This is a good news story. Over the past twenty years, Canadians have turned the existential problem of a potential insolvency for the Canada Pension Plan into a new problem—and one that’s great to have. The CPP is now a financial behemoth that ranks among the world’s largest pension funds.

Sitting on $576 billion today—$200 billion more than anticipated just a few years ago—the CPP Fund is projected to exceed $1 trillion by 2031 and reach as high as $1.5 trillion five years later. It’s stuffed with more than enough money to pay out benefits for the next 75 years.

Alberta’s recent outsized claim to the CPP Fund in the event of that province’s withdrawal from the national pension plan has drawn attention to the size of the fund. How much money do we really need to finance the CPP’s pension obligations? If it’s too large, should we reduce premiums? Or increase benefits? Or more perhaps controversially draw down the surplus to invest in our future in other ways?

At a time when Canadians are struggling to pay the grocery bills and everything from health care to education to the military is underfunded, we should have a serious debate about the mammoth size of the CPP Fund. We need a reasoned discussion concerning the amount of its assets, its projected growth rates, and whether it is now overfunded.

How did we get here? The reforms of the 1990s

Originally, the CPP was set up as a pay-as-you-go plan. This meant that current workers would pay for current retirees. By the mid-1990s, serious concerns arose about the solvency of the fund as its reserve was projected to be depleted by 2015.

To prevent this, the federal and provincial governments co-operated to enact measures to restore the long-term sustainability of CPP. They increased premiums, reduced the growth of benefits, and created the CPP Investment Board (CPPIB) to invest contributions not immediately needed to pay benefits. The fund now has two sources of growth: premiums from workers and returns from investments made by the CPPIB.

Every three years, Canada’s chief actuary examines the current and future finances of the CPP and assesses its sustainability for the next 75 years. The most recent report, which was published in December 2022, confirmed the long-term sustainability of the CPP at current premium rates based on conservative investment returns.

How did the fund grow so fast?

The overfunding of the CPP isn’t a policy failure for which the public servants who run the pension plan or the portfolio managers who manage the investment at the CPPIB are responsible. In reality, they’re the heroes of this story. Over the past ten years, the CPPIB has racked up a smashing average annual return of almost 10 percent which places it among the world’s best.

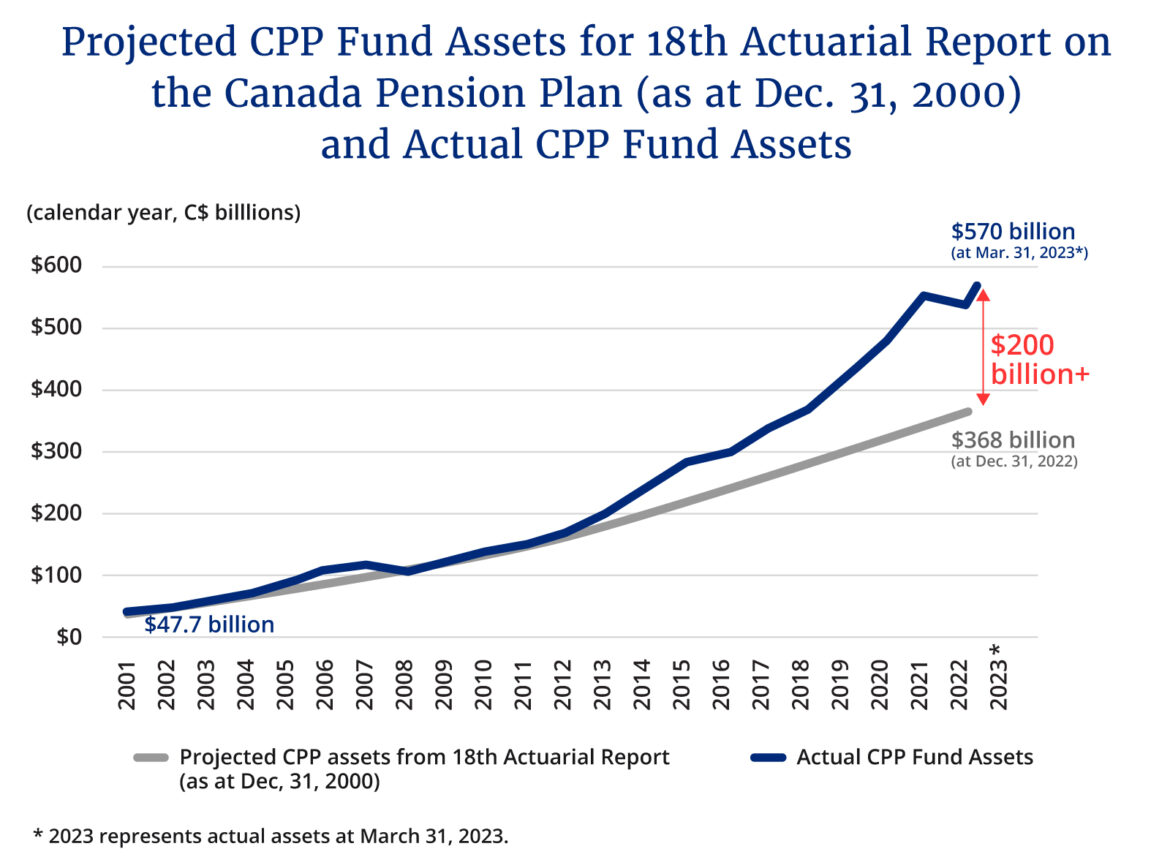

How much do we have now? Let’s look at the numbers. They portray an astonishing success. In the past 20 years, the CPP fund has grown from $67 billion to $576 billion today.

In the official reports, one read things such as: “Due to strong investment performance over the three-year period from 2019 to 2021, investment income was more than $100 billion higher than expected.”12023 Annual Report, page 8. CPP Investment Board. Another industry observer recently wrote that “Net asset growth has widely outstripped earlier actuarial projections.”2“CPP Investments does it again.” Warren Lovely, Market View and Strategy, National Bank of Canada, May 25, 2023.

Going forward, based on the most recent risk-averse projections of the chief actuary, the fund’s annual surpluses are expected to land in the range of $30 to $40 billion, accumulating and compounding year after year.

A financial colossus

In its 2023 fiscal overview, the CPPIB reported that the CPP Fund is years ahead of schedule and now holds $200 billion in excess of its earlier projections (see its own graph below). 3Fiscal 2023 Results Overview, page 13. (May 22, 2023). CPP Investment Board.

The reports of the chief actuary and the CPPIB state that the fund is “sustainable over the long term,” but interestingly they refrain from indicating the minimum fund size needed to achieve this goal. This opaqueness deprives us of a benchmark for sustainability and risk margins. Perhaps the CPP is actually sustainable with a smaller amount of assets as long as its payouts exceed contributions with a comfortable cushion.

There are many different reports one can read but they all essentially say the same thing: The CPP Fund is healthy for the next seven decades.

Where we’ll be in 2031 and upward revisions

In 2015, the chief actuary predicted that the CPP Fund would hold about $625 billion in its coffers by 2031, enough to finance CPP benefits until 2090.429th Actuarial Report Supplementing The 27th And 28th Actuarial Reports On The Canada Pension Plan As At 31 December 2015, Table 9 Financial Projections Base Cpp After Amendments. Just three years later in 2018, the same chief acutary’s office increased the 2031 projection to an aggregate of $942 billion.530th Actuarial Report on the Canada Pension Plan. Tables 11 and 21.

The story gets even better as yet again the 2031 projection was recently revised upward to now more than $1 trillion.631st Actuarial Report on the Canada Pension Plan. Tables 11 and 21. In the past eight years, in other words, the projection of the CPP Fund’s 2031 total holdings went from $625 billion to over $1 trillion—an upswing of $375 billion.

Today the CPP Fund sits on $200 billion of excess investment returns. If the projections pan out, that number grows to $375 billion by 2031, a massive financial reserve that is superfluous to funding the CPP to the 2090s according to the most recent three reports of the chief actuary.

In short, the federal government is running a hedge fund that’s sitting on hundreds of billions more than it expected.

Should we draw down the fund in a responsible way?

Everyone will agree that the CPP must remain funded in a secure, predictable, and risk-averse manner to ensure its long-term viability. But how large of a fund do we truly need to ensure this? According to the chief actuary’s reports from just a few years ago, $625 billion in 2031, not $1 trillion, would be enough to sustain the CPP with current premiums and payouts until the 2090s. So why do we now need $1 trillion in 2031?

No matter how you look at it, the CPP is now grossly overfunded for its needs, thereby granting us the luxury of choices. This prompts the question: What should be done with the CPP Fund’s surplus?

Generally speaking, there are four options or a combination thereof: (1) cut premiums, (2) increase benefits, (3) deploy the capital in some way, and (4) do nothing. According to the chief actuary, premiums can be reduced, albeit marginally. While the CPPIB’s average returns have been great for the last ten years, they may not always be so. Undoubtedly, it will have down years in which returns may be negative, and so we must proceed with caution.

Remember the CPP’s purpose is to pool retirement savings for the future. Arguably there are other ways we can invest in our future. The growing surplus is kind of like having more than enough in your RRSP for retirement but you continue contributing anyway. But what if your roof needs repairs? It that a better use of one’s scarce resources?

In a similar vein here, should we deploy the CPP Fund’s excess returns for badly needed public goods and services? Aging infrastructure, insufficient public transit, schools in disrepair, money-starved health-care systems, and our impoverished military each need tens of billions in new capital over the next several years.

It’s our money. It’s not heresy to have the debate

Given the importance of the CPP to Canadians, there’s precious little public debate on this issue. The hardest part may be wrapping our heads around it. But we’re obliged to discuss our options. Overcoming people’s reluctance to alter the financing of the CPP—and inviolable trust in the minds of Canadians—will be difficult.

To be clear, this is not a call for politicians to raid the CPP. We must guard against reckless moves. Reducing premiums could provoke questions of intergenerational fairness. Unwinding hundreds of billions in investments can’t be done overnight. Perhaps the federal government should create an all-party committee advised by top bureaucrats and with provincial participation to examine the issue and create a responsible, long-term strategy, similar to what they did when facing the opposite problem in the 1990s.

What to do with today’s $200 billion surplus or the projected future reserves requires serious, sober thought. Yet that money belongs to Canadians, not the government nor the CPPIB. It came from our own paycheques and we hired smart people to safely invest it. It paid off handsomely. We should have the discussion. And remember, this is a good news story.