In each EconMinute, Business Council of Alberta economist Alicia Planincic seeks to better understand the economic issues that matter to Canadians: from business competitiveness to housing affordability to living standards and our country’s lack of productivity growth. She strives to answer burning questions, tackle misconceptions, and uncover what’s really going on in the Canadian economy.

Canada is facing several economic challenges—from investment attraction to productivity growth to high rents. And there is a sense that we’re falling behind in all of them. One might wonder, is there anything we’re doing well at compared to our international peers?

Yes, there is. According to a recent report, when it comes to educational attainment, Canada doesn’t just excel but ranks higher than any other country in the OECD.

Specifically, educational attainment is defined as the percentage of individuals (aged 25 to 64) who have attained “tertiary education” or what we would call post-secondary. This would include any sort of schooling beyond high school whether that be university, college, or a technical training school.

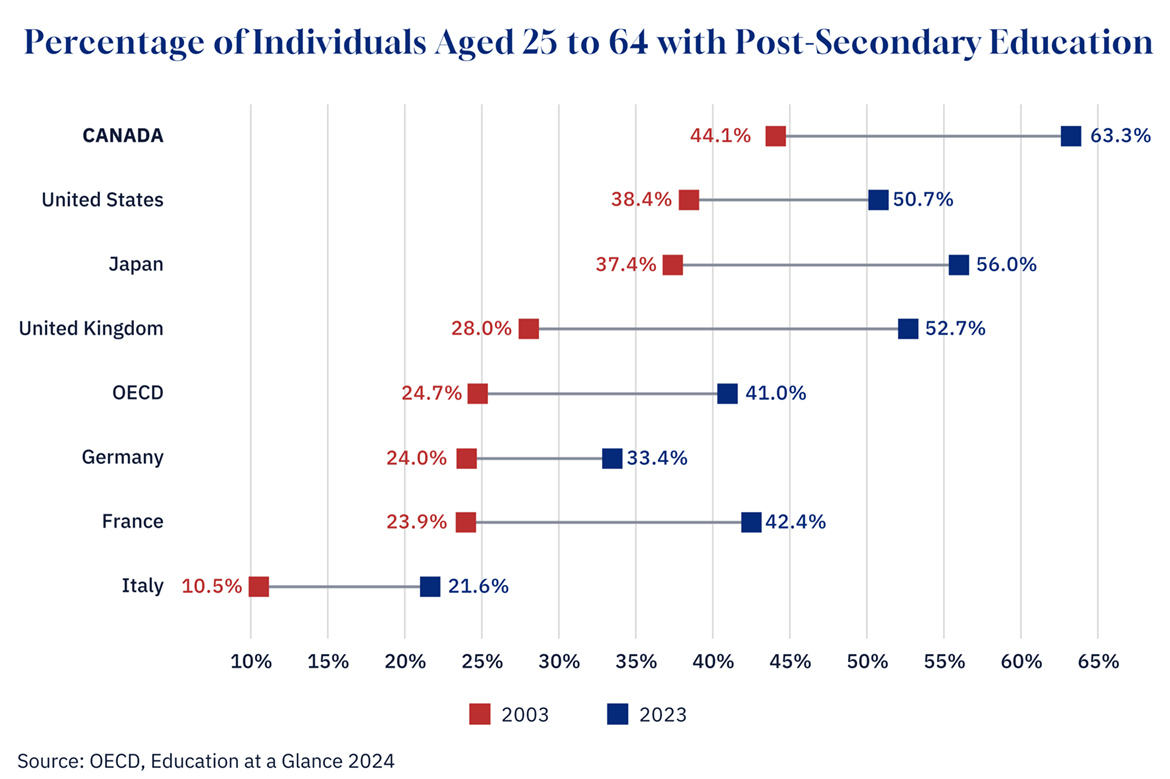

Canada has consistently maintained a competitive edge in this area. Twenty years ago, about 44 percent of Canadian adults had some form of post-secondary education. This was higher than almost every other country in the OECD and well above the second-highest country in the G7 which was the United States at 38 percent.

And it’s gotten even better since. Fast forward to 2023 and rates of higher education have increased virtually everywhere around the world. Countries like the United Kingdom, Japan, and France have all made significant strides, with over 18 percent-point increases in the share of adults completing post-secondary education.

Graphic credit: Janice Nelson.

Canada has managed to exceed even that impressive growth. As of 2023, 63 percent of Canadian adults have received education beyond high school. This represents a 19 percent-point increase over the last 20 years and puts Canada 7 percent points ahead of the next highest country in the G7 (Japan at 56 percent), and ahead of every single OECD country.

It’s worth noting that immigration has helped to drive this success. The share of adults with post-secondary education is high among those born in Canada (59 percent) but even higher among those who immigrate to Canada (73 percent).

Importantly, individuals with higher levels of education have better labour market outcomes. Not only are they more likely to be employed, but a recent report by RBC shows that individuals with post-secondary education in Canada earn 51 percent more than those with only a high school diploma. In a world where a skilled workforce is highly valued, this is an important advantage for Canada to have and to keep.

A version of this post was originally published by the Business Council of Alberta at businesscouncilab.com.