Canadian auto industry experts are alarmed by U.S. ambassador Pete Hoekstra announcing Tuesday that U.S. President Donald Trump’s administration intends to put tariffs on surplus vehicle exports to America. The economic impact to a beleaguered Canadian economy would be yet another major blow—the auto sector contributes an estimated $94 billion and makes up between 1 to 4 percent of the national GDP.

The U.S. ambassador, while speaking at an event hosted by the Canadian International Council, claimed Washington is planning to tariff all Canadian auto exports exceeding the number of U.S. auto imports to Canada.

“Using what we’ve done as a model, it’s very possible that, you know, the 400,000 units that go to the U.S. today will come in at a lower tariff rate,” Hoekstra said, referencing the estimated surplus number of vehicles being exported into the U.S. from Canada. “But if you’re starting to go to 450,000, 500,000 in all of those, you’ll pay a higher tariff.”

Canada exported an estimated 1.85 million vehicles to the U.S. in 2024, and automotive manufacturing supports more than 125,000 direct jobs.

Dan McTeague, president of Canadians for Affordable Energy, believes the proposed tariffs by the ambassador would be very damaging for Canada’s auto industry.

“So [about] a third [of the industry would] be affected. So it’s [roughly] a $5.5 billion dollar hit and a substantial decline in the growth of the economy,” McTeague said. “What are the side effects, too? I mean other industries that [will be hit hard] as a result of this. The parts industry supports much of what’s going on. Think of big companies in Guelph…Magna [and] Linamar.”

Canada and the United States are preparing for upcoming renegotiations of the Canada-United States-Mexico Agreement (CUSMA) scheduled to take place in July 2026, with particular focus on sectors like the automotive and dairy sectors that could face significant changes and disruptions.

“I’m wondering if it’s [really] about auto [or] if it’s really about supply management…because they pretty much got everything else,” McTeague, who previously worked for Toyota, said. “But it sounds like trade is going to be the way ahead. So it’s going to require [Prime Minister Mark Carney to deliver on his promise] that he can negotiate with Trump.”

Efforts from the Carney government are already underway to address trade disputes ahead of that formal review process, as tensions mount. The U.S. has already implemented 25 percent tariffs on foreign automotive parts in Canadian car exports earlier this year.

Ian Lee, associate professor at the Sprott School of Business, believes the Trump administration has been pretty transparent on its motives for hitting the Canadian auto sector with tariffs.

“I’m not surprised…the Trump administration is focused on manufacturing. They’ve said so repeatedly, and Trump…is very, very focused on bringing manufacturing back to America,” Lee told The Hub. “So I don’t think Trump is that committed to…CUSMA to the extent that it means protecting or allowing reciprocity in autos.”

Lee doesn’t see the auto sector as an integral part of Canada’s overall economy in 2025, but does believe it would be devastating to communities within Ontario.

“It’s always been a major part of our relationship with the States, even though, when you look at the actual GDP today, 2025, 1 to 3 percent is really, really small…And this idea that Canada is going to collapse if we lose the auto sector, we can test the hypothesis, test the theory, by looking at the Australians,” Lee said.

“Australia surpassed Canada in GDP per capita since they exited automotive manufacturing and now pivoted, while they were already…a resource giant, but they pivoted even more towards resources. And we are sitting on some of the largest supplies of critical minerals and resources across the country, in the world.”

Lee believes Canada should focus CUSMA negotiations more on our comparative advantage in natural resource sectors. He cited Canadian economists Stephen Gordon and Trevor Tombe’s separate research both “showing that in the last quarter of a century, almost all of our increase in our standard of living was due to the contribution of the resource sector.”

The automotive sector, which has historically represented a cornerstone of Canada-U.S. economic integration, may face existential uncertainty with the latest comments from the U.S. ambassador. Industry observers are questioning whether automakers might relocate operations to avoid potential tariffs on excess vehicle exports. The prospect of such disruptions has raised concerns about the integrated nature of North American automotive manufacturing, where components frequently cross borders multiple times during the production process.

“We understand the economics and how you’ve built your economy around those types of things, but over a period of time, in some of these critical industries, you know, we’re going to see some of that moving back into the United States,” Hoekstra added on Tuesday, suggesting that industrial capacity will shift southward.

“The ambassador is from Michigan, he knows that the U.S. surplus in annual auto parts shipments to Canada more than makes up the difference,” Automotive Parts Manufacturers’ Association president Flavio Volpe said to the Globe and Mail.

The U.S. ambassador also claimed the Trump administration had initially hoped for more comprehensive negotiations beyond simply renewing CUSMA. “Americans were hopeful that we could negotiate a bigger deal,” Hoekstra said at the Ottawa event. “On trade, whether it’s energy, whether it’s automotive, whether it’s nuclear, defence and all of those types of things, we were hoping that we would not just renegotiate CUSMA, but that we could take it into being something much bigger.”

The current trade environment has been complicated by the Trump administration’s imposition of various tariffs on Canadian goods. Since returning to office, President Trump has put in place a 50 percent tariff on steel and aluminum, 25 percent on automobiles, and 35 percent on goods traded outside the CUSMA framework, with exceptions for oil, gas, and potash at 10 percent.

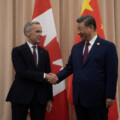

Despite the trade dispute, there have been areas of cooperation, particularly regarding China policy. Hoekstra praised Canada’s decision to impose 100 percent tariffs on Chinese-made electric vehicles and 25 percent levies on Chinese steel and aluminum. “We very much appreciate the decision that Canada has made, and we recognize the cost that you are paying for that,” he said, acknowledging the economic impact of Chinese retaliation on Canadian canola, seafood, and agricultural products.