Canada’s per capita GDP has yet to return to its pre-pandemic level. Indeed, it has been declining. The implications of this lack of productivity growth for our long-term standard of living are dire—especially when compared to the United States, our primary trade partner and economic competitor.

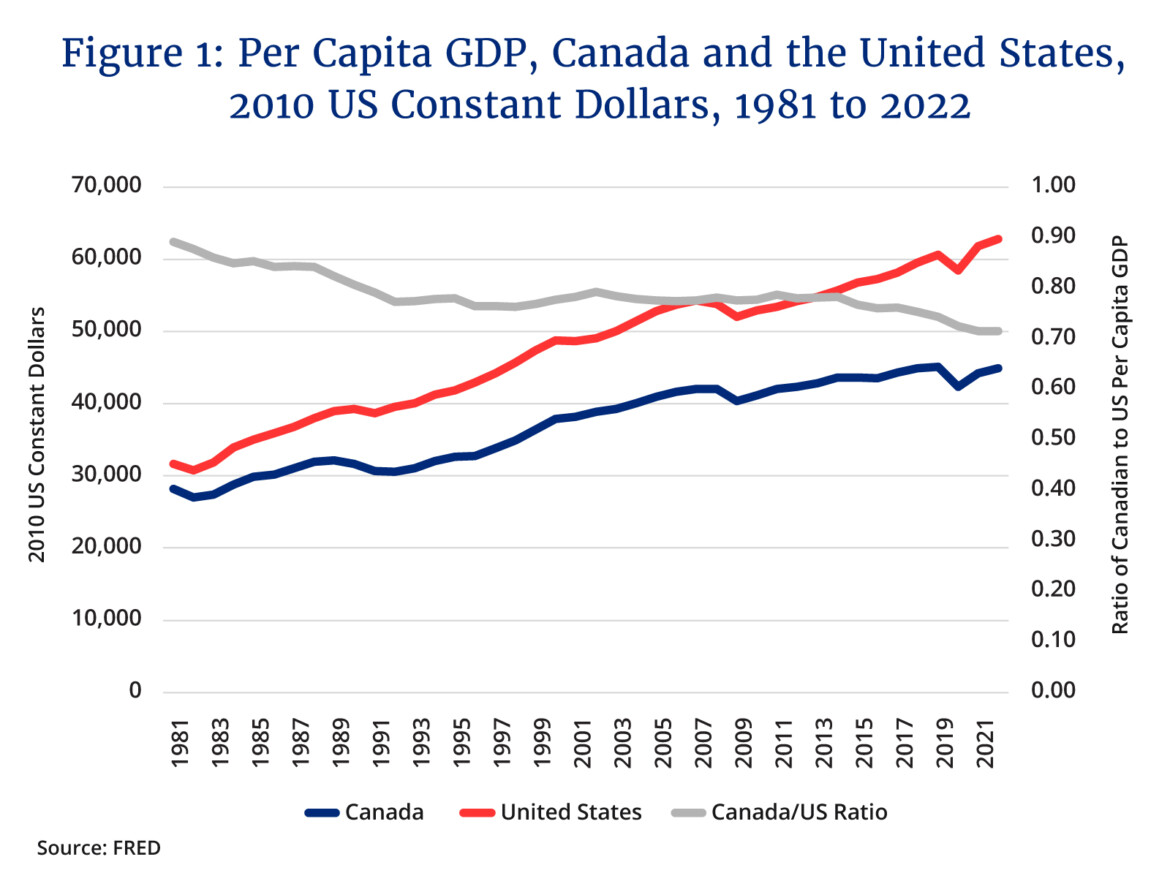

Indeed, relative to the United States, the latest decline is but the most recent installment in a moribund performance that is part of a trend going back decades. Figure 1 plots per capita GDP for Canada and the U.S. in inflation-adjusted USD from 1981 to 2022 along with the ratio of Canadian to US per capita real GDP. The result is striking.

While both Canadian and U.S. real GDP per capita have grown over time, there is a persistent gap between the two countries. Real per capita GDP in Canada since 1981 has grown by 59 percent, while the increase has been 98 percent for the U.S. As a result, the gap between the two countries has grown. In 1981, Canadian real per capita GDP was nearly 90 percent that of the U.S. whereas by 2022 it was just over 70 percent.

This relative decline appears to have occurred in three phases: a fall from 1981 to the mid-1990s, a levelling off at about 80 percent from the mid-1990s to about 2014, and then another decline to the present.

Moreover, while Canada’s real per capita GDP has always lagged the U.S., the trend since 1981 reverses one of historical growth relative to America. From the 1870s to the early 1980s, Canadian real per capita GDP relative to the U.S. grew from about 70 percent to peak at nearly 90 percent. In the span of four decades, we are now back to where we were in the 1870s. However, it should be noted that there are regional differences in performance. Alberta, Saskatchewan, and Newfoundland and Labrador have tended to do a bit better as a result of their natural resource sectors. As well, when one looks at major urban centres more recently, Quebec City, Vancouver, and Montreal have seen larger real per capita GDP increases than Toronto, Calgary, and Edmonton. Nevertheless, the national environment is one of decline relative to the United States.

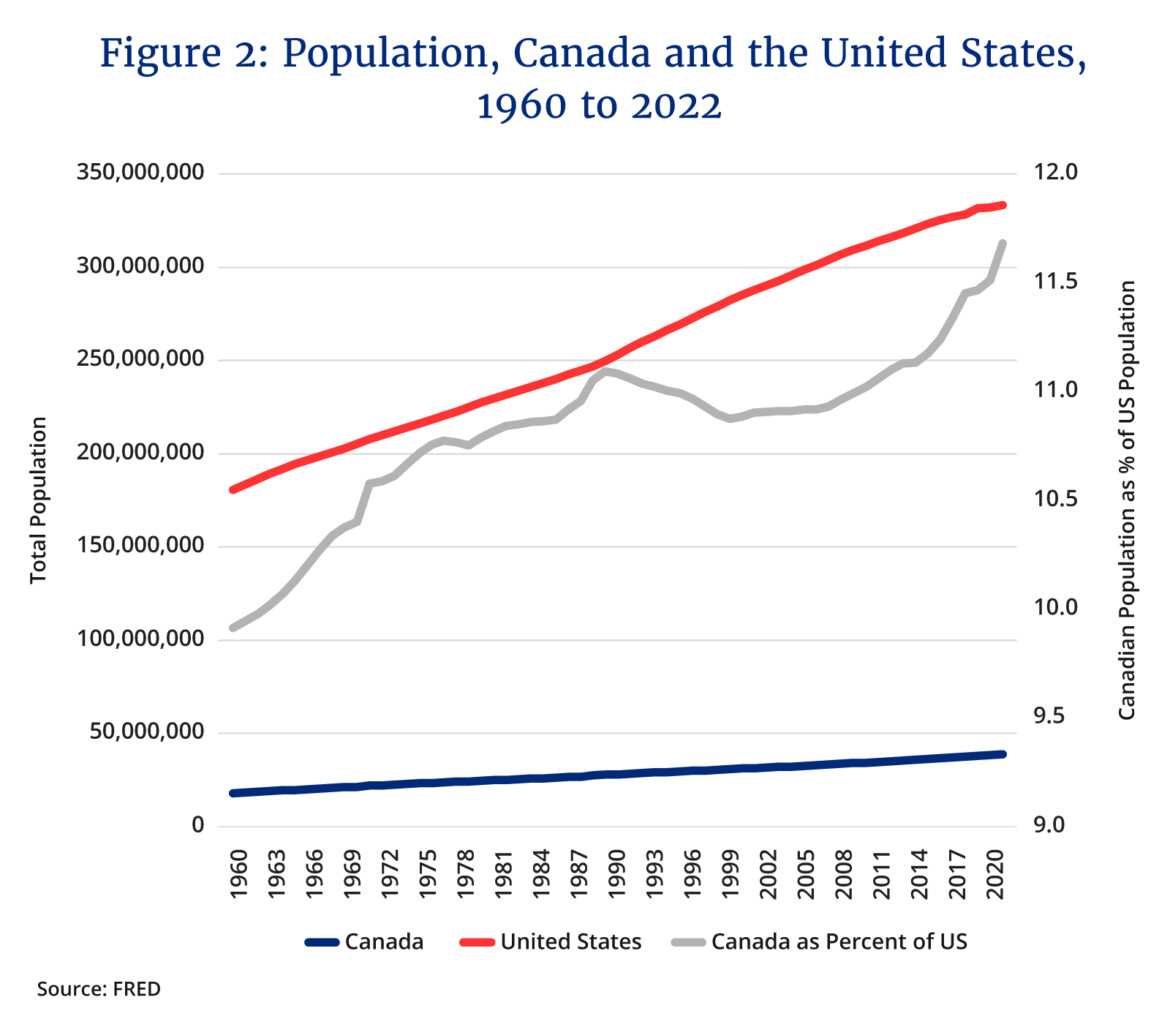

The reasons for this can be summarized across five areas: population growth differentials, capital investment, investment in research and development, structural economic issues, and, finally, the policy environment. Figure 2 provides background on what has recently become the most popular reason for explaining Canada’s real per capita GDP performance: high population growth. As a result of increased immigration levels that also include numerous international students and temporary workers, Canada’s population growth is at the highest rate since the 1950s. In the third quarter of 2023, Canada’s population was estimated at 40.528 million people—up a record one million people from 2022, which was already a year of record growth.

Economic growth can be of two types: extensive or intensive. An increase in the total size of the economy or GDP is extensive growth, whereas an increase in GDP per person is known as intensive growth. For intensive growth to occur, inflation-adjusted GDP must grow faster than population. And all other things given, if Canada’s population grows faster than the U.S., then it will be a factor in a growing per capita income differential. As Figure 2 shows, that has indeed been the case for a long time, as illustrated by an increase in Canada’s population as a share of that of the U.S.

Between 1960 and 2022, Canada’s population increased by 117 percent while that of the U.S. grew 85 percent. As a result, Canada went from 10 to 12 percent of the U.S. population. We are becoming bigger relative to our southern neighbours, which should have the benefit of increasing our domestic market size and creating economies of scale. And as immigrants are generally younger, the recent population growth also helps address the labour shortages associated with an aging population. More people can indeed fuel extensive economic growth. However, unless the stock of capital grows alongside to boost productivity, intensive economic growth will not follow.

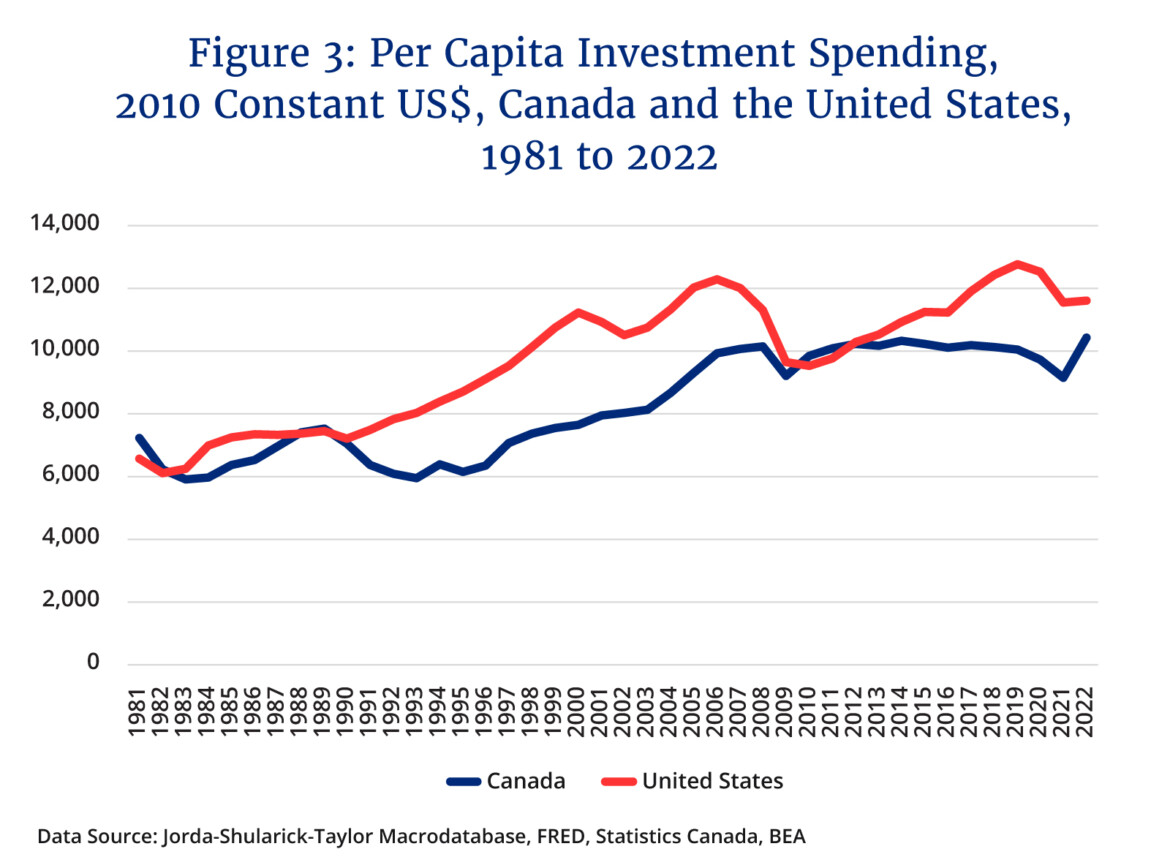

Oddly enough, Canada’s recent performance in capital investment—investment in buildings, plants, machinery, and equipment—seems respectable relative to the U.S. when examined only as a share of total GDP. Our investment to GDP ratio is currently about 23 percent while the U.S. is at 21 percent. However, as with GDP, investment spending per capita is also a relevant measure, and here Canada’s deficiency becomes apparent. With a much larger per capita GDP in the U.S. than Canada, it can devote more spending per person to investment. Here Canada has also fallen behind the U.S., as illustrated in Figure 3.

Real per capita investment in Canada has generally been lower than that of the U.S. And whereas U.S. investment spending per capita recovered after the 2007-08 Great Recession, ours has essentially been flat. In 2022, real per capita U.S. investment spending per person in 2010 constant U.S. dollars was 11,601 but 10,424 in Canada—an amount ten percent lower. Canada needs to increase per capita investment spending by an additional 1,117 dollars just to match the U.S. in per capita investment spending. Doing so would raise our overall investment spending to GDP ratio from 23 to 26 percent. Needless to say, given our population growth rates, in order to get investment spending per person well above U.S. levels, we would need to devote nearly 30 percent of our GDP to capital formation. That has not happened in Canada since the wheat boom era of the early 1900s—incidentally also the era of Canada’s fastest population growth.

And of course, it is not just the quantity of investment that matters but the quality and composition, and here it turns out that Canada’s spending on research and development as a share of its GDP has been declining for the last two decades relative to the U.S. and its G-7 counterparts. Indeed, as a share of GDP, Canada spends about half that of the U.S. and also spends less than all the other G-7 countries, with the exception of Italy—though they have been catching up and are likely to surpass us soon. As well, much of our productivity-boosting investment and research has historically occurred in our natural resource sectors, which we have recently demonstrated a definite lack of commitment to reprising.

Two other factors are also important in Canada’s productivity lag. To start, despite population growth and a market size now topping 40 million, we remain, compared to the U.S., a relatively non-competitive and closed business market dominated by duopolies and oligopolies, particularly in transportation and telecommunications. Witness the most brazen example yet when Canada’s two major airlines essentially carved up Canadian service territory in a manner not much different from crime lords carving up the proceeds from gambling or drugs. It is no coincidence that airfares have soared in the aftermath. Despite the country’s population doubling over the last forty years, our markets are apparently still “too small” to allow for more competition and we remain a captive market for oligopolistic firms including retailers. Combine this with provincial and federal implementation and regulatory environments that have raised the cost of starting just about anything and you have a recipe for long-term economic ossification.

The final shoe to drop explaining our productivity malaise is a Canadian policy environment which can be described as anarchic federalism. At its best, Canadian federalism is a cooperative enterprise that allows for policies and practices tailored to regional preferences with consultation and coordination of economic policies to promote overall Canadian economic performance. At its worst, Canadian federalism can be a petulant collective of myopic jurisdictions operating at cross-purposes that frustrate any attempts at national coordination. Over the last decade, Canada’s provinces and the federal government have become increasingly prone to bickering. Even infusions of federal cash at the individual and governmental levels seem to have become insufficient incentives to get things done aside from communicating what seems to be a federal preference for consumption spending over investment spending.

Think of this as Canadian federalism in action: Ottawa controls the levers of immigration and has used this power to increase the population to address aging populations and labour shortages but without thinking much about the consequences on health services and housing stock. The provinces control health and education services but in the wake of rising population and demand both sectors are highly stressed and finding it hard to cope. Then there are the municipalities which essentially control the key levers for land zoning and housing construction and yet despite what seems to be a roaring demand for housing are moving slowly if at all. It seems like Canada’s economic strategy has simply been to increase population—indeed a tool for promoting extensive growth—while assuming that anything needed to boost productivity—intensive growth—would simply descend from the heavens.

As a result, we are now in a situation of having a growing population and a bigger market but with less competition resulting in higher prices and less convenient services. We have more spending on health and education but hallway health care and students with declining test scores. And, the coup de grace, a generation of Canadians unable to afford a home even if they have good high-paying jobs. This is not good. Is it any wonder that economic growth is lagging given that the environment needed to support more business investment seems to have disappeared in a quagmire of finger-pointing and discord?

The long-term implications of Canada’s falling real per capita GDP and a growing gap with the U.S. are simple: a declining standard of living and ultimately out-migration of the best and brightest. Since 2010, Canada’s annual growth rate of real per capita GDP has averaged 0.9 percent while the U.S. has averaged 1.5 percent. At those rates of growth, in a quarter century, Canada’s real per capita GDP will be 60 percent that of the U.S. We are on track to becoming a relatively poorer country with a more fractious political system that seems unable to get things done. Is this really the country we want for our children?