Welcome to Need to Know, The Hub’s roundup of experts and insiders providing insights into the federal election stories, policy announcements, and campaign developments Canadians need to be keeping an eye on.

Could deeper integration with the U.S. now be on the table?

By Theo Argitis, The Hub’s editor-at-large for business and economics

Reports of the death of Canada’s deep economic relationship with the United States may have been greatly exaggerated.

Canada and Mexico appear to have been largely spared the latest round of U.S. “reciprocal tariffs,” aimed at what the administration claims are unfair trading practices. Not only that, the U.S. has extended an exemption for both countries on a separate set of tariffs announced last month, which were framed as a response to inaction on border issues.

The Canadian dollar jumped on the news amid hopes the move signals Trump’s willingness to revive the trilateral North American free trade agreement.

What remains unclear is Trump’s broader strategy for North America—and whether there’s a price he intends to exact for this leniency. Could something resembling a customs union be of interest to him?

As I’ve written before, a customs union could achieve many of the same objectives for the U.S. as export tariffs.

Trump’s fundamental economic policy objective is to shift more resources toward U.S. production.

An export tariff on Canada would do this by making Canadian goods more expensive in U.S. markets, driving up demand for American alternatives–effectively shifting U.S. consumption toward domestic products.

A customs union—which would erect a common tariff wall around a free-trade North America—could serve a similar purpose. Canadian consumers would buy fewer goods from Europe and Asia, redirecting those purchases toward U.S. producers.

It may be hard to believe that deeper integration is even a possibility in today’s climate. Just last week, Prime Minister Mark Carney declared that the era of a deepening Canada-U.S. economic relationship was over.

Speaking to reporters late yesterday, Carney cited the continuation of tariffs on auto sectors and steel and aluminum, and threatened that Canada would respond with retaliatory tariffs. “We are going to fight these tariffs with countermeasures,” Carney said.

But Ontario Premier Doug Ford was on U.S. media yesterday sounding like someone prepared to make some type of deal.

“Let’s carry on a strong relationship,” Ford said on Bloomberg TV. “Let’s build the AmCan fortress, the American Canadian fortress, around both countries and be the wealthiest, most prosperous, safest two countries in the world.”

The good news and the bad news for Canada

By Joseph Steinberg, associate professor of economics at the University of Toronto

After months of rumors and speculation, President Trump announced the details of his reciprocal tariff plan late Wednesday afternoon. It’s a doozy: virtually all countries will face a minimum 10 percent tariff, and some of the United States’ biggest trade partners will face substantially higher duties, including China, the European Union, Vietnam, Japan, and South Korea. All told, U.S. tariffs are slated to rise to an even higher level than during the Smoot-Hawley era of the 1930s.

For Canada and Mexico, the announcement comes largely as a relief, as imports of USCMA-compliant products, energy, and potash are exempt from the reciprocal tariffs. For now, the tariffs on non-compliant products announced one month ago due to the “fentanyl emergency” continue, as do the tariffs on steel, aluminum, and the non-U.S. content of autos, but the outlook for trade within North America may actually look a bit brighter than it did Wednesday morning.

The overall economic outlook is substantially more dismal, however. My analysis indicates that President Trump’s reciprocal tariff plan will cause the global economy to shrink substantially, especially if other countries retaliate. While the U.S. economy itself will take the largest hit, Canada’s reliance on trade with the U.S. means that we will likely get dragged down with it.

These reciprocal tariffs may not last very long; their legal underpinnings are questionable, and the political blowback will grow as the U.S. economy worsens. Regardless, they have made the future of trade policy less certain, which will leave a lasting scar on the global economy.

A crane lifts a shipping container at an automated port in Tianjin, China, Monday, Jan. 16, 2023. Mark Schiefelbein/AP Photo.

Trump and the China question: It didn’t have to be this way

By Sean Speer, The Hub’s editor at large

Donald Trump’s tumultuous decade or so as a politician has been marked by two axioms: first, the West’s understanding of its relationship with China was based on a mistaken interpretation of Chinese ambitions and interests; and second, Trump’s pursuit of his heterodox yet fundamentally correct read of Chinese economic and geopolitical goals has been mostly chaotic and ineffective. Yesterday’s tariff announcement reflects both truths.

His administration is set to impose tariffs as high as 50 percent on Chinese exports. It’s also poised to impose sweeping tariffs on dozens of other countries, including several traditional allies.

In an alternate universe, Trump would have built a coalition of countries from G7 partners to developing countries that have since come to share his more skeptical view of China’s involvement in the global trading system and its expansionary ambitions. Even the Trudeau government’s 2022 Indo-Pacific Strategy acknowledged that China is “an increasingly disruptive global power” [that’s] “looking to shape the international order into a more permissive environment for interests and values that increasingly depart from ours.”

Trump’s source credibility on the China question—he was the first major Western politician to raise these doubts—could have enabled him to build new alliances and arrangements to isolate the Chinese Communist Party and deepen economic and security cooperation among countries with similar models of political economy and political values. The result could have been to check Chinese expansionary ambitions and put pressure on the CCP to open up its market in the name of reciprocity.

Instead, the president has done virtually the opposite. He has targeted allies, undermined trust in the United States, and now opened up trade wars with dozens of countries around the world. His crucial insight about the failures of the so-called “China consensus” has been lost to his own chaos. David Frum has gone as far as to describe yesterday’s tariff announcement as a catalyst for a “Chinese century.”

While it’s probably too early for such declarations, there’s no question that Trump has forfeited his advantage on the China question. Notwithstanding China’s own inherent weaknesses—including political corruption, aging demographics, and slowing economic growth—it now seems likely to come out of the second Trump administration stronger and more influential.

The Wall Street Journal’s editorial board put it this way:

Mr. Trump’s new tariff onslaught is giving China another opening to use its large market to court American allies. South Korea and Japan are the first targets, but Europe is on China’s list. Closer trade ties with China, amid doubts about access to the U.S. market, will make these countries less likely to join the U.S. to impose export controls on technology to China or to ban the next Huawei.

For those of us who believe that China represents a significant threat to Canada’s interests, this is a regrettable outcome. Trump’s personal undiscipline and governing disorder have most likely set back the cause of constraining Chinese efforts to dominate the world.

Why exports are not enough

By Livio Di Matteo, professor of economics at Lakehead University

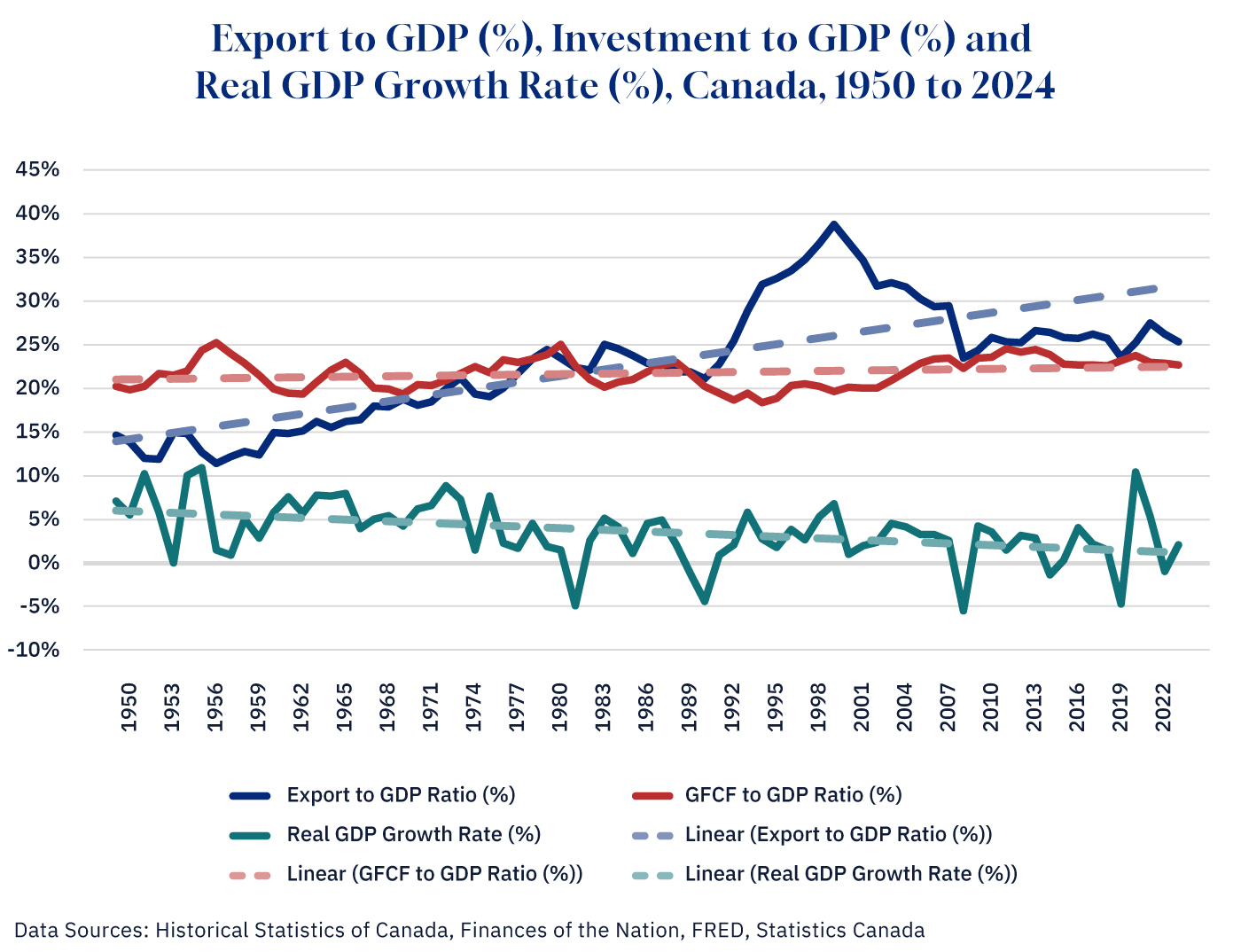

In the face of Trump’s tariffs, the case is being made that Canada must grow and diversify its exports to other countries around the world. Much is made of the fact that exports are a key driver of the Canadian economy in terms of both employment and income generation. However, the data tell us that exports are only part of the picture when it comes to Canada’s prosperity.

The accompanying figure plots three series plus a linear trend for the period 1950 to 2024 constructed from data obtained from Statistics Canada, Historical Statistics of Canada, Finances of the Nation, and FRED. This is the period that saw the rise of increased integration of the Canadian and U.S. economies with accentuation after the late 1980s in the wake of the Canada-U.S. Free Trade Agreement, and subsequently the NAFTA. From 1950 to 2024, Canada’s real per capita GDP grew fourfold as the export-to-GDP ratio rose from 15 percent to peak at 39 percent by the year 2000 and then decline to 25 percent at present.

Graphic credit: Janice Nelson.

This period of increasing export orientation of the Canadian economy is accompanied by two other interesting trends. First, while our real per capita GDP since 1950 has quadrupled, it has been growing at a diminishing rate. Real annual GDP growth over the 1950 to 1960 period averaged over 5 percent, but from 2014 to 2024 it averaged 2 percent. This long-term decline has occurred despite a long period of growth in our total exports of goods as a share of GDP.

So, what accounts for this performance? Well, the third plotted series is the gross investment to GDP ratio (business and government capital formation) and it shows a flat trend. While it has ebbed and flowed, it has essentially stayed flat. One can hypothesize that the reason why Canada is seeing diminishing rates of economic growth over the long term, despite what has been a successful export sector, is the anemic performance of its capital investment. While Canada has taken advantage of its growing export market, especially in the U.S., it has not focused on the longer term, which requires increased investment in capital stock to boost productivity in both its domestic as well as export-oriented industries.

The productivity lag story is an old canard in Canadian economic policy, but it is nonetheless real. Going forward, Canada is now faced with weakness on the investment front as well as a decline in its U.S. export market.

The solution? A boom in business capital investment is required to retool our economy to meet both domestic and future export needs. A boom in renewing business and plant equipment, new energy and transport infrastructure, and housing stock can drive the Canadian economy in both the short and long term, even with a turbulent export sector. The next federal government needs to put in place the tax incentive policies and a streamlined regulatory framework to boost investment. Exports alone are not enough. Indeed, they never were.

Canada must become more competitive

By Ian Lee, professor at Carleton University’s Sprott School of Business

The good news from President Trump’s press conference tariff announcements is that Canada dodged the bullet of additional tariffs—at least for now.

It should be loudly noted that this was due to the USMCA, which mostly protected Canada from retaliation.

The bad news is that Trump announced very significant tariffs on many other countries around the world, which will likely trigger a global recession.

Some politicians and analysts may argue the worst is behind us, as Canada has experience in managing recessions, and therefore we will be in good shape.

Nothing could be further from the truth. Canada has been in long-term structural economic decline for many years, and this has accelerated dramatically during the last 10 years.

This has been masked by our continued overwhelming dependence on the U.S. for 75 percent of our exports,

Nonetheless, our productivity gap with the U.S. has reached its widest level in a century, according to Professor Tombe at the University of Calgary, declining to an unprecedented 50 percent of U.S. levels. Moreover, our corporate income taxes are higher than the U.S. As well, R&D and ICT per worker are significantly lower than in the U.S.

As a consequence of these worsening structural issues, Canada’s next government must:

- Negotiate a new USMCA that will eliminate the tariffs imposed in exchange for opening up our economy as Trump has demanded;

- must eliminate $200 billion interprovincial trade barriers immediately, to reduce serious barriers to growth and innovation;

- must diversify our trade to become less dependent on the U.S. by eliminating the natural resource restrictions that the Trudeau government placed on development and export of our natural resources—e.g., no pipeline bill, tanker ban, caps on oil and gas production, ban on LNG exports, Bill 69 that created some of the most onerous review requirements in the world.

Why are these reforms needed? Because Europe and China, and now the U.S. have shown they do not want our manufactured goods. Indeed, all three regions and countries have adopted protectionist measures.

However, the EU, Asia, and the U.S. want to buy our natural resources—potash, canola, wheat, uranium, oil, gas, timber, seafood, etc. (as the U.S. has done for 150 years).

In the emerging new international economic system, Canada must address its declining productivity and become much more competitive if it is to retain its high levels of prosperity.

It’s no mystery why younger voters are embracing the CPC’s economic agenda

By The Hub’s Theo Argitis, Taylor Jackson, and Sean Speer

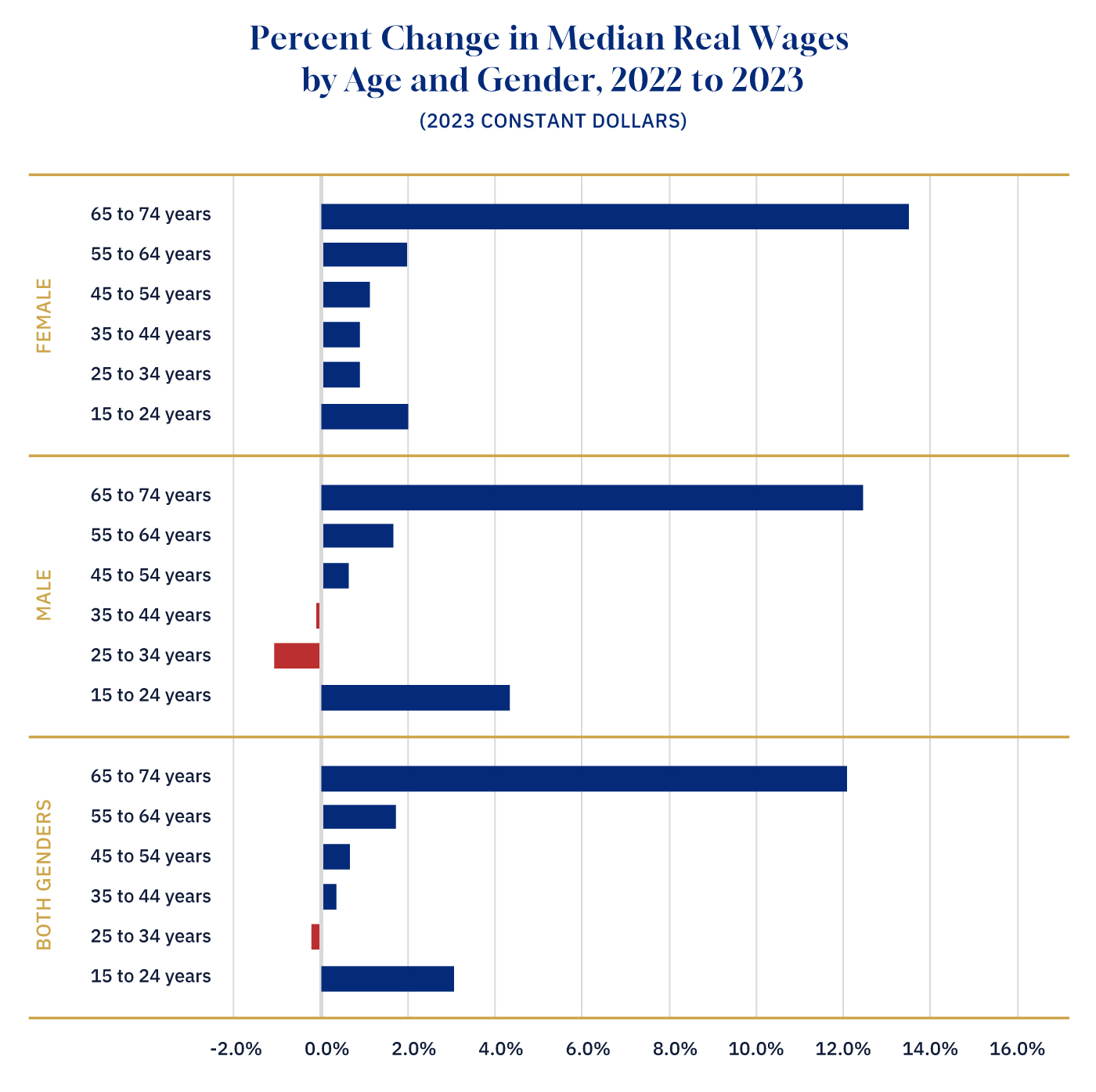

As the election campaign has come to turn on Canada’s intergenerational divide, new data from Statistics Canada reinforces the extent to which age has become a key determinant of one’s economic experience.

The statistical agency’s analysis of 2023 tax filer data finds that although the national real median wage increased by 1.1 percent, there was significant variance based on age and gender.

Graphic credit: Janice Nelson.

Tax filers aged 45 to 54, the group with the highest median incomes, experienced a 0.7 percent increase to $67,800 in median wages, salaries, and commissions.

Those between the ages of 65 and 74 saw the largest increase, up 12.1 percent to $20,960 in real terms.

By contrast, those aged 25 to 34 saw a decline in their median wage of $100, down 0.2 percent to $55,650.

The decrease in this age group was driven by a drop in the median wage for men. From 2022 to 2023, men aged 25 to 34 saw their median wages decline by almost $600 or 1.1 percent. Men in the 35 to 44-year age range also saw a decline in their real median wages.

Women in both of these age groups, on the other hand, saw median wages rise by 0.9 percent after accounting for inflation.

These different outcomes broadly match what we’re seeing in voters’ assessment of Canada’s economy, the key issues animating the election, and even their political preferences.

Recent Hub interviews with pollsters David Coletto and Darrell Bricker have noted the degree of age polarization in their election polling and the extent to which the Conservative Party and its message of change are strongly resonating with younger men.

StatsCan’s wage data suggest that this voter group’s desire for change is rooted in the evidence. These voters understand their own economic circumstances in absolute terms and relative to others in the economy.