Setting the stage

Through energy projects like the Trans Mountain Expansion (TMX) and LNG Canada, Canada has begun to diversify its oil and gas exports. But in a geoeconomic world, these alone do not amount to a national playbook. Canada is competing in an arena where tariffs, sanctions, resource dominance, and fiscal coercion are weapons of statecraft. We must have a deeper understanding of our current energy ambition and where we want to be in the future.

Free market competition no longer governs prosperity—state power over markets is the new playbook. Strategic industries, from pipelines to semiconductors, have become extensions of statecraft, wielded as instruments of leverage, coercion, and survival. The global economy is starting to look like a geopolitical cage match. The impact of this new order—tariffs, sanctions, control of trade routes, and dominance over strategic resources—is now routinely felt in the global arena.For more on this, see Issue 002 – Geoeconomics and State Capitalism, Studio.Energy, September 8, 2025 For Canada, this shift is not an abstract debate. It is an urgent strategic question: How should a resource-rich, trade-dependent nation position itself in a world where economic force and state capitalism, not market fairness, set the rules?

Canada in the cage match

Canada is privileged with nearly every resource the world covets—from agriculture to critical minerals—but oil and natural gas remain the most strategically significant. In 2024, Canada exported $187 billion CAD in upstream oils, natural gas, and refined products—that’s a quarter of the $780 billion in total exports that year.Canadian Exports of Crude Oil and Natural Gas, Canadian Association of Petroleum Producers, February 2025

Unfortunately, we aren’t showing up in the ring like a serious contender should. Our posture continues to be passive, with oil and natural gas exports overwhelmingly tied to the U.S., leaving us exposed to recurring price discounts and political pressure—realities that are now impossible to ignore. We’ve been on the receiving end—tariffs here, trade bans there—and from canola to copper, our defence has often looked more like curling up on the ropes than counterpunching.

But the intent to fight is beginning to emerge. Canada’s federal and provincial governments are working to expand trade relationships and build infrastructure for new markets. The passing of Bill C-5 is a constructive step, akin to a pledge to hit the gym and add some muscle. But strength alone doesn’t win a match. Building a pipeline yields just a pipeline—there must be a strategic purpose behind it.

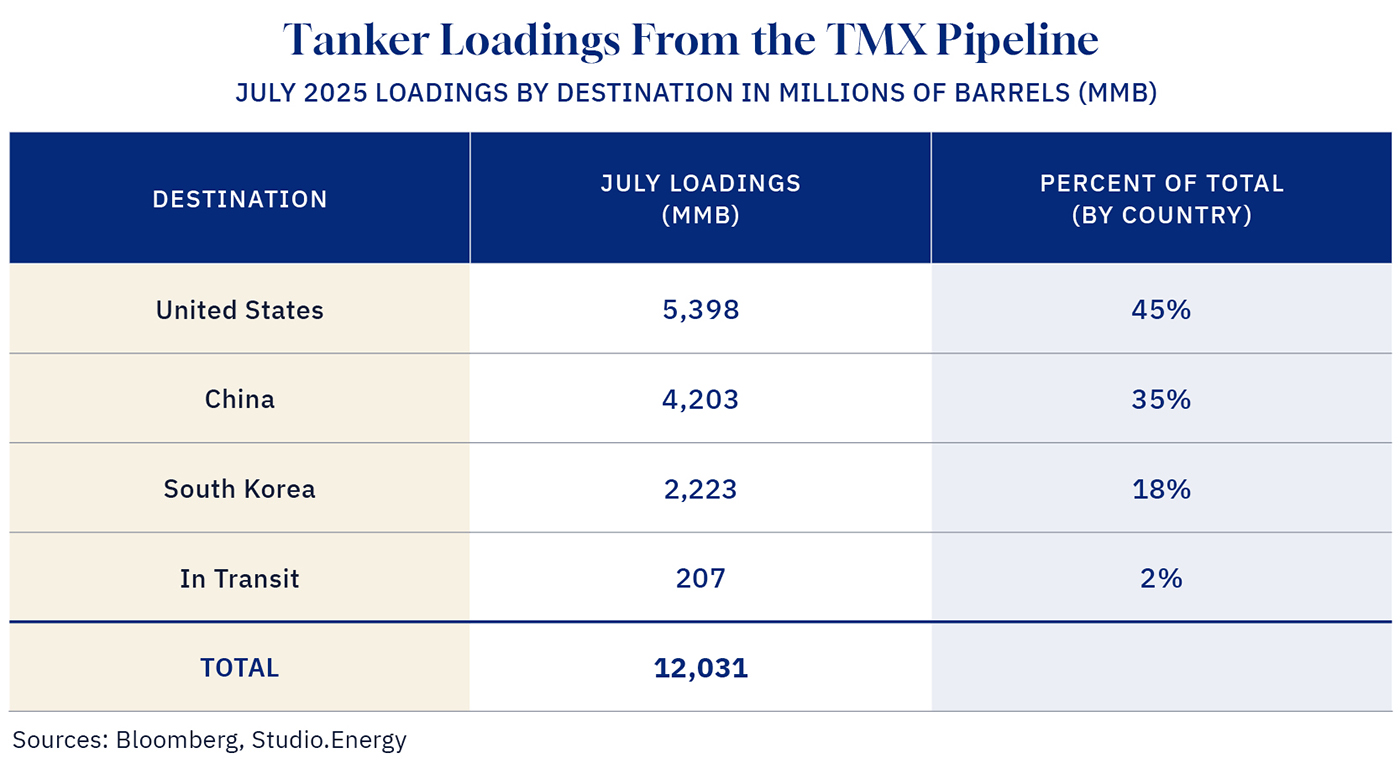

The opening of the TMX in 2024 improved our strategic position, at least for the time being. It narrowed the price discount for our heavy oil benchmark, Western Canadian Select, and sent over 220,000 barrels per day to Asia for the first time. When you consider that global consumption is over 100 million barrels daily, it’s not a lot, but it’s a start toward market diversification.Oil Market Report, International Energy Agency, August 2025 The table below shows the latest data for tanker loadings from the TMX pipeline.

Table 1. Graphic credit: Janice Nelson.

Similarly, LNG Canada sent the first cargoes of LNG off the B.C. coast at Kitimat this summer. The export capacity for Phase 1 of this facility is about 14 million tonnes per year, roughly 1.8 billion cubic feet per day. While this is significant for easing Canada’s upstream natural gas constraints, it is a drop in the Pacific Basin bucket, where annual trade exceeds 300 million tonnes.LNG Canada, First Cargo Puts Canada on Map of LNG Exporting Nations (June 30, 2025)

Canada has taken some long-overdue baby steps towards improving access to oil and gas markets beyond North America. But it hasn’t been easy: the buildout of TMX and LNG Canada came after a dozen years of arduous, expensive infrastructure-building challenges. For now, all we have achieved is some better commodity pricing for oil; natural gas is still discounted. In this aggressive geoeconomic arena, that’s just shadowboxing.

Levels of ambition in a geoeconomic era

As Canada negotiates this new order, there are four levels of ambition we can pursue in terms of how active and strategic a player we choose to be in the arena. At the moment, our country and our energy industry are trying to get promoted from the lowest level.

1. Market Hostage—Low level of ambition with a passive stance, highly vulnerable to market discounts and economic coercion

A passive stance is like watching a reality TV show—you see the drama but are powerless to shape the outcome. Hydrocarbon producers are forced to accept whatever price and terms buyers dictate, largely because they have no alternative markets.

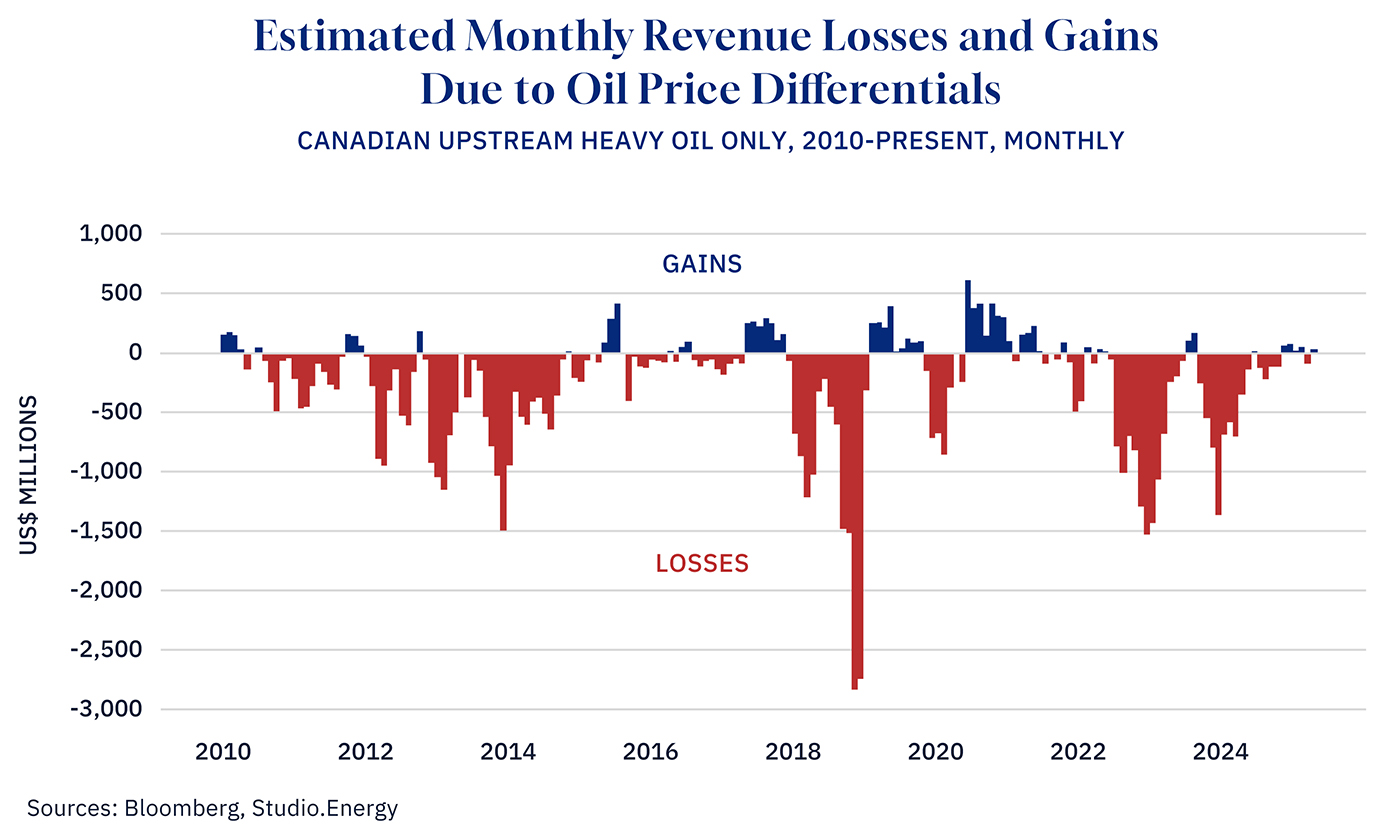

The result is predictable: price discounts, lost revenues, royalties, and taxes, plus exposure to political pressure. Over the past 15 years, Canada’s experience selling heavy oil at steep discounts due to pipeline bottlenecks and overreliance on U.S. buyers is a textbook example of this passive vulnerability.

The financial consequences of being a Market Hostage hit the bottom line of Canada’s upstream industry. On heavy oil and bitumen sales alone, the forfeited revenue to the industry is of the order of a net $49 billion USD over the last 15 years, or an average of $3.3 billion USD per year. The figure below shows the monthly forfeitures since 2010, which peaked at $2.7 billion USD in July 2018. This, in turn, results in lower revenues for Canadian governments as well.

Figure 2. Graphic credit: Janice Nelson.

2. Competitor—A more assertive stance, able to maximize market potential and withstand pressure, but often playing defence

A “Competitor”-level nation, along with its industries, actively invests in getting products to market and diversifies its customer base, capturing more value while remaining attractive to investors. The completion of the TMX nudged Canada toward this level by opening access to Asia, narrowing oil price discounts, and expanding supplier options. But the gain is fragile—as Figure 1 shows, almost half of all new TMX exports still go to the U.S. Without more export capacity to a wider base of international customers, the relatively small amount of market access is not a strong strategy for the times. The same can be said for our country’s first LNG export terminal, where export volumes are not yet significant enough to narrow Western Canadian natural gas price discounts.

3. Negotiator—Influential with the ability to use energy as a shield and a bargaining chip in national strategy

To achieve the title of “Negotiator,” our energy sector, Indigenous communities, provinces, and federal government must be aligned to maximize profitability, royalties, and taxes, and be ready to defend national economic interests. Oil and gas volumes become strategic bargaining chips, enabling Canada to respond to tariffs, sanctions, or other economic coercion.

Reaching this level requires building consequential global export capacity, meaning more transport to the coast from western producing regions. This would require aligning federal and provincial interests with upstream, midstream, and downstream sectors of the oil and gas industry.

At a time when many countries are increasingly migrating to various models of state-sponsored capitalism, Canada lacks the degree of state-industry alignment required to propel us to this level. Becoming a Negotiator doesn’t imply a need for state control or nationalization. This ambition could be achieved if Canada were to realize better collaboration between and among federal and provincial governments, Indigenous communities, and alignment with the entire supply chain of the oil and gas industry, including investors.

4. Aggressor—Wields market power of vital resources to gain geopolitical advantage

Aggressor nations not only control vital resources but also wield them decisively to achieve their geopolitical aims. The label “superpower” fits here, though the term is often thrown around too casually. The U.S. and China are the only two countries that truly deserve the title. Alliances and cartels can also achieve this ambition, with OPEC+ being a prime example.

Canada, due to our lack of export scale beyond North America and collegial approach to international relations, is not likely to achieve Aggressor status. However, by understanding this level, it can help us set realistic ambitions and clarify the gap between where we are and where we could be.

What will it take?

As Canadians consider our country’s energy ambitions in the broader context of geoeconomics and state capitalism,For more on this, see Issue 002 – Geoeconomics and State Capitalism, Studio.Energy, September 8, 2025 they should ask themselves these questions:Studio.Energy will be addressing these questions in forthcoming Now You’re Thinking articles.

- What oil and gas export volumes are necessary to achieve an ambition level of 2 or 3, or even 4?

- What would it take to build—and keep—full, new oil and gas pipelines?

- What consumer markets should be targeted?

- What are the impediments and conditions required to achieve each level?

- Where should investment come from?

- How can investors—domestic and foreign—be enticed to help Canadian industry build the infrastructure it needs to further its ambitions?

- How will climate policy aims be reconciled with a necessity to increase our geoeconomic ambitions?

Canada is slowly waking up to the understanding that a passive ambition is no longer acceptable, let alone in an era of economic aggression. The federal government’s creation of the Major Projects Office, designed to fast-track approvals for energy infrastructure, reflects this shift.

Paired with a shared national ambition, the office could become a powerful tool to align government, Indigenous communities, investors, and strategic industries, turning Canada’s resource wealth into enduring economic leverage.

A version of this post was originally published by Studio.Energy.