Welcome to Need to Know, The Hub’s roundup of experts and insiders providing insights into the federal election stories, policy announcements, and campaign developments Canadians need to be keeping an eye on.

The Conservatives have found their early election target

By Sean Speer, The Hub’s editor-at-large, and Taylor Jackson, The Hub’s research and prize manager

Two days into the campaign and a single phrase has come to define the Conservative case against the Liberals’ re-election: the lost decade.

It seeks to convey Canada’s poor economic and social outcomes over the past decade of Liberal governance. The most notable expression is Canada’s declining GDP per capita, which has fallen for eight of the past 11 quarters.

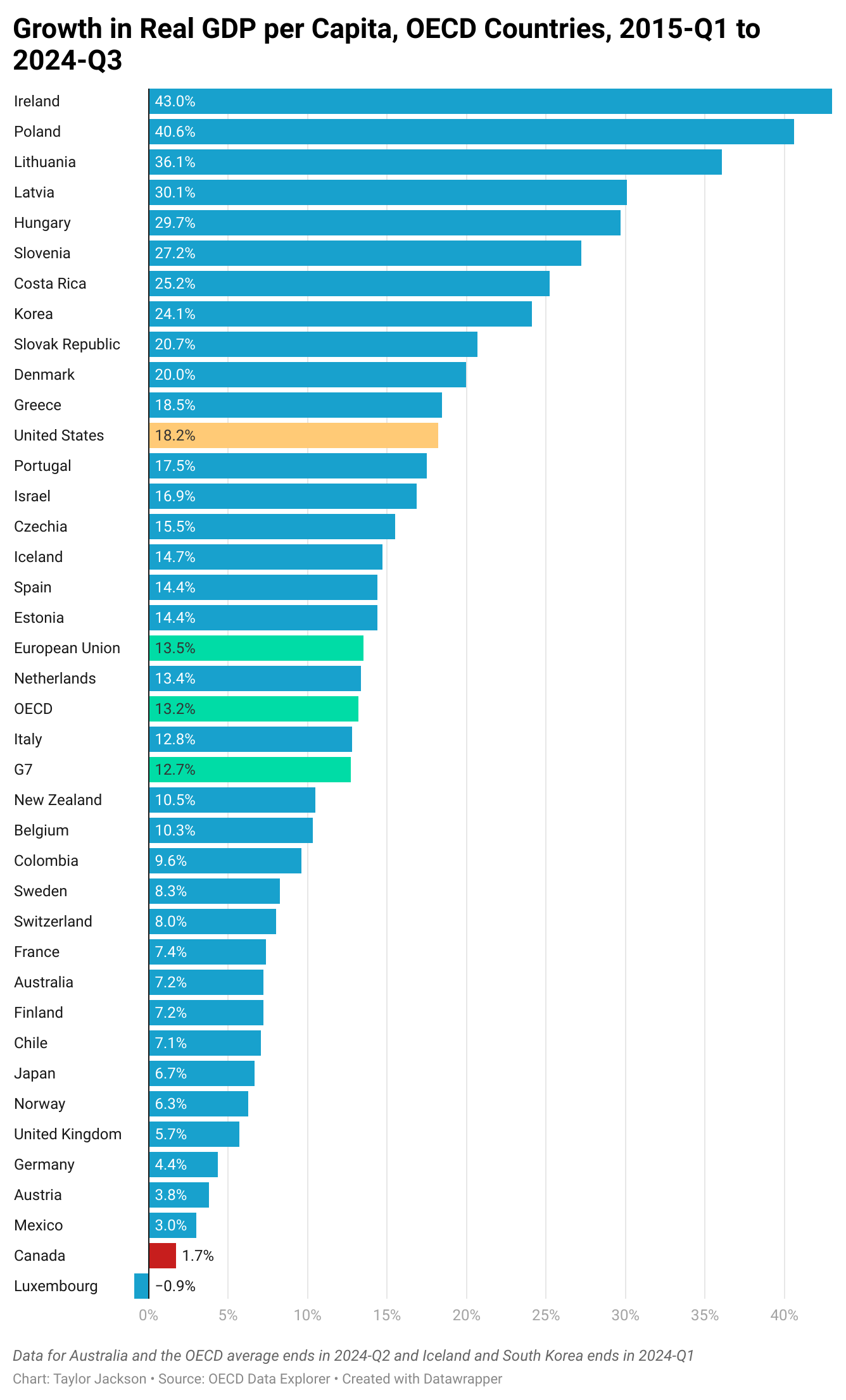

The result, as the chart below shows, is that over the last decade, Canada has experienced the second-lowest GDP per capita growth in the OECD at 1.7 percent. The U.S. by contrast has seen growth of 18.2 percent over the same period.

But it must be emphasized that the lost decade isn’t merely about flat or declining living standards. It’s extended across a range of economic and social measures, including low business investment, weak productivity, slow income growth, high household debt, and so on.

We know because we coined the phrase just over a year ago, in March 2024. As we wrote at the time: “We’re in the midst of a lost decade. Our politics should be focused on avoiding a second one.”

It’s a good sign therefore that the political parties are talking about how the lost decade has exhibited itself and what we can do to put the country on a better trajectory.

A key factor is understanding what caused our lost decade. It shouldn’t be thought of as happenstance. This isn’t a case of external forces or mere events.

It has reflected the Liberal government’s own economic assumptions. The government has pursued a deliberate strategy of extensive growth that’s artificially boosted economic inputs through an unprecedented surge of immigration and debt-financed public spending. The overall size of the economy grew, but we didn’t get any richer.

What we need is a policy of intensive growth—one that doesn’t just boost inputs but instead aims to expand the economy’s productive capacity. Think of it as the difference been stimulative versus sustainable growth.

The good news so far is that both the Conservatives and Liberals are nodding in this direction. We’ve already seen commitments to reform Canada’s regulatory system, reverse harmful tax hikes on capital, and shift government spending from consumption to investment.

There will no doubt be key differences between the political parties regarding these questions over the next six or seven weeks. But if the campaign is explicitly (or even implicitly) focused on learning the lessons of the lost decade and avoiding a second one, it will be a positive development for Canadians.

Crunching the numbers on the Liberal tax cut

By Trevor Tombe, professor of economics at the University of Calgary and a research fellow at The School of Public Policy

Canada’s federal election is now underway. While there were a number of significant policy announcements leading up to this widely anticipated campaign launch, the first major proposal following the writ drop came from the Liberal Party: a commitment to lower the federal personal income tax rate on the first bracket—from 15 percent to 14 percent.

The appeal is clear. Since such a change affects the disposable incomes of nearly every Canadian who pays personal income tax, the political rationale practically writes itself.

Indeed, this is not unlike the approach Premier Danielle Smith took at the start of Alberta’s last provincial election. And this also mirrors one made by former Conservative leader Andrew Scheer during the 2019 federal campaign—their “Universal Tax Cut.”

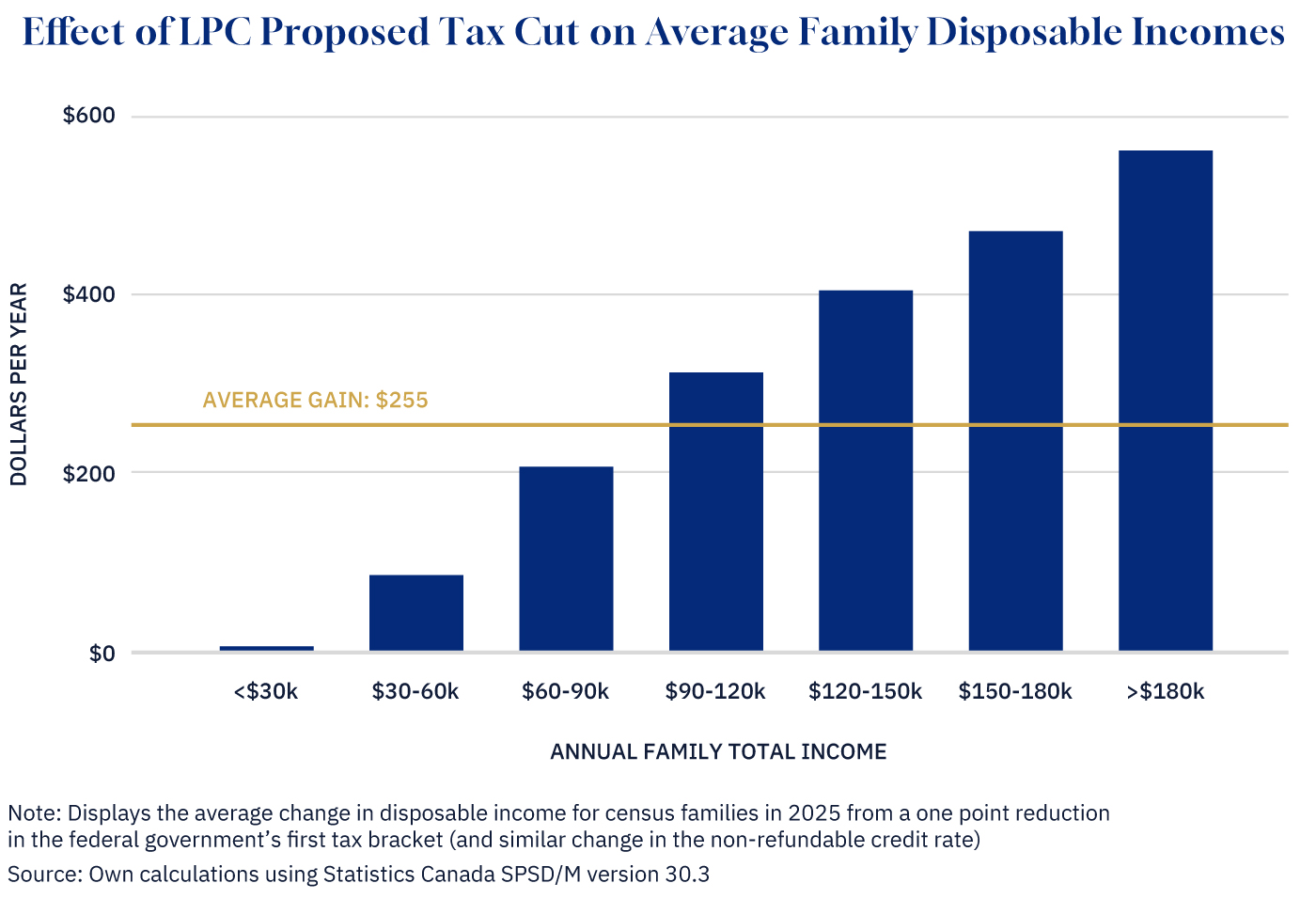

Let’s look at the numbers to understand what this policy might mean. For starters, I can confirm the Liberal estimate that roughly 22 million individuals would see some benefit under this change. I estimate that the average person who benefits would gain approximately $240 per year. And across the roughly 15 million families that see any benefit, the average gain is about $345 (or $255 when families that do not benefit are included).

Below, I’ve estimated the average effects on disposable incomes across families at different income levels. For households earning less than $30,000, the effect is negligible. For those with incomes above $180,000, the average savings reach approximately $560 per year.

Graphic credit: Janice Nelson.

These values are lower than the ones highlighted by the Liberal Party. They correctly note in their release that a two-income household could save as much as $825 annually. But that figure applies only to individuals whose incomes already exceed the top end of the first tax bracket—currently around $60,000. It’s also important to recognize that reducing the first-bracket rate would shrink the value of several non-refundable tax credits. As a result, even individuals earning more than $60,000 may not fully capture the maximum benefit.

As with any policy announcement, there are trade-offs to consider. The most important question concerning this announcement is what will be done elsewhere in the federal budget to sustain this rate reduction, either with lower spending or tax increases elsewhere.

In terms of total costs, the party did not release a costing of the policy at the time of writing. My own estimate places the annual cost to the federal budget at approximately $5 billion.

This policy also comes with an important opportunity cost: it may delay or displace broader tax reform that not only increases Canadians’ disposable incomes but also improves the economic and investment incentives. That could involve broader changes to the very structure of our business and personal taxation system. Whether this kind of broader rethinking of economic policy by all parties is in the cards will become clearer as the campaign unfolds.

At the time of writing, the Conservatives had committed to lowering taxes as well but provided no details. Now that they’ve announced their own tax cut policy, stay tuned for a longer analysis on how their plan compares to the Liberals’ dropping later this week here at The Hub.

The Apple Cider Vinegar election

By Chris Spoke, real estate investor and the founder of August, a Toronto-based agency that designs and builds digital products

For the past few weeks, Apple Cider Vinegar has topped the Netflix charts. The limited series tells the true story of Belle Gibson, an Australian wellness influencer who faked a terminal brain cancer diagnosis and claimed to cure it through clean eating. In parallel, it follows Milla Blake, who is genuinely sick with epithelioid sarcoma and turns to raw food and juicing, urging her cancer-stricken mother to do the same. Both ultimately die.

The show is a scathing retrospective on well-meaning but ultimately hollow ideological trends—degrowth environmentalism, militant feminism, Instagram veganism—portrayed with unflinching critique. The only grounded voices are from practical, plainspoken men in their lives—Milla’s oncologist, her father, Belle’s husband—all dismissed by empowered but naive influencers.

I texted a friend after watching: this feels like the end of Zero Interest Rate Policy-era fakeness.

Canada finally appears to be waking from its own ZIRP-era dream, where fundamentals like productivity, economic growth, and the cost of living were sidelined in favour of cabinet gender quotas, net-zero targets, and symbolic reconciliation. Add to that a new wave of American hostility, and the mood has shifted. Reality is back in fashion.

On Sunday, Mark Carney triggered a federal election set for April 28. Both serious contenders in Carney and Conservative leader Pierre Poilievre are converging on practical priorities: interprovincial trade, tax cuts, and increased LNG production and export. Even government efficiency is back on the table.

Apple Cider Vinegar captures a broader moment: the collapse of comforting fiction and the return of hard truths. In culture and in politics, people want results. The grown-ups are being invited back into the room.

Realness is making a comeback.

Will Trump dominate this campaign? Maybe not

By Royce Koop, professor of political science at the University of Manitoba

Canadians are being inundated with news and commentary about U.S. President Donald Trump’s promises to impose tariffs and annex our country. He’s an existential threat out to wreck our economy, seize our resources, and replace all portraits of King Charles with pictures of his own scowling mug.

But are Canadians really so concerned about Trump? Not as much as you might think.

The Angus Reid Institute released polling just yesterday showing that cost of living and inflation remain by far the top issues of concern for Canadians. Fifty-four percent of those polled identified these as their top concerns. In contrast, only 38 percent identified relations with the U.S., including tariffs, as a significant concern.

In fairness, Canada-U.S. relations are now a bigger concern than both health care and housing affordability.

Both the bulk of Canadian media and the Liberal Party are now busily priming the Trump/tariff/sovereignty theme. Priming occurs when emphasis on an issue causes voters to base their evaluations of parties on that issue. So if Canadians are told day after day after day that Trump is an existential threat, they are more likely to vote for the party that they think is best able to address that threat.

So it’s no wonder the Liberals are working overtime to prime Canadian sovereignty and identity. The strange, rambling conversations between Mark Carney and Mike Myers, for example, can be understood in this way.

But Angus Reid’s findings demonstrate that, despite all the priming and noise, economic issues have remained top-of-mind concerns for Canadians. Pierre Poilievre needs to keep priming cost of living and inflation while demonstrating that he’s best positioned to provide relief for Canadians.