With his departure from politics looming, discussions of Justin Trudeau’s legacy have been the hot topic of conversation in Canada. But no such discussion is complete without factoring in Trudeau’s economic legacy. Here are six charts that illustrate how Canada’s economy has fared during his time in office.

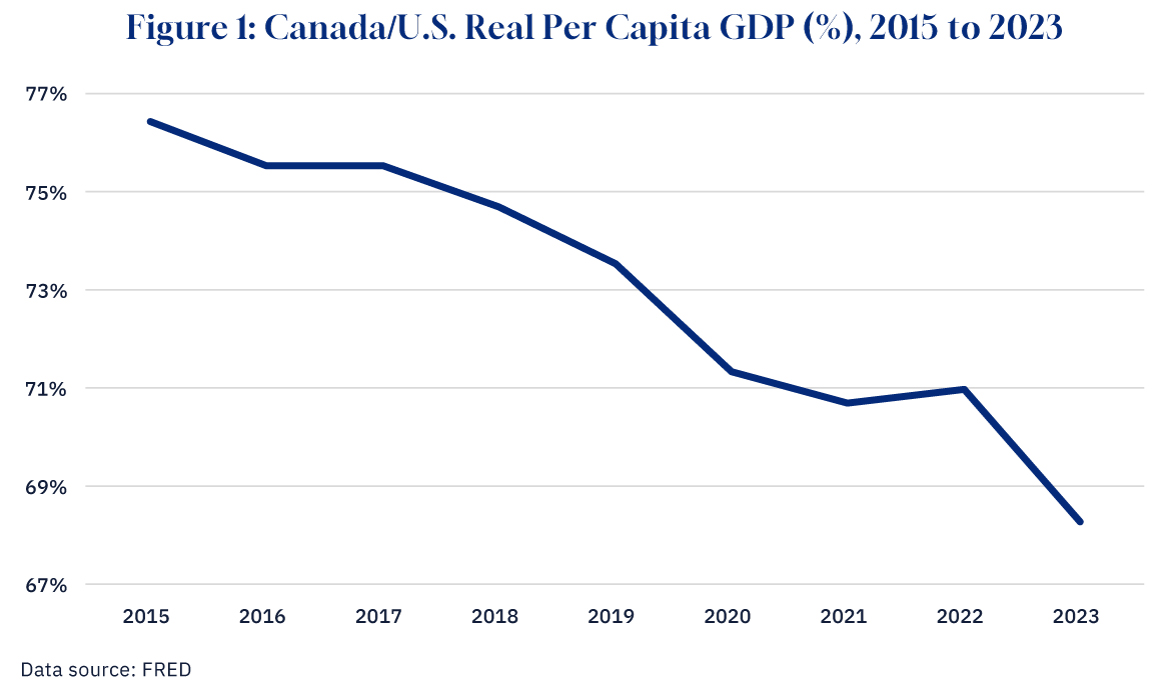

The Canada-U.S. gap widened

Canada’s economy has grown over the nine years of Prime Minister Trudeau’s government. Still, after adjustment for inflation and population, there has been poor performance in our real per capita GDP growth. This has come at a time when the United States economy has grown quite robustly, and the result has been a widening of the Canada-U.S. income gap.

Graphic credit: Janice Nelson.

Whereas in 2015, Canadian real per capita GDP as a share of that of the United States was just over 76 percent, it now stands at 68 percent. The continued decline in our standard of living relative to our largest trading partner does not bode well for either our future standard of living or the competitiveness of our economy.

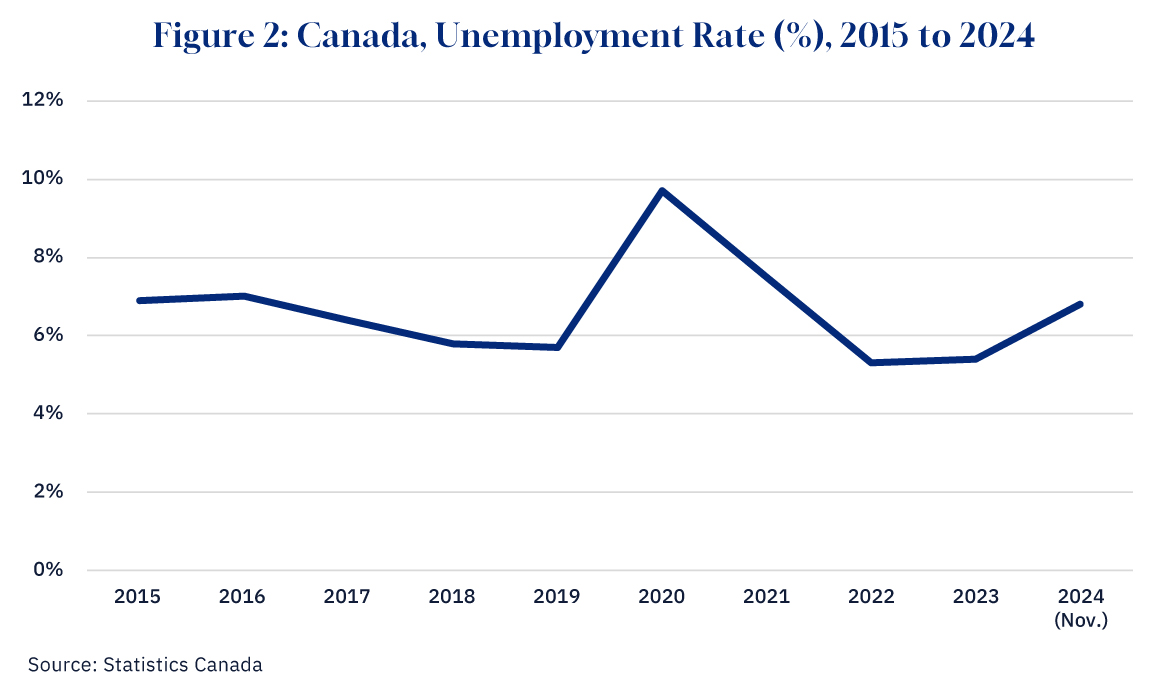

The unemployment rate stayed the same—thanks to public-sector employment

Between 2015 and 2024, the Canadian economy increased its total employment from 17.9 million to 20.6 million jobs. However, at the same time rising population as a result of immigration has expanded the labour force. Notwithstanding the pandemic fluctuations, the overall unemployment rate is not much changed from 2015.

Graphic credit: Janice Nelson.

In 2015, the annual unemployment rate stood at 6.9 percent and as of November 2024, it was at 6.8 percent. Moreover, when the employment increase is examined in more detail, what emerges is rising public-sector employment, stagnating private-sector employment, and a decline in self-employment.

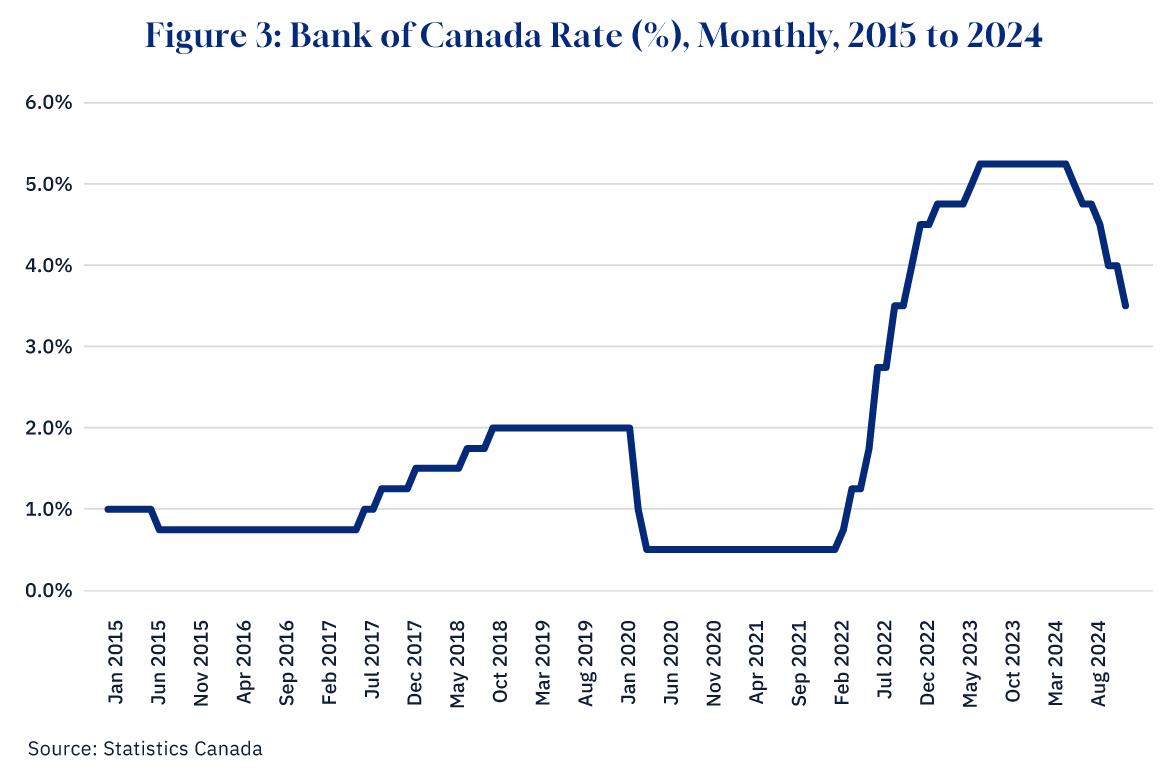

Interest rates are up

The Bank of Canada Rate (the rate at which the Bank of Canada charges commercial banks for loans) was below 1 percent for most of 2015 and then began to rise but dropped down to historic lows during the pandemic.

Graphic credit: Janice Nelson.

After being at half a percent for nearly two years, the rate began to rise as inflation took hold and by 2024 had been at a peak of 5.25 percent for nearly a year. It then began to decline as inflation eased but at 3.5 percent, the Bank Rate remains higher than when Trudeau took office. Given the recent declines in the value of the Canadian dollar relative to the USD, the cost of our consumer imports will rise possibly sparking an uptick in inflation. It would appear that for the time being, further interest rate declines are going to be on hold.

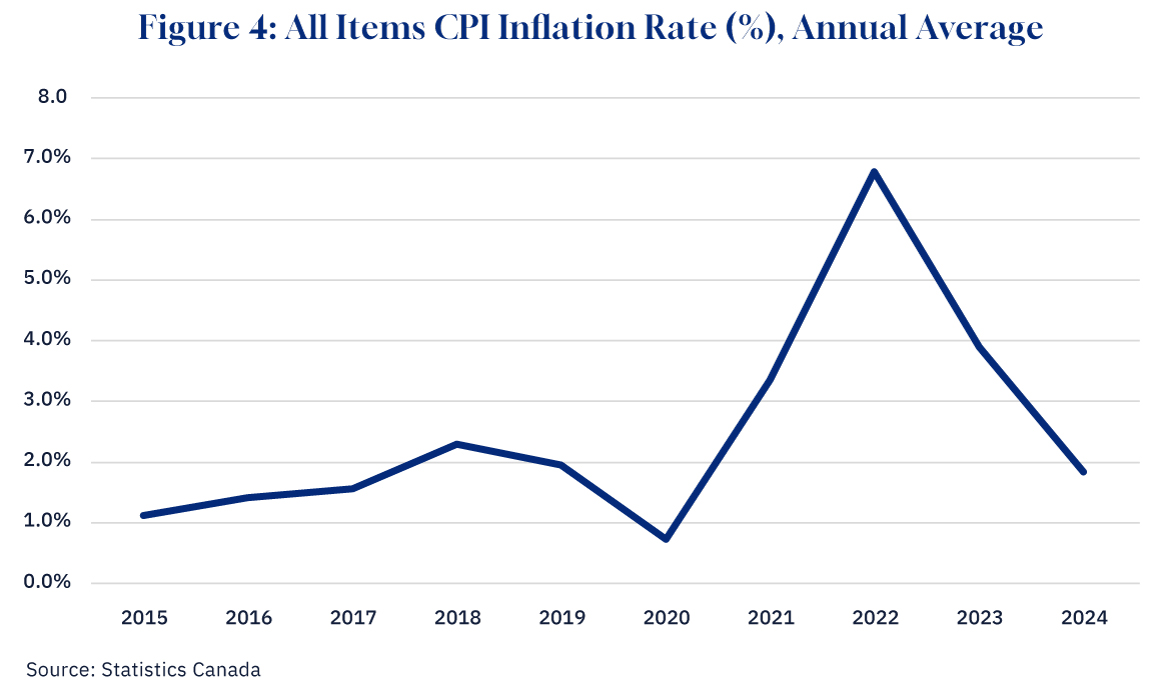

Inflation was way up (before falling back down)

In 2015, the annual average inflation rate was just over 1 percent and remained low until the pandemic when a conjunction of supply chain disruptions, rapid population growth, and generous fiscal stimulus caused it to rise peaking at just under 7 percent in 2022, at which point the Bank of Canada began to raise interest rates to bring inflation down.

Graphic credit: Janice Nelson.

By 2024, inflation was again within the 1 to 3 percent target range of the Bank of Canada. From 2015 to 2024, the All-Items Consumer Price Index grew by 26 percent. Canada has become a much more expensive place to be a consumer. We won’t even look at housing prices.

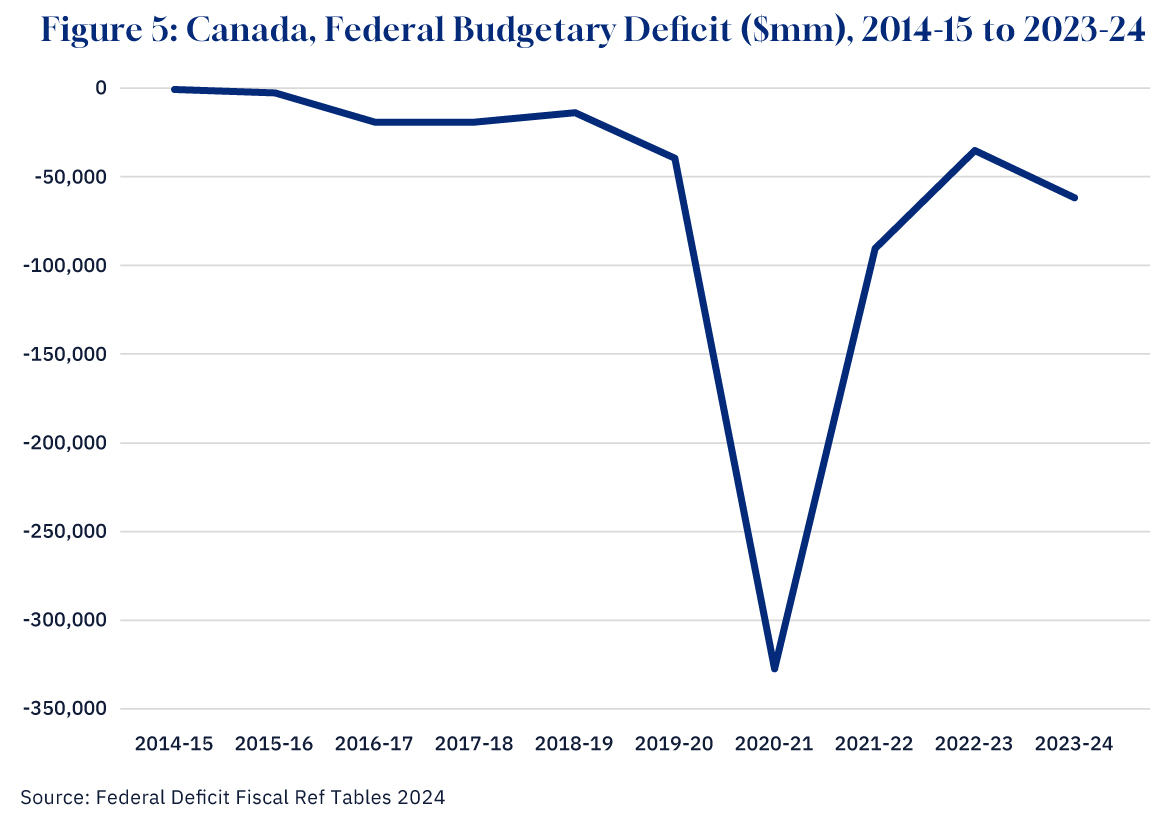

Deficits are way, way up

There has been a deficit every year that Trudeau has been in office with the result being deficit accumulation to date of well over $600 billion dollars. Indeed, the largest ever single absolute deficit in Canadian federal fiscal history was the 2020-21 fiscal year’s $328 billion total.

Graphic credit: Janice Nelson.

While the 2020-21 deficit was ostensibly incurred for the war on COVID-19, in hindsight it was much larger than it needed to be. Deficits have been a means to help finance a long-term expansion in the federal fiscal footprint which notwithstanding the pandemic bump, went from just over 14 percent in 2017 to over 17 percent in 2024.

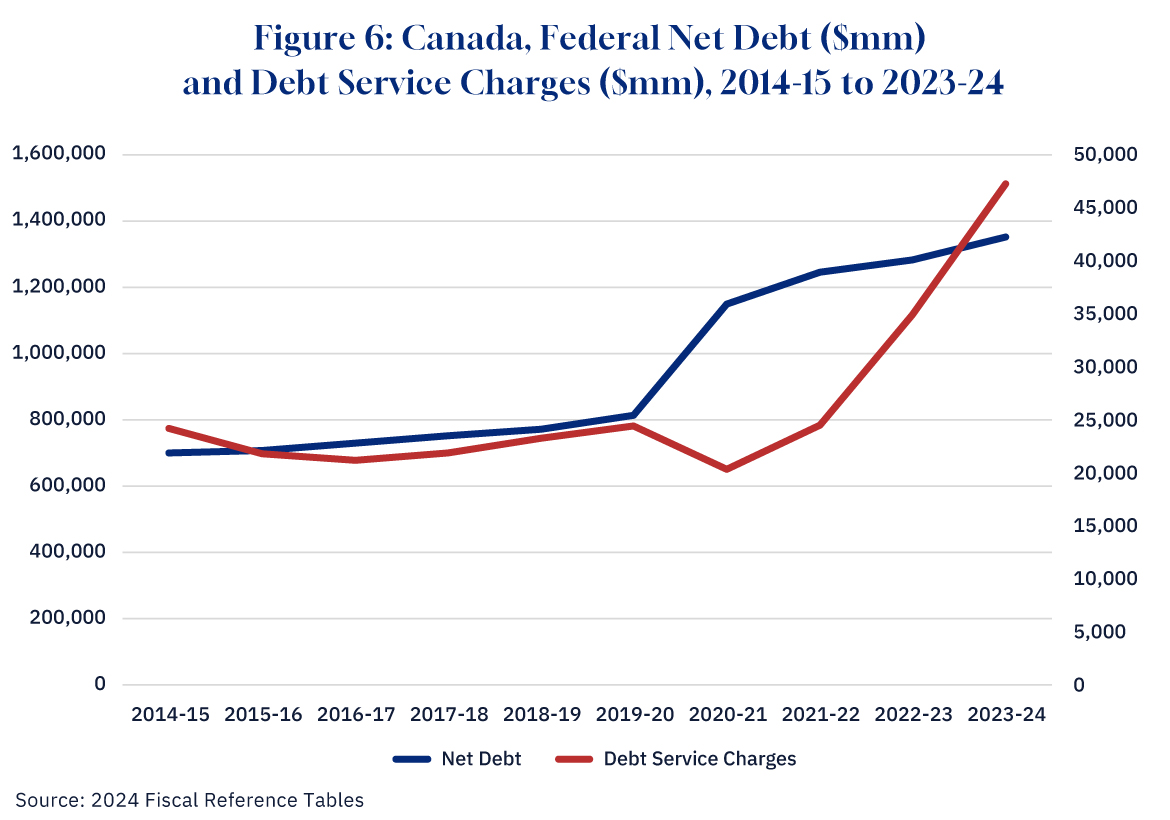

Debt doubled and debt service costs were stable (before going way, way, way up)

As a result of multiple deficits including the massive 2020-21 deficit, over the terms of the Trudeau government, the net federal debt has nearly doubled rising from $701 billion to $1.35 trillion. However, because debt turns over slowly and much of it was contracted at historically low interest rates, debt service costs were remarkably stable, rarely going above $24 billion annually from 2014-15 to 2021-22.

Graphic credit: Janice Nelson.

However, with the rise in interest rates has come rising debt charges, and from $24.5 billion in 2021-22, they grew to $47.4 billion in 2023-24. And given the power of compound interest, debt is the gift that keeps on giving.

Debt charges are expected to reach $53.7 billion in 2024-25, accounting for nearly 10 percent of federal spending.