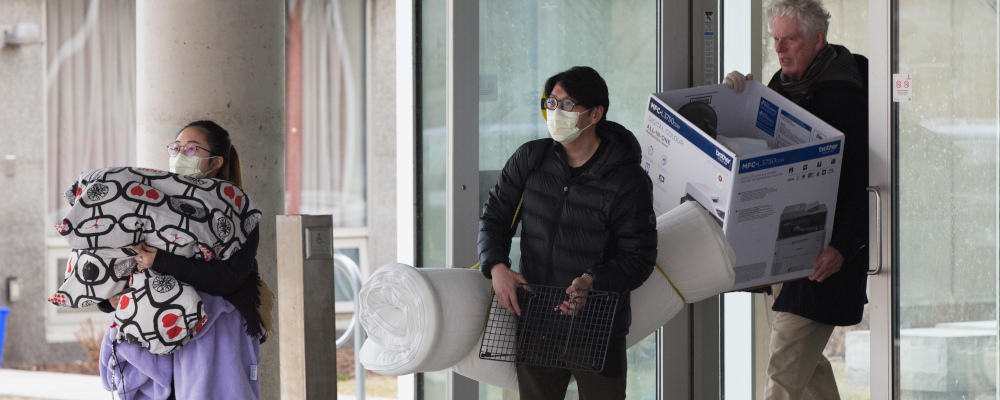

Ontario is facing a housing crisis that extends to our university and college campuses. At the start of the school year, it seemed like every other day there was a headline in local or national media of a student struggling to find a home, sleeping in their car, or heading to a food bank because all their savings were going to rent.

Our country is finally having the debate we’ve long needed about our housing shortage, but it is time that this is extended to our post-secondary sector as well. Thankfully, the solution to ensure all students—whether international or domestic—have an affordable and attainable roof over their heads does not need to be that complicated.

Purpose-built student accommodation (PBSA) has the potential to be one of the best-performing asset classes in Canada. Despite grappling with the challenges of the pandemic, rising inflation, and interest rates, PBSA has shown remarkable resilience.

The driving force behind the strong fundamentals is a constrained housing supply market: it is almost impossible for Ontario post-secondary institutions to build new housing fast enough to meet demand.

In Ontario, universities and colleges that receive more than $10M from the Government of Ontario are guided by Ontario’s Broader Public Sector Procurement Directive, which mandates lengthy Request for Proposal (RFP) processes for all construction and service contracts. What’s more, universities cannot take on debt as their balance sheets roll up to the province.

This means that it is incredibly difficult for universities to build on-campus housing on their own. They have to look to the private sector to support financing, development, and construction.

Most often, a university will maintain day-to-day operations once the building is built. To execute these kinds of public-private agreements, universities must run an RFP process and then engage in contract negotiations; all before they can go through entitlements and build the residence. The RFP and negotiation process alone can take six years, and then tack on another five to build. That’s 11 years before a student accommodation for 100 undergraduates is realized.

The greatest difference between on-campus housing in Ontario and other markets like the United States and the United Kingdom is this red tape. For decades, the U.S. and the U.K. have been able to control their campus expansions and land bank real estate to enhance their built environment, attract new students, and grow. The more urban a university is, the more pronounced its real estate activities are.

Reviewing the BPS Procurement Directive to lessen restrictions and allow universities to proactively engage with the private sector to explore a variety of structured agreements to build housing on campus is something the government can proactively do to support the supply of new housing in the short term.

In comparison to on-campus student housing, there is also private purpose-built student accommodation: the developer owns the lands, assumes the finance and construction risk, and engages a third-party property manager, or the university, for day-to-day operations once built.

The private purpose-built student accommodation market in Canada is nascent compared to other markets. The country’s ratio of students to beds (also known as the provision rate) is 12 percent—among the lowest in the world. The U.K.’s provision rate of private PBSA beds is 34 percent; America’s is 16 percent.

Canada has a conservative lending environment that has historically concentrated debt capital in a select few commercial asset classes, namely office, retail, and industrial. Since COVID, and the return of students to campus, there has been real institutional interest in the private purpose-built student accommodation asset class due to the strong fundamentals of the Canadian market—the sustained and growing demand.

Developers who want to build off-campus purpose-built student accommodation still face numerous challenges. The biggest question they face today is, “What if interest rates do not decline?” The headwinds against developers are significant: escalating costs, extended approval timelines, sourcing equity capital, and navigating an illiquid debt environment. The uncertainty surrounding interest rates is closely tied to valuation risk. So, the dilemma is clear: how can we introduce new supply to the market while fulfilling our fiduciary responsibilities as investors?

The government has made some important moves in recent weeks to make these projects easier to pencil in: the removal of the federal portion of the HST and the recent provincial announcement to remove their share is welcomed.

There is so much more the government can do to support Canadian developers to unlock the housing supply in our university markets: implementing continuous programs through the Canada Mortgage and Housing Corporation that promote high-density developments and streamline bureaucratic processes, fast-tracking applications for building permits, and encouraging the construction of energy-efficient buildings are three critical steps that can ease the PBSA development process.

Universities can form alliances to lobby provincial governments for change, supported by the private sector. Strengthening partnerships between the public and private sectors is essential for delivering best-in-class student residences.

Leaders in development, education, and governance can play a pivotal role in attracting international investors to the Canadian market. By hosting events, webinars, panels, and engaging in conversations with like-minded individuals, we can initiate a dialogue about the supply constraints and how to fix them.

As we navigate the challenges of today’s macroeconomic environment, developers maintain their inherent optimism about Canada’s student housing market, and it is essential that we recognize the untapped potential it holds.

With the right combination of government support, private-sector partnerships, and individual efforts, Canada’s PBSA sector can thrive and continue to attract both domestic and international investors.

Recommended for You

The state of Canada’s economy halfway through 2025

Peter Menzies: It’s no wonder Canadians are tuning out the legacy media

DeepDive: Canada’s universities are failing to provide proper civic education. Here’s how Alberta can correct course

The Notebook by Theo Argitis: Trump halts trade talks, Carney’s trade-offs and John McCallum’s legacy