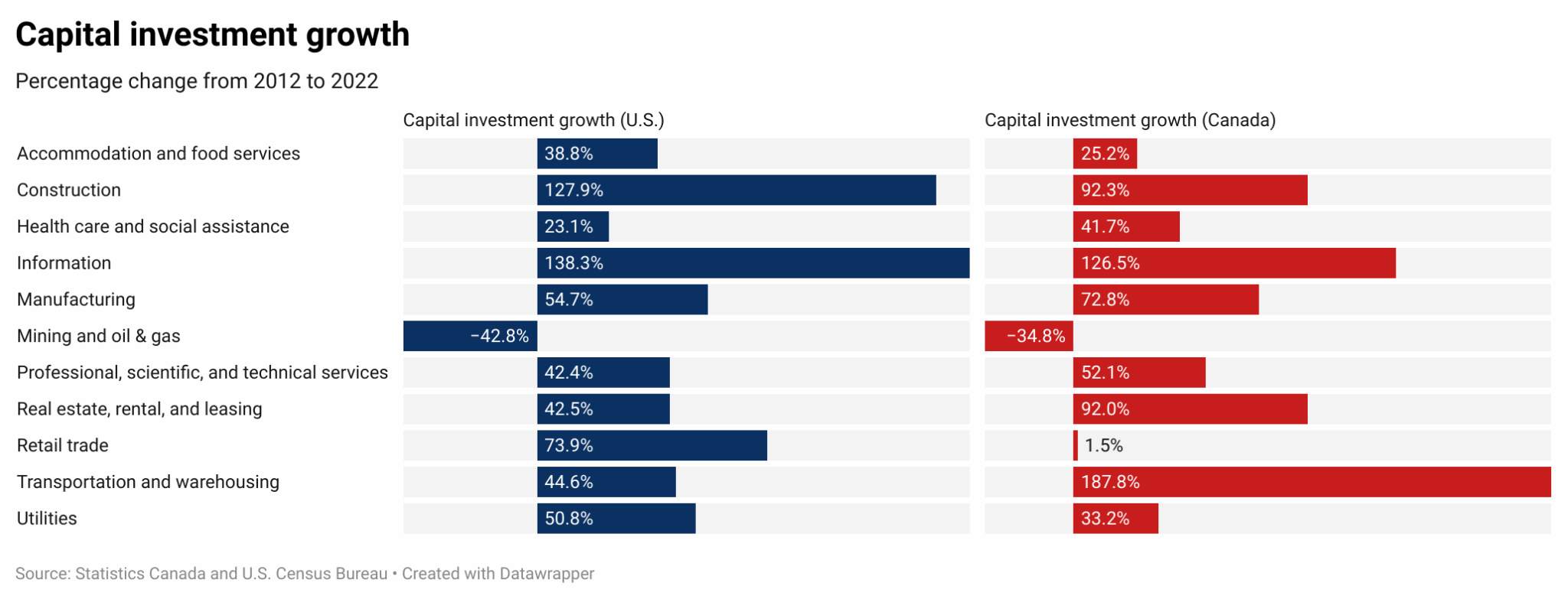

But while that’s a problem on its own, the same report points out that the issue is more widespread than just oil and gas. Most other sectors of the Canadian economy have also seen sluggish investment growth compared to our international competitors over the last several years.

Take our closest neighbour for comparison. There has always been an investment gap between Canada and the U.S., but it continues to widen. Economy-wide, non-residential capital investment in Canada has grown by about 26 percent, compared to 42 percent in the U.S. over the most recent 10-year period for which we have available data. When you factor in Canada’s faster-growing workforce, the gap widens even further—investment per worker rose just 14 percent in Canada versus 34 percent in the U.S.

Looking at individual industries is also revealing. While it’s not a perfect apples-to-apples comparison—each country has unique industry dynamics, economic conditions, and some methodological differences—it points to some areas in which Canada may be falling behind.

The widening gap between Canadian and U.S. investment growth is driven by a few key industries: construction, utilities, retail, and accommodation and food services. Not only did investment in these industries grow faster in the U.S., but they’re also either large or capital-intensive industries, meaning the impact is especially significant.

But there is one industry that stands out above all others: information. These are the businesses that help us communicate, access information, and use technology. Over the last two years for which data is available, investment there increased by 50 percent in the U.S.compared to 23 percent in Canada.

That should be a wake-up call for two reasons. One is that, to the extent that this growth reflects investments in digital infrastructure—data centres, cell towers for 5G, and the like—this could have large spillover benefits to the broader economy. And two, productivity growth from these investments takes time, but is sure to follow. Narrowing this investment gap will be critical to improving Canada’s global competitiveness.’

A version of this post was originally published by the Business Council of Alberta at businesscouncilab.com.