The Canadian economy is weakening. The sluggishness—characterized by slow GDP growth and unemployment edging beyond 7 percent overall, with rapidly increasing joblessness, particularly among those between 15 and 19, at around 11 percent—is becoming harder and harder to wave away. The consensus now is that in 2025, growth measured by change in GDP will range from 1 percent to 1.8 percent.

Yet even those alarming data don’t tell the full story. Tracking total GDP change as a leading indicator of how our economy performs risks understating the depth of the challenge we face. Here is a reality check using a different metric: real GDP per capita for those between ages 15 and 64.

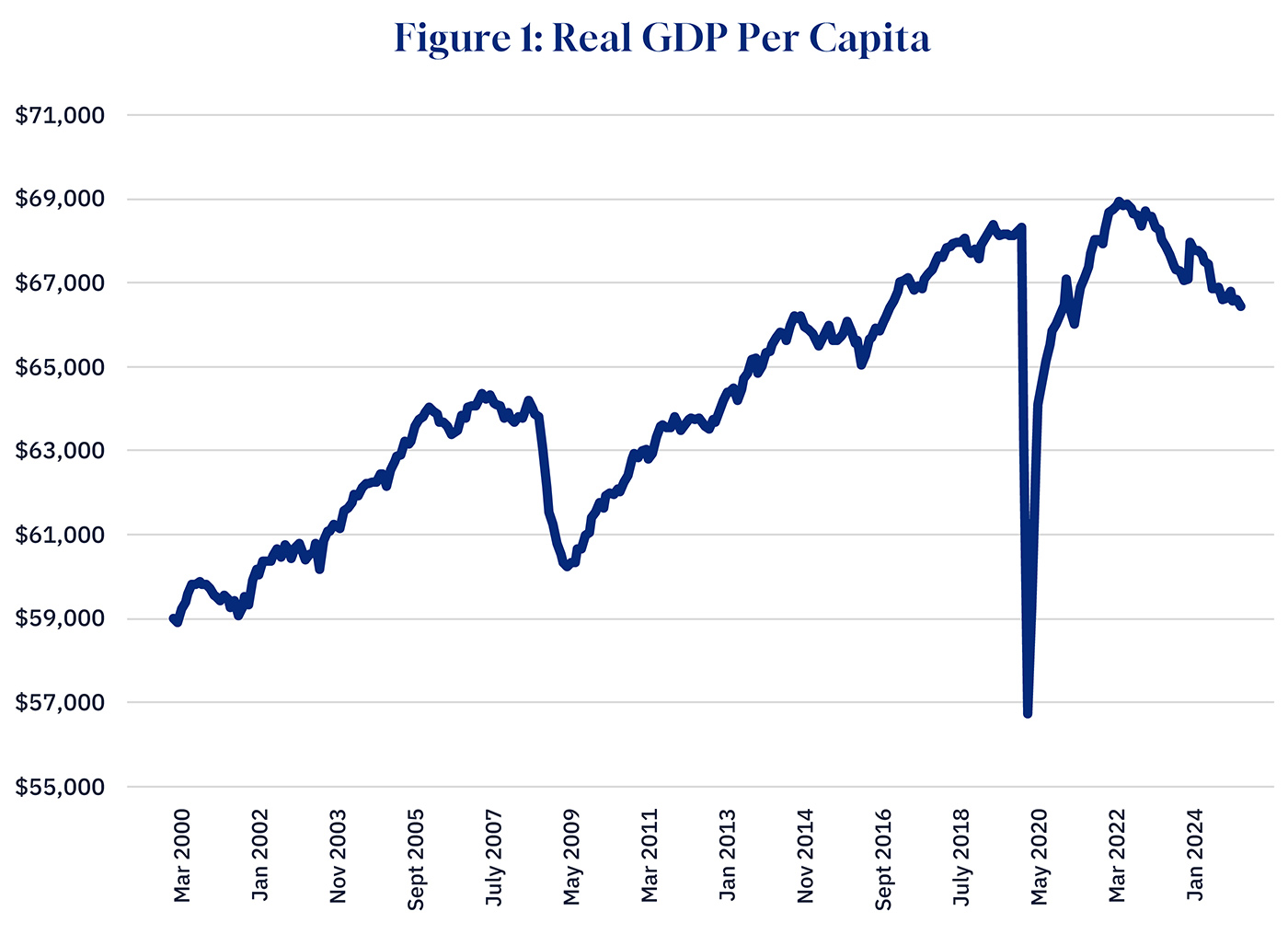

Figure 1 displays the real (inflation-adjusted) GDP per person in that age group over the past 25 years. The first seven years witnessed a strong economy, driven by natural resources and commodity exports. Also important at that time were trade integration with the U.S., a strong U.S. economy raising demand for lumber and fossil fuels, stable monetary policy, and fiscal surpluses leading to debt reduction.

The takeaway? Canadians are poorer in June 2025 than they were in April 2017.

Graphic credit: Janice Nelson

A slowdown in growth in 2005-06, due to weakening U.S. demand, monetary tightening, and a strong Canadian dollar, gave way to the general collapse as the Great Recession stalled the global economy. Canada weathered this event quite well, emerging in 2009 with a higher-than-ever annual growth rate that persisted until 2015, when lower oil prices delivered a resource shock, underscoring the country’s dependency on global fossil fuel markets for its economic welfare.

Then, COVID-19 hit the world economy. Canada, however, recovered smartly, with real per capita GDP reaching an all-time high in September 2022. But since then, the roof has collapsed. Real per capita GDP has been declining precipitously for three years.

The article highlights a decline in real GDP per capita. What does this metric truly signify for the average Canadian's economic well-being?

Beyond GDP growth, what other key economic indicator is in 'free fall' and what are its implications?

The article mentions proposed government policies like tax cuts and spending increases. How might these policies interact with falling investment and economic growth?

Comments (1)

I’m not sure even that will wake up the Dozy Dominion.