After a “lost decade” of stagnant incomes, rising crime, government failures on basic functions like health care and immigration, and a once-in-a-generation affordability crisis driven by inflation, a majority of Canadians believe that Canada is broken. But decline is a choice, and better public policies are needed to overcome Canada’s many challenges. Kickstart Canada brings together leading voices in academia, think tanks, and business to lay out an optimistic vision for Canada’s future, providing the policy ideas that governments need to ensure a bright future for all Canadians.

The Canada Workers Benefit (CWB) isn’t working. It is intended to lift low-income workers out of poverty and to support them as they increase their wages, but there is little evidence it is doing this effectively. With a better design, however, it could.

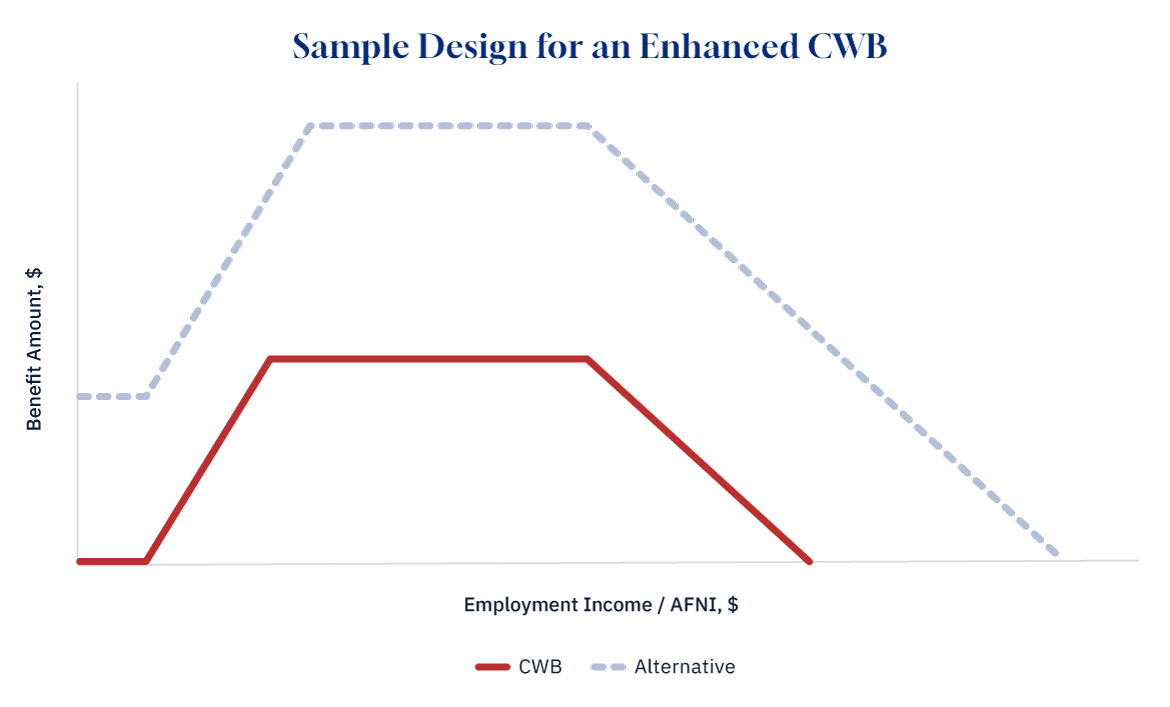

That’s why Maytree and Community Food Centres Canada (CFCC) are proposing that all federal parties commit to two complementary reforms: raise the maximum benefit amount so full-time work is enough to escape poverty and add a benefit floor to help everyone get a foothold in the labour market.

The current state of the CWB

The CWB is a refundable tax credit that provides the equivalent of a 27-cent top-up for each dollar in employment income over $3,000 annually. It quickly reaches a maximum credit of $1,518 for single individuals and $2,616 for families (including couples and single parents) before beginning to phase out at $24,975 in adjusted net income for single individuals and $28,494 in adjusted family net income for families.

About 2.5 million Canadians received the CWB in the 2022 tax year, and the cost of this tax expenditure is projected to be $4.5 billion in 2024.

Why isn’t the CWB working?

The Conservative and Liberal governments that introduced and expanded the CWB (formerly the Working Income Tax Benefit) over the past 17 years have repeatedly offered two policy rationales: first, the CWB is intended to improve the living standards of low-income workers by supplementing their earnings. Second, it is intended to act as an incentive for people to enter low-wage work or to increase their hours of work.

The last time Finance Canada published a detailed profile of recipients, it showed that nearly two-thirds were unattached individuals, a group who have been largely left behind when it comes to government income supports. In fact, unattached working-age adults face the highest rates and deepest levels of poverty in Canada.

Given this, the first problem with the current design is that the maximum amount is simply too low to significantly improve the lives of recipients, especially when compared to the federal benefits targeted to seniors or to families with children. Having a full-time job in Canada should be enough to live a life of dignity. However, even when combined with full-time minimum wage earnings, the CWB maximum amount does not guarantee an escape from poverty.

In theory, the CWB should cause people to increase their hours worked because the benefit amount grows with each additional hour. This contrasts with the rest of the income security system, where marginal tax rates can actually exceed 100 percent for people with low incomes, meaning they lose more of their combined benefits than they make in wages. But because the CWB maximum is so low, the period where the benefit grows with income is quite short. A single worker reaches the maximum benefit amount at an income of only $8,622—maybe 15 weeks of full-time minimum wage work, depending on the jurisdiction. Raising the maximum would increase the income range where the benefit has a realistic chance to encourage more work.

Looking at real-world data, there is little evidence showing that the benefit is large enough to have a meaningful impact on whether and how much people work. Proponents of the CWB often point to studies from the United States showing that the similar Earned Income Tax Credit (EITC) has caused an increase in labour market attachment. Recent research, however, has upended that consensus.

For the benefit to act as an incentive, people have to know about it and claim it. We don’t know how many people are eligible for the CWB but do not receive it because they don’t file taxes, but we can be certain the CWB is doing nothing to incentivize this group. What we do know is that in 2019 the federal government moved to automatically qualify those who are eligible and do file their taxes—a change that was in part necessary because many were unaware of the benefit. Recent increases in child benefits have caused tax-filing rates to increase among those who are eligible. The same result is likely if the CWD were to be significantly increased.

Finally, the current benefit structure ignores the very real barriers to entering the labour market that are often associated with living in poverty. Provincial social assistance programs are woefully inadequate, and without the income security to afford a basic level of housing, food, transportation, appropriate clothing, and more, work is simply out of reach for many people.

Deputy Prime Minister and Finance Minister Chrystia Freeland shakes hands with workers, Oct. 17, 2022 in Gatineau, Que. Adrian Wyld/The Canadian Press.

How to fix the CWB

The first step in addressing these challenges is obvious: raise the CWB maximums considerably. A higher maximum would increase the incentive effects both of entering the labour market and working additional hours. It would also put more money in the pockets of those Canadians most in need and most forgotten by our income security system.

This idea has enjoyed cross-party support in recent years, with the 2021 platform of the Conservative Party of Canada promising to double the maximum CWB amount and past NDP platforms also committing to increasing the maximum amount. Maximums have increased slightly under the current Liberal government because they are indexed to inflation.

Our goal at Maytree and CFCC is to advance the human right to an adequate standard of living for all, whether through work, benefits, or a combination of income sources. Canada’s failure to achieve this is the result of broken systems, not individual failings. Thus, while work is an important part of fulfilling many of our economic and social rights, it will never be the solution for everyone. We need multiple, integrated approaches.

It is in this spirit that we propose a second reform to the CWB: add a floor amount that any low-income person or family would receive, including those who are not working. For those who work, the benefit would increase from the floor amount to a higher maximum, maintaining and enhancing the work incentive feature of the CWB. Not only would the floor amount offer needed support to Canadians living in the deepest poverty, but it would also help those who have become detached from the labour market to stabilize their lives and move closer to work.

When people living in low-income are offered financial stability, they invest in their future. A study of CERB recipients found that 40 percent took some form of formal or informal training in pursuit of employment or other life goals, and uptake of learning was especially high among young people, Indigenous people, racialized people, and immigrants.

Moreover, receiving a basic amount of the CWB when one is not working would immediately increase awareness of the benefit among all low-income Canadians, opening new opportunities to communicate to recipients how they will benefit by entering the labour market or increasing their earnings.

Graphic credit: Janice Nelson.

Inflation may be down, but the cost of living is not. The temporary support offered by the federal government in recent years was simply not enough. We need bold reforms to enhance our income security systems in ways Canadians can rely on.

Our proposed CWB design would improve living standards and labour market incentives for low-income Canadians and show struggling workers that they are not on their own. It’s time for a more generous and effective Canada Workers Benefit.