In this edition of The Notebook, we look at what Prime Minister Mark Carney’s appointments at the very top of his government reveal about his agenda. We preview the G7 summit and how Carney has been reshaping Canada’s foreign policy ahead of the gathering. We examine the fiscal impact of new defence spending plans. And we share a preview of The Hub’s exclusive interview with BCE CEO Mirko Bibic, who offers a candid take on what’s driving the country’s largest telecom company.

Core with a clear mission

It appears the pinnacle of power in Ottawa is now fully formed.

This week’s appointment of Michael Sabia as clerk of the Privy Council, which is the top post in Canada’s public service, completes the trinity that will form the backbone of Carney’s new government.

Alongside Sabia are Carney himself and Marc-André Blanchard, the PM’s chief of staff.

If you like, you can stretch that power trio into a quintet by including David Lametti, Carney’s principal secretary, and Natural Resources Minister Tim Hodgson. This is the innermost ring of Carney’s inner circle.

Tim Hodgson, left, Minister of Energy and Natural Resources, shakes hand with Prime Minister Mark Carney after taking part in the cabinet swearing-in ceremony at Rideau Hall in Ottawa on Tuesday, May 13, 2025. Christinne Muschi/The Canadian Press.

Sabia is a veteran public servant and former CEO of both Hydro-Quebec and Caisse de dépôt, Canada’s second-largest pension fund. Blanchard is a former ambassador to the UN, who also held an executive role at the Caisse and ran McCarthy Tetrault, one of Canada’s most powerful law firms.

Lametti is a former justice minister under Trudeau, while Hodgson is an ex-Goldman Sachs banker who has spent time on the boards of the Ontario Teachers Pension Plan and the Public Sector Pension Investment Board.

I’d love to say there’s some subtlety here, a nuance that a writer like me could decode to reveal where the Carney government is heading. But the message isn’t subtle.

Carney is clearly trying to assemble a high-performance executive team of managerial technocrats, not to deliberate, but to deliver on an ambitious economic transformation agenda.

They are all extremely accomplished operators with elite backgrounds and education, which is not an accident. Credentials matter to Carney.

They are corporate leaders, but of a certain type: bridging both public and private sectors over their careers. These men have moved fluidly between Bay Street, government, and global finance. And that’s a hint at the type of state-driven economic strategy this government seems set to pursue.

One common theme, in particular, shouldn’t be missed: capital markets. These are people with deep financial expertise. Carney at Goldman and Brookfield. Blanchard and Sabia at the Caisse. Hodgson at Goldman. Their backgrounds tell you a lot about where this government is placing its bets.

Carney’s industrial strategy will require deep pools of investment. Central to their agenda will be how to marshal and deploy funds toward national economic priorities. Pipelines. Power. Transmission lines. Mines. These are long-horizon, high-risk bets. They need institutional backers and capital.

And these men know how to find it.

This isn’t just a Canadian story. The importance of managing capital flows is back on the table around the world. In the U.K., the newish Labour government that Carney has advised is moving to require domestic pension funds to invest more at home. In Canada, Caisse CEO Charles Emond said just this week that the fund’s U.S. exposure—currently at 40 percent—has likely peaked.

From money to materials

But here’s a word of caution for Carney’s team: unlocking capital will only be half the job. The bigger challenge will be what happens on the “real” side of the economy. You still need private-sector demand for projects. Investors need builders. Bankers need takers.

Despite their deep expertise in handling capital, fundamentally, the job ahead is not just about financial plumbing but about industrial and digital transformation.

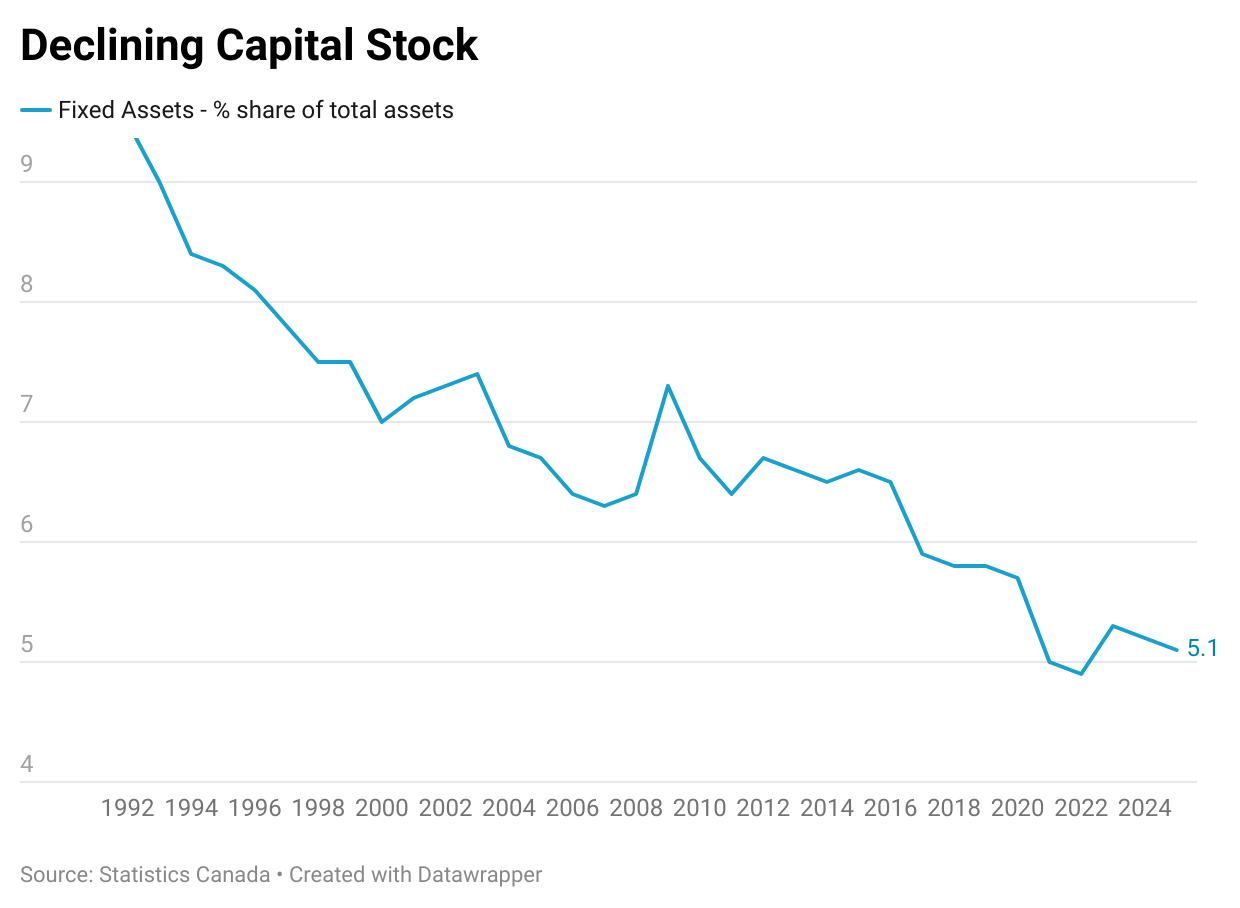

One of the quiet failures of the past decade has been our neglect of Canada’s capital stock—the infrastructure and machinery needed to actually produce goods and ship merchandise.

StatsCan released new data on this. At the end of March, the market value of non-residential fixed assets was $3.6 trillion, just 5.1 percent of total assets in the country. In 1990, that share was double.

Graphic credit: Theo Argitis.

Carney’s project is about reversing that trend and shifting our national focus back to productive capital. This will require buy-in from corporate executives. Without private-sector appetite to spend, especially in sectors like infrastructure and energy, the government’s ambitions will stall.

G7 and Carney’s foreign policy

The G7 is meeting this weekend in Kananaskis, Alberta, for what will be the most consequential gathering of world leaders since Donald Trump began inflicting chaos on the global economy.

As I wrote earlier this week, Carney is using the moment to reshape Canada’s foreign policy with a doctrine that puts national sovereignty at its core. His approach is built around a few core tenets: economic resilience, strategic autonomy, alliance-building, defence modernization and capacity, and territorial integrity.

Ahead of the summit, I also spoke with John Kirton, the longtime director of the G7 Research Group at the University of Toronto. His take: this one matters a lot. You’ll find the interview here, and plenty of his research here.

The G7 agenda, as you’d expect from Carney, is rooted in economics.

This includes an emphasis on energy security and digital transformation. Think of things like critical minerals, AI, and quantum computing. Carney also wants the leaders to discuss how to unlock private investment to build infrastructure and expand markets.

But as always with these summits, the real action is often on the sidelines, in bilateral meetings and backrooms. Or whatever crisis hijacks the headlines. Leaders from Australia, Brazil, India, Mexico, Saudi Arabia, South Korea, South Africa, and Ukraine are expected to join. All eyes will be on Trump, and whether he upends everything. Maybe we’ll get some clarity on what the new global trade order will look like.

Trump is reportedly in talks with more than 20 countries on bilateral deals, and his administration says some announcements are imminent. Carney, for his part, confirmed that Canada and the U.S. are deep in negotiations on a joint economic and security deal, though expectations for a breakthrough this weekend are low.

Defence budget gets real

Adding fuel to speculation that a deal is near between Canada and the U.S. was Carney’s announcement this week that Canada will immediately meet NATO’s 2 percent target, five years ahead of schedule.

The new spending commitment will add $9 billion this year to the budget and $62 billion cumulatively over five years, according to estimates by RBC Economics. (The difference with Carney’s campaign platform is closer to $15 billion over five years.)

But an even bigger shift may still be coming. NATO may be poised to adopt a new floor of 3.5 percent of GDP for core defence spending at a summit later this month. In The Hub this week, economist Trevor Tombe calculated that hitting that higher threshold would mean defence spending of $160 billion by 2035, up from $66 billion next year. Financing that, he writes, would require cuts to non-military spending of nearly 3 percent of GDP. That would be a fiscal squeeze not seen since the Harper government’s post-2010 austerity drive.

The fiscal math is already tight. Even at the 2 percent defence spending target, Bennett Jones estimates the government would need permanent savings of 15–20 percent in non-defence program spending, or about $30 to $45 billion annually, to steadily bring down the debt-to-GDP ratio.

Carney’s ambitions are big. What’s been lacking, however, is any talk of trade-offs, which sooner or later will need to be addressed. Ambition, no matter how well designed, still runs into the hard math of governing.

BCE’s Bibic has a warning

Also dropping Monday on The Hub is my wide-ranging interview with Mirko Bibic, CEO of BCE Inc., Canada’s largest telecom company.

In our conversation, Bibic shares his perspective on the opportunities for Canadian telecoms from emerging technologies like AI, as well as his outlook for the broader economy. The head of Bell Canada also has a clear message for policymakers in Ottawa: don’t take investment for granted.

In particular, he warns that a recent regulatory decision, which forces major telecom providers to open up their fibre networks to other large incumbents, risks undermining the very capital investment needed to build Canada’s digital infrastructure.