The wealthiest Canadians continue to reap greater riches compared to their poorer fellow citizens, as the top high-earning households consolidated more of Canada’s total net worth in mid-2025. The top 20 percent of the wealthiest households now enjoy nearly two-thirds (64.8 percent) of Canada’s national net wealth, according to new Statistics Canada data.

“[The growing wealth gap in Canada] reflects a disconnect between the stock market, which continues to do well, especially in the U.S., and the real economy in Canada, which is weak,” economist and Macdonald-Laurier Institute director Tim Sargent told The Hub. “If the current U.S. stock market boom, narrowly based on tech, proves to be a bubble, then that gap will narrow. Time will tell: it will depend on what are the potential gains of AI in the economy and how soon they materialize.”

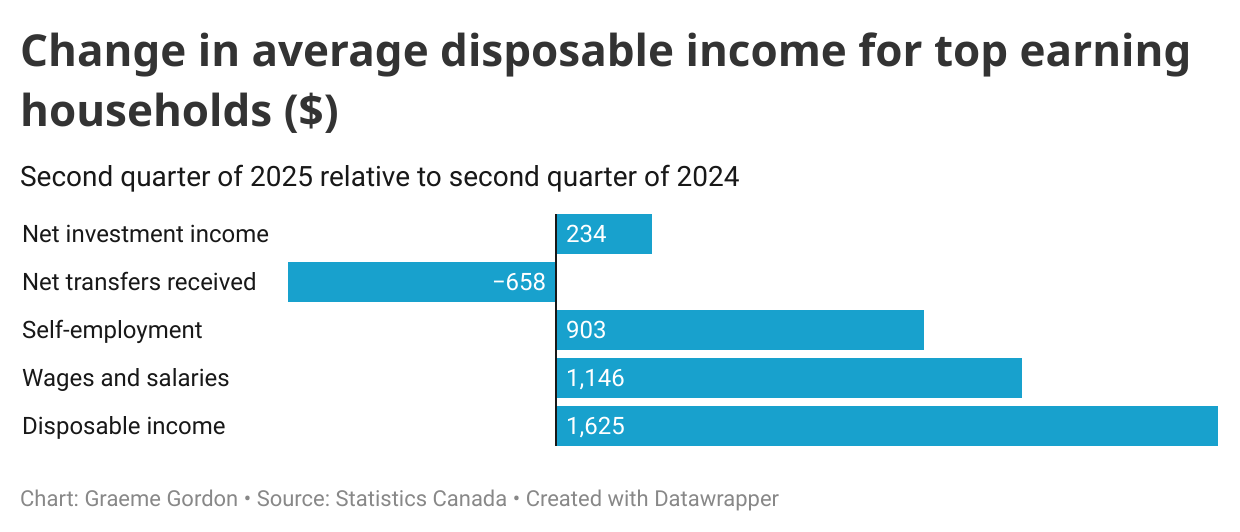

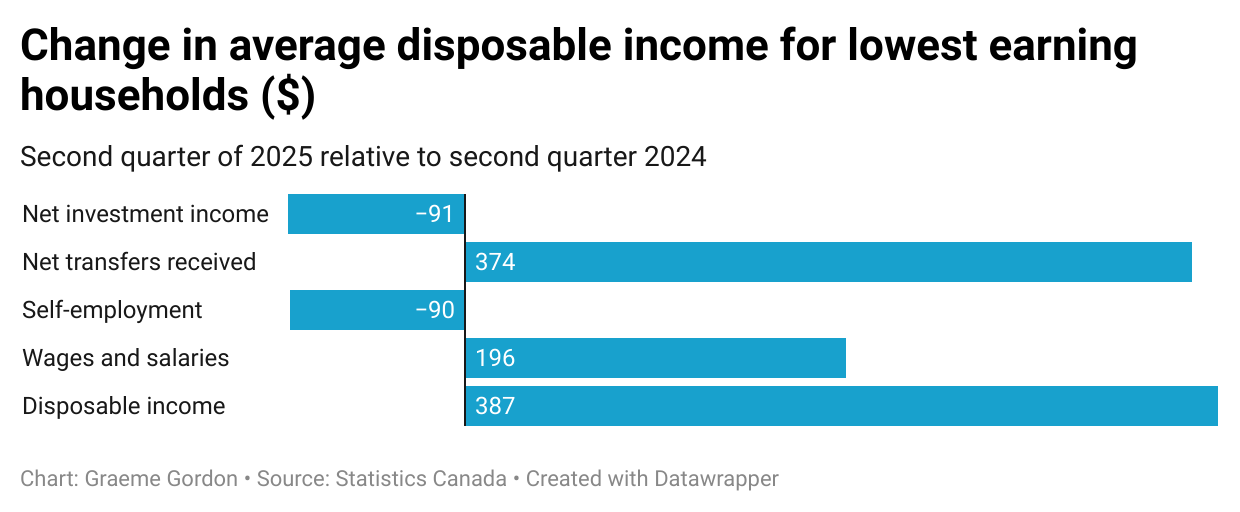

Meanwhile, the second quarter data from Statistics Canada revealed that despite the bottom 20 percent of Canada’s lowest income households seeing the largest increase in disposable income—jumping up an above-average annualized 5.6 percent—top-earning Canadians still realized a bigger stake in the overall net worth pie.

The wealthiest families’ average net worth totaled $3.4 million per household, expanding the wealth gap between the top 20 percent and bottom 40 percent to 61.5 percent, inching up 0.2 percentage points from the start of 2025.

The top Canadian households also grew their net worth the most in the second quarter, at 4.9 percent, largely from stronger growth of 9.6 percent in their financial assets compared to much lower growth in mortgage debt of 1.9 percent.

According to the Statistics Canada report—which looked at distributions of Canadian households’ wealth from income, consumption, saving, assets, and investments—the lowest income households’ gains in income primarily came from government assistance, including Employment Insurance (EI), social assistance, and retirement benefits.

Paradoxically, Statistics Canada found the bottom 20 percent of Canadian households paid fewer taxes despite increased income because the government assistance is either exempt from being taxed or taxed at a lower rate.

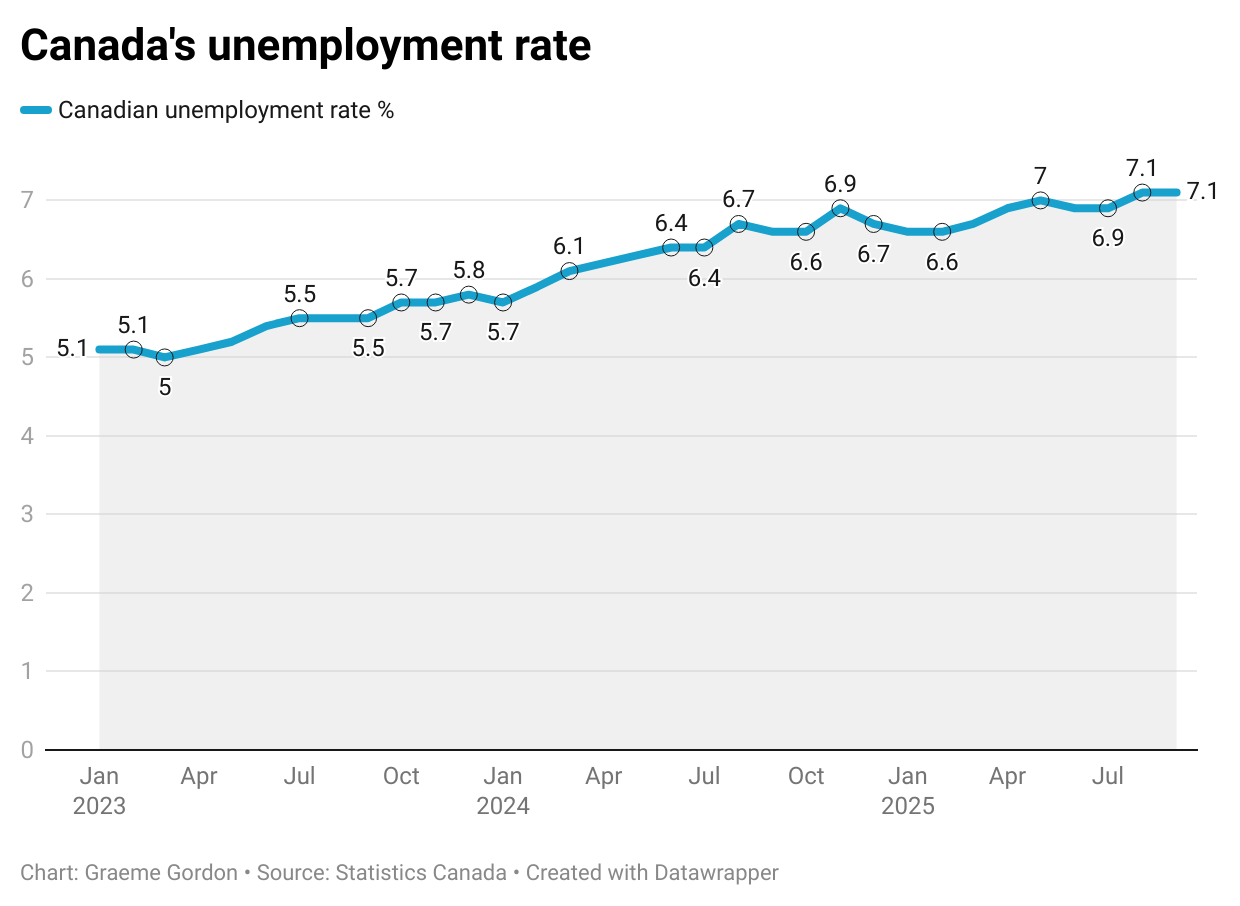

The increases from EI payments are only likely temporary and track with reports on major layoffs and the climbing unemployment rate, most recently recorded at 7.1 percent. Concerningly, job openings have dropped to an eight-year low, under 470,000, in spite of Canada gaining 5 million people in the same time period.

Statistics Canada’s latest numbers on lower-income taxation echo the Fraser Institute’s September report that concluded Canadian households, making a combined income of $65,000 or less, only contribute 2 percent of overall taxes to all three tiers of government. Meanwhile, the Fraser Institute on taxation of Canadians also found the top 20 percent of income-earning families pay the majority of all taxes: 57 percent in British Columbia, 57.1 percent in Alberta, 58 percent in Ontario, and 55.5 percent in Quebec.

Adding to the statistics of the increase in wealth disparity in Canada, Statistics Canada’s latest report showed a “record’ income gap between Canadian households in the top 40 percent and bottom 40 percent, with a 48.4 percentage point difference in share of disposable income. The 40 percent of top-earning Canadian households make 65.8 percent of overall income earned in 2025, compared to the bottom 40 percent only earning 17.4 percent of the total earnings from all Canadians’ incomes.

Statistics Canada’s latest numbers also revealed that, on average, Canadians’ net savings across all income levels dropped for the first time since the 40-year high inflationary climax of 2022. The national statistical office for Canada linked lower wage growth and increased spending habits of Canadians translating to less money being put away. The average Canadian household’s disposable income rose by 3.9 percent, down from 5.9 percent the same time last year.

Sargent believes the falling net savings is another indicator that Canada’s economy is likely in a downturn.

“Wage earnings were notably weak in the second quarter of 2025 for workers in goods-producing sectors such as mining and oil and gas extraction, as well as manufacturing, and in services-producing sectors such as trade, and professional and personal services,” the Statistics Canada report noted.

However, former Statistics Canada chief economic analyst and Fraser Institute senior fellow Philip Cross doesn’t believe it’s time for Canadians to panic. “I think [the data] actually says people are looking through that weakness as temporary…the economy seems to be muddling along,” Cross said to The Hub. He cited Canada gaining 60,000 jobs in September and GDP remaining at 1 percent.

Canadian young adults are not making great wealth gains

Nevertheless, as Canada may still be teetering toward a possible recession, the country’s adult youth continue to be left in the dust for wealth gains, which Statistics Canada’s latest data mirrors.

Younger households under the age of 35 only increased their wealth by an annualized 2.1 percent on average, and this age demographic saw reduced real estate ownership.

“The youngest households were the only group with continually decreasing mortgage debt since the end of 2022, as rising interest rates and housing cost pressures reduced home ownership affordability,” the Statistics Canada report noted.

The bad news for Canadian youth continues to mount. The youth employment rate (ages 15 to 24) was only at 53.6 percent this summer, the lowest level since 1998, excluding the pandemic.

“It’s people at the lowest, at the bottom of the totem pole, who are the most vulnerable,” Cross said.

Is government assistance a sustainable solution to Canada's widening wealth gap?

How does the disconnect between the stock market and Canada's real economy impact wealth distribution?

What are the implications of young Canadians struggling to build wealth and own homes?

Comments (1)

It comes as no surprise that highly skilled immigrants would not find Canada attractive. It also comes as no surprise that young highly skilled Canadians don’t find Canada attractive. When the economy in this country takes a downturn, the solution always seems to be to prop up weak segments through excessive government spending and pay for it by raising taxes–again. We justify this by scapegoating certain Canadians who someone in Ottawa has decided aren’t paying their “fair” share. How many times have we heard–the rich cheat on their taxes that’s why they have money? Boomers are robbing the youth of their future? Not only is this strategy old but it’s never worked.

Every tax dollar collected is a dollar taken out of the economy so how about we try something really bold and lower taxes–corporate, business, development, capital gains, income. Maybe then the economy will grow, international companies will set up shop, Canadian companies will become competitive, builders will build and the trickle down effect will be highly skilled workers will have a reason to be in Canada.