The Trans Mountain pipeline is now shipping oil. Finally.

Canada’s west coast has not seen a new pipeline in over 70 years. But it comes 11 years after the initial application to the National Energy Board, more than six years behind schedule, and with staggering cost overruns—rising from an estimate of roughly $5 billion in 2013 to $34 billion today.

Was it worth the high price?

Whoever or whatever is to blame for the delays and cost overruns, the answer to that question is clear: Yes! And it’s not even close.

I say this for two main reasons. First, taxpayers are not on the hook in the way that most people think. Indeed, we may not lose any money on the purchase at all. Second, and more importantly, the pipeline’s economic benefits to Canada far surpass its cost.

Let’s start with taxpayers.

Understanding the Trans Mountain pipeline’s finances

Many worry that taxpayers will face large losses from owning the pipeline.

Recent financial filings paint a very different picture.

Oil producers cover some cost overruns with roughly $11 per barrel in tolls, which could cover just over $9 billion in costs (or about 30 percent of the total). That’s high—more than double the project’s initial estimate—but far better than the alternative of hauling crude by rail.

The cost overruns were also largely covered by debt, which is relevant for at least two reasons. First, any future buyer of the pipeline does not need to pay $34 billion for taxpayers to avert a loss. The buyers would assume these debt obligations instead. Second, and perhaps more importantly, interest on that debt pales in comparison to projected future revenues.

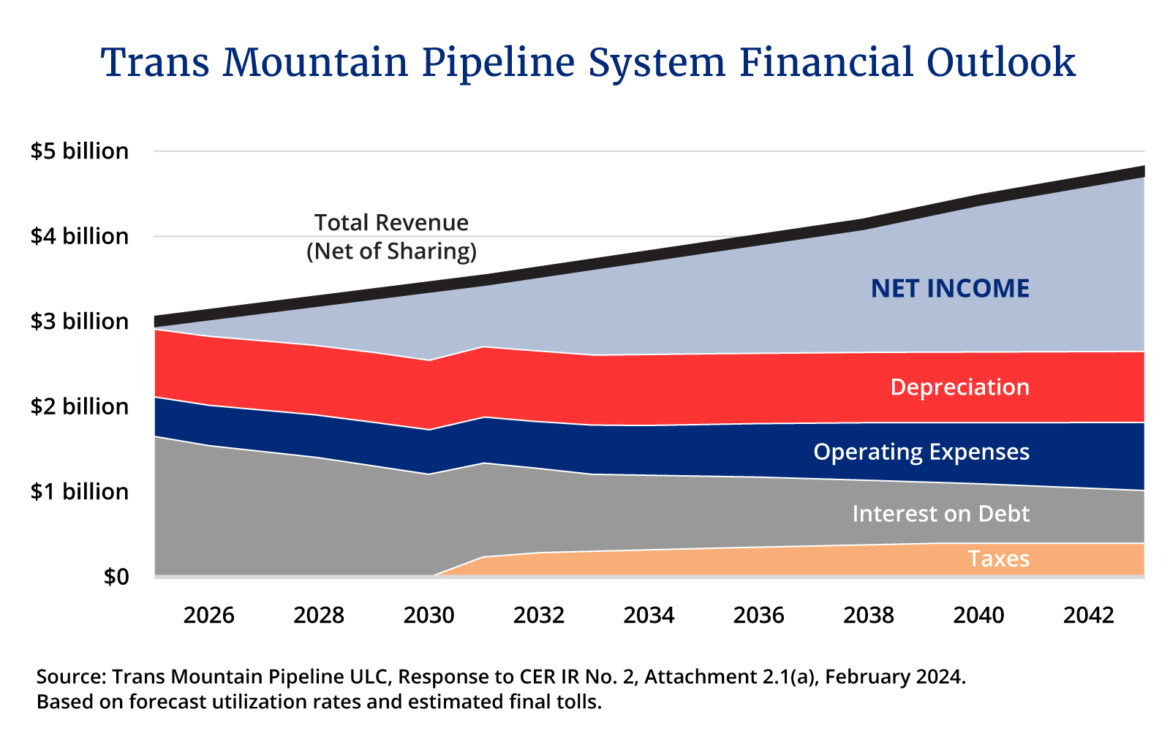

Trans Mountain anticipates revenues will soon reach $3 billion and expenses of less than $500 million. Interest on the project’s large debt will exceed $1.6 billion, but this still leaves considerable cash available to start repaying debt.

Even better, interest costs will gradually fall while revenues and profits rise. The pipeline will be highly profitable for many years.

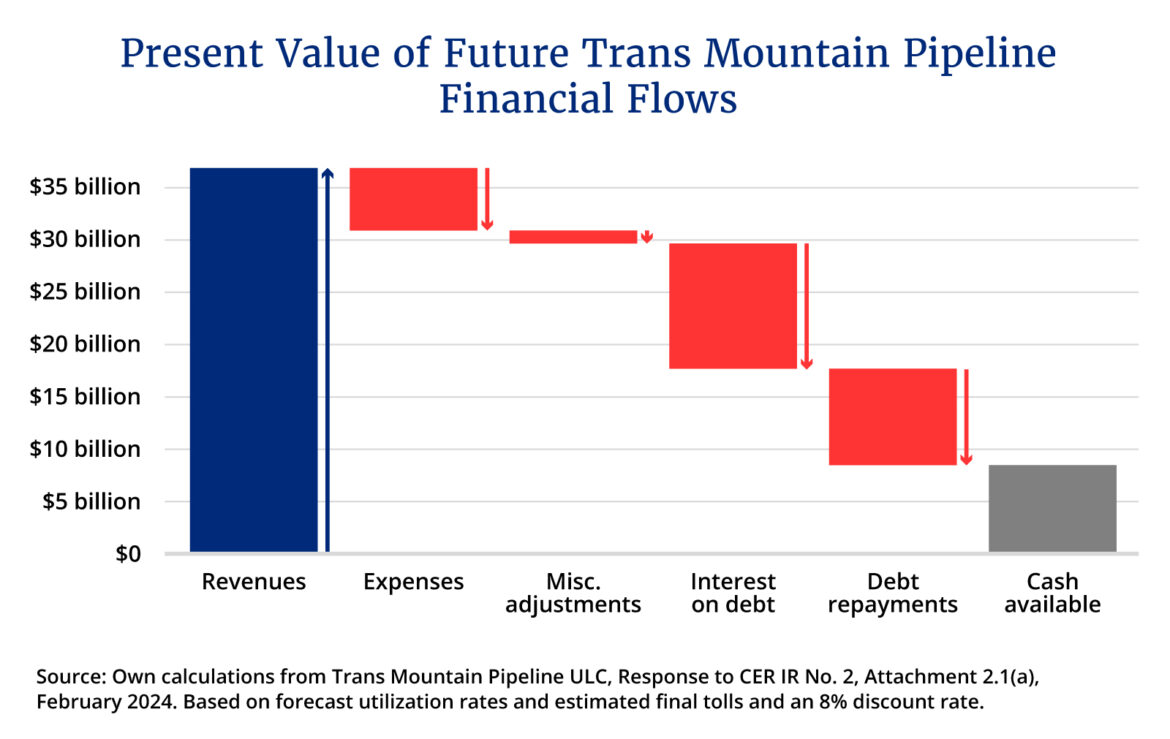

To value the pipeline today, one shouldn’t just add up two decades worth of revenues minus expenses. A dollar tomorrow is worth less than a dollar today. If each year “discounts” the value of money, by say 8 percent, then I estimate the value of projected earnings (before depreciation and interest) over the next twenty years is between $26 billion and $38 billion, depending on the scenario.

Some of that will go towards interest and debt repayment, but between $4.2 billion and $8.6 billion is left over.

Naturally, these projections have risks. But despite the cost increases, it’s not a stretch to see a scenario where this pipeline is worth more than the $4.5 billion that Canada bought it for back in 2018.

Today, equity in the project is just under $8 billion and is expected to only grow from here.

Broad gains for Canada’s economy

There are also broader economic benefits for Canada.

For oil producers, these benefits are obvious. The 890,000 barrel-per-day pipeline now has a capacity equivalent to over 1,300 railcars of crude oil per day. (That’s a lot!) It will mean lower-cost access to markets abroad, raising producer prices here.

There are even benefits for producers who don’t directly ship through the new pipeline because the differential between Canada’s oil prices and those abroad will shrink. The Canada Energy Regulator (CER) estimated that having ample pipeline capacity adds about $9 per barrel to what Canadian oilsands producers receive.

This adds up quickly with millions of barrels produced daily.

Last month, the Bank of Canada predicted a 0.25 percentage point increase in second-quarter growth from the new pipeline. That is no small move for a nearly $3 trillion economy.

Looking ahead, the gains may be even larger. Over the 25 years between 2016 and 2040, for example, the CER estimated that building no new pipelines would cost Canada’s economy nearly $240 billion (in today’s dollars). Building pipelines avoids these costs.

These estimates suggest that the entire cost of the pipeline is more than compensated for by higher GDP after only a few years of operation. Not a bad return.

It’s not just Alberta that will see a boost. There are benefits throughout the Canadian economy. Research by my University of Calgary colleague Ken McKenzie and co-author Jared Carbone suggests a 10 percent boost in oil prices increases national economic output by 1 percent, with benefits for all provinces except New Brunswick. My own estimates confirm this.

Of course, updated analysis today may yield different results, but only at the margin. The scale of benefits would remain massive.

Worth every penny

None of this excuses the project’s jaw-dropping cost overruns. Nor should we avoid thorough investigations to ensure future large projects don’t suffer a similar fate.

There is likely plenty of blame to go around. Policy decisions by several premiers and prime ministers were certainly one factor. Site-C and Coastal Gas Link construction starting at around the same time is another—they unavoidably increased the pipeline’s costs by competing for scarce talent and materials. Conditions on the ground also turned out to differ significantly from initial estimates. And, of course, COVID-19 didn’t help.

Despite the sticker shock, the pipeline remains incredibly valuable, both as an individual asset and as a key piece of infrastructure for Canada’s economy.

The pipeline may have been late and (far!) over budget, but it was worth every penny.

Recommended for You

‘There is no free lunch’: Canada’s debt addiction is only getting worse

Canada’s spiralling debt problem in 5 charts

Pierre Poilievre secured a resounding win—here’s why: The Weekly Wrap

Ontario’s Progressive Conservatives need a wake-up call