Prime Minister Mark Carney’s first budget, set to pass in the House of Commons late Monday, spends $94 billion less in capital investments than the Liberal government claims it does, according to a new report published by the Parliamentary Budget Officer (PBO) late Friday.

The PBO found that the “subjectivity” in Budget 2025 when defining certain expenses translated to the Carney government overstating capital spending by 30 percent for its five-year fiscal plan. The PBO projects Ottawa’s actual investment spending will be $217.3 billion from 2024-25 to 2029-30, rather than $311.5 billion.

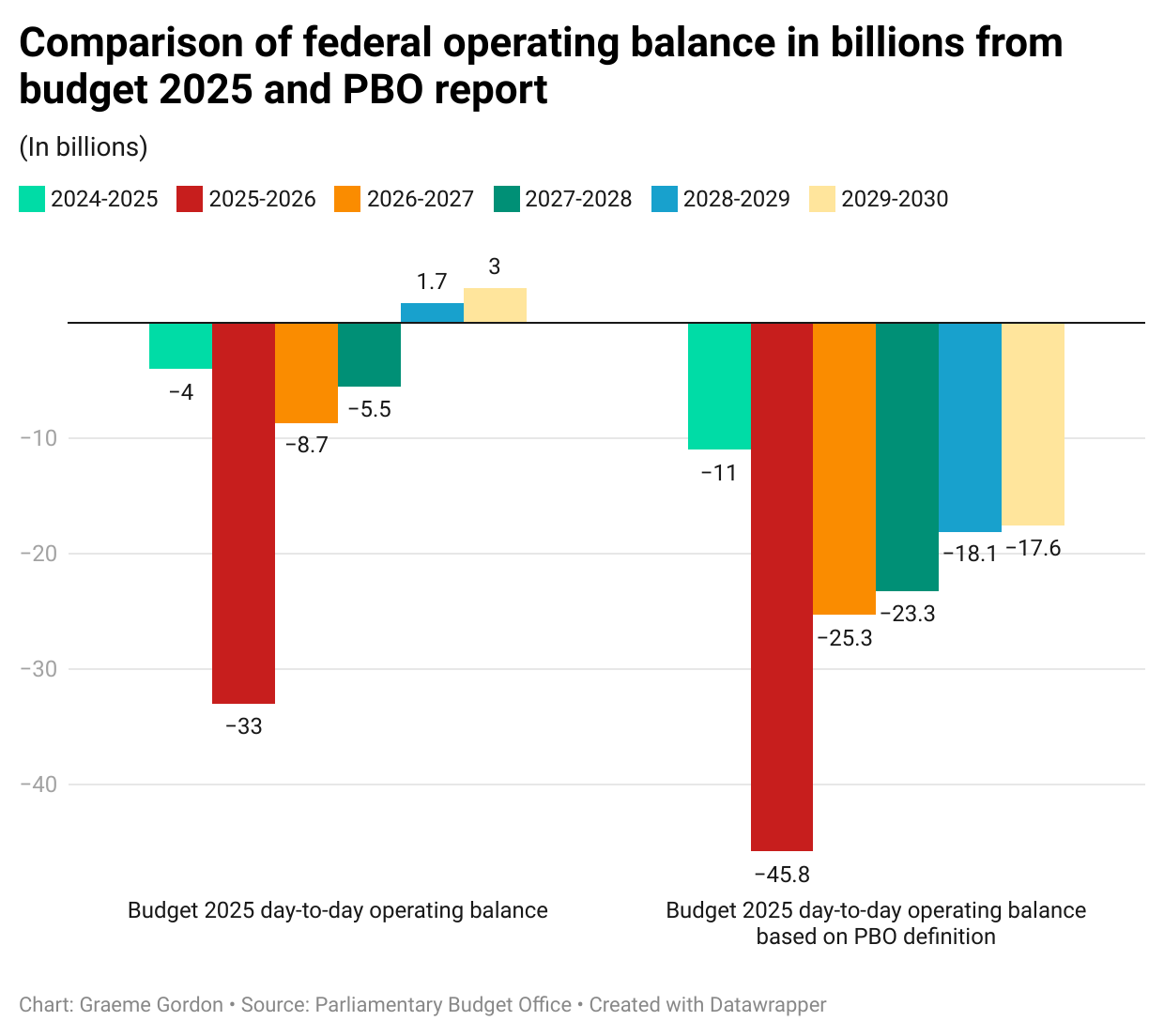

According to the PBO, the $94 billion will instead largely be used for expenses and shortfalls in the federal government’s annual operational balance sheet. Interim PBO Jason Jacques and his staff believe that the “overly expansive,” mislabeled “capital investment” budget line items—including investment tax credits, subsidies, and corporate income tax expenditures—will contribute to sustained deficit spending of Ottawa’s day-to-day operating balance for the rest of the decade.

“[The government has] thrown some things in there, some categories of spending, which other jurisdictions in other countries would not typically include,” Jacques said in a CTV interview aired Sunday. “The biggest risk with all of this is: If you’re not spending on productive capital investments, if you have an overly broad definition, then you’re not going to get the investment impact and the growth in the economy that the government expects.”

In the budget, Finance Minister Francois-Philippe Champagne had projected that future federal deficits would strictly be used to cover funding capital investments by 2028-29. The government plans to run a $78.3 billion deficit this fiscal year (more than double what the Trudeau government projected the deficit for 2025-26 would be), followed by slightly declining deficits of $65.4 billion, $63.5 billion, $57.9 billion, and $56.6 billion for the next four years. However, the PBO calculated that the Liberal government only has a 7.5 percent chance of attaining the goal of a declining deficit-to-GDP ratio due to the increased spending in government operations.

Shortly after Canada Strong Budget 2025 was published two weeks ago, top-three credit agency Fitch Ratings downgraded the credit score of Canada from AAA to AA+/Stable because of “persistent fiscal expansion and a rising debt burden weaken[ing] its credit profile.”

The PBO raised concerns about both the deficit and Canada’s new credit score.

“I agree with not the new government but the previous government that indicated that the debt-to-GDP ratio is the most important medium-term indicator of fiscal sustainability and essential for securing Canada’s AAA credit rating,” Jacques added. “The government has cut that anchor…the way the government went about this certainly was not transparent.”

Jacques explained that the debt-to-GDP ratio has been a fiscal anchor for the Government of Canada for over 30 years and that the Liberal Party of Canada campaigned on maintaining it as such during the 2025 election.

During Question Period on Monday, Conservative Leader Pierre Poilievre challenged Carney about the Liberal government’s budget doubling deficit spending and the PBO report.

“The 2025 budget is an investment budget, a generational investment budget. It will grow our economy. According to the PBO, this policy is sustainable in the long-term,” Carney said in response.

Finance Minister Champagne’s office added that they believe the PBO report “takes a narrow outlook of Canada’s fiscal and economic policy trajectory, looking at Canada’s budget in isolation-absent longer-term considerations and knock-on effects.”

The Liberal government cites its investments and tax incentives in the budget as having a “catalyzing” effect that could help spur $1 trillion in investment over the next five years.

The PBO review of the budget also notes the debt-to-GDP ratio, which the former Trudeau government committed to decreasing, is now projected in Budget 2025 to increase from 42.4 percent this year to 43.1 percent next fiscal year, then up to 43.3 percent in 2027-28. The PBO highlighted that Finance Canada in the last three consecutive years had previously projected the debt-to-GDP ratio to steadily decline and either fall below or near 10 percent by 2055-56. The new budget diverges from this, instead projecting debt-to-GDP to remain relatively stable but only drop down to 37.2 percent in 2055.

Jacques’s budget review recommends that the federal government create an independent expert body that would set which federal spending categories and measures should be seen as capital investment under a larger definition beyond the Public Accounts of Canada.

Back in September, the PBO predicted Canada’s GDP growth would stay sluggish and below a healthy 2 percent into the next decade, with annual interest payments estimated to reach $82.4 billion by 2030-31. Prime Minister Carney’s Budget 2025 projects debt charges in 2029, at $76.1 billion, will cost more than federal funds for health care and child care combined.

Is Carney's budget truly an 'investment budget' if PBO says $94B is for operations, not capital?

How does the PBO's analysis of Carney's budget impact Canada's credit rating and fiscal sustainability?

What are the potential economic consequences if 'capital investment' is broadly defined, as the PBO suggests?

Comments (4)

The government engages in a full-time misuse of the word “investment”. The normal meaning provides a return on invested capital. If you look at the massive spending on battery plants that have been called investment you will see that it is a synonym for wasteful spending that achieves nothing. Let’s at least call it spending even if we can’t always call and wasteful.