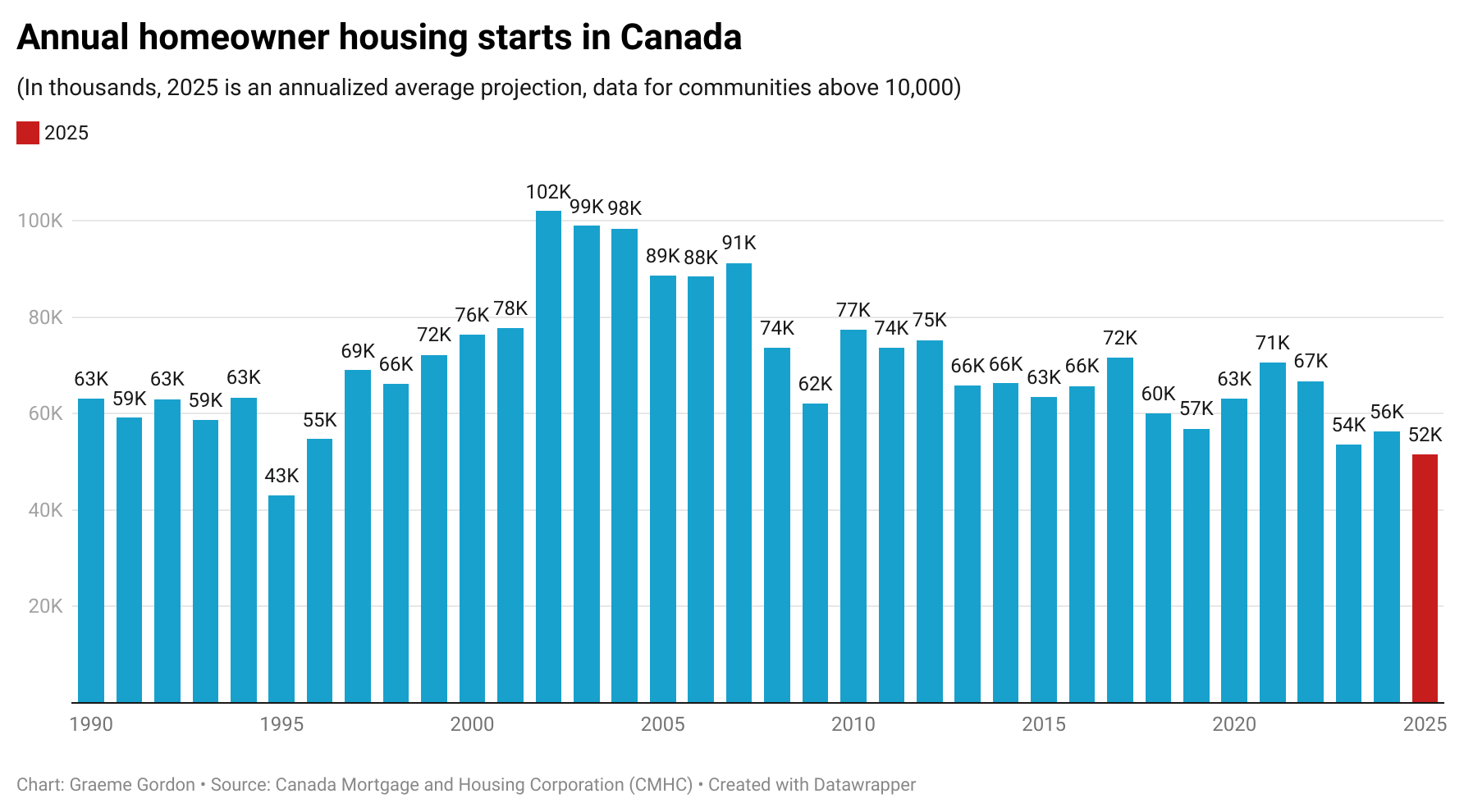

The home ownership dreams of both Millennials and Gen Zers are being further crushed as housing developers react to Canada’s volatile housing market. If trends continue, 2025 is on track to set a 30-year low in housing starts across the country.

Homeowner housing starts in 2025 show an average annualized rate of new builds at its lowest since 1995, with only 41,384 homeowner housing starts (housing built to sell directly to homebuyers) recorded from the new year until the end of October for cities or towns of over 10,000. If the average monthly rate continues, there will be 51,545 new units started in 2025, nearly half the starts of the high of 2002’s 102,038, and a continued downward trajectory of houses built over the past two decades.

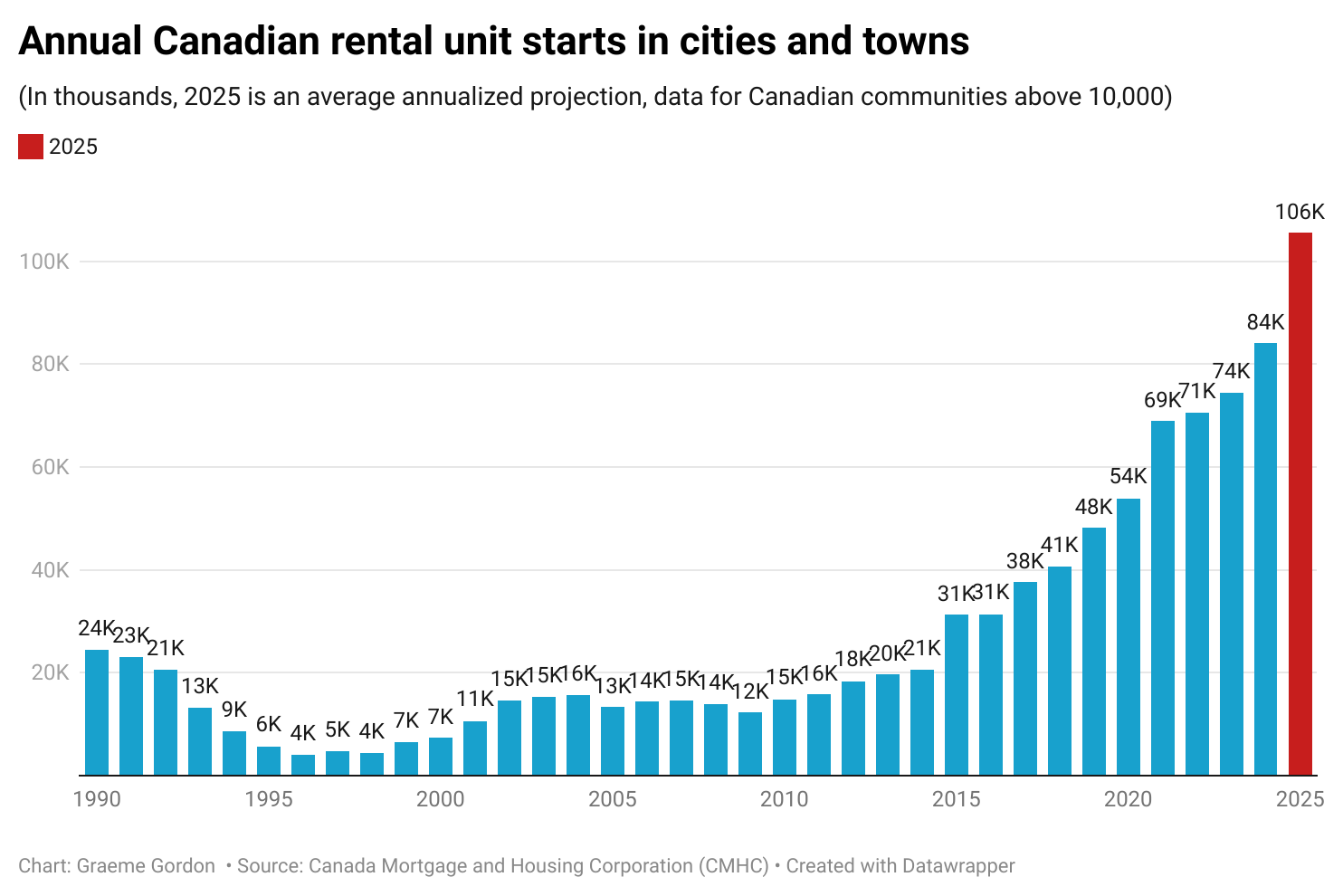

However, Canadians needing to rent have options. Rental unit starts, for cities and towns over 10,000, hit an annual record high of 87,971 within the first 10 months of 2025, which would translate to an annual rate of 105,565 new rental units for all of 2025.

According to the latest housing start data released by Canada Mortgage and Housing Corporation (CMHC) this week, rental starts are now doubling the rate of homeowner housing starts for 2025.

“Over the last few years, purpose-built rental has become a lot more profitable than building high-rise condos,” Missing Middle Initiative founding director and Hub contributor Mike Moffatt said in an interview. “And then on top of that, it’s just gotten difficult for a lot of places to build what I call ground-oriented housing, single-detached, that town home and things like that, because of high taxes, development charges, land use policies.”

Last month, the average home price in Canada dropped to $679,900, a 20.2 percent dip from the March 2022 peak. Moffatt believes this has had a major adverse effect on housing development outside of rentals.

“The challenge is that prices are so low now that they don’t cover the cost of construction, which is one of the reasons why sales have basically evaporated, because the builders and developers have gotten to a point where they just can’t produce product and make it profitable and get financing,” Moffatt explained, citing Toronto, the GTA, then metro Vancouver as the cities where housing starts have dried up the most.

Between record levels of immigration and non-permanent residents, as well as a greater proportion of young Canadians in their twenties and thirties unable to afford leaving the rental market for homeownership, Canada has seen a spiking demand for rentals. The average Canadian rental costs $2,137 a month, dipping slightly from 2024, but well above the 2020 August average of $1,718.

Some of the other main reasons for the spike in new rental builds are the federal government’s elimination of the GST on purpose-built rental, the creation of an accelerated capital cost allowance provision for rental construction, and a new apartment construction loan program which provides low interest loans for construction.

“It’s more policy driven than market driven,” Moffatt told The Hub. “The federal government has put in place a number of programs over the last decade to accelerate rental construction. It made sense [at the time] because we went through a 30-some-odd-year period where we didn’t build much rental at all.”

Meanwhile, condo starts have dropped significantly in 2025 to a new low from at least the past decade. This year, they are projected to hit just above 50,000, nearly 9,000 less than in 2024. In the case of Toronto, where the condo market has tanked, sales of new condos dropped 90 percent in August from the 10-year average.

Rising housing costs have been eating away at Canadians’ monthly take-home pay, with more and more of their salaries going towards their rents or mortgages. The Government of Canada estimates Canadians now spend 35 to 50 percent of their income on housing and utilities.

Moffatt’s analysis of housing market data (including falling building permits and growing building costs, while home prices and land purchases drop) indicates this trend of declining housing and condo starts will continue for the next few years.

During the election, Prime Minister Mark Carney unveiled four policies to help address the housing crisis. They included a first-time home buyer’s GST rebate on purchases of new homes, a reduction in development charges, a Build Canada Homes agency supporting larger development projects for low-income housing, and a tax credit for small apartment complexes.

Moffatt said the budget only fully delivered on the GST rebate, while Build Canada Homes has only dispensed half of its budget. He added that the reduction in development charges was “watered down,” and the government didn’t deliver on the tax incentives for the construction of smaller apartment buildings.

The housing expert said the prospects for the average young Canadian adult being able to afford to buy a home in five years’ time are grim.

“I think it’s going to be less realistic and viable. My fear is that we don’t address the cost issue [and] we go through a period of three to four years where nothing gets built, and then the economy improves, or immigration goes up, and you get a lot of demand chasing very little supply.”

With homeowner housing starts at a 30-year low, what does this mean for the dream of homeownership for young Canadians?

Why are rental unit starts at a record high while homeowner starts plummet?

Given the grim outlook for homeownership, what are the potential long-term economic and social consequences for Canada?

Comments (4)

Immigration, loved by Walmart, Canadian Tire and every holder of a fast food franchise whether Wendy’s, MacDonalds Burger King or Tim’s not to mention all south Asian Canadian politicians. Not so much by young white Canadian males. Follow the money.