Health care is a hot topic in Canada these days, with several provinces taking big swings attempting to reform our ailing medicare system. One consistent criticism has been the system’s middling performance across key metrics despite ever-increasing funding.

The Canadian Institute for Health Information (CIHI)’s just-released National Health Expenditure (NHEX) allows us to step back and assess just how much Canada is actually spending on health care, as well as the breakdown by province.Full disclosure, I am a member of the CIHI NHEX Advisory Panel.

The data shows that total health spending in Canada is at $399 billion, up 4.2 percent from last year’s total, real per capita total care spending is up 1.1 percent, and health expenditure to GDP at 12.7 percent, up from 12.5 percent. However, health expenditure growth has slowed from 6.1 percent in 2024 and 7.4 percent in 2023. Moreover, growth varies across Canada’s provinces ranging from a low of 3.3 percent in Newfoundland and Labrador and Quebec respectively to a high of 7.3 percent in Manitoba. Meanwhile, hospital spending is projected to grow by 4.0 percent in 2025 and physician spending by 3.1 percent.

There are infinitesimal numbers here with many decimals, and it is easy to lose oneself in the data without examining important trends as Canadians engage with their provincial public health-care systems in an era marked by continuing fallout from the pandemic, inflation, and population growth. A closer parsing of the figures in real per capita terms by composition and province reveals differences at odds with the aggregate picture.

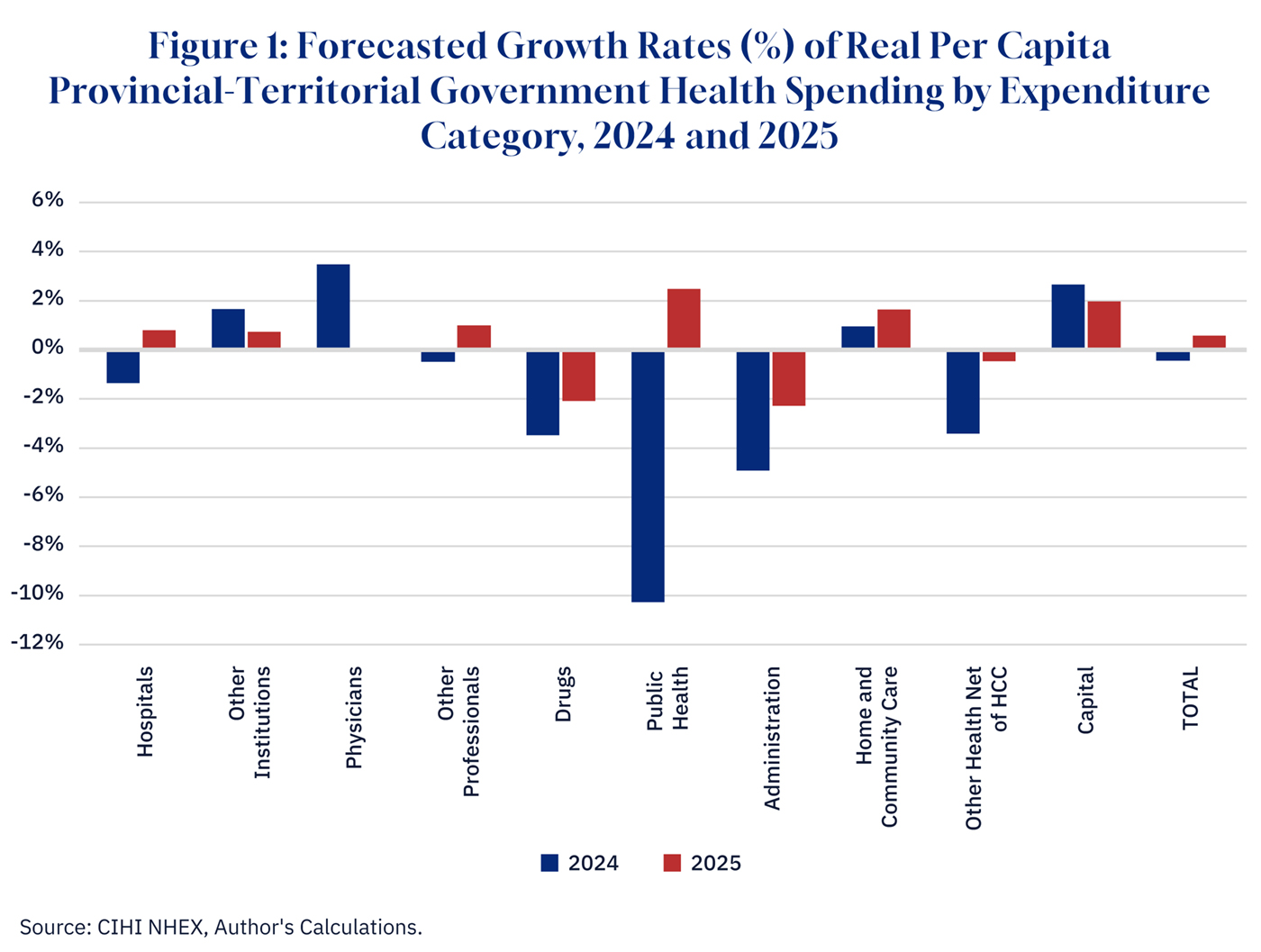

Figure 1 plots the growth rates of real per capita provincial-territorial government health spending by category for 2024 and 2025. The categories with consecutive increases of spending adjusted for population and inflation are other institutions (mainly long-term care), home and community-based care, and capital. Hospital expenditure is expected to grow 0.8 percent in 2025 but after a 1.4 percent decline in 2024.

Graphic credit: Janice Nelson

Similarly, real per capita physician spending saw a hefty 3.5 percent increase in 2024, but in 2025 a -0.1 percent decline. Provincial government drug plan spending per capita is shrinking at -3.5 percent in 2024 and -2.1 percent in 2025. Capital spending, however, is quite healthy, though more shiny new buildings and equipment will ultimately need to be accompanied by physicians and perhaps even drugs.

Moreover, where Canadians live matters, with different provinces seeing different spending amounts. In 2025, per capita provincial government spending in Canada’s provinces ranged from a high of $8,253 in Newfoundland and Labrador to a low of $5,750 in Ontario. The territories ranged from $20,768 in Nunavut to $12,297 in the Yukon. Provincially, Ontario is at the bottom, joined by Quebec ($6,277), Alberta ($6134), and New Brunswick ($5,934), while at the top, Newfoundland and Labrador is followed by Nova Scotia ($7,785), Prince Edward Island ($7,746), and Manitoba ($7,242).

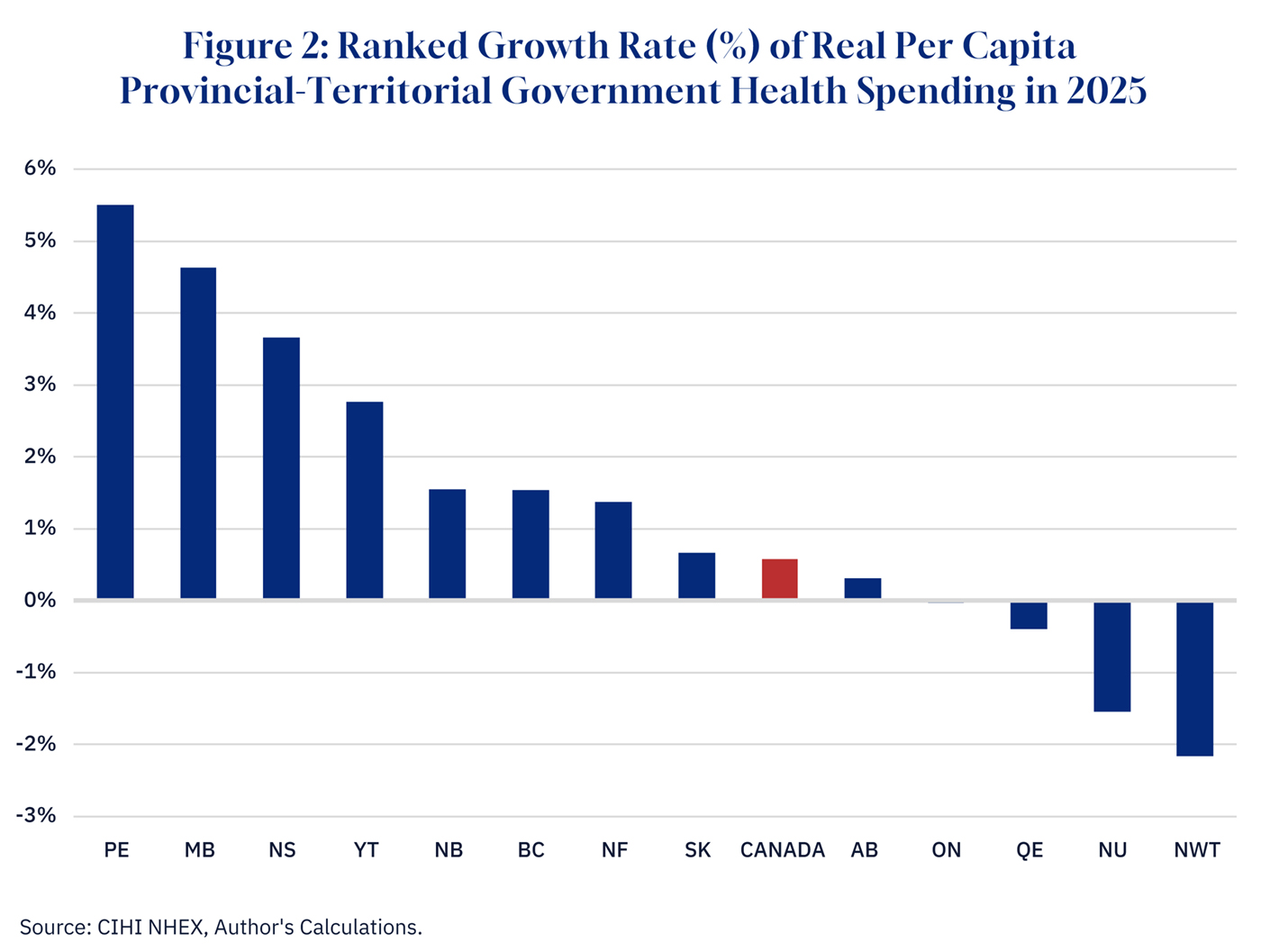

Over time, these differences can be aggravated by differences in growth, as illustrated in Figure 2, which presents the ranked growth rate of real per capita provincial-territorial government health spending in 2025. The fastest growth rates of total real per capita government health spending—all over 3 percent—were highest in Prince Edward Island, Manitoba, and Nova Scotia. At the bottom, experiencing varying degrees of negative growth, were Ontario, Quebec, Nunavut, and the Northwest Territories.

Graphic credit: Janice Nelson

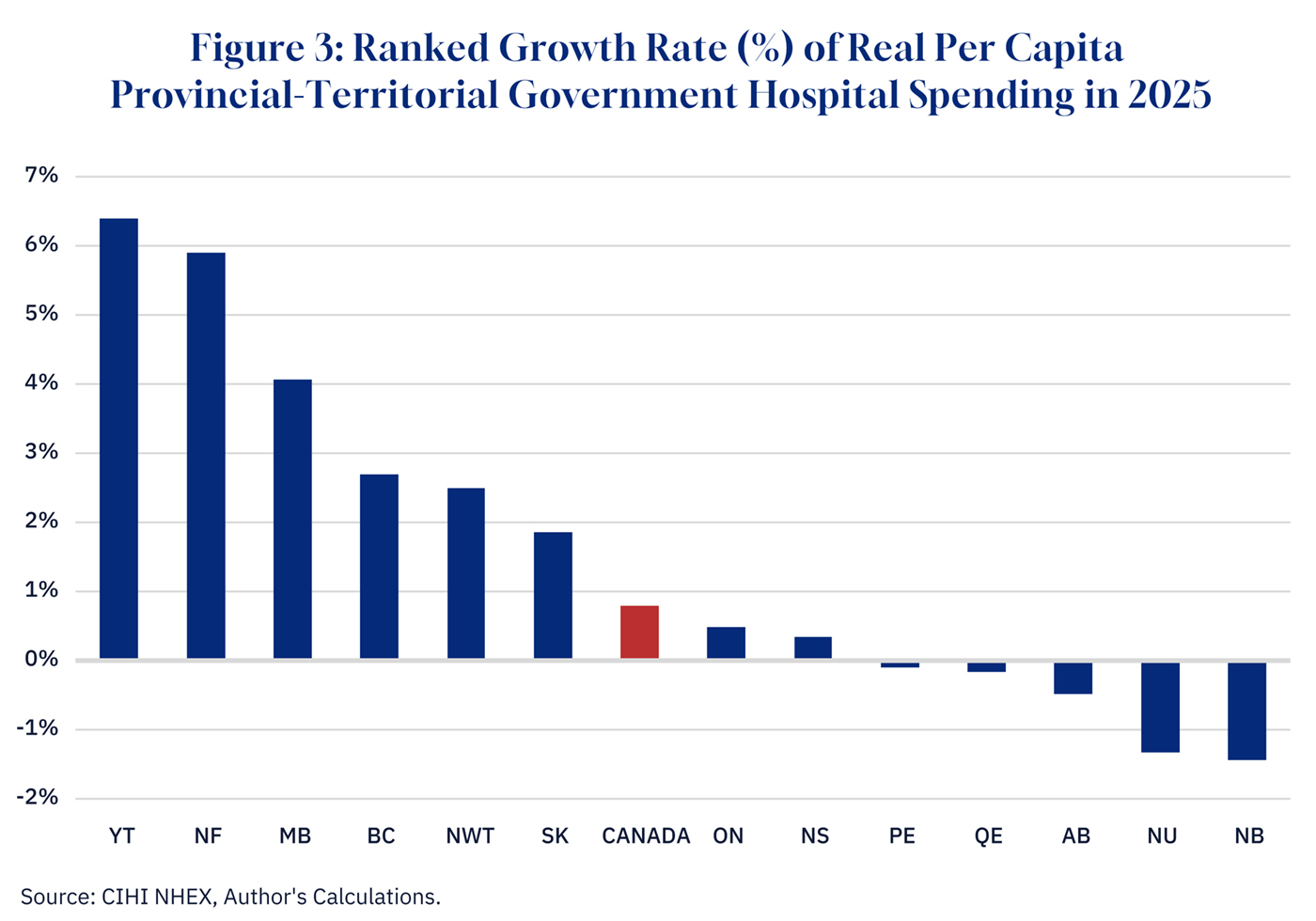

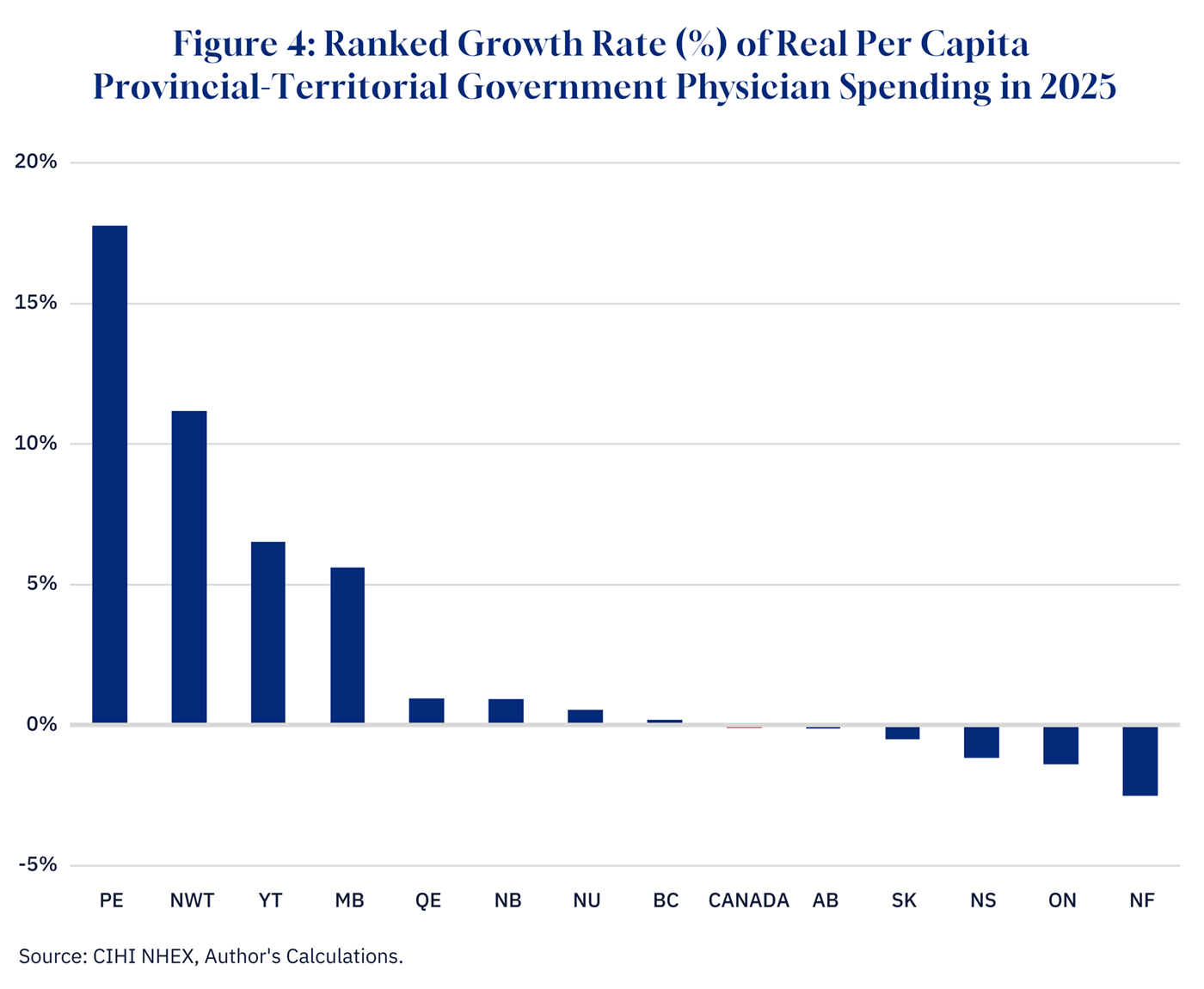

Of course, despite the broader determinants of health and community-based health programs, when push comes to shove, Canadians expect public health care to provide access to physicians and hospitals, and Figures 3 and 4 provide the growth rate rankings for both.

Graphic credit: Janice Nelson

Graphic credit: Janice Nelson

Real per capita provincial government hospital spending in 2025 was over 3 percent in the Yukon, Newfoundland and Labrador, and Manitoba. British Columbia, the Northwest Territories, and Saskatchewan followed above the 0.8 percent Canadian average. Ontario and Nova Scotia eked out increases of 0.5 and 0.3 percent, respectively, while all the remaining provinces and Nunavut saw negative growth, with New Brunswick bottoming at -1.4 percent.

The differences in physician spending are more interesting. Prince Edward Island will see real per capita provincial government physician spending (in 2025 dollars) increase 17.8 percent in 2025. This comes on the heels of what appears to be a concerted effort to add net new physicians as retirements occur. Prince Edward Island is followed by the Northwest Territories, the Yukon, and Manitoba, which all saw growth of over 5 percent.

Meanwhile, negative growth of -0.1 percent was the national average, and below this are Alberta, Saskatchewan, Nova Scotia, Ontario, and Newfoundland and Labrador.

The provinces and territories vary when it comes to their respective spending growth rates and making choices about which sectors to direct growth. For example, as mentioned, Prince Edward Island, even with robust growth, has chosen to direct much of the increase to physicians rather than hospitals. Manitoba’s increase has gone to both hospitals and physicians. Newfoundland and Labrador’s modest increase has gone mainly to hospitals, with physicians less favoured.

Ontario’s growth in real per capita provincial health spending in 2025 is essentially zero, coming with a 0.5 percent increase in hospital spending and a 1.4 percent decline in physician spending. Alberta is seeing a 0.3 percent increase in real per capita spending, but the increase seems directed to either hospitals or physicians. British Columbia is directing more of the increase to its hospitals and much less to physicians.

What should Canadians make of all this? The onwards and upwards nature of aggregate provincial government health spending comes with sideways differences across expenditure categories and jurisdictions. While real per capita spending is up nationally, some provinces and territories have seen declines.

Moreover, even increased spending may not necessarily go to alleviating shortages in hospital-based or physician care, depending on the province or territory in question. These variances are a result of differences in rates of population growth, aging, human resources, cost of service delivery, and, of course, political responses to the crisis of the moment.

Why does Canada's healthcare spending vary so much by province, and what does this mean for Canadians?

Despite rising healthcare costs, are Canadians seeing improvements in physician and hospital access?

With healthcare spending at 12.7% of GDP, what are the key areas where Canada's money is actually going?

Comments (3)

Details on growth rate is great but I would rather see actual costs and costs per individual