Welcome to Need to Know, The Hub’s roundup of experts and insiders providing insights into the developments Canadians need to be keeping an eye on.

Today’s weekend edition dives into thought-provoking research from think tanks, academics, and leading policy thinkers in Canada and around the world. Here’s what’s got us thinking this week.

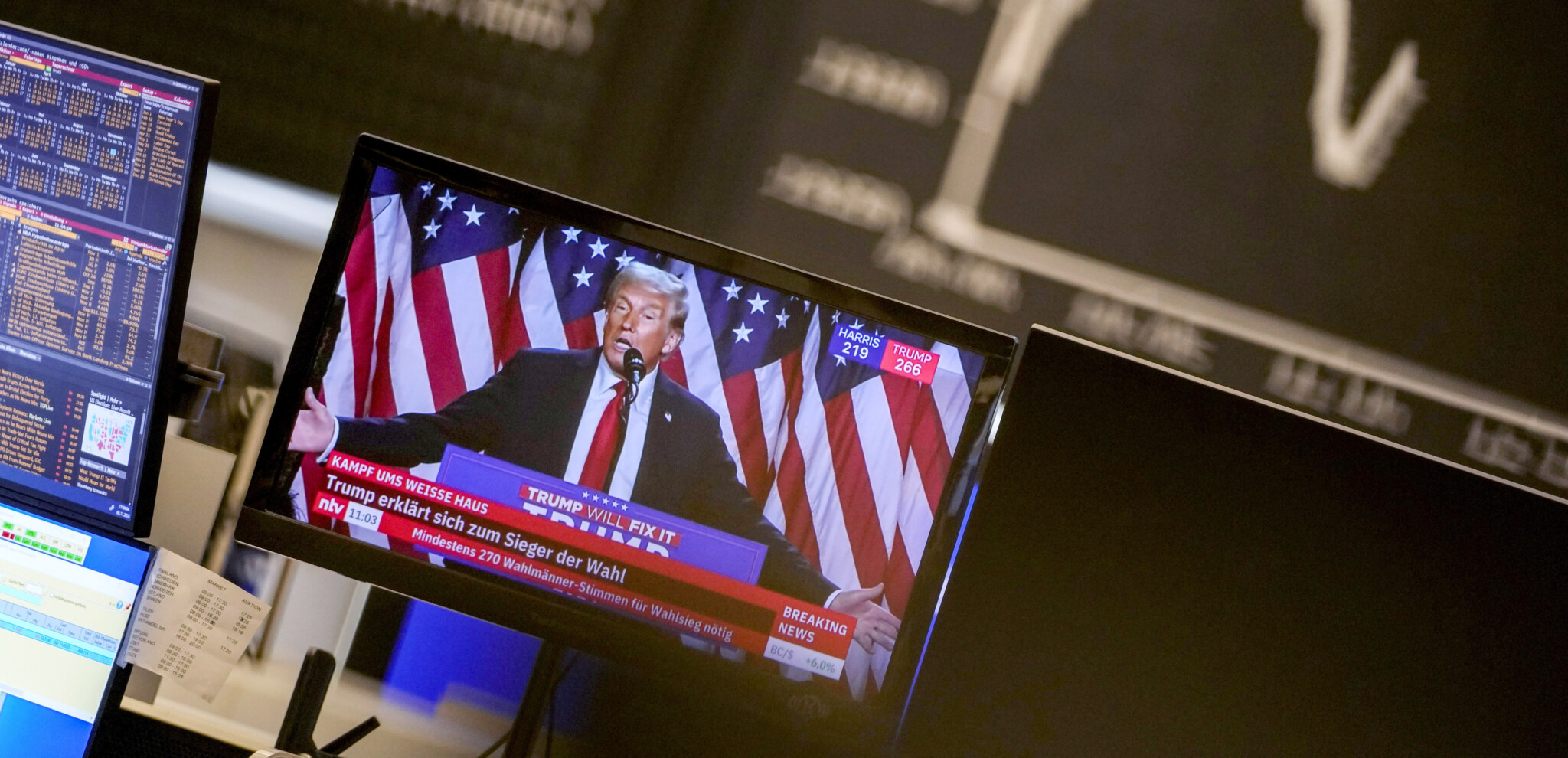

Canada is officially aboard the trade war roller coaster. This week saw many twists and turns, as Canada went from being tariffed to not tariffed in the span of just a few days. Yet the roller coaster is set to take another bend this coming Wednesday, when the steel and aluminum tariffs are set to take effect.

Experience has proven that those tariffs would be detrimental to American businesses and consumers. During his last term in office, President Trump’s steel and aluminum tariffs cost an estimated 75,000 American jobs throughout the economy. Meanwhile, the steel industry only added 1,000 jobs.

The fact that tariffs result in more economic pain than gain is well-known by economists. As J.P. Morgan’s chief global strategist David Kelly said this week, “The trouble with tariffs…is that they raise prices, slow economic growth, cut profits, increase unemployment, worsen inequality, diminish productivity and increase global tensions. Other than that, they’re fine.”

However, if Trump is to abandon his trade war once and for all, the pressure will need to come from the American people. They will have to feel enough economic pain to the point that the tariffs become an electoral liability.

Let’s take a look at how much consumers could stand to lose from the current round of tariffs.

Tariffs hurt low-income Americans the most

This week saw Trump once again impose tariffs on imports from Canada, Mexico, and China. If these tariffs are actually implemented for more than a few days, they are projected to cost the average U.S. household more than $1,200 (USD) annually, according to the Peterson Institute for International Economics (PIIE). As a reminder, the tariffs include a 25 percent levy on most goods from Canada and Mexico—excluding Canadian energy, which faces a 10 percent tariff—and an additional 10 percent levy on Chinese imports.

These measures, should they be implemented, could cause the largest American tax increase since at least 1993. The direct financial impact on U.S. consumers stems from higher prices on a wide array of imported goods, including everyday items such as fruits, vegetables, electronics, and automobiles. The PIIE analysis indicates that previous tariffs, like those implemented during the 2018-19 trade war with China, resulted in U.S. importers bearing the brunt of the costs, leading to increased prices for American consumers.

But the economic repercussions extend beyond immediate consumer costs. Economists warn of potential disruptions to supply chains, reduced economic growth, and a shrinking export sector. Retaliatory measures from tariffed countries, including Canada and Mexico, could further exacerbate these issues, leading to a cycle of escalating trade barriers and income losses for main street Americans.

The tariffs could hit low-income Americans the hardest. According to the PIIE report, Americans in the lowest income quintile will see their annual after tax incomes fall by 2.7 percent, while those in the top quintile will only feel a hit of 1.2 percent.

And if you think an extension of the tax cuts made in the 2017 Tax Cuts and Jobs Act, which are set to expire in 2025, will be enough to offset the economic effects of the tariffs, think again. Americans in the bottom 60 percent of the income distribution will be made worse off.