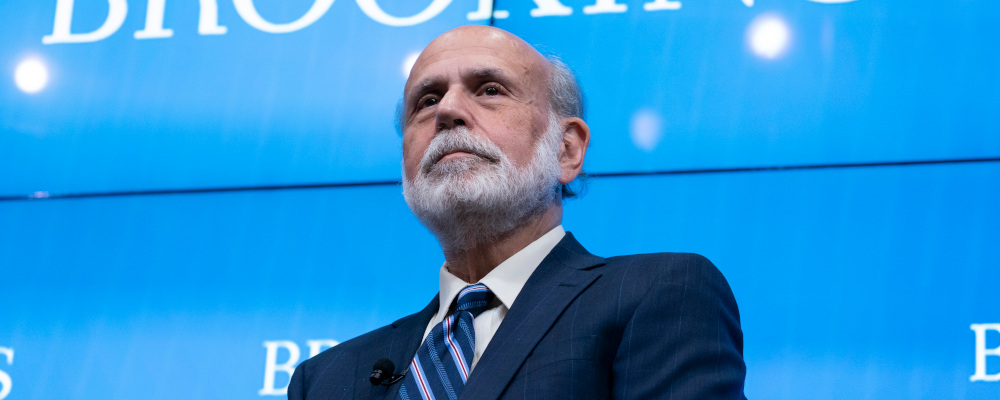

Last week former U.S. Federal Reserve Chair Ben Bernanke (along with two other economists) was awarded the Nobel Memorial Prize in Economic Science for his 1980s research on bank runs and the systemic risk that they pose for the overall economy.

Of the 92 laureates since the prize was established in 1969, Bernanke is a unique awardee because he’s not merely a research economist. He actually put his research into practice in response to the global financial crisis during his tenure as America’s top central banker.

The implications of his research and lasting influence from his eight-year term (2006-2014) at the Federal Reserve are currently the subject of some debate. On one hand, his use of extraordinary policies including quantitative easing and zero-bound interest rates to stabilize the economy during the crisis are credited with staving off a far-worse economic disruption. On the other hand, there’s a growing view that it normalized these policy tools and inadvertently turned the Federal Reserve into something of a “fiscal policymaker” in the subsequent decade including, most recently, in the context of the pandemic.

The current spike in inflation has led to a debate about the relative role of this sustained period of loose monetary policy and what has come to be described by his critics as the “Bernanke bubble.” (For informative analysis on the causes and sources of high inflation, Hub readers should check out University of Calgary economist Trevor Tombe’s previous Hub articles on the subject.)

Bernanke’s award—especially in a context in which his ideas and record are the subject of new, real-time scrutiny—had me recently thinking of the prize’s ninth recipient, Friedrich Hayek, and his famous Nobel lecture in 1974.

Hayek was a heterodox economist whose deep attachment to classical liberalism (he famously wrote an essay entitled, “Why I’m not a conservative”) situated him as more of a moral philosopher than a hard-core econometrician. His Nobel lecture, which reflected a theme that was common throughout his career, was entitled “The Pretence of Knowledge.”

Its brilliant exposition of the limits of human knowledge in general and the explanatory power of economics in particular is a much-needed rejoinder to the overconfidence and overreach of the Bernankean generation and its offspring.

Hayek’s main thesis was that economics had in the post-WWII era assumed ambitions to think and talk about itself as a field similar to the physical sciences. These ambitions were, in his judgment, wrong. They had led to what he called “scientism”—a concerted yet misguided attempt to apply the rigour and confidence of scientific methods to the economy and society.

He thought that this was mistaken because no model could possibly account for the complexity of the multitude of individual choices and preferences in a large, dynamic economy. As George Mason University economist Don Boudreaux summed it up in a short book on Hayek: “imagine a jigsaw puzzle of one billion pieces.”

Hayek’s main takeaway was notwithstanding the best intentions of smart and capable technocrats to micromanage the peaks and valleys of the business cycle, we ought to be skeptical of their ability to wield the blunt tools of government policy to accentuate the upsides and circumvent the downsides. These efforts would invariably succumb to what he called the “knowledge problem.”

Such technocratic tinkering effectively turned government policymaking into an exercise of dial-turning. Policymakers would move the policy dial in one direction to mitigate against an immediate-term problem and then would invariably have to move them in the opposite direction to inadvertent address the consequences of their initial action. The latter may even be worse for the economy and society than the former. As Hayek explained in his Nobel address:

To act on the belief that we possess the knowledge and the power which enable us to shape the processes of society entirely to our liking, knowledge which in fact we do not possess, is likely to make us do much harm.

There’s also the invariable tendency to forget the axiom that there can be too much of a good thing. Take our current economic context. An expansionary fiscal and monetary policy may have been justified in the global financial crisis. But the failure on the part of governments and central banks to restore a more normal policy in the ensuing decade has contributed to the current bout of stagflation. Hayek’s skepticism would have made him highly alert to this risk. Bernanke, by contrast, was in hindsight too sanguine about the potential for excesses in the application of his ideas.

This doesn’t mean that he was wrong per se. But it may mean that he overestimated the capacity of policymakers to hold the dial steady. There’s a case that in hindsight the demand-side response to the global financial crisis begot some of the policy excesses that have produced our current economic challenges. Their short-term benefits need to be weighed against the long-term by-product of renewed technocratic hubris about our ability to perfectly fine-tune the public policy dials. The wrong takeaway for many, in other words, was that we could get the upside of a stimulative policy without any of the downsides.

The downsides shouldn’t be discounted. The massive policy shift initiated by Bernanke artificially boosted economic activity, but it also distorted capital formation and investment decisions and minimized policy trade-offs in ways that circumvented a proper conversation about the structural reforms necessary to improve the country’s economic fundamentals.

Reading Hayek’s speech can be interpreted as a from-the-grave critique of Bernanke. It’s easy to forget that he was actually referring to circumstances in his own era. In particular, he was lamenting the consequences of the policymaking hubris that originated from the ideas of his intellectual rival John Maynard Keynes whose “general theory” was arguably a proper response to the contingent circumstances of the Great Depression but came to be interpreted by his successors as a universalized theory of the role for government in the economy.

This “bastardized Keynesianism” abandoned Keynes’s specific insights (including for instance the idea that governments should deleverage during periods of economic growth) and instead came to simply imbue the spirit of state activism. The eventual result, which was manifesting itself as Hayek delivered his speech, was the stagflation crisis of the 1970s.

Hayek summed up his critique of the intellectual forces that had contributed to these economic conditions as follows:

…economists are at this moment called upon to say how to extricate the free world from the serious threat of accelerating inflation which, it must be admitted, has been brought about by policies which the majority of economists recommended and even urged governments to pursue. We have indeed at the moment little cause for pride: as a profession we have made a mess of things.

There’s a sense that we’ve made a mess of things once again. Central bankers are now trying to extricate us from the inflation problems that their own policies helped to create. The process is bound to be disruptive for households and the economy as a whole.

It ought to therefore be a lesson in the limits of our ability to turn the dials, the axiom that there can be too much of a good thing, and the ultimate need to focus on economic fundamentals. That might start with a refresher on the pretence of knowledge.

Recommended for You

The state of Canada’s economy halfway through 2025

Peter Menzies: It’s no wonder Canadians are tuning out the legacy media

‘It’s really important that we make mining fashionable again’: Ken Ash on why mining is essential to creating a happy and secure Canada

The Notebook by Theo Argitis: Trump halts trade talks, Carney’s trade-offs and John McCallum’s legacy