Welcome to Need to Know, The Hub’s roundup of experts and insiders providing insights into the economic stories and developments Canadians need to be keeping an eye on this week.

How to grow the economy—and maybe even revenues too

By Trevor Tombe, Trevor Tombe, professor of economics at the University of Calgary and a research fellow at The School of Public Policy

Trump’s tariff threats on Canadian imports have renewed interest in policy reforms to strengthen our economy.

While action has been limited, some provinces have taken steps—Manitoba has invested in infrastructure to improve the Port of Churchill, and British Columbia has fast-tracked certain resource projects. But more can be done, especially in tax reform, where there may be low-hanging fruit.

Business taxes are particularly important because they directly impact investment incentives. I’ve previously suggested companies be allowed to fully write off their capital investments, but an alternative worth considering is an outright cut to corporate tax rates, especially in smaller provinces.

Some may worry that cutting corporate taxes would reduce government revenues. But in many parts of Canada, tax rates appear to exceed the revenue-maximizing threshold—meaning that reductions could actually increase revenue. These provinces are on the wrong side of the “Laffer curve”: when taxes rise, investment falls, and in some cases, the decline is so steep that overall revenue shrinks.

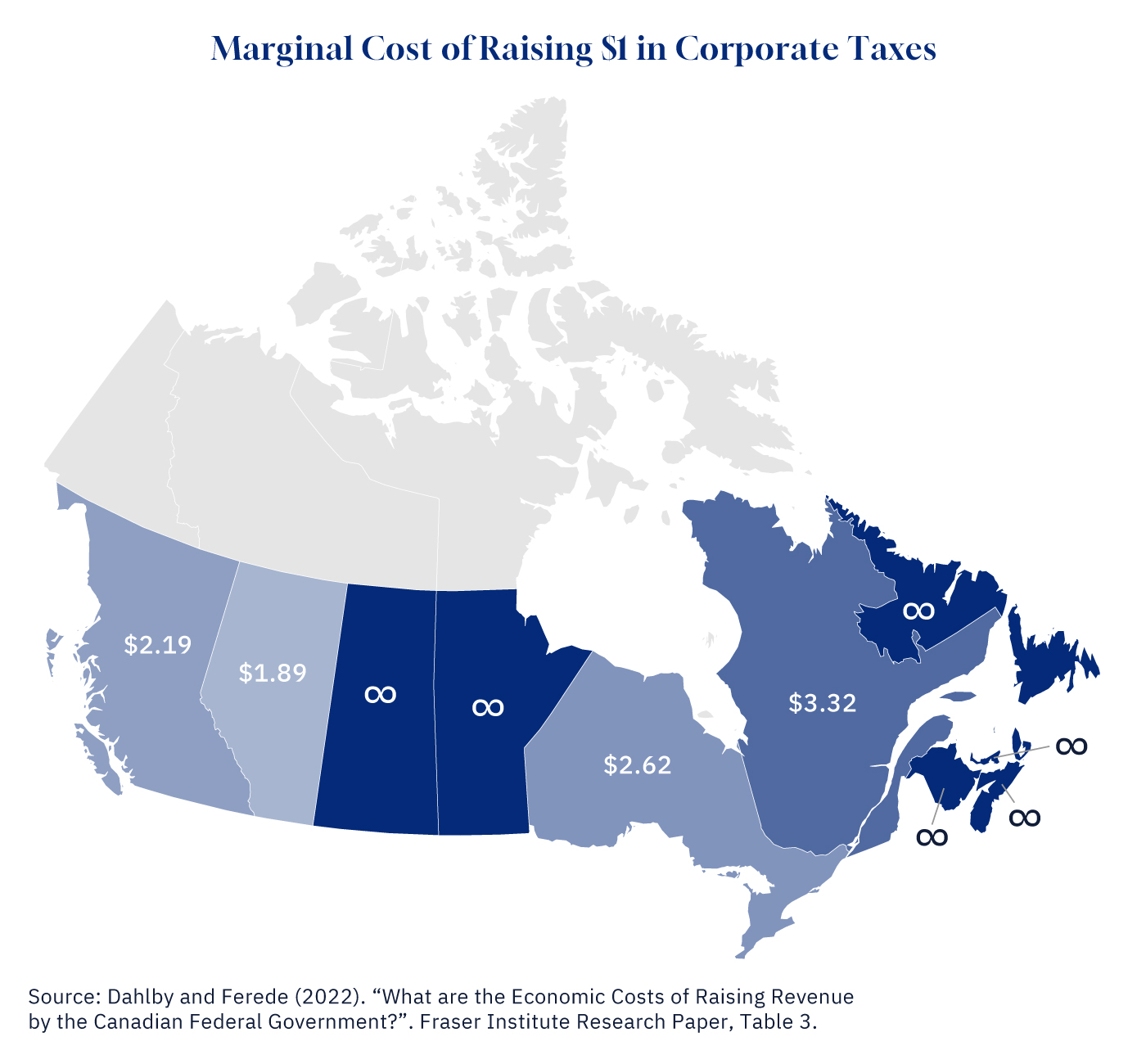

Just how costly are corporate taxes? The best estimates come from my University of Calgary colleague Bev Dahlby and his co-author Ergete Ferede. Their research quantifies the economic costs of raising an additional dollar in revenue through corporate income taxes. Among Canada’s four largest provinces, they found that these costs range from $1.89 per $1 of revenue raised in Alberta to $3.32 per $1 raised in Quebec. The situation is even more striking in Atlantic Canada, Manitoba, and Saskatchewan, where the cost is effectively infinite—higher taxes yield no additional revenue, while lower taxes could boost both investment and government income.

Graphic credit: Janice Nelson.

Despite this, provinces can be reluctant to cut business taxes, as some of the benefits extend beyond their borders. This is where the federal government could step in, offering incentives for provinces to lower business taxes or by spearheading a broader reform of the entire system. If structured properly, such a move could encourage investment, strengthen economic growth, and—critically—do so without necessarily reducing government revenues.

Conservative Leader Pierre Poilievre speaks at hisCanada First rally in Ottawa, on Saturday, Feb. 15, 2025. Justin Tang/The Canadian Press.

Pierre Poilievre sticks to his economic strengths in pivotal weekend speech

By Theo Argitis, managing director at Compass Rose Group

Poilievre’s “Canada First” speech on Saturday was more of an adjustment than a major pivot. The Conservative leader updated his long-standing critique of Liberal governance to reflect the emerging threat of U.S. economic aggression and tap into rising nationalism at home.

The tone was sharply patriotic, to be sure. Yet, the core Poilievre message remained intact: the Liberals have weakened Canada—economically, politically, and strategically—and the Conservatives will restore prosperity. In the process, they will also bolster our nation’s sovereignty, independence, and resilience. It was a speech of refinements.

- Canada was once economically strong—which allowed it to resist U.S. dominance.

- Liberal mismanagement has eroded that strength—leaving Canada vulnerable to American tariffs.

- Energy policies have not only made the country poorer—but more dependent on the U.S.

- Capital flight has cost investment and jobs—increasing America’s economic leverage.

- Canada must build its military strength—rather than relying on American protection.

“The media says I should change my plans because of this tariff threat,” Poilievre said. “In fact, the Trump tariff threats have proven Conservatives right on everything.”

The speech tacitly acknowledges that the ballot question is shifting—from affordability and economic malaise to who can best defend Canada against a belligerent Donald Trump. Poilievre’s bet is that his long-standing economic prescriptions—tax relief, energy independence, and investment-friendly policies—are the answer to both.

Canada’s economic challenges demand more than a résumé

By Louis-Philippe Beland, associate professor of economics at Carleton University

With the Liberal Party leadership race nearing its conclusion on March 9, 2025, and Mark Carney emerging as the frontrunner, he has yet to present concrete solutions to Canada’s worsening economic challenges. Under Liberal policies, Canada has faced large federal deficits, costly new social programs, a housing crisis, a strained immigration system, an underperforming health-care system, declining productivity, and stalled energy projects—all requiring urgent action.

If a tariff war with the U.S. erupts, what is Carney’s plan to protect Canadian jobs and industries? While trade policy is important, domestic economic weaknesses remain unaddressed.

Fiscal policy and government spending

Rising debt-service costs threaten essential services. What is Carney’s plan for federal health transfers, implementing spending cuts, and managing costly new social programs? How will he meet the 2 percent NATO spending target for defence?

Housing crisis

Homeownership is increasingly out of reach. Despite record immigration, housing construction lags, worsening affordability. Will Carney push for zoning and permitting reform? What is his plan to address high development costs?

Immigration and asylum system failures

Canada admitted 485,000 permanent residents in 2024, yet asylum backlogs exceed 260,000 cases. With nearly 3 million temporary residents, Ottawa’s policies have strained housing, health care, education, and infrastructure (source 8). What is Carney’s immigration strategy?

Health care and productivity decline

ER wait times remain problematic in major Canadian cities, and delays in accessing medical procedures are lengthy. Productivity growth remains stagnant. Business investment remains weak, limiting long-term economic prospects.

Carney has yet to outline a clear economic framework. Which of Trudeau’s economic policies did he support? Which ones did he help implement? Canadians need concrete answers—not just a résumé.