Japan’s landslide election on Sunday delivered more than just a supermajority for Prime Minister Sanae Takaichi’s Liberal Democratic Party. It offered a sobering preview of what may be coming to Canadian polling stations this spring: how excessive economic stimulus wrapped in fiscal fantasy is intoxicating voters across the advanced West.

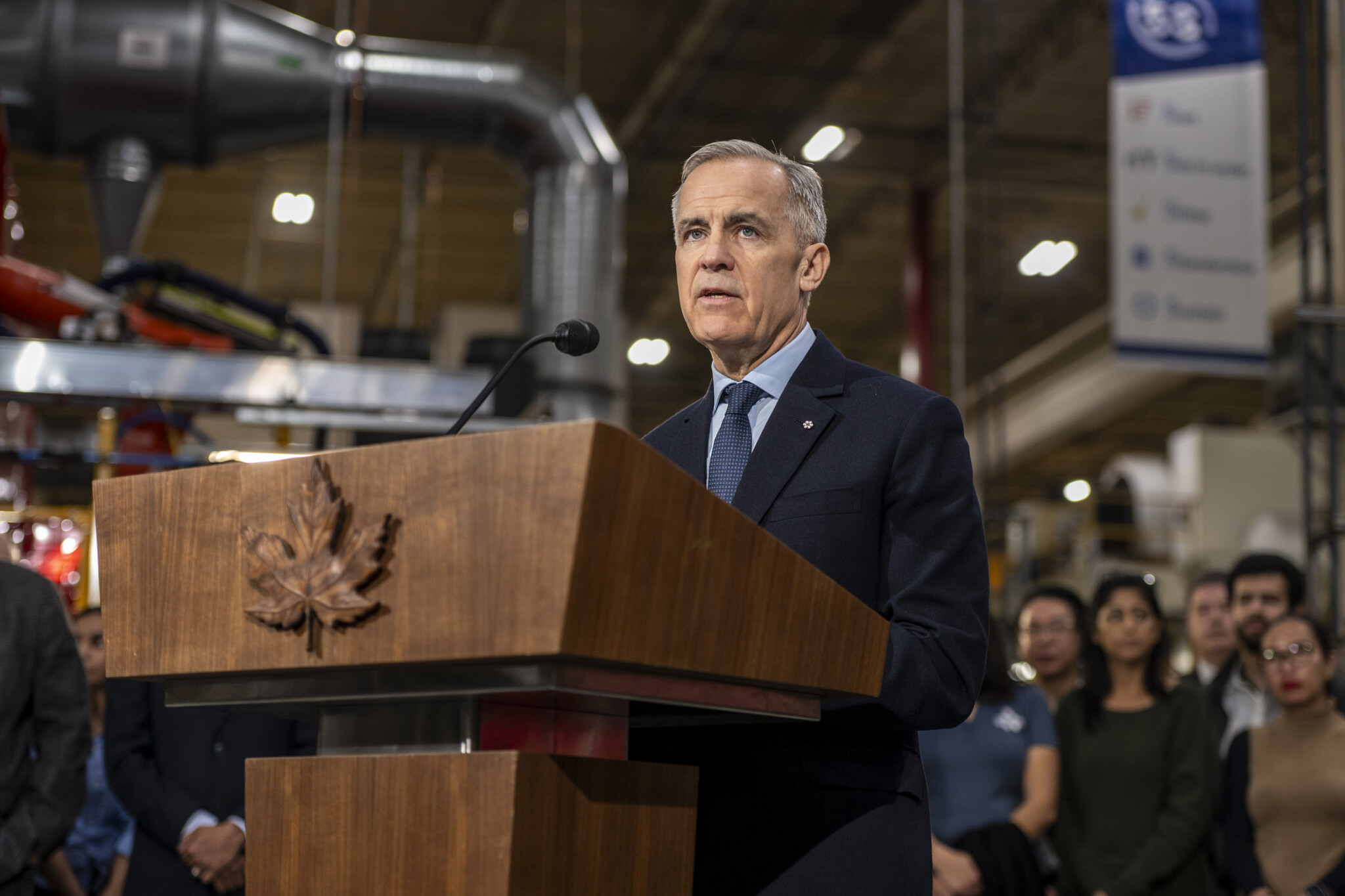

The parallels between what unfolded in Tokyo this weekend and what Mark Carney is promising Canadians are impossible to ignore. Sanae Takaichi swept to power on the back of a $135 billion stimulus package and a politically irresistible pledge to suspend Japan’s consumption tax on food—a $30 billion annual hit to revenues for a country already drowning under debt that exceeds 250 percent of GDP. Sound familiar? It should. Carney’s fall budget featured tax cuts alongside a projected $78 billion deficit, recently sweetened with an additional $13 billion in HST credits for low-income earners to make life “more affordable.”

This is the new playbook for electoral success across advanced democracies: promise generous fiscal spending and cut taxes where it counts politically, and let tomorrow worry about itself. Takaichi explicitly embraced “Abenomics”—the late Prime Minister Shinzo Abe’s doctrine of aggressive stimulus—and voters rewarded her handsomely despite warnings from financial markets. Carney, for his part, seems to be reading from the same script, offering Canadians what amounts to “Carneyomics”: an expansionary fiscal policy on steroids that lifts asset prices today while deferring the consequences to some ill-defined future.

The political logic is brutally effective. High-incident older voters see their stock portfolios swell, and the non-asset owning class is bought off through direct government handouts. The electoral rewards are immediate and tangible. The costs—permanently higher borrowing rates, imported inflation, currency devaluation, and ultimately slower growth or worse—remain conveniently abstract and distant. At least until they aren’t.

Japan’s recent election results serve as a cautionary tale for Canada’s fiscal future, highlighting the potential repercussions of economic policies and public sentiment. Japan’s political landscape has shifted dramatically, reflecting broader concerns about fiscal responsibility and governance. As Canada navigates its own economic challenges, the lessons from Japan’s electoral outcomes may provide critical insights into the importance of sustainable fiscal practices and the need for responsive leadership. The implications of these developments could resonate deeply within Canada’s political and economic framework.

How might Japan's election results influence Canada's upcoming federal election?

What are the potential economic consequences of the 'Carneyomics' approach?

Why is Japan's experience a warning for Canadian policymakers?

Comments (2)

This short term logic has hurt me.

As a relatively new homeowner who renew’d his mortgage with an extra $5000 annually in mortgage payments.

Had the Liberals just increased taxes to fund their spending habits, interest rates would be lower and my mortgage payments would be less. Increase in spending financed via inflationary deficits is taking its toll on me. And it creates so much uncertainty.

Any tax increase would have been offset by lower interest rates on my line of credit and payments to my mortgage. This is why I wish the liberals raised taxes to fund their pet projects.

Someone always pays for new spending, whether it be taxes or deficits, and right now new homeowners are being asked to eat bitterness.