A new research paper sheds light on the Trump administration’s trade policy in a broader historical context, including what it may mean for the future of free trade and globalization as we know it.

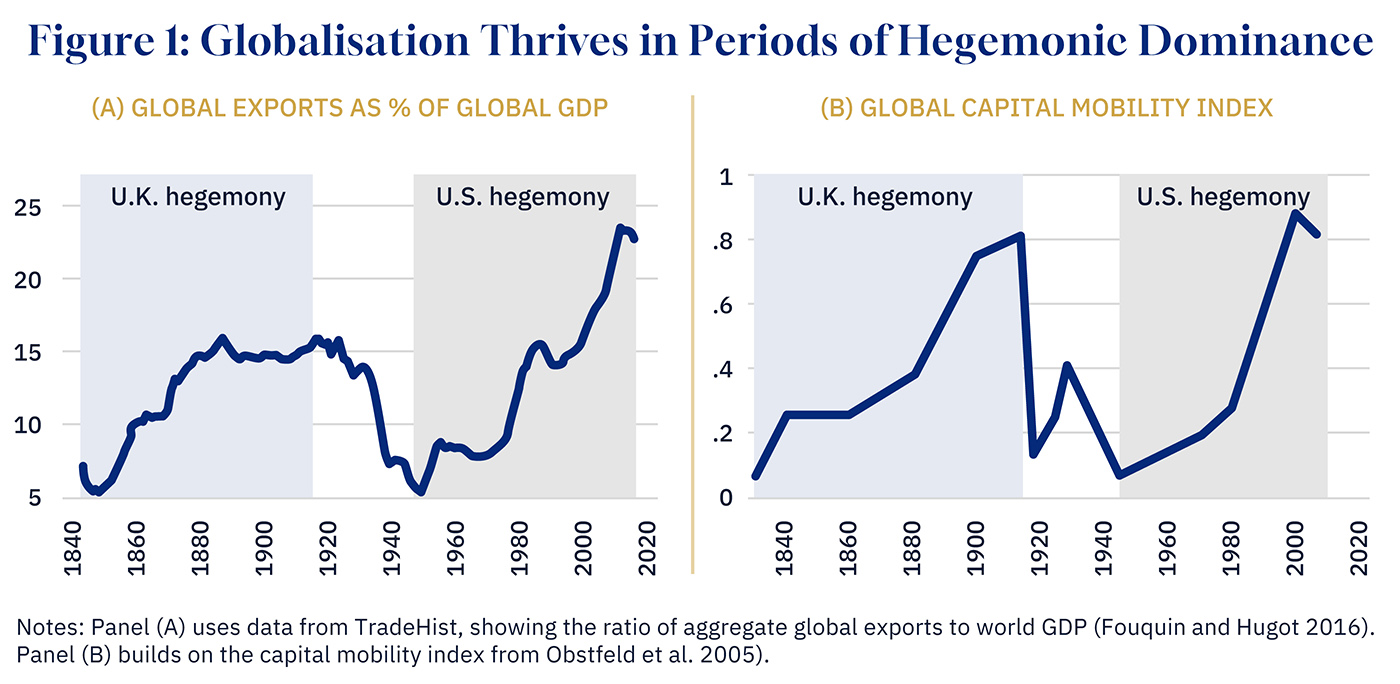

The new study from VoxEU, entitled “Why globalisation needs a leader: Hegemons, alignment, and trade,” pores over historical economic trade data from the last two centuries, showing global exports and global capital mobility thrived under British hegemony until the leadup of the Second World War, and then American hegemony, especially so after the end of the Cold War.

The basic insight is that free trade and globalization, as measured by global exports as a share of global GDP and the flow of globalized capital, seem to thrive in a unipolar context in which the dominant player or hegemon uses its economic, cultural, and political power to support global exchange.

Graphic credit: Janice Nelson.

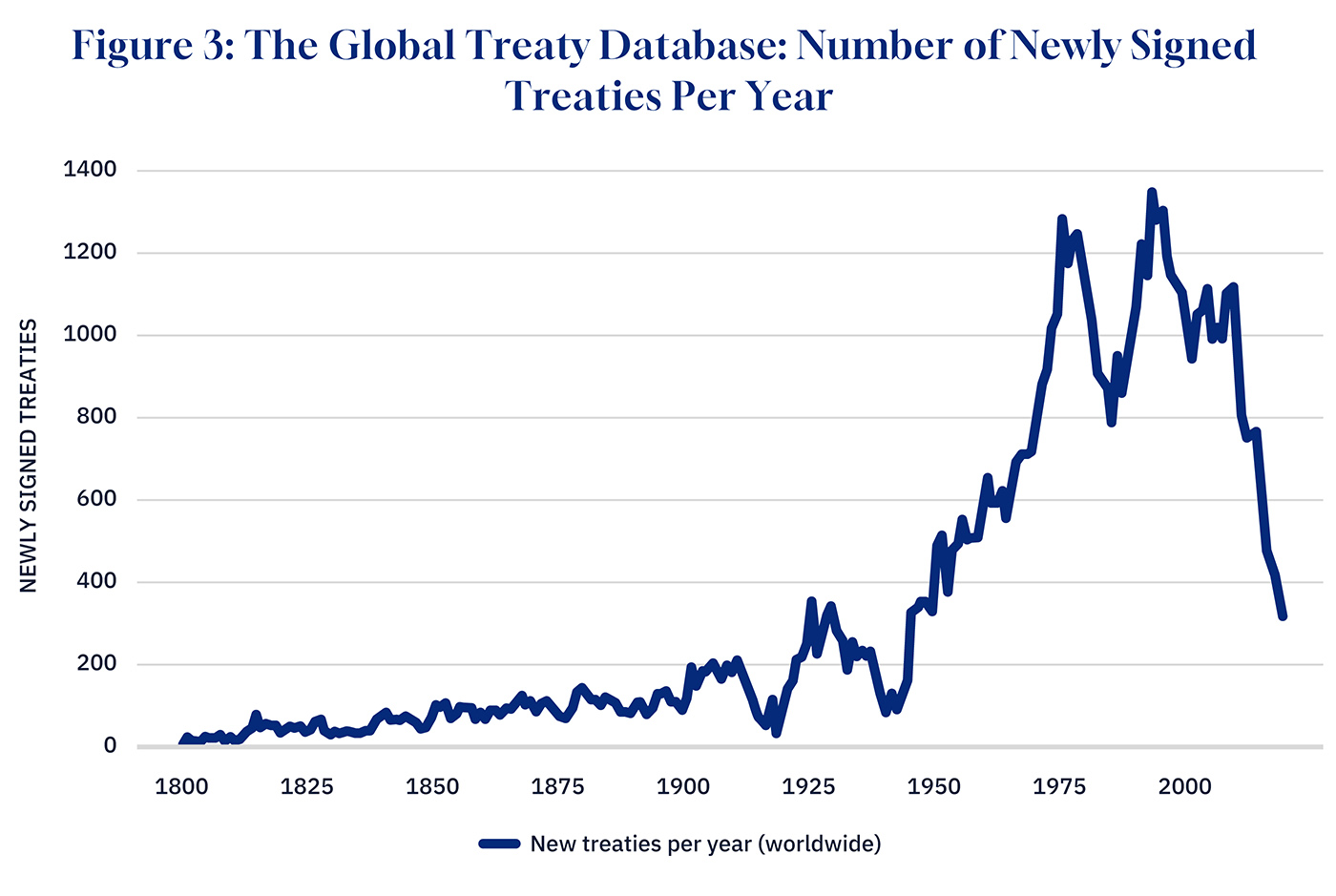

“The paper found that by looking back over history in the arc of the last 200-plus years, that really, globalization and trading, particularly measured through treaty formation, associated with matters that have to do with trade, those sorts of activities flourish when there is a unipolar environment, highly dominant economic actor, usually militarily as well,” head of trade and investment at Sussex Strategy Group Bill Hawkins said in a podcast interview with The Hub.

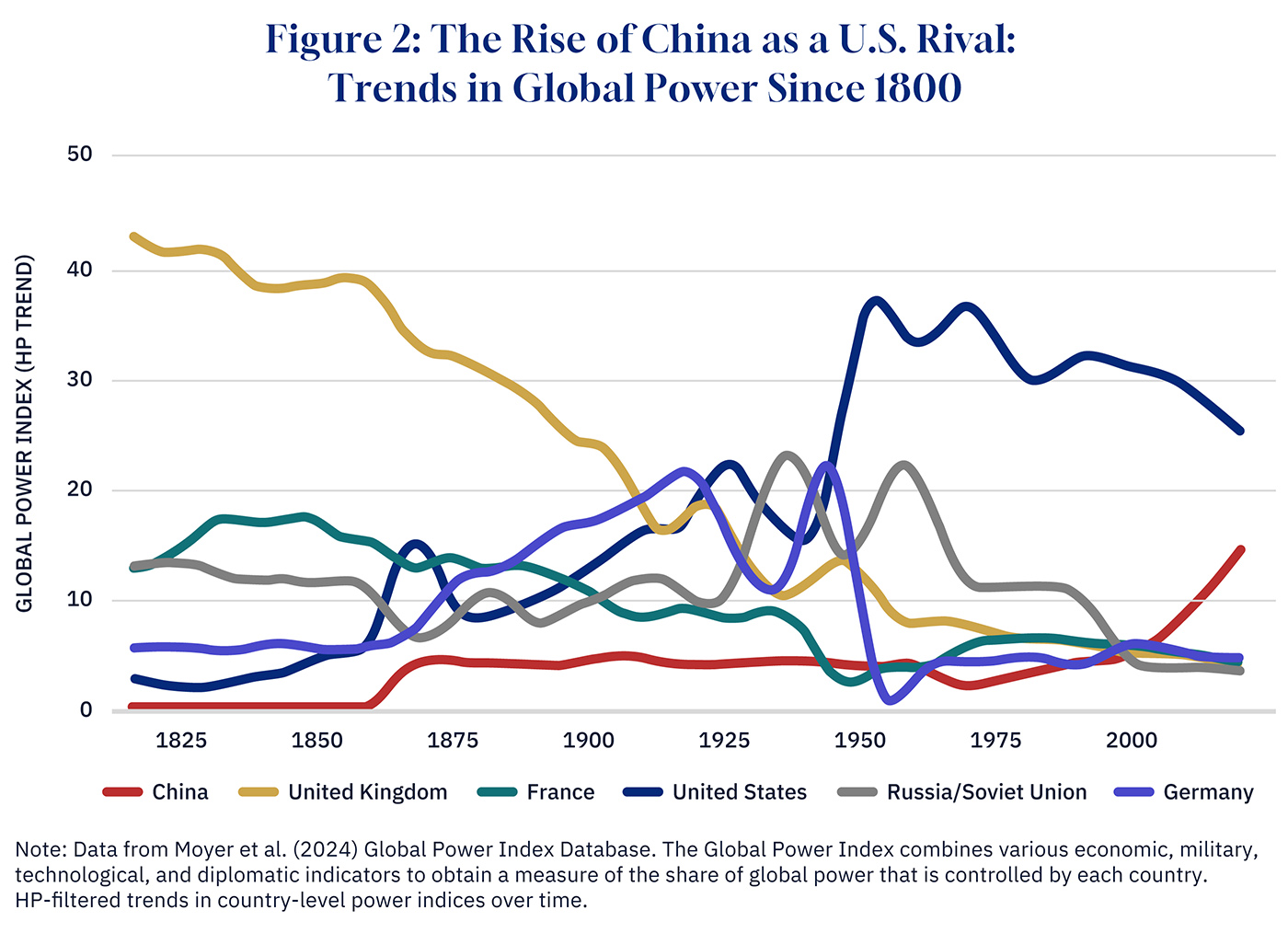

When the unipolar hegemon loses its dominance, geopolitical tensions rise as other powers compete for trading “blocs,” argue the VoxEU study’s authors.

Graphic credit: Janice Nelson.

“In a unipolar world, countries balance their policy preferences against the economic gains from aligning with the hegemon. A sufficiently large hegemon magnifies these gains, leading to broader policy convergence and deeper trade integration—what we call hegemonic globalisation,” the paper’s thesis reads in part.

On the other hand, the economic researchers contend, countries antagonistic or with conflicting preferences to the hegemon are economically “hurt” by this unipolar world. The theory also highlights that when multipolarity forms, where two or more hegemons are present, a “fragmentation” of global trade occurs.

“Think [of the] British Empire, think most recently over the last century, Pax Americana, and that in the absence of that kind of ordering power, there is a significant disaggregation, lots of headwinds, all fighting against trade and the costs associated with economically existing as a middle power nation rise dramatically,” Hawkins explained “And it characterizes, really, the environment that we are well on our way in terms of heading into.”

Hawkins previously discussed how Canada is currently facing trade challenges with both the U.S. and China as the two rival superpowers use Canada as a proxy in their jockeying for global advantage. Most recently, China slapped Canada with a 75.8 percent tariff on all Canadian canola products.

The risk is that Canada’s diminished market access to the two countries discourages investment, both domestic and foreign.

“I spent a lot of time with officials in various departments [in Ottawa last week]. And the frightening aspect of the discussions was associated with the acknowledged degradation in the investment thesis to put capital into Canada,” Hawkins explained.

“And it’s not simply foreign investors…but it is Canadian companies themselves, when you look at their capital allocations over the first part of 2025, significant billions of dollars, significant sums have been invested in North America, but were not [invested] in Canada, [only] south of the border,” Hawkins added.

Currently, 75 percent of Canadian exports, worth approximately $670 billion, are sent to the United States, compared to just 4 percent or $30 billion to China, Canada’s second-largest market.

Source: VoxEU Aug. 2025. Graphic credit: Janice Nelson.

The VoxEU paper cites a 2024 Global Power Index database, which shows fracturing in the global economy occurring due to the rise of China as a dominant power rival to the U.S. One consequence is that the number of trade treaties has fallen precipitously in recent years. As a proxy for globalization, it may show that the decline of American unipolarity is already starting to undermine free trade and globalization.

This commentary draws on a Hub podcast. It was edited using AI. Full program here.