In each EconMinute, Business Council of Alberta economist Alicia Planincic seeks to better understand the economic issues that matter to Canadians: from business competitiveness to housing affordability to living standards and our country’s lack of productivity growth. She strives to answer burning questions, tackle misconceptions, and uncover what’s really going on in the Canadian economy.

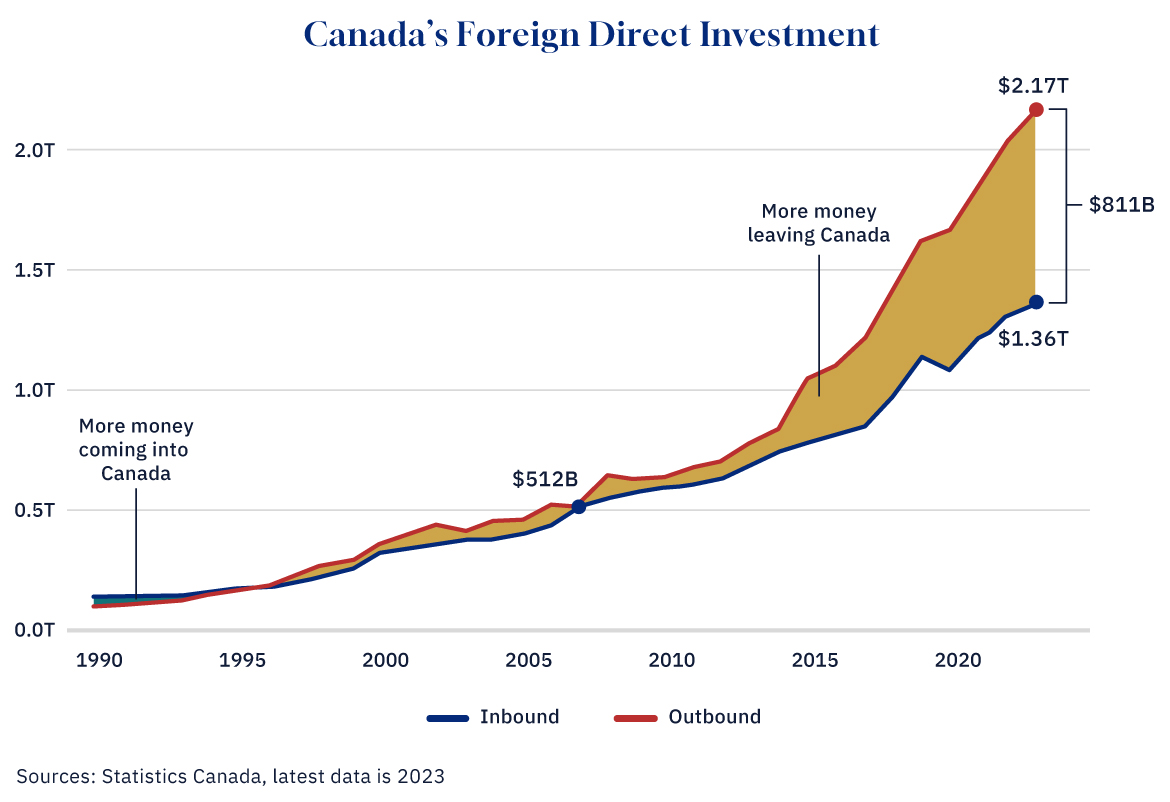

Sometimes you’ll hear it said that no one wants to invest in Canada anymore. But is it true? Foreign direct investment (FDI) shows foreign investors are pouring more money into Canada than ever before, but there’s more to the story.

There are lots of ways to invest in Canada, whether that be buying shares of Canadian companies or starting a local business. The reason FDI is a particularly useful measure of Canada’s attractiveness is that it represents a long-term commitment by foreign investors. These aren’t investors looking to make a quick return in the TSX overnight; these are investors making lasting investments in the market where they see the most opportunity longer term.

FDI trends suggest investors continue to see opportunity in Canada. Over the past three decades, FDI flowing into Canada has increased—with an average annual growth rate of approximately 7.4 percent. This is good for Canadian business. This inflow of funds can help businesses make important capital investments, get new projects underway, and even help to diversify a country’s exports, jumpstarting new sectors or expanding existing ones.

But there’s a “but.” Canadians are also investing more money in foreign markets than ever before. And, comparatively, the increase of money leaving Canada dwarfs the growth in money flowing into Canada—a trend that has become particularly evident since 2014. To put some numbers on it, investment flowing into Canada has increased at a rate of 6.9 percent per year since 2014 while money flowing out (“outbound” FDI) has increased at a rate of 11.1 percent.

Graphic credit: Janice Nelson.

Canadians investing in foreign businesses isn’t necessarily bad. Research has shown that as countries grow richer, they tend to invest more in other markets. Nonetheless, a large and disproportionate outflow of investment could point to Canada losing its relative investment appeal.

Why this gap is widening isn’t entirely clear. One possibility is that FDI has shifted away from primary industries like agriculture, oil and gas, and forestry globally—the very industries that have drawn the most capital into Canada—and other industries in Canada have yet to catch up. Another possibility is a concern many business leaders have had for years: an uncertain policy landscape and high regulatory barriers could be keeping investment dollars at bay.

This post was originally published by the Business Council of Alberta at businesscouncilab.com.