The federal government’s latest budget included significant new spending: $8.5 billion over five years for housing, $7 billion for research, $5 billion for a new disability benefit, $1.5 billion for pharmacare, etc. Overall, spending is now up over $67 billion over five years compared to the government’s plans from last November.

But despite this new spending, the projected deficits increased only modestly thanks to a stronger-than-expected economy and several tax increases, one of which was particularly large.

Much of the reaction to the budget has centred on the fact that capital gains taxes will rise.

Today, only half of capital gains are taxable. But starting June 25, two-thirds of such gains over $250,000 will count. The increase in the “inclusion rate” could raise $19 billion over five years.1This will also increase provincial revenues by something on the order of $10 billion.

So what should Canadians make of this? Will it hurt productivity and competitiveness, as some fear? Or will it “tackle one of the most regressive elements in Canada’s tax system,” as the government says?

Neither. The reality is far more boring but no less important to understand. I’ll try to explain. (Your eyes may be tempted to glaze over, but do push through. It’ll be worth it.)

Put aside whether you think the spending increases are wise or not. And put aside whether you prefer lower taxes in general or not. This particular tax change is defensible for many reasons.

It is a change that modestly improves the efficiency and equity of Canada’s tax system.

It is also a change that crosses party lines. The last time Canada increased capital gains taxes, the Conservatives were in power. And the last time we decreased such taxes, the Liberals were.

It is even a change that those who are strongly opposed to higher taxes could get behind. Instead of using the revenues for new spending, for example, we could lower other taxes to compensate. The critique should then be that the government didn’t lower those other taxes, not that it changed the inclusion rate. I’ll come back to this point, but first we must understand what makes capital gains different.

Why tax capital gains differently?

If I earn a dollar as wages and you earn a dollar as capital gains, our ability to consume or save more is identical. The concept of “horizontal equity” demands we tax both dollars similarly, regardless of where they came from.

A dollar is a dollar is a dollar.

This logic has guided Canadian tax policy since the 1960s, when a Royal Commission clearly enumerated this and other core principles. And Canada does pretty well here, at least when it comes to treating labour and capital income similarly.

But taxes are lower on capital gains than on wages. Is this a form of special treatment? At the risk of giving a very economist answer: it depends.

Consider someone who owns a second home in Toronto. If they bought the average property ten years ago for $500,000 and sold it today for $1.1 million, they would have $600,000 in capital gains. If a dollar truly was a dollar, regardless of where it came from, then the inclusion rate for this gain would be 100 percent.

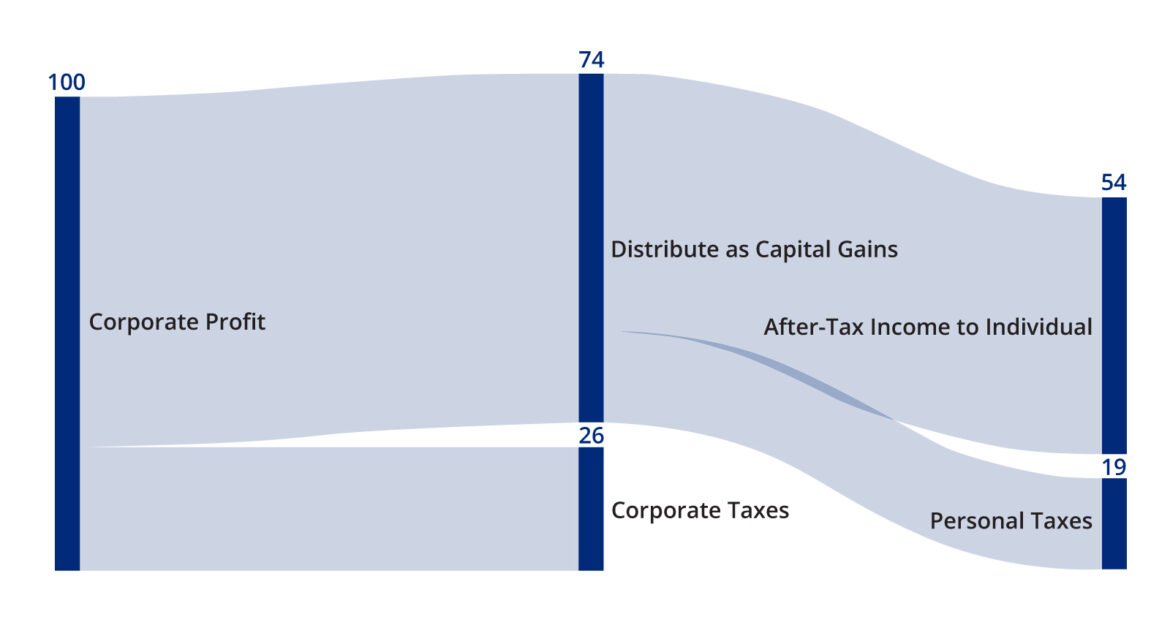

But things are very different when it comes to capital gains on, say, corporate shares because the corporation itself will pay taxes on its profits. Based on average corporate tax rates in Canada, only 74 cents on each dollar in corporate profits are available to distribute to owners, and it’s on this that personal income taxes are paid.

Currently, the situation looks like this for an average Canadian in the top tax bracket:

This individual has 54 cents after tax since only half the capital gains count. If 100 percent of the 74 cents in capital gains were included in an individual’s personal taxes, then only about 35 cents would be left after all taxes were paid. That would mean an effective tax rate of 65 percent—far above the top personal income tax rate of roughly 53 percent. That’s a problem and an important reason why capital gains are only partially included.

Still with me? Good!

So what’s the “right” inclusion rate?

The case of corporate capital gains

Corporations have many options to distribute the value they create: dividends, interest, share buybacks, and so on. An efficient tax system is one that is neutral and doesn’t bias such decisions. Each should face similar taxes.

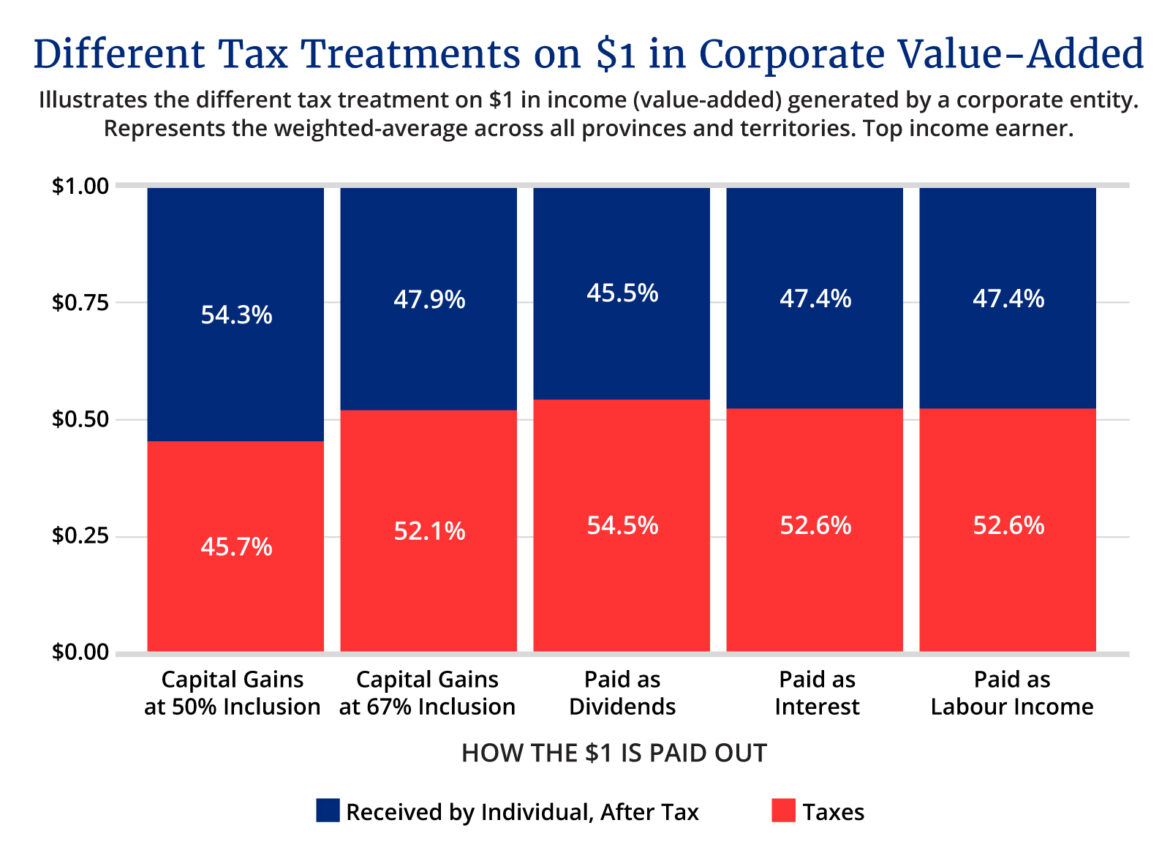

If profits are paid out as dividends, then a complicated formula leaves about 45 cents on the dollar in after-tax income for the individual. (Notice, this is very similar to the 47 cents on each dollar in wages paid to a high-income individual!)

But if the firm buys back some shares, then, as we saw above, 54 cents on the dollar in after-tax income is received by the individual. That creates a bias towards paying out corporate value through capital gains rather than dividends.

The trick to achieving equal treatment is to set the inclusion rate so roughly the same amount will be left for an individual after all taxes have been paid. It turns out, that’s roughly two-thirds.2There is no magic number. The right inclusion rate changes over time with other aspects of the tax system.

The government’s change makes the after-tax amount a person receives from capital gains very well aligned with other types of payments.

That’s good! It makes the tax system more efficient and equitable.3There are plenty of details I’m glossing over. Interested readers who want to know more should read this, this, this, and this. And if the goal was to align the tax treatment of capital gains and dividends, then an even higher inclusion rate could have been justified, potentially as high as 75 percent.

Alternative uses of revenue

None of the above should be viewed as an argument for higher taxes. Different people will reach different conclusions over whether federal taxes should or shouldn’t increase. Indeed, having the government take a majority of each additional dollar is a concern some have.

For those who oppose higher taxes, a higher inclusion rate can still be a smart move.

For example, the corporate tax rate could have decreased by one percentage point (from 15 to 14 percent) with the additional funds from the higher inclusion rate. Or, if you’d prefer, the top personal income tax rate could have decreased by roughly four percentage points (from 33 to 29 percent, as it was back in 2015).

A broader set of tax changes could have delivered all the benefits of increasing the inclusion rate without increasing overall taxes. For some, this was a missed opportunity in Budget 2024.

Of course, whether lowering other taxes is preferable to increased spending is a point where reasonable people will differ. And it’s an important debate to be had.

But from the perspective of getting the underlying structure of Canada’s tax system right, increasing capital gains taxes made good sense.