The announcement by Elon Musk that Tesla would no longer accept Bitcoin came as a shock to the crypto community and has led to a dramatic reversal in its price momentum.

To add to its woes, China has now reiterated its prohibitions on the use of Bitcoin, adding further concerns about its adoption as a ubiquitous currency.

The problems with Bitcoin run deeper than just Musk’s flip-flops or the CCP‘s growing antagonism towards cryptocurrencies and investors could soon find out the hard way. Here is what you need to know before putting a dollar of your hard-earned savings in any digital currency.

The fundamental distinguishing feature of Bitcoin relative to fiat currencies is its decentralized architecture. There is no central bank, no central authority, no management of the currency. This has always appealed to those who think regular central banks are run irresponsibly, those who don’t believe in governmental oversight at all, and of course the smaller but vocal cohort of conspiracy theorists and anarchists that think fiat money was always a scam.

Many enthusiasts find a psychological appeal in Bitcoin — the same kind of appeal that “gold bugs” find in gold — consistent with their belief that any currency not backed by gold is living on borrowed time and will eventually collapse.

There is an ongoing debate on whether Bitcoin is a medium of exchange or a store of value with speculative potential. Although its enthusiasts would like to think that it is a good medium of exchange, and will eventually be the dominant one, most of them are really in it for the speculative gain. And in fact, it is not a very good medium of exchange, even apart from its technical complications and scalability limits, for precisely the reason that speculators like it.

If someone wants to make a contract to pay for something in Bitcoin, they won’t like it if its value increases, requiring them to pay you more value than had been intended. So, people who want to use it as a medium of exchange, try to hold it for as little time as possible, and people who want to speculate hold it for longer periods.

Early bitcoin use was largely to move money anonymously. Drug dealers, people trying to expatriate money, organized crime, all thought that it was a good way to launder and transfer illicit funds. And any price appreciation along the way was just a bonus. But the anonymity has been overstated, and now a large majority of Bitcoin holders are speculators.

Even though Bitcoin enthusiasts deplore central banking, many of the rules that govern central banking still hold.

Even strategic investors may allocate a modest portion of their portfolio in this high risk, potentially high return asset. A few think it can become a store of value to displace gold and seek to preserve their capital for the eventual central banking apocalypse.

But even though Bitcoin enthusiasts deplore central banking, many of the rules of money supply that govern central banking still hold. The more a currency is used or held in a given system, the more is needed to maintain a stable currency value. And because the maintenance of stable value makes currencies useful as both a store of value and as a medium of exchange their stability has become the preeminent objective of central bankers. These institutions devote a great deal of resources to that goal.

In the last half of the 20th century, the main strategy for ensuring price stability was careful management of the money supply (we are speaking of money here, not just physical currency). The inflationary 1970s undermined confidence in the management of the money supply, contributing to general uncertainty and a weak economy. Even with a currency that is managed competently and transparently, it is sometimes difficult to retain confidence in its value, and there are many examples of incompetent management. Restoring confidence proves extremely difficult.

One of the challenges faced by central bankers is that the amount of money needed in the market changes regularly and somewhat unpredictably. To capture this lack of correlation between the supply of money and the amount needed for price stability, economists developed the notion of the velocity of money — you could imagine it, simplistically, as the measure of how quickly the money is being circulated.

If people hold money for longer periods of time, you need more of it in the system than if they use it quickly and then exchange it for non-monetary assets. But since the velocity of money cannot be measured directly and is highly unstable, central banks eventually moved towards measures of capacity in the economy to try to predict whether more money should be created or removed, primarily by the mechanism of interest rate changes. Higher interest rates tend to increase the velocity of money as investors are less willing to hold an asset with no return.

These rules have an analogue when thinking about cryptocurrencies. Except that there is no one to do the managing — no one to decide whether more currency is required. The designers of the system must have considered that, as they designed a mechanism for creating more Bitcoin, so that the supply of money could more closely follow demand.

The creator(s) instituted a very hard mathematical problem that had to be solved using expensive computing capacity (the same capacity that Elon Musk’s Tesla decided was too environmentally costly) to permit the creation of new Bitcoin. The incentive to create this new money would rise and fall with the Bitcoin price as a kind of automatic stabilizer. The higher the Bitcoin price, the greater the incentive to create more. But that is still a crude way to manage supply and it has no reverse gear to remove money when there is too much, other than the reduction in purchasing power with a decline in overall value. And there is a hard ceiling built into the system on the amount of Bitcoin that can be created in the long term, so eventually that crude price stabilizer will fall away and make the velocity changes worse.

Don’t expect Telsa to accept gold as payment either if the same environmental concern holds.

This bears similarity to gold mining and why Bitcoin creators called the process of creating more Bitcoin “mining.” There is an economic and environmental cost to mining gold, as tons of rock have to be mined and crushed to extract tiny amounts of gold. Don’t expect Telsa to accept gold as payment either if the same environmental concern holds.

What are the greatest fears of central bankers? Well inflation is their second worst fear, which is the reduction of the value of money over time. That can become endemic in the system as inflationary expectations become entrenched and can cost long term savers the purchasing power of their savings.

Central bankers’ biggest fear however is deflation, where money increases in value over time. They fear deflation because if people develop the expectation that money will increase in value over time, they will hold it for longer to benefit from appreciation. And when people hold onto their money, economic growth will decline with the reduction in spending. So they carefully manage the supply of money through interest rates, to try to navigate a course between those two great fears.

Since its inception, Bitcoin has experienced long periods of exceptional deflation, as its value has skyrocketed. To the extent that the enthusiasts and now, more recently, the general public has developed the expectation that increases in value will continue, they have held it for longer and longer to benefit from that appreciation. This is a self-reinforcing process, where the higher the price goes, the more expectations for further increases are reinforced and the more people want to hang on. In essence it reduces the velocity of Bitcoin and hence requires increased supply. But because Bitcoin mining cannot keep up with the demand, the increase in holding periods causes its price to rise.

Expectations however are fickle. They can change, and we are seeing the effects of that change. If people expect Bitcoin to decline, they may still use it to conduct illicit transactions, but they will try to do so in the shortest time possible, to avoid getting caught when the music stops. This will dramatically increase Bitcoin velocity and create oversupply.

The potential volatility of these changes in expectations can cause wild swings in Bitcoin prices. And we are seeing that play out right now. The critics of central bank currency management are learning that a self-regulating currency is hard to create.

Bitcoin enthusiasts are all over the Twittersphere and the financial networks spreading messages of calm, “buy the dip”, “it’s just tax time” — anything to avoid the dreaded reversal of bullish expectations.

But regardless of the eventual path of Bitcoin value, they are learning that currency management turns out to be more art than science, more psychology than mathematics and better focused on being boring than dynamic.

As a former governor of the Canadian central bank once remarked during the 2008 financial crisis, “we will know that the crisis is over when central banking is once again relegated to the back page of the financial section where it belongs.”

Recommended for You

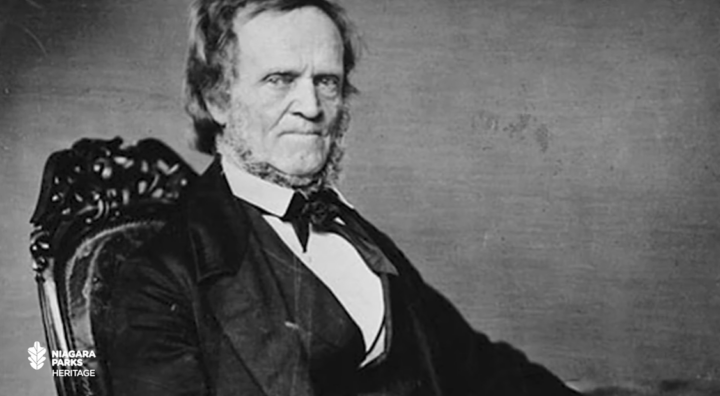

William Lyon Mackenzie is worth the drive, if you can find him

We need thorough ethics investigations, not fulsome ones

Are conservatives really rights-deniers?

It’s time for Poilievre to speak out against Trump

Comments (0)