DeepDives is a bi-weekly essay series exploring key issues related to the economy. The goal of the series is to provide Hub readers with original analysis of the economic trends and ideas that are shaping this high-stakes moment for Canadian productivity, prosperity, and economic well-being. The series features the writing of leading academics, area experts, and policy practitioners. The DeepDives series is made possible thanks to the ongoing support of the Centre for Civic Engagement.

Canada’s most important relationship

With more than 75 percent of Canadian goods exports going to the United States, it is imperative that Canada gets its relationship with the U.S. right. Canada’s trading relationship with the U.S. is more than just headline numbers however—that 75 percent represents thousands of businesses and countless individuals whose livelihoods depend on low-cost access to the U.S. market. While Canadian policymakers face uncertainty about American negotiators’ goals and pain points, Canadian business leaders face the additional challenge of projecting what PM Carney’s government will offer in exchange for market access.

These layers of uncertainty call for a clear-eyed, systematic assessment of Canada’s trade outlook. One way to do this is to follow the playbook of intelligence agencies and leading thinktanks globally, using what’s broadly categorized as foresight techniques to assess what may happen in the future and how to know what scenarios are most likely to occur. We examined a range of these techniques in a previous article, which we will apply here to Canada’s trading relationship with the U.S.

The analysis will give us a framework through which to view the Canada-U.S. trade relationship going forward, and how to adjust our expectations as events occur. For now, it looks like we’re headed into an increasingly volatile period with negotiations across many industries, though perhaps not to the full-blown catastrophe that would be the end of CUSMA.

Scoping the question

Before diving into research and analysis, it’s important to start with the right question. While different organizations will have different needs, in general, foresight analysts look to balance breadth and depth, ensure that our analysis is aligned with our stakeholders’ needs, and, of course, make sure it’s forward-looking. Examination of the past can be a key part of foresight, but only as an input to a future-focused analysis.

For our purposes, we’ll assess the question “How will Canada-U.S. trade develop over the remainder of President Trump’s term?”

Issue decomposition

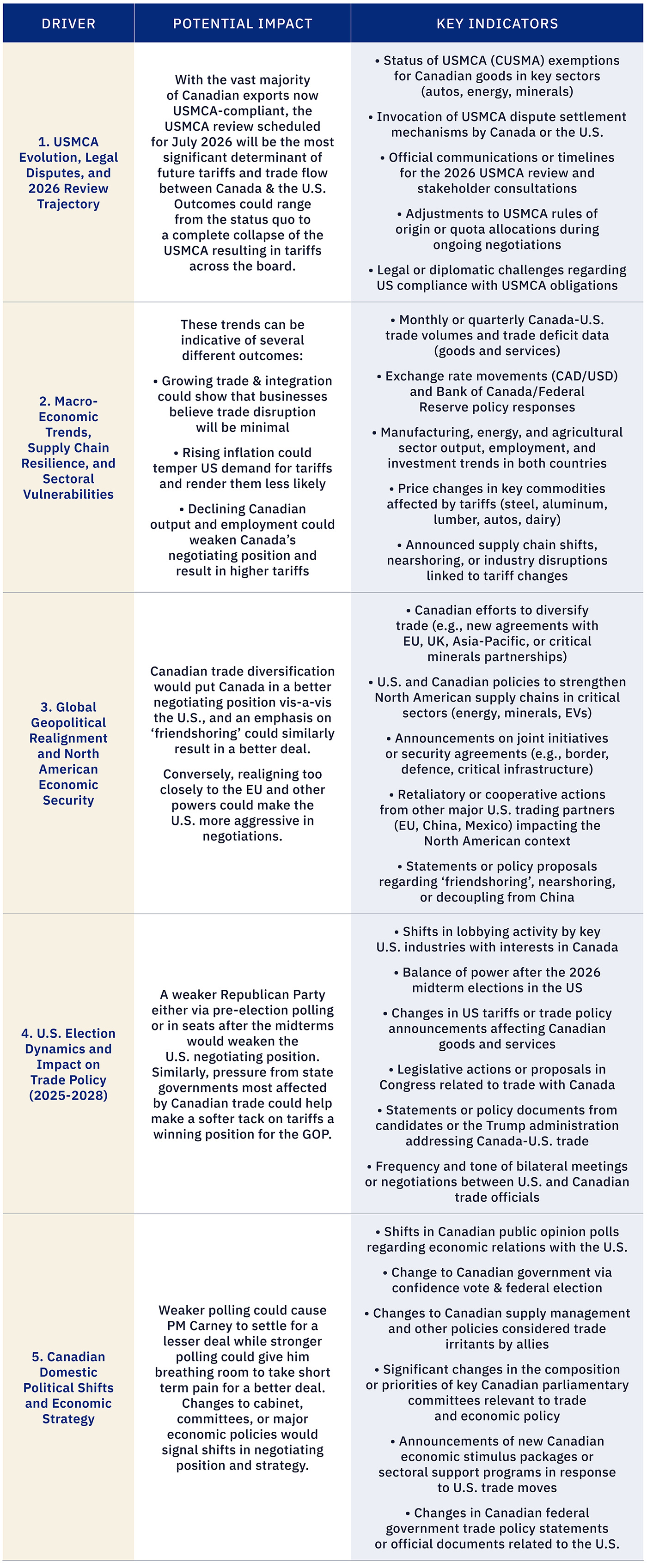

The first stage of foresight analysis is issue decomposition, which breaks our question down into its key components. When performed well, the process produces a thorough view of the primary drivers behind an issue as well as what signals would indicate a change in the direction of a given driver.

Here are the key drivers of Canada-U.S. trade relations over the next couple years, and the more granular, observable indicators that can be monitored (and even forecasted). This decomposition was created using ARC, an AI analysis tool, and then edited by a human analyst.

Graphic credit: Janice Nelson

Having established the drivers of the Canada-U.S. trade relationship, analysts can then do much more in-depth analyses of the most important and volatile components. The Hub has recently featured several articles relating to these drivers, including CUSMA, Canadian domestic political considerations, and a plan to diversify Canada’s trading partners. These perspectives can be effectively drawn together using our decomposition analysis and pieced into a comprehensive view of Canada’s trade conundrum.

Scenario planning

Next, we imagine five possible futures for Canada-U.S. trade using a technique called scenario planning. This is a creative analytical process used to imagine all the reasonably possible futures of a given subject so that analysts are not blinded by preconceived notions of what will or might occur.

Having already performed a decomposition analysis, we can use it to inform our scenarios. For example, in Scenario 1 below, we will consider a world in which our first driver about the CUSMA goes in a catastrophic direction, while in Scenario 4, geopolitical shifts enable Canada to diversify its trade partners faster than expected.

While scenario planning is often performed by teams of analysts, subject matter experts, and decision makers, the scenarios below were produced with ARC and edited by an analyst.

Scenario 1: Escalation via CUSMA breakdown: Trump moves to suspend or terminate CUSMA

Frustrated by ongoing disputes (e.g., supply management, internet regulations, border security), President Trump announces the U.S. intent to suspend or formally terminate CUSMA, using the agreement’s withdrawal clause or other legal mechanisms. This move triggers a six-month withdrawal process, introduces massive uncertainty for North American supply chains, and prompts immediate market and currency volatility. Canada and Mexico scramble to negotiate interim deals with the U.S. and each other, while affected industries lobby intensively for exemptions or policy reversals. Legal and political pushback in Congress and from U.S. business groups creates strong domestic resistance, but the threat of CUSMA collapse becomes the dominant issue for North American trade, deeply affecting investment and long-term planning.

Scenario 2: Sectoral tit-for-tat: Auto, dairy, and energy sectors face rolling tariff and quota battles

The U.S. and Canada avoid a comprehensive trade breakdown, but sectoral disputes intensify, with each side targeting sensitive industries for new or increased tariffs, quotas, or regulatory barriers. The U.S. continues to pursue higher tariffs and stricter quotas on Canadian autos, dairy, and critical minerals, or other sectors, while Canada responds with targeted countermeasures (e.g., on U.S. agricultural or consumer goods). Both countries use the CUSMA dispute mechanism more frequently, and industry groups escalate lobbying for relief or exemptions. Cross-border supply chains are disrupted on a rolling basis, especially for small and medium-sized enterprises unable to absorb compliance costs. Government support programs are expanded to offset damage, but persistent sectoral skirmishes undermine long-term stability and investor confidence.

Scenario 3: Legal disruption: U.S. courts invalidate tariffs, forcing policy reset

A U.S. federal court rules against President Trump’s use of emergency powers to impose sweeping tariffs (e.g., under IEEPA), forcing the administration to suspend or roll back key tariffs on Canadian goods. The sudden legal reversal compels the U.S. to renegotiate trade policy or revert to prior tariff levels, creating a temporary thaw in trade tensions. However, Trump publicly denounces the ruling, vowing legislative or executive workarounds. Canadian exporters gain near-term relief, but uncertainty over the durability of the court decision and possible U.S. countermeasures means businesses remain cautious. The episode sets a significant precedent, but does not resolve underlying policy disputes, and the risk of re-escalation persists.

Scenario 4: North American supply chain pivot: Canada accelerates trade diversification

Facing persistent tariff uncertainty and repeated U.S. policy volatility, Canada accelerates its economic pivot toward Mexico, the EU, and Asia-Pacific partners. Ottawa and Canadian industry prioritize new infrastructure and energy corridors (e.g., pipelines and LNG terminals with Mexico), deepen trade ties with the EU and Indo-Pacific, and invest heavily in nearshoring and supply chain resilience outside the U.S. While the U.S. remains Canada’s largest trading partner, the share of trade with the U.S. declines, especially in sectors most exposed to tariffs (e.g., autos, steel, lumber). Canadian government support, including financial incentives and regulatory streamlining, enables businesses to absorb transition costs. U.S.-Canada trade tensions persist, but the economic impact is partially mitigated by successful diversification and North American sectoral reintegration (especially with Mexico).

Prime Minister Mark Carney, left, and President of France Emmanuel Macron deliver a joint statement at the Palais de l’Elysee in Paris, France on Monday, March 17, 2025. Sean Kilpatrick/The Canadian Press.

Scenario 5: Minimal change at 2026 CUSMA review—continuity and predictable adjustment

In the 2026 scheduled review of the CUSMA, the U.S., Canada, and Mexico ultimately agree to preserve the agreement’s core provisions after intense but ultimately pragmatic negotiations. All parties bring forward grievances—on issues like dairy, autos, digital trade, and dispute resolution—but after months of haggling, only minor updates and clarifications are made, such as technical amendments, new side letters, or modest sectoral concessions. No significant new tariffs, quotas, or sweeping regulatory changes are introduced. The threat of U.S. withdrawal is used by the Trump administration as leverage but is not acted upon. Political leaders in all three countries declare victory, presenting the outcome as a defense of national interests, but the fundamental framework and market access provisions of the CUSMA remain intact. Business and investor confidence strengthen, supply chains remain stable, and there is a modest uptick in long-term planning and investment, especially in sectors previously at risk. Some friction and uncertainty linger—particularly as the U.S. presidential election approaches—but the CUSMA 2026 review becomes a largely technical process without major disruption.

Of course, scenario planning isn’t only useful for business leaders anticipating future scenarios—they can also be used to imagine futures we can directly pursue through decisions and policies. For Canadian politicians, the scenarios below are a mix of variables they cannot control (Trump’s and U.S. courts’ actions) and ones they can (Canada’s own tariff policy and trade diversification).

Similarly, Canadian businesses might use the above as a foundation for their own organization-specific scenario planning: what could result for their business in each of these scenarios and what actions they could take to create better possible outcomes for their shareholders.

So which scenario is most likely?

The best way to determine what’s next would be to directly forecast the indicators from our decomposition. For example:

- A forecasted decline in manufacturing output, particularly in prominent cross-border industries like automobiles, would suggest Scenario 1 is less likely. Such a decline could push U.S. negotiators away from a CUSMA catastrophe and toward prolonged, industry-specific negotiations as they grapple with the fallout of a hard-line approach.

- A forecast of continued Chinese trade aggression through new tariffs on Canadian oil or coal on top of the recent canola tariffs could further weaken Canada’s negotiating position, making the diversification of Scenario 4 less likely. Chinese aggression spreading to the U.S. and other allies, however, could also highlight the importance of “friendshoring” and result in a better deal for Canada because of the strategic and security benefits.

- A forecast that Americans will continue to disapprove of the president’s tariff policy (only 38 percent of Americans approve of it at the moment) would improve Canada’s negotiating position and potentially increase the likelihood of Scenarios 2 and 5, with the U.S. backing away from general tariffs and pursuing more specific deals. Conversely, if it is predicted that the Trump administration will successfully sell tariffs to American voters, CUSMA may not last long in 2026.

Unfortunately, the Canadian forecasting community is small and underdeveloped, meaning we don’t have robust, crowd-sourced forecasts on these topics. Forecasting represents a huge opportunity to improve foresight capabilities for Canadian governments and businesses, but at present, we must make do with the few Canadian topics available on foreign prediction markets and forecasting platforms:

Polymarket (prediction market): Will Trump make a trade deal with Canada in 2025?

- Yes: 9 percent

- No: 91 percent

For instance, bettors on Polymarket think it is highly unlikely that Canada and the U.S. will arrive at a trade deal before the end of the year. While this isn’t necessarily consequential in the near-term due to CUSMA, it is a bearish signal for CUSMA negotiations in 2026: if we can’t come to an agreement now, is CUSMA likely to be gutted next year?

An LCBO employee removes American whiskey from the shelves at the 100 Queen’s Quay East LCBO outlet in Toronto on Tuesday, March 4, 2025. Laura Proctor/The Canadian Press.

Good Judgment Open (forecasting platform): What will be the total value of U.S. exports in goods to Canada in the second and third quarters (Q2+Q3) in 2025?

- <$152 billion: 18 percent

- $152 – $164 billion: 39 percent

- $164 – $176 billion: 25 percent

- $176 – $188 billion: 12 percent

- >$188 billion: 6 percent

Forecasters at Good Judgment Open anticipate a fairly significant dropoff in Canadian exports to the U.S. in 2025, with a 57 percent chance of being down at least 8 percent versus the $178 billion recorded in Q2 and Q3 2024. This is indicative of continued tariff uncertainty, perhaps greater tariffs, and a possible shift to other markets.

You can contribute to a stronger Canadian foresight community by forecasting more indicators below. Take a look and share your thoughts on three key signals for what is next in Canada-U.S. trade negotiations:

- Will Canada end or adjust its dairy, eggs, and/or poultry supply management rules in 2025, with respect to trade with the United States?

- A sign that Canada is further capitulating in negotiations could be if Canada adjusts its eggs, poultry, and dairy supply management system, which has been mentioned frequently by President Trump as an irritant in trade negotiations.

- Will Canada announce it has agreed to lower tariffs on goods from another OECD country (excluding the United States) in 2025?

- If Canada announces lower tariffs on goods from another OECD nation, it could be an indication that Canada is making a serious attempt to diversify its export markets, increasing the likelihood of Scenario 4.

- Will the Republican Party maintain its majority in both the Senate and House of Representatives after the 2026 midterm elections?

- The Republican Party losing its governing trifecta (or even polling suggesting this is likely) could be enough to complicate the U.S. government’s negotiating position with Canada. Poor polling could push the U.S. to accelerate a deal and agree to one more favourable to Canada, while an actual loss of power in either chamber would make passing a new, more punitive trade deal more difficult. All these outcomes would suggest Scenario 1 is becoming less likely.

Putting it all together

So how do we know which scenario is most likely? While there isn’t a robust Canadian forecasting community, the Polymarket and Good Judgment forecasts above suggest that our current trade dispute is not going away quickly. With trade likely declining year over year and a new deal unlikely in 2025, Canadian businesses are set up for greater uncertainty in 2026, with the very foundations of North American trade at risk with the renewed discussions about CUSMA.

Nonetheless, with the president’s tariff war polling poorly, and midterm elections around the corner, I suspect we are headed toward Scenario 2, avoiding the complete catastrophe that would be the total collapse of CUSMA, but with economic damage nonetheless from protracted negotiations and sector-specific tariffs.

As important as determining the most likely scenario right now, however, is changing our opinions and forecasts as the facts change. That is one of the greatest strengths of thorough foresight analysis—it gives us a comprehensive framework through which we can view and interpret new facts, events, and forecasts, improving our analysis and yielding an increasingly accurate view of what is to come.

Monitoring the signals from our decomposition and crowd-sourcing more forecasts over the coming weeks and months will be an integral part of this analysis, as will occasional updates to the framework as events warrant.

The global trade war the Trump administration has instigated has already seen a number of countries sign unfavourable deals in order to maintain access to the U.S. market. Though we are not without bargaining chips, Canada is even more dependent on the U.S. economy than the EU, Japan, and others that have already made deals. Combined with trade pressures from China, Canadian politicians and business leaders are caught in a difficult position.

Now more than ever, Canadians need to employ robust foresight and forecasting tools to ensure we know not only how best to negotiate with President Trump’s team, but also how to prepare for a world with greater trade barriers with our most important ally.