In each EconMinute, Business Council of Alberta economist Alicia Planincic seeks to better understand the economic issues that matter to Canadians: from business competitiveness to housing affordability to living standards and our country’s lack of productivity growth. She strives to answer burning questions, tackle misconceptions, and uncover what’s really going on in the Canadian economy.

It goes without saying that these are uncertain times for Canada, from the threat of U.S. tariffs to the risk of a recession. For governments, these challenges place a lot of pressure on budgets, especially federally. That’s why many economists have been highlighting the importance of having fiscal “room” to make sure we’re saving enough money for a rainy day, given it’s pretty darn cloudy.

But there’s another emerging challenge that’s making government budgeting harder: accounting for contingent liabilities.

What, exactly, is a contingent liability? Essentially, it’s money that could be owed if a certain event occurs. If it’s likely to happen and the cost can be estimated, accounting standards, understandably, stipulate that it should be captured in the budget. That’s very different from spending on, say, health care, which is a known and easily quantified expense. This might not sound like an important consideration but, in fact, an unexpected increase in contingent liabilities was the main reason the federal budget deficit for the last fiscal year was revised upward by $21.9 billion—from $40 billion as of Budget 2024 last spring to $61.9 billion in December.

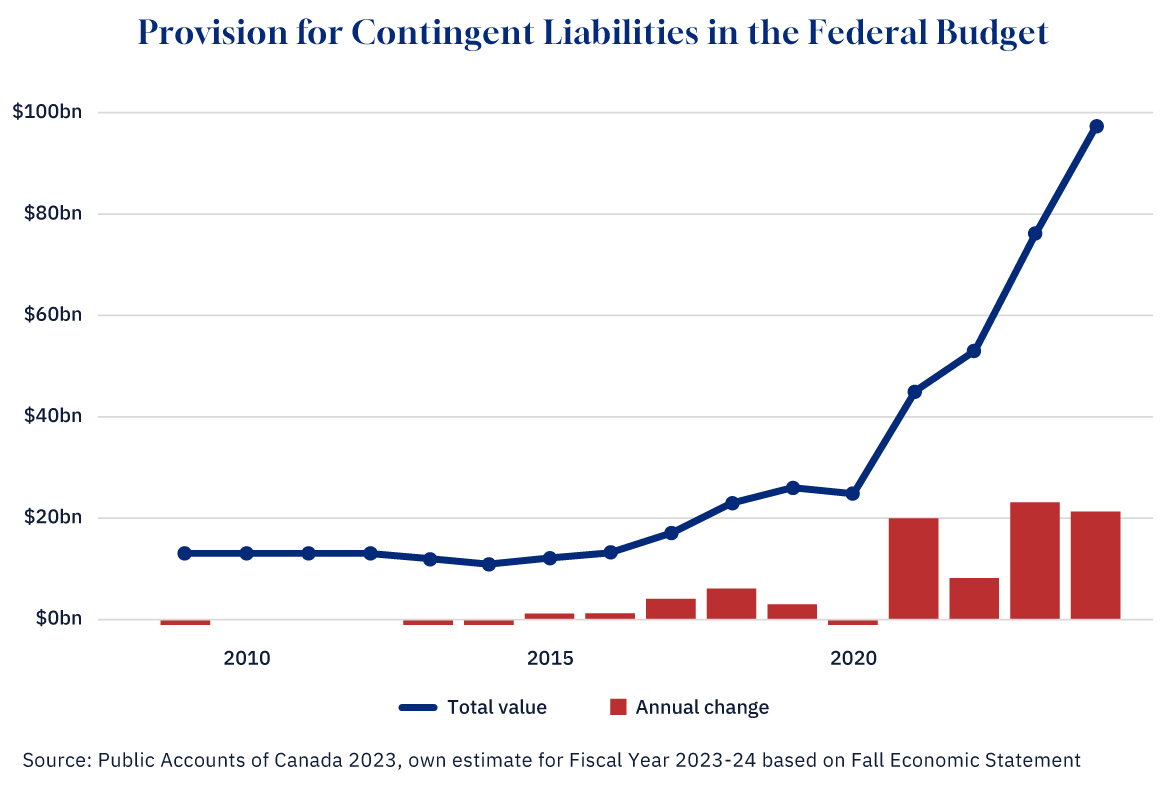

While the scale of this increase may be historically unusual, it is consistent with recent trends. The total value or “stock” of contingent liabilities is about eight times what it was just 10 years ago with much of that growth happening recently. In three of the last four years, the value of contingent liabilities has increased by at least $20 billion—enough to double the deficit in any given year.

Graphic credit: Janice Nelson.

Importantly, these expenses cannot simply be cut. An analysis by the Parliamentary Budget Officer notes that much of this increase relates to Indigenous claims, representing efforts by the government to address past injustices. Claims that can be difficult to estimate as final amounts often differ substantially from initial estimates.

The challenge of the current and, likewise, future governments will be to better estimate and account for possible increases in contingent liabilities to ensure Canada can meet its budgetary needs and be prepared for a rainy day.

A version of this post was originally published by the Business Council of Alberta at businesscouncilab.com.