Today Statistics Canada released inflation numbers for December 2023 that shows the inflation rate somewhat unexpectedly increased to 3.4 percent. We turned to The Hub’s resident economics expert Trevor Tombe to understand what these numbers mean. He breaks down the data and offers his perspective on whether or not—and to what extent—inflation will continue to grow in 2024. The upshot? We shouldn’t be too worried yet—the December inflation increase counterintuitively shows that inflation pressures are in fact easing, even if not as fast as some might hope.

SEAN SPEER: What should we make of the news that inflation actually increased from 3.1 percent in November to 3.4 percent in December? Is this a temporary blip that can be explained by contingent factors or is it a sign that inflation is stickier than we might have anticipated?

TREVOR TOMBE: This is a great question that highlights an important feature of inflation calculations that many don’t appreciate: they’re a year-over-year comparison. This means the December 3.4 percent rate is effectively the accumulation of twelve months of price changes since last December. Effectively, we drop last year’s December and add in this year’s to get the updated inflation numbers. Last year, there was an unusually large price drop and this year there was a relatively normal price drop. (Prices normally fall in December because of holiday sales.) So since last year’s unusually large drop was eliminated, that tended to make the 12-month total increase slightly.

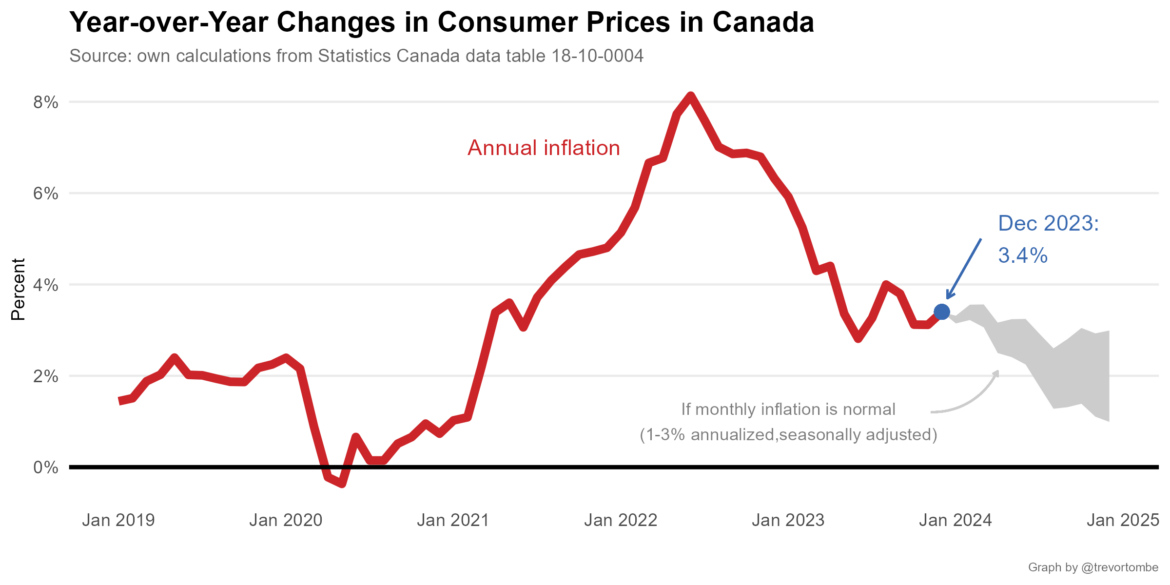

The inflation rate of 3.4 percent for December 2023 was actually a sign that the average consumer price increase between November and December 2023 was relatively normal. It’s not necessarily a sign that things are going to get worse. And perhaps most interestingly of all, we’ll see this continue for several months. If everything from here on out proceeds normally (with monthly price changes aligned with a 2 percent annual inflation rate), then we’re not likely to see an actual drop in the headline inflation rate for the next several months, as I illustrate below. So, overall, December 2023’s number continues to show that inflation pressures are easing, even if not as fast as some might hope.

SEAN SPEER: There’s been a lot of talk about a so-called “soft landing” and the potential to bring inflation back to target without provoking a recession. What, if anything, do the December numbers tell us about that scenario? Are they a sign that we may need to see further tightening in the labour market and the economy more generally before inflation falls back to where it needs to be?

TREVOR TOMBE: Inflation has come down a lot from its 2022 highs, and much of this might be thanks to rising interest rates by the Bank of Canada. Not all, of course. Energy prices falling from their summer 2022 highs account for roughly 40 percent of the drop compared to December 2023. But if we look over the past year, the decline in inflation pressures is fairly broad-based. From groceries to communications to vehicles and more, most product categories are contributing less to inflation. Demand for many goods and services, especially those sensitive to interest rates, is showing particularly large drops in price pressures, as research by myself and my colleague Dr. Sonja Chen documented in a recent C.D. Howe paper.

The cost of this has been slower economic growth, however. Unemployment in June 2022, when inflation peaked, was less than 5 percent. Today, it’s nearly 6 percent. And overall economic growth has slowed to a crawl and is dramatically outpaced by population growth—meaning that on a per capita basis Canada’s economy is significantly smaller today than in recent years. Canada has avoided a central bank-induced recession so far, which some might consider a soft landing. I tend to view the data as showing a relatively successful reduction in inflation, but not one without costs. It seems to be shaping up to be a bumpy landing, but ultimately one we can walk away from without too many bruises. I’ll take it.

SEAN SPEER: There’s been some attention (including recently at The Hub) about wage inflation reflected for instance in the growth of wage settlements in 2023. Is there any concern in your mind that the persistence of wage increases (even as unemployment ticks up) may make it more difficult to bring inflation back down to target?

TREVOR TOMBE: Wage growth has indeed been rising over the past year. The latest data from the labour force survey shows average hourly wages are up 5.4 percent compared to a year earlier, and average weekly earnings are up 5.2 percent. That’s good news for individuals since that’s higher than inflation over the past year. So we’re slowly recovering our lost purchasing power. However, there is a valid concern that rising wages, which are a considerable cost to businesses, may wind up leading to further price increases as those businesses seek to cover those rising costs.

This isn’t a necessary outcome, though. If productivity growth rises, then rapid wage growth doesn’t actually increase business costs since each hour worked will produce more than before. So on a per-unit basis, labour costs don’t necessarily rise. The trouble is that Canada’s productivity performance has been pretty terrible over the past few years. Labour productivity growth has been negative for 12 of the past 13 quarters! This is my main concern. If productivity continues to fall while wages continue to rapidly rise, then something will have to give. Indeed, the Bank of Canada, for its part, highlights this as one of the key “upside risks” (that is, risks to inflation rising).

SEAN SPEER: What other factors are you following that could influence the Bank of Canada’s efforts to restore price stability?

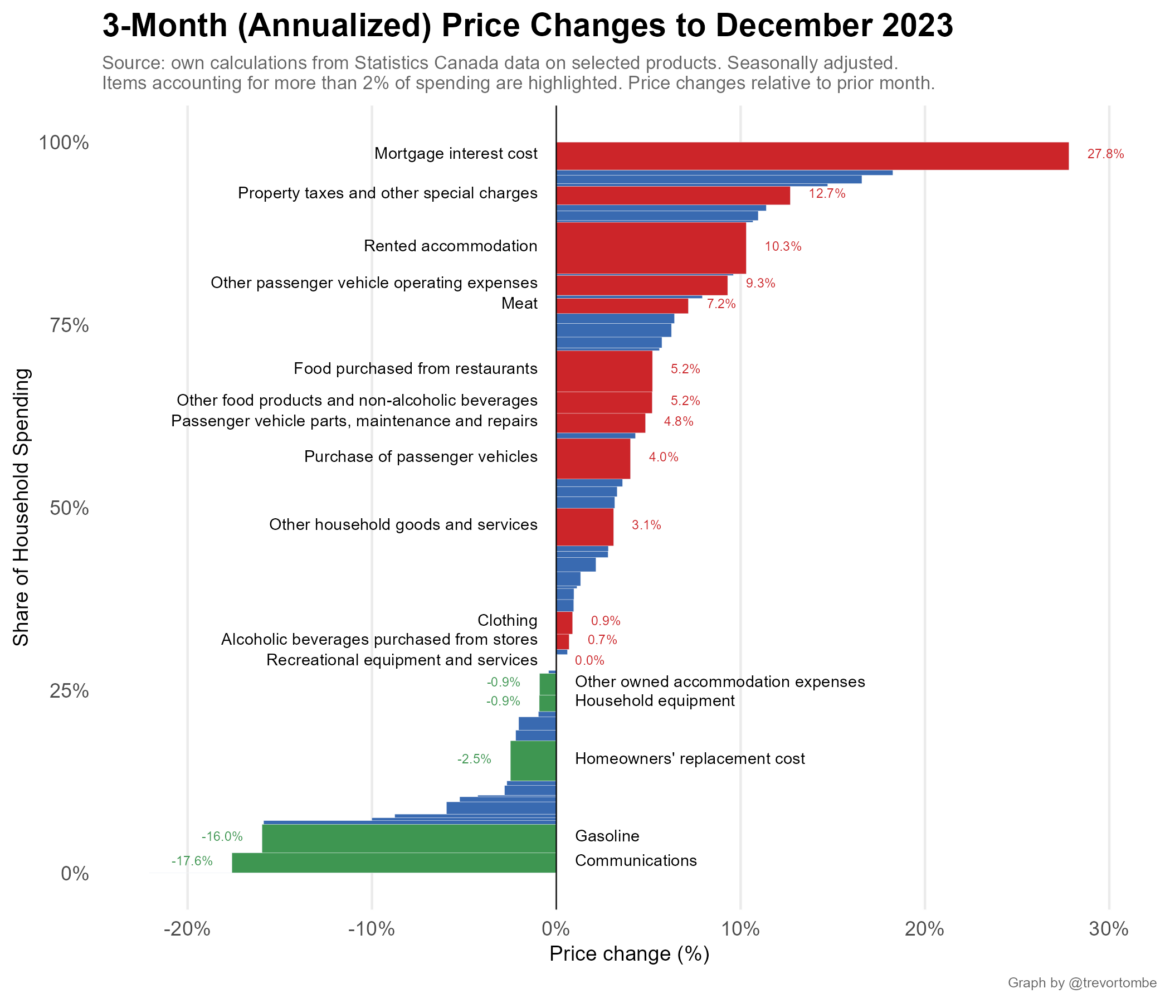

TREVOR TOMBE: One of the biggest factors behind the current high rate of inflation is shelter. Much of that is housing costs. Average rents are rising at a rate of 10 percent over the past three months (on an annualized basis), property taxes are rising at 13 percent, home insurance at 11 percent, and, of course, mortgage interest costs are rising at an even more rapid 28 percent. Shelter is at the heart of the broader affordability challenge for many Canadians, especially in some of our largest cities. This is perhaps the single largest issue to keep an eye on.

Goods inflation has returned almost to relatively normal levels, including grocery price increases, which have essentially returned to normal (although price levels remain far, far above where they were). And excluding shelter costs, services inflation is also not a particularly large problem. It’s all coming down now to shelter costs, something The Hub has rightly highlighted as a challenge for quite some time. There are exceptions to this, of course. Restaurant prices are rising faster, for example, which might be related to wage pressures that we just talked about. But the biggest items, as I show below, are dominated by shelter-related items.

SEAN SPEER: How will December’s results influence the Bank of Canada’s thinking about interest rates? Do you think they may cause a delay in rate cuts this year?

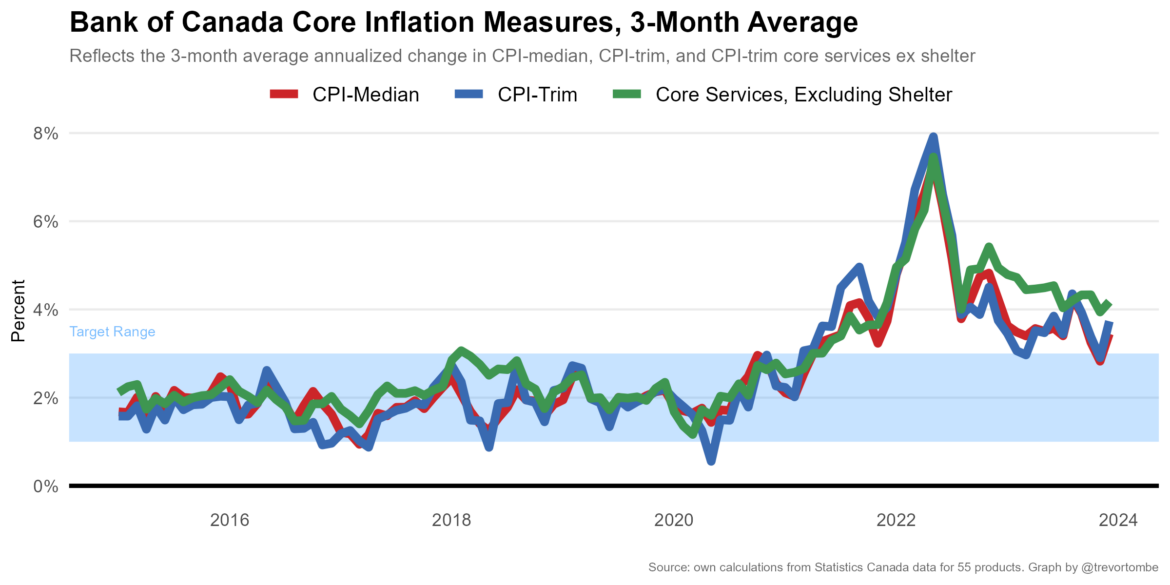

TREVOR TOMBE: The main headline rate of inflation includes many volatile components that are a poor guide to monetary policy. The Bank needs to think about where Canada’s economy will be one to two years down the line. It does not react month-by-month to changes in the overall rate of inflation. Instead, it uses (along with many other pieces of inflation) measures of “core” inflation that strip out volatile components. It’s not that these volatile components aren’t important to individuals—all price changes can strain a family’s budget. But by stripping out the volatile components, the Bank gets a better indicator of where total inflation may be headed in the future. They’re better predictors, if you will. The December results, unfortunately, showed that three of the key core measures reversed the positive trend we were seeing. Over the past three months, those measures rose between 3.4 percent and 4.2 percent (on an annualized basis), which I plot below.

So for me, that probably means a modest delay in when we should expect rates to fall. I strongly suspect we won’t see a reduction in rates at the January 24 meeting. The one to watch will be March 6, and that might still be a coin flip. April and beyond may be when we see some changes. The Bank has been clear that it needs to see “further and sustained easing in core inflation” before it lowers rates. The December data shows we aren’t seeing that yet.

Recommended for You

‘Can we actually be an independent country?’: Michael Ignatieff on the 60th anniversary of Lament for a Nation

Fred DeLorey: Why the NDP may be in even bigger trouble than we think

Michael Geist: Children accessing porn is a problem, but government-approved age verification technologies are not the answer

Daniel Zekveld: Age verification for pornography is not government overreach