Many Canadians are eager to put 2024 in the past. The past year was defined by political and economic turbulence that reshaped the nation’s leadership, policies, and global standing. Modest economic growth and a welcome decline in inflation offered glimpses of stability, yet the unrelenting burden of high housing and food costs as well as a falling dollar left many struggling, overshadowing any progress.

The economic situation was also eclipsed by the political turbulence in Ottawa which concluded with the resignation of Prime Minister Justin Trudeau and the prorogation of the House of Commons. The next Liberal Leader and de facto prime minister will inherit an electorate showing some signs of optimism about the future but still besmirched by economic and financial anxiety.

The findings of Pollara’s 30th Annual Economic Outlook Study highlight a complex and evolving economic landscape in Canada. What we find is that although perceptions of recession have improved significantly, with fewer Canadians believing the country is in recession compared to last year, skepticism about the economy’s overall strength remains pronounced.

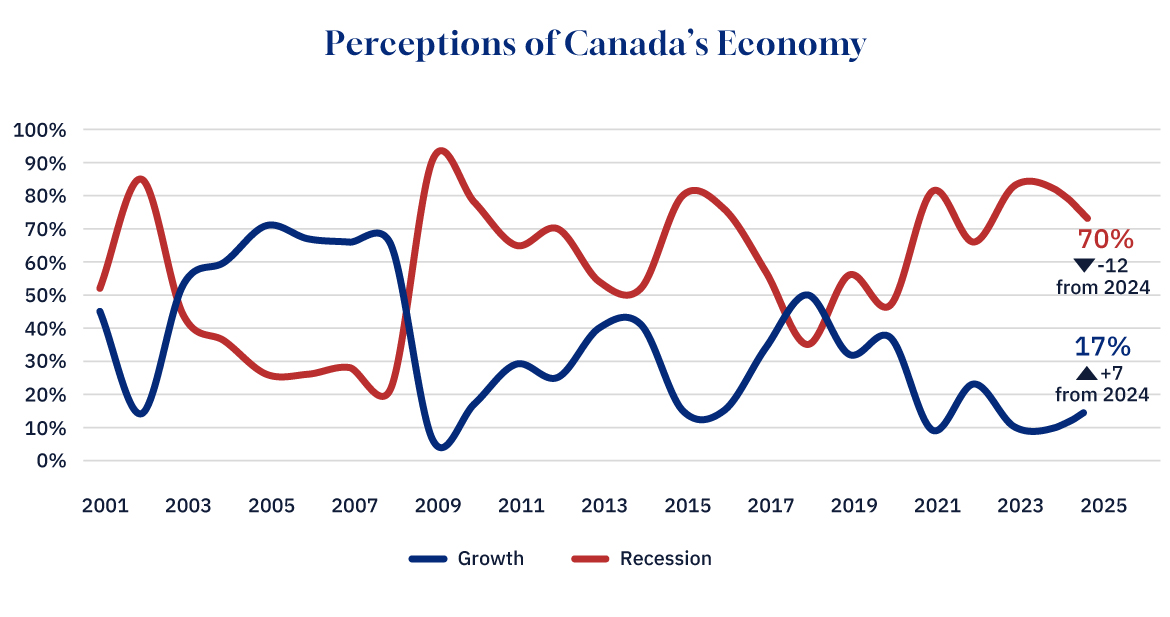

A majority of Canadians still view the current economic climate as weaker than in prior years, indicating a cautious and tempered optimism. In specific terms, looking at Figure 1, we see that a strong majority of Canadians (70 percent) continue to feel our economy is in a recession—down 12 percentage points from last year. This is not new as Canadians have been living with recessionary fears since 2018. In fact, when looking over the last quarter century, Canadians have had very little confidence in the economy since the five-year period between 2003 and 2008.

Figure 1. Graphic credit: Janice Nelson.

The upcoming year will be difficult for grocery store magnates as “the cost of food at the grocery stores” remains one of the main pressure points facing Canadians. Specifically, 41 percent of Canadians indicate that the cost of food at the grocery store is a major source of stress—relatively unchanged from last year and up from 38 percent back in 2022. Housing expenses (33 percent mention this item as a major source of stress) come second, ahead of income tax (24 percent), gas at the pump (23 percent), and loan repayments (21 percent).

Broader financial sentiment across Canada reveals a gloomy outlook. More than half (51 percent) of Canadians expect our economy to worsen next year compared to only 13 percent who are expecting things to improve. Canadians also feel pessimistic about the global economy with 45 percent expecting it to get worse. In a similar vein, 39 percent of Canadians expect Canada’s unemployment situation to worsen in the next twelve points and only 13 percent expect an improvement on the job front.

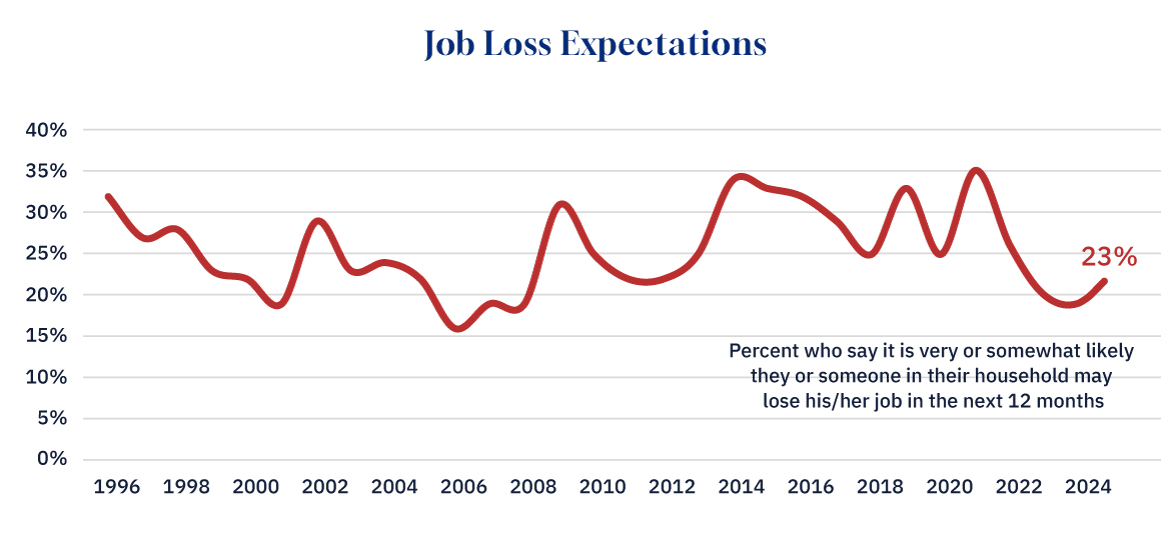

At the individual level, 40 percent of Canadians expect their household will fall behind in the year ahead while only 9 percent expect their income to “more than keep pace.” To add to the economic picture, 23 percent of Canadians think it is likely that they or a member of their immediate family may lose their jobs in the next twelve months. This proportion is higher among those who work blue collar jobs (36 percent) than those in service (30 percent) and white collar (26 percent). While troublesome, job loss expectations are relatively low by historic standards (see Figure 2).

Figure 2. Graphic credit: Janice Nelson.

Canadians are more optimistic about the economic outlook south of the border. While 34 percent of Canadians think the U.S. economy will worsen in 2025, some 29 percent are optimistic about our neighbor’s economic prospects (more than double the proportion of Canadians who feel positively about our own economy).

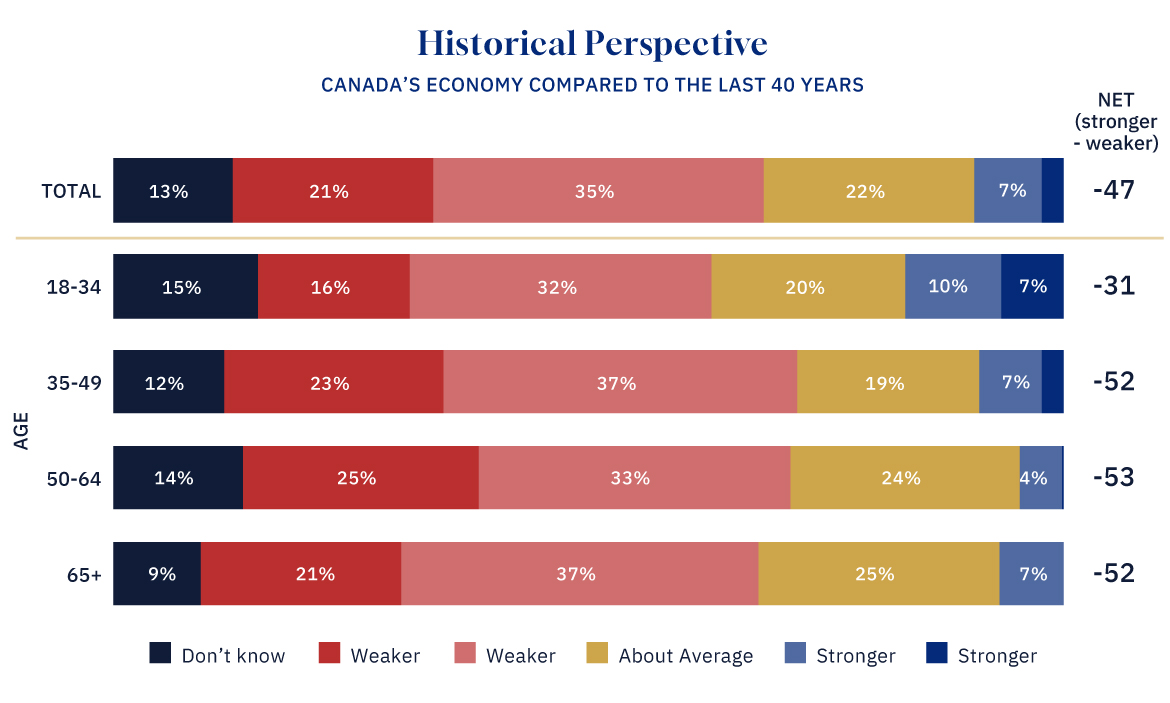

Let’s turn to one last set of findings. This year, Pollara is celebrating 40 years of research insights. Over the next few months, we will take a retrospective look at several moments and issues over those last four decades. In this context, Canadians were asked to evaluate the current state of the economy relative to the past 40 years, based on their knowledge and experiences. The findings reveal a largely negative assessment of today’s economic conditions. More than half of Canadians (56 percent) believe the current economy is weaker than in previous decades. Notably, 21 percent—a significant proportion—feel that the Canadian economy is at its weakest point in the last 40 years.

This sentiment underscores the depth of economic anxiety permeating the population. These perceptions may reflect not only recent economic struggles but also a broader sense of erosion in financial stability and opportunity. For many Canadians, memories of periods like the early 2000s, marked by stronger economic confidence, contrast sharply with the uncertainties of today. Such widespread pessimism also highlights the importance of addressing underlying structural issues in the economy to rebuild public confidence and foster a more positive outlook for the future.

Figure 3. Graphic credit: Janice Nelson.

The historical comparison and the broader economic outlook provide a sobering reminder of the challenge awaiting the new prime minister starting March 9th. These findings also highlight the hurdles facing opposition leaders aiming to unseat the Liberals. The incoming Liberal leader will confront an electorate that is hopeful for stability but deeply uneasy about persistent economic and financial pressures. This leadership transition presents both an opportunity and a test for the Liberal Party, as the new leader inherits a nation weighed down by political and economic uncertainty, demanding a decisive policy departure to rebuild confidence.

For the opposition, particularly Conservative leader Pierre Poilievre, Trudeau’s resignation and widespread economic dissatisfaction present some complications. With Trudeau no longer the lightning rod, voters will expect a substantive challenge to the Liberal agenda, alongside tangible solutions. Simple slogans and well-worn talking points are unlikely to suffice in addressing the electorate’s mounting skepticism and desire for measurable progress.