The Trudeau government has placed a major economic and environmental bet on electric vehicles. Not only has it dedicated more than $50 billion in total public subsidies on electric vehicle production, but widespread consumer adoption is key to Ottawa’s own emission reduction plan.

Under the current plan, all new vehicle sales (including cars, SUVs, and light truck sales) must be fully electric or plug-in hybrid by 2035.

Canada has a long way to go. Just 1.5 percent of all light-duty vehicles registered by the end of 2022 were fully electric or plug-in hybrid. And just 10.8 percent of new vehicle registrations in 2023 were for EVs or hybrid. Put simply: we have just over 10 years to go from less than 11 percent of new vehicles to 100 percent.

The rapid transition away from fossil-fuelled vehicles therefore raises many more questions about charging access, electrical grid demand, affordability, and even whether emissions will be significantly reduced.

Take charging capacity for instance. The first hurdle for most Canadians will be the ability to charge up their EV, whether at home or on the road. According to the government, we will need 455,500 public charging ports by 2035, a sharp increase from the 26,500 ports as of 2023. This means installing 98 new ports every day for the next 12 years at a cost of about $6 billion. Importantly, this figure does not account for the even larger number of private charging ports required.

The EV transition will also strain the electrical grid. Electricity demand is expected to increase by 20,000 GWh by 2030 and five times that amount by 2040. Canada would need an additional 13 wind farms the size of its largest (Buffalo Plains in Alberta) by 2030 and over 66 such wind farms by 2040—a huge undertaking especially given that Canada’s approval and construction timelines are some of the slowest in the OECD.

Basic financial costs for consumers is another pressing issue. Apart from higher upfront costs, studies indicate EVs face greater depreciation. Also, repairs and replacement parts are more expensive, which could lead to higher insurance premiums.

While people cite EVs for lower fuelling and maintenance costs, these savings may be overstated. Maintenance costs for new vehicles tend to be modest over the first five years. So, the actual dollar savings may not be significant.

Furthermore, governments will need to recoup the $16 billion in lost gasoline taxes from EV owners, as Alberta and some American states have done with new fees.

Equity concerns also arise over the costs of public versus private charging. Lower-income households will likely rely on more expensive public charging. One study suggests this alone can add $10,000 to an EV’s lifetime operating costs. Moreover, despite heavy subsidies, EV purchases remain skewed towards higher-income households.

When we factor in billions of dollars in subsidies given to corporations, including the new EV investment tax credit in the 2024 federal budget, the inequalities are further exacerbated.

The core promise of EVs lies in their potential to reduce greenhouse gas emissions. While EVs produce no tailpipe emissions, their operational emissions depend on the source of electricity. Charging EVs with fossil fuel-generated electricity, such as coal, undermines potential GHG savings. For example, according to Canada’s Energy Regulator, an electric Hyundai Ioniq emits less than one gram of GHG per kilometre driven in Quebec, compared with 107 grams in coal-reliant Nova Scotia.

The trend towards larger and heavier EVs, driven by SUV demand, also presents challenges. Automakers are increasingly using aluminum in EV construction to reduce weight and improve driving range. However, producing one tonne of aluminum generates six times more GHG emissions than steel. A recent study forecasts aluminum use will increase three to five times by 2050.

An accelerated EV sales mandate would worsen the looming shortage of critical minerals needed for battery production. Automakers would face the challenge of allocating limited mineral supplies for their battery manufacturing. Because of market demand and profit considerations, they may opt to produce fewer but larger batteries suited for electric SUVs and trucks, rather than more numerous smaller batteries used in compact and mid-size EVs. Unfortunately, producing fewer large EVs would result in fewer reductions in GHG emissions.

If EV price premiums remain high, Canadians may keep their older gas-powered vehicles longer, which Stellantis CEO Carlos Tavares warns would be a “disaster” for the climate.

There are also doubts about whether EVs can fully substitute for conventional vehicles. In some cases, households will buy an EV but keep their gas-powered vehicle, undercutting GHG reductions.

Rather than imposing aggressive EV sales targets, the government should introduce gradually tightening GHG emissions standards. This would enable automakers to adjust vehicle portfolios to align with market demands and environmental targets while giving infrastructure and technologies time to catch up.

However, these emissions standards must align with market realities and industry timelines. Securing new critical mineral sources, offering affordable EVs, and ensuring ample charging options will give Canadians the confidence to go electric.

Recommended for You

Canadians lost confidence in Parliament at end of Justin Trudeau’s prime ministership: Statistics Canada

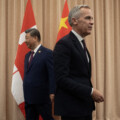

‘All risk and no reward’: The Roundtable on why Carney’s China trip is a really big deal

Mark Carney’s spelling and the ghost of Sir John A. Macdonald

Harper was right—Canadian foreign policy should prioritize the Americas: The Weekly Wrap