Media reports concerning a major expansion of Power of Siberia, a major Russia-China gas link, will have important implications for Canada’s natural gas export ambitions. The deal, which reportedly could add 50 billion cubic meters, would, if it moves forward to construction, reshape global gas flows and reset the global medium to long-term supply/demand balance.

To put it in perspective: 50 billion cubic meters is nearly 10 percent of the total global LNG market and therefore demands attention from Canadian LNG developers as well as federal and provincial governments.

The Russia-China megadeal coincides with the initial announcement of the first five projects of national interest by Prime Minister Mark Carney, which includes a second phase of Canada’s first export-oriented liquified natural gas project, LNG Canada.

The inclusion of LNG Canada Phase 2 in the national project list reflects a broader, but by no means comprehensive, political consensus between the federal government, many but not all First Nations, and the governments of British Columbia and Alberta in support of the Canadian LNG sector. With this backing, Canadian LNG can weather the storm from the Russia-China deal and other changes in global market and geopolitical conditions.

Just four years ago, Canada’s sector faced bleak market conditions due to COVID-19 and surging U.S. supply. And then the Russia-Ukraine war sent prices soaring. The war was a brutal reminder that political stability and reliability matter to LNG buyers as much as price.

China now believes it has a strong bargaining position with Russia to support a deepening of the bilateral gas relationship. Other buyers, particularly in the EU, Japan, and Korea, are phasing down imports of Russian LNG due to geopolitical risk.

These same buyers are also cautious about U.S. LNG in the context of growing trade tensions. U.S. Energy Secretary Chris Wright was in Europe this week offering tougher sanctions on Russia- conditioned on more EU purchases of U.S. oil and gas. This blending of U.S. natural gas exports with geopolitical and trade-related “asks” from Washington could be an opportunity for Canada. But navigating these dynamics will require leadership from Ottawa, which, so far, Prime Minister Mark Carney and Natural Resources Minister Tim Hodgson seem willing to provide by bringing LNG to the table in talks with European heads of state and other trading partners.

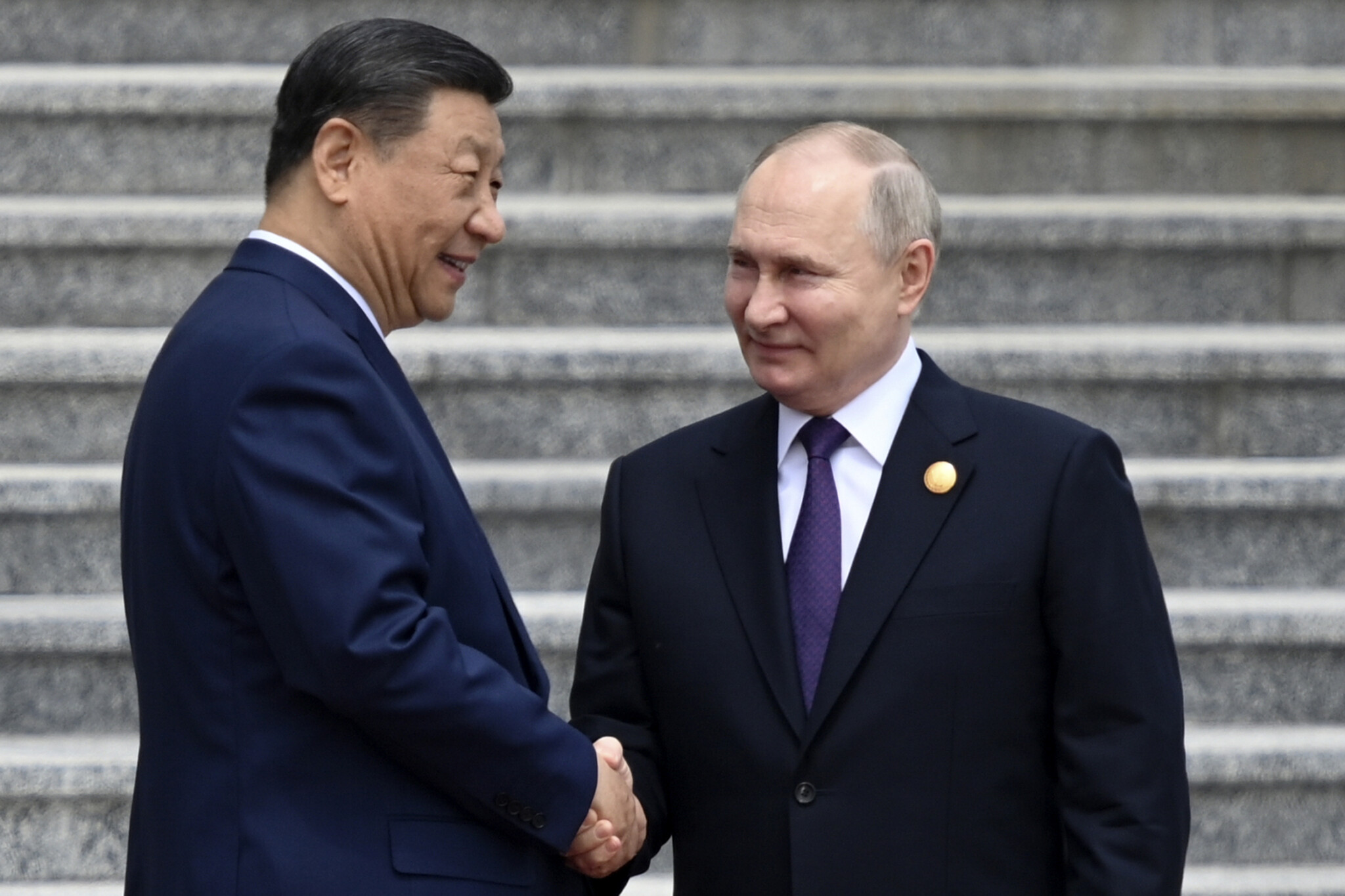

China and many other Asian buyers value a state-to-state component to their long-term LNG procurement, as gas security specifically and energy security more broadly are core to their conception of national security. The Power of Siberia 2 deal is very much embedded in a deepening of the China-Russia strategic relationship.

On the environmental front, certain LNG buyers are also showing growing interest in the lower methane-intensity LNG that Canada can provide. China may be less focused on this attribute, but it’s a major consideration for the EU and Japan/Korea. Russian gas has a higher degree of flaring and fugitive emissions certainly than Canada—according to the IEA 2025 Global Methane Tracker, the emissions intensity of Russian oil and gas is 50 percent higher than Canada.